When your home insurance claim is declined, it may feel like you’ve been punched. All that work you did to document the damage, file the claim, and talk to the insurance company representative–and for what? It may be tempting to be harsh with your insurance company representative or even give up on trying to get your claim approved.

Before you do either of those things CALL US IMMEDIATELY. There are several reasons for your claim might have been denied, from a lack of coverage to missed deadlines. Once we know why your claim was declined, we can start working on fixing the problem to get your claim approved.

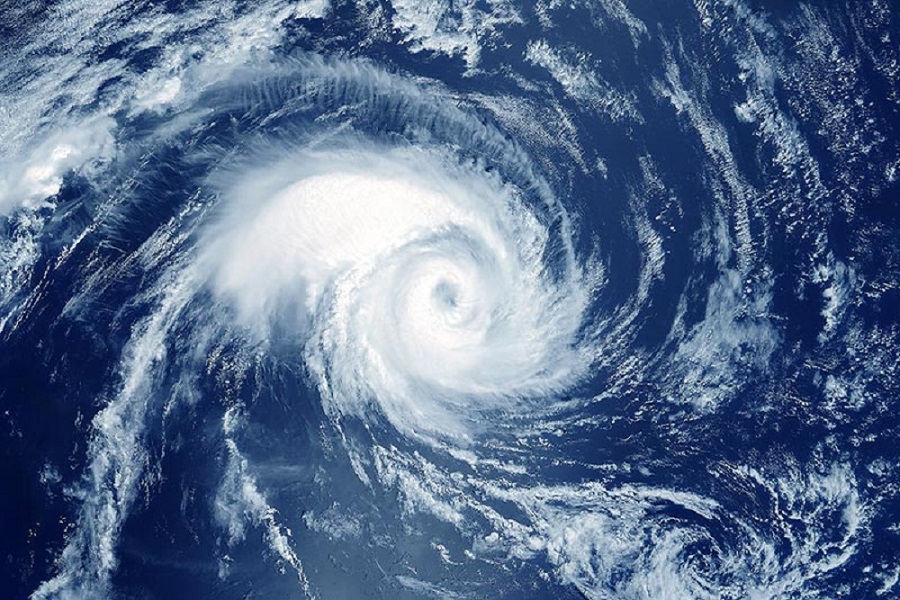

- Lack of Coverage- When your property is damaged, and you don’t have the right insurance coverage, you might be out of pocket. This will depend on the situation, some plans will cover you for losses resulting from falling debris, theft, or natural disasters such as fire or floods. You should review your policy to see that you have the coverage you need. Suppose your insurance claim is denied because of a lack of coverage. In that case, it may be time to review your policy and ensure you have the right protection.

- When it comes to home insurance claims, missing a deadline can be costly. Most insurers have a time-sensitive filing requirement, so if you don’t notify them of damage to your home quickly, your claim may be denied. There are many reasons why a home insurance claim may be denied, but missing a deadline is one of the most common. So if a covered peril has damaged your home, notify your insurance company as soon as possible and start the claims process.

- When you buy home insurance, you are committing to pay your premiums on time every month. Many people do not understand how critical this is and end up missing payments, which can result in a claim denial. There are a few tips to avoid this:

- Set a reminder on your calendar to pay your premiums on time every month.

- Pay your premiums online, so you don’t have to worry about forgetting.

- Sign up for automatic payments so your provider can automatically deduct the amount from your account each month.

If you do forget or miss a payment, don’t panic! Instead, contact your provider as soon as possible and see if there is anything they can do to help you correct the error. Failing to pay premiums is one of the most common reasons for an insurance claim denial.

- When you file an insurance claim, you’re asking the company to pay for damages that have already occurred. In order for the insurer to determine whether or not to pay out on a claim, they need to be aware of all the relevant facts. This includes information about the damage, your personal information, and your insurance history.

- Lying or misrepresenting information in any way can lead to claim denial. This might include hiding or downplaying the extent of the damage or failing to disclose relevant information about your policy or prior claims. Suppose the insurance company discovers that you’ve been less than truthful. In that case, they can refuse to pay out your claim, and you might even face legal penalties.

It’s important to remember that honesty is always the best policy regarding insurance claims. Ensure you provide accurate information to the insurer, and if you have any doubts about what needs to be included on the form, ask for help from an agent or broker. These simple steps can help ensure that your claim is processed quickly and smoothly.

When it comes to insurance claims, proper documentation is critical. Your insurance company may deny your claim if you don’t provide the right information. The under noted are some of the most common insurance claim denials:

- Poor documentation: Property owners must document any damage resulting from a disaster and other relevant information when filing a claim. Adjusters need as much information as possible.

- It’s every homeowner’s worst nightmare: their home sustains damage, and the insurance company denies their claim. While it’s admittedly rare for an insurance company to deny a claim, there are a few reasons why it may happen. A common reason, is if the homeowner fails to take steps to prevent further damage to the property.

- Almost all homeowner policies require homeowners to take reasonable steps to prevent further damage to the property after a covered loss.

- Another reason an insurance company may decline a claim is if the property is not maintained adequately. For instance, if you don’t keep up with routine repairs or you don’t clear away debris after a storm, you could be at risk of having your claim denied.

While it’s certainly possible for an insurance company to deny a claim, it’s important to remember that this is usually only done as a last resort. Most companies will work with homeowners to devise a solution that works for everyone involved. If you’re concerned that your insurer may deny your claim, contact them as soon as possible and ask for clarification on their policy.