Public Adjusting Firms Near Me: Top 2025 Experts

Why Finding the Right Public Adjusting Firm Matters for Your Claim

When property damage strikes your home or business,public adjusting firms near mebecomes one of the most important searches you’ll make. These licensed professionals work exclusively for you—not the insurance company—to ensure you receive fair compensation for your losses.

Quick Answer: How to Find Public Adjusting Firms Near You

- Search online directories and professional associations like NAPIA

- Check state licensing boards for verified credentials

- Ask for referrals from attorneys, contractors, or other property owners

- Read client reviews and testimonials

- Verify they’re licensed, bonded, and insured in your state

- Ensure they specialize in your type of claim (fire, water, storm damage, etc.)

The insurance claim process is overwhelming, especially after significant property damage. A research study found thatusing a public claims adjuster increases insurance claim payouts by 747% on averagecompared to handling claims alone. This highlights why professional representation is crucial.

Insurance companies employ adjusters to minimize payouts.You deserve an expert working just as hard for your interests.Public adjusters are state-licensed professionals who understand policy language, know how to document damages properly, and have the negotiation skills to maximize your settlement.

Whether you’re facing fire damage, water damage, or hurricane destruction, the right public adjusting firm can make the difference between a disappointing settlement and full compensation.

Quick look atpublic adjusting firms near me:

What is a Public Adjuster and How Do They Help?

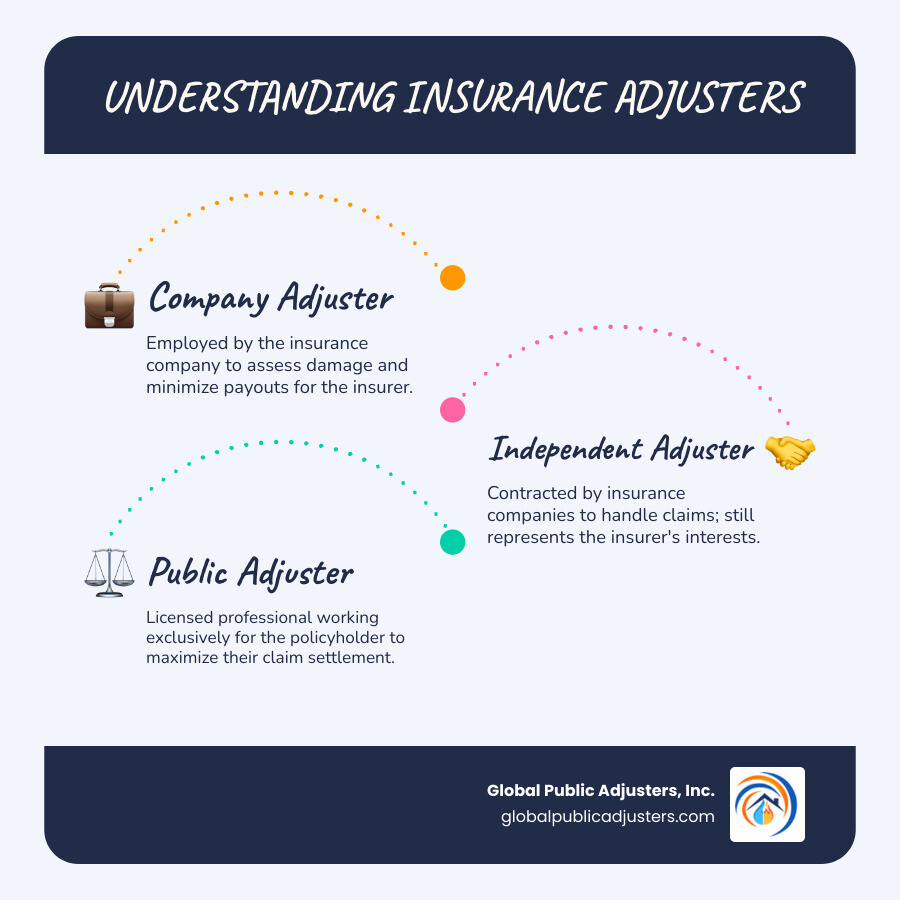

When your property is damaged, your insurance company sends an adjuster to evaluate the loss. But their loyalty is to their employer, not you.

Apublic adjusteris a licensed insurance professional who works exclusively for you, the policyholder. They are your personal advocate in the complex insurance claims process, fighting for your best interests while the insurance company’s adjuster works to protect their employer’s bottom line.

Hiring a public adjuster levels the playing field. Insurance companies have experts working to minimize payouts; a public adjuster is your expert, working to maximize what you receive.

A public adjuster manages your entire claim.They start with a thorough property inspection, identifying hidden issues like structural problems or secondary water damage. They then prepare detailed documentation and estimates, using their knowledge of construction costs and building codes to define the true scope of repairs.

Crucially,they handle all negotiations with your insurance company.This means you avoid the stress of confusing policy language and lowball offers. Your public adjuster presents your claim professionally to achieve the maximum settlement.

| Feature | Public Adjuster | Insurance Company Adjuster |

|---|---|---|

| Allegiance | Works exclusively for the policyholder | Works for the insurance company |

| Goal | Maximize policyholder’s settlement | Minimize insurance company’s payout |

| Perspective | Advocates for your best interests | Represents the insurer’s financial interests |

| Expertise | Interprets policy to your benefit, knows industry standards | Interprets policy to insurer’s benefit, follows company guidelines |

| Fees | Contingency-based (no recovery, no fee) | Part of the insurer’s operating costs |

| Typical Outcome | Often results in significantly higher settlements | Initial offers may be lower than true value |

The difference is clear. With a public adjuster, you have someone fighting exclusively for you, not against you.

More info about what a public adjuster can do for you

The Key Benefits of Hiring a Professional Advocate

Dealing with property damage is stressful enough without the added complexity of an insurance claim. Hiring a professional advocate provides several key benefits:

- Stress Reduction:You can focus on getting your life back to normal while an expert handles the paperwork, phone calls, and confusing policy language.

- Time Savings:A proper claim is a full-time job. A public adjuster handles the hours of documentation, research, and follow-up, freeing up your time.

- Industry Expertise:Public adjusters are experts in policy interpretation, construction costs, and insurance law. They find coverage you might not know you have and ensure you claim every dollar you’re entitled to.

- Higher Payouts:Studies show policyholders with public adjusters receive significantly higher settlements—often 747% more. This is because they know how to properly document losses and negotiate effectively.

- Leveling the Playing Field:Your insurer has a team of experts. A public adjuster is your dedicated professional, ensuring you have an equally qualified advocate fighting for your interests.

When you search for“public adjusting firms near me,”you’re seeking peace of mind and fair treatment during a difficult time.

Common Property Damage Claims They Handle

At Global Public Adjusters, Inc., our 50+ years of experience in Florida means we’ve handled every type of property damage. We know how to manage each situation effectively.

- Fire damage:These complex claims involve not just fire destruction but also hidden smoke damage, structural issues, and contents losses that require meticulous documentation.

- Water damage:Burst pipes or appliance failures can lead to secondary damage like mold and structural weakening. We identify all related damage, not just what’s visible.

- Hurricane damage:These claims often involve a combination of wind damage, flooding, and structural loss, each requiring specific expertise to document and claim properly.

- Roof leaks:A seemingly minor leak can cause extensive interior damage. We assess whether a simple repair or a full replacement is warranted under your policy.

- Mold damage:Often resulting from water intrusion, mold requires specialized assessment. We counter insurance company attempts to minimize these claims.

- Other Losses:We also handle claims for vandalism, flood damage, and sinkholes, each with unique challenges and coverage requirements.

- Business interruption:We help businesses recover lost income after property damage forces a closure, providing the detailed financial analysis these claims require.

More on property damage claims

The Public Adjuster Process: From First Call to Final Payout

When you work withpublic adjusting firms near melike ours, we manage the entire claims process for you, from the first call to the final payout.

Our process is designed to be thorough, transparent, and focused on getting you the compensation you deserve.

- Initial Consultation:We start with a free, no-obligation conversation to discuss your damage and how we can help.

- Contract Review:If we’re a good fit, we review a straightforward contract that outlines our services and fee structure with complete transparency.

- Damage Documentation:We conduct a meticulous inspection of your property, using photos, videos, and detailed notes. We may bring in specialists like engineers to identify damage that isn’t obvious.

- Claim Preparation:We compile all evidence, estimates, and policy information into a professional claim package that presents a compelling case to your insurer.

- Policy Analysis:We dive deep into your insurance policy to understand every detail, allowing us to find coverage you might not know you have.

- Negotiation:We handle all communication with your insurance company. We present the documented claim, challenge lowball offers, and fight for a fair settlement based on your policy.

- Settlement:We guide you through the final paperwork to secure a settlement that reflects the full extent of your damages. Our fee is paid from this settlement, so you never pay anything upfront.

Understanding Public Adjuster Fees

A common question is, “What does a public adjuster cost?”

We work on a contingency fee basis, meaning you pay nothing upfront. We invest our time and resources into your claim, and our success is tied directly to yours.If we don’t recover money for you, you owe us nothing.

When we secure a settlement,our fee is a small, state-regulated percentage of that amount.This is clearly stated in our contract, so there are no surprises. The fee typically ranges from 10% to 20% of the total settlement. This structure ensures we are motivated to maximize your claim, as our success depends on yours.

When Should You Call a Public Adjuster?

While you can handle a claim yourself, calling a professional is essential in certain situations.

- Large or complex claims:If your property has major damage from a fire, hurricane, or extensive water intrusion, you need an expert to manage the many moving parts.

- Denied claims:Don’t accept a denial as the final word. We specialize in reviewing denied claims and building a compelling case to overturn the decision.

- Low settlement offers:Insurers often start with low offers. We can review their offer and negotiate for a settlement that covers your actual costs.

- Feeling overwhelmed or short on time:Managing a claim is time-consuming. We handle the entire process so you can focus on your life and work.

- Your insurer is unresponsive:If your insurance company is delaying or ignoring you, a public adjuster can get the process moving again.

Insurance companies have professionals protecting their interests. You should have one protecting yours.

Signs you need a public adjuster

How to Find Reputable Public Adjusting Firms Near Me

When you search forpublic adjusting firms near me, you’re making a critical decision for your financial recovery. Finding a trustworthy firm is straightforward if you know what to do.

Here’s a systematic approach to find qualified firms:

- Start Online:A search for “public adjuster” plus your city (e.g., “public adjuster Orlando FL”) will provide a starting list.

- Check Directories and Reviews:Use Google Maps, Yelp, and the Better Business Bureau to find local firms and read client reviews. Look for consistent patterns of positive feedback.

- Ask for Referrals:Attorneys, contractors, and real estate agents often work with public adjusters and can provide trusted recommendations.

- Verify Credentials:Before committing, check their license with your state’s Department of Insurance. This is a crucial step.

- Look for Professional Memberships:Associations like the National Association of Public Insurance Adjusters (NAPIA) require members to meet high ethical and educational standards.

Vetting Credentials: What to Look for in the Best Public Adjusting Firms Near Me

Once you have a shortlist ofpublic adjusting firms near me, it’s time to vet them carefully.

- State Licensing:This is non-negotiable. A public adjuster must be licensed in your state. Verify this on your state’s Department of Insurance website.

- Bonding and Insurance:A reputable firm will be bonded and carry professional liability insurance. This protects you from errors and financial issues.

- Relevant Experience:Look for firms with a long track record and specific experience with your type of damage. Our 50+ years at Global Public Adjusters, Inc. means we’ve handled nearly every scenario.

- Client Testimonials:Seek specific examples of success, such as overturning a denial or securing a much higher settlement than the initial offer.

- Professional Memberships:Belonging to groups like NAPIA shows a commitment to industry standards and ethics.

- Specialized Expertise:For complex claims like hurricane or fire loss, ask about their specific experience in those areas to ensure they have the right skills.

Questions to Ask When Searching for Public Adjusting Firms Near Me

Come prepared with the right questions when you speak with potential firms. You are hiring them for a critical job.

- “What’s your experience with claims like mine?”Ask for specific examples of similar cases they’ve successfully handled.

- “Can you provide recent client references?”A reputable firm will gladly connect you with past clients. A refusal is a red flag.

- “How do you charge?”Confirm the contingency fee percentage in writing and ask about any other potential costs.

- “How will you keep me updated?”Understand their communication process, frequency, and who your main point of contact will be.

- “What is your process for denied or low offers?”Ensure they are prepared to fight and challenge the insurance company’s decisions.

- “Who will handle my claim day-to-day?”Confirm that an experienced adjuster, not a junior associate, will be managing your file.

- “What is a realistic timeline for my claim?”Experienced adjusters can provide a general timeframe, but be wary of promises that sound too good to be true.

- “How do you document damages?”They should describe a thorough process involving photos, videos, specialized software, and expert consultations when needed.

More questions to ask your public adjuster

Frequently Asked Questions about Public Adjusters

When you’re dealing with property damage and searching forpublic adjusting firms near me, it’s natural to have questions. Here are answers to the most common ones.

Can a public adjuster help if my insurance claim was already denied?

Yes, absolutely.A denied claim is often the beginning of the negotiation, not the end. Insurance companies deny claims for many reasons, and these decisions can often be successfully challenged.

When you bring us a denied claim, we act as investigators and advocates. We thoroughly review your policy, the denial letter, and the damage to find grounds for an appeal. We then reopen the claim with new evidence and a professionally prepared case designed to counter the insurer’s reasoning. We have successfully overturned countless denials for our clients.

What to do when your claim is denied

What qualifications should a public adjuster have?

A qualified public adjuster must have several key credentials:

- Licensing and Bonding:They must be licensed and bonded in your state, which is a legal requirement. You can verify this with your state’s Department of Insurance.

- Experience:Look for a proven track record of handling claims similar to yours. Experience provides insight into how different insurance companies operate.

- Positive Reviews:Testimonials from past clients offer a glimpse into their communication style, professionalism, and ability to get results.

- Professional Memberships:Affiliation with organizations like the National Association of Public Insurance Adjusters (NAPIA) indicates a commitment to high ethical and educational standards.

A good public adjuster is an expert in policy interpretation, damage assessment, and negotiation.

State regulations are key, like this example from Virginia.

Why can’t my contractor just handle the insurance claim?

While it may seem convenient, it isillegal in most states for a contractor to negotiate an insurance claim.This is considered the unlicensed practice of public adjusting and can jeopardize your claim.

A contractor’s expertise is in construction, not insurance policy interpretation. A public adjuster is the only professional, besides an attorney, who is licensed to represent you in negotiating a property claim. There is also a potential conflict of interest, as a contractor’s main goal is to secure the repair job, not necessarily to maximize your entire settlement, which might include things like temporary living expenses.

Your contractor provides essential repair estimates, but the job of interpreting your policy and negotiating with the insurer should be left to a licensed public adjuster.

Conclusion

When your property is damaged, the path to recovery can be challenging. Finding the rightpublic adjusting firms near meis the key to securing fair compensation instead of fighting a frustrating battle with your insurer.

As this guide has shown, a public adjuster advocates exclusively for you. The data is clear: expert representation can dramatically increase your settlement. More importantly, it provides invaluable peace of mind. While you focus on getting your life back to normal, your adjuster handles the complex negotiations, policy interpretations, and paperwork.

At Global Public Adjusters, Inc., our team has over 50 years of experience helping Florida property owners in Orlando, Pensacola, and beyond. We don’t just process claims; we fight for fair settlements that cover the full scope of your damages.

Having a professional on your side is crucial.Insurance companies have experts working to minimize their payouts. You deserve an equally qualified professional working to maximize yours.

For dedicated representation, the experienced team at Global Public Adjusters, Inc. can manage your claim from start to finish.We work on a contingency basis, so you pay nothing unless we secure a settlement for you.

Ready to level the playing field? Explore our full range ofclaim support servicesto see how we can help you recover the compensation you deserve.