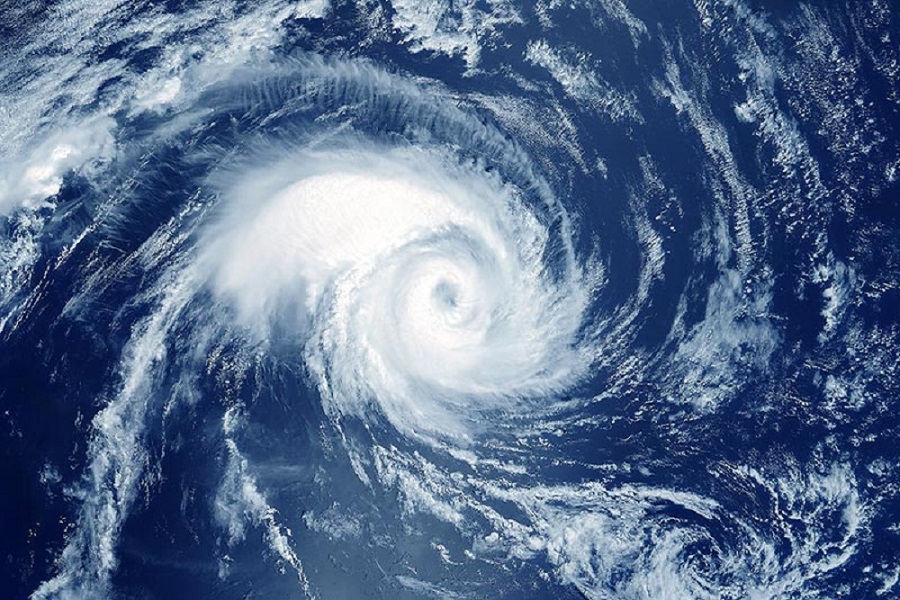

Residents affected by Hurricane Ian are now starting to assess the damage and file insurance claims. The problem is that the path of the hurricane was so complicated, with so many different types of damage, that it’s going to be very difficult to figure out who should pay for what. As As an example, if a tree falls on your house, is that damage covered by your homeowners policy or your auto insurance? If your car was damaged by rising flood waters, is that covered by your homeowners policy or your auto insurance?

These are difficult questions to answer, and insurance companies are going to be reluctant to pay out claims until they have a good idea of what is and isn’t covered. This is going to be a long and complicated process, and it’s going to take some time for everyone involved to figure out what happened. In the meantime, residents affected by Hurricane Ian should start gathering evidence and documenting the damage as best they can.

Most insurance and property analysis companies have increased their damage projections after the aftermath of the storm. CoreLogic noted in a press release that insured and uninsured losses due to wind and flood damage could be as high as $70 billion dollars from Hurricane Ian.

Total property loss is estimated between $41 and $70 billion dollars – CoreLogic.

Total insured loss is estimated around $50 billion – Insurance Information Institute

Flood loss to FEMA-sponsored National Flood Insurance Program (NFIP) and privately insured customers estimated to be $8 to $18 billion — CoreLogic

Uninsured flood loss estimated to be $10 to $17 billion – CoreLogic

Wind losses estimated to be $23 to $35 billion – CoreLogic

Litigation cost estimated to be $10 to $20 billion – Insurance Information Institute

First steps after the hurricane:

Most experts say documenting damage is key. Take pictures and video of all the damage and salvage whatever receipts possible. If you have to make any emergency repairs, keep all those receipts as well. You should not start permanent repairs until the insurance adjuster instructs you to do so. In Florida, contact the Department of Business and Professional Regulations to make sure a contractor is properly licensed before starting any repairs.

After a hurricane, it is critical to act very quickly in order to file a claim. Contact an insurer adjuster as soon as possible in order to find out what the time frame is for filing a claim. The National Flood Insurance Program (NFIP) only allows 60 days to file a Proof of Loss form. If any losses are overlooked, they can be submitted with a supplemental loss claim. In Florida, homeowners have four years to file a homeowner claim. Flood, home, auto, boat, and property insurers will need to send out adjusters to survey the damage. Try not to throw anything away before it is inspected, according to the LDI. Even if it is moldy, try storing the item outside. If you are not insured or underinsured, you may be able to apply for assistance from FEMA. This can include help with uninsured or underinsured damage and loss. You may also be eligible for assistance with temporary lodging, clean-up, and other disaster-related expenses.

If you’re a homeowner affected by Hurricane Ian and need help from FEMA, be sure to apply as soon as possible. The deadline for most people is 60 days after the hurricane hits, but that deadline can be extended for people who have major damage or who are living in a shelter. You can apply online at disasterassistance.gov or by phone at 1-800-621-FEMA (3362).