Public adjuster for fire damage: Maximize 1st Claim

Why Fire Damage Claims Are More Complex Than You Think

Public adjuster for fire damageis a licensed professional who works exclusively for you—not your insurance company—to document losses, steer complex policy language, and negotiate the maximum settlement after a fire. They typically work on a contingency basis (10-15% of your settlement), meaning you pay nothing upfront and only if they secure compensation for you.

Quick Answer: When You Need a Public Adjuster for Fire Damage

- Your initial settlement offer seems too low to cover repairs

- The insurance company denied or delayed your claim

- You’re overwhelmed by complex paperwork and policy language

- Hidden damage (smoke, soot, water from firefighting) wasn’t fully assessed

- You want an expert to maximize your payout (average 3-5x higher settlements)

Dealing with the aftermath of a fire is devastating. You’re facing not just the visible burn damage, but also smoke damage throughout your home, water damage from firefighting efforts, and potential structural issues you can’t even see yet.

Then comes the insurance claim process—and that’s where many homeowners feel truly overwhelmed.

Your insurance company will send their own adjuster to assess the damage. But here’s what most people don’t realize:that adjuster works for the insurance company, not for you. Their job is to settle your claim—often for as little as possible.

This is where a public adjuster changes the equation. A public adjuster isyouradvocate, working exclusively on your behalf to ensure every dollar of damage is documented, every covered loss is claimed, and you receive the full settlement you’re entitled to under your policy.

This guide will walk you through everything you need to know about hiring apublic adjuster for fire damage—from understanding what they do, to knowing when you need one, to choosing the right professional for your situation.

QuickPublic adjuster for fire damageterms:

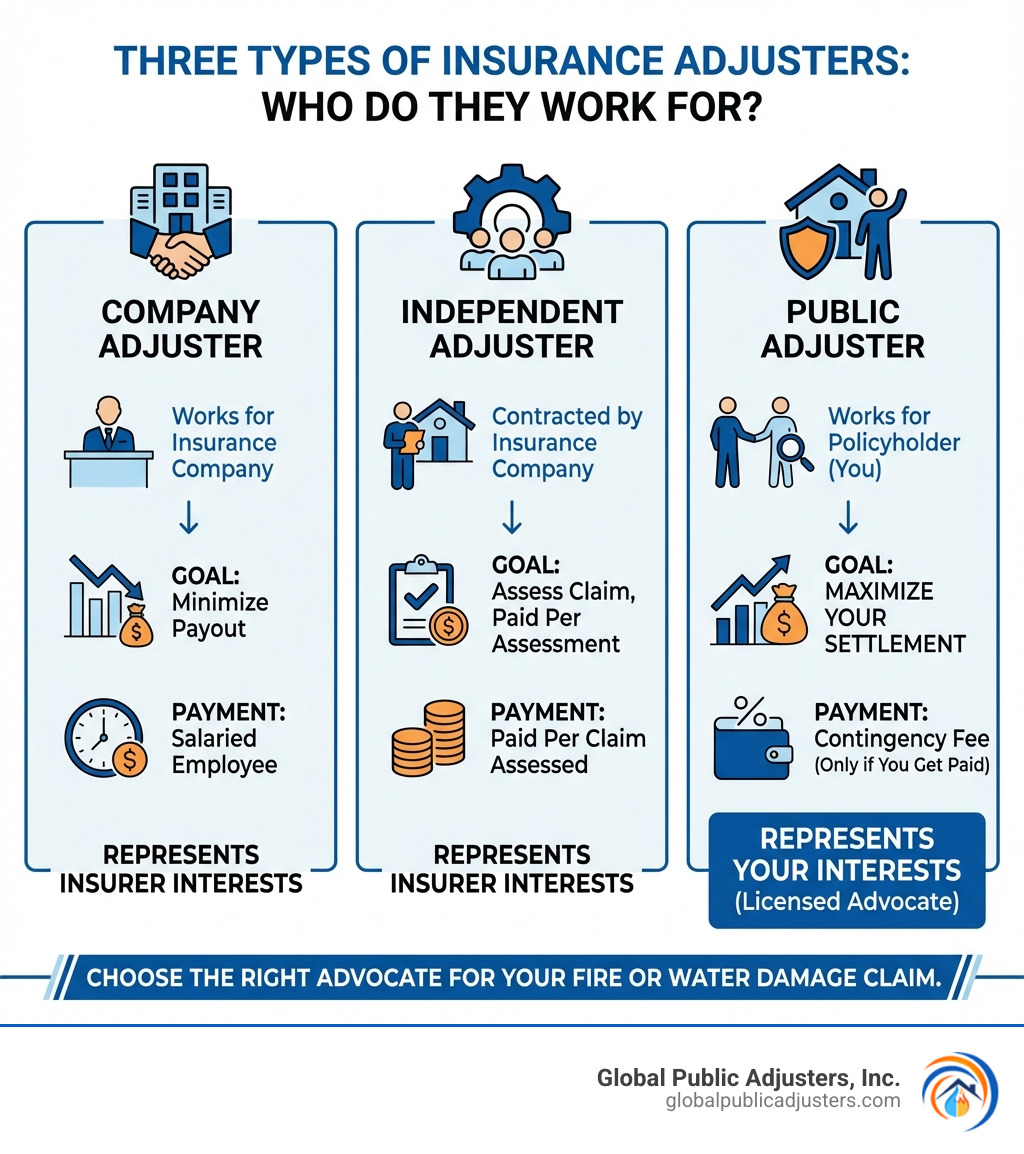

Understanding the Key Players: Public Adjuster vs. Insurance Adjuster

When fire strikes your property, you’ll inevitably encounter various professionals involved in the claims process. It’s crucial to understand who each person represents, as their loyalties and objectives can significantly impact your claim’s outcome.

The Insurance Company Adjuster

The insurance company adjuster is the first person your insurer will likely send to your property after a fire. They are either a salaried employee of your insurance company or an independent adjuster hired by your insurance company to assess the damage. Their primary goal, understandably, is to protect the insurance company’s financial interests. This means they will assess the damage with an eye towards minimizing the payout.

While they may seem helpful, their objective is to ensure the company pays no more than absolutely necessary. They might overlook certain damages, apply depreciation where it’s not fully warranted, or interpret policy language in a way that benefits the insurer. They are not there to advocate for you. For tips on how to interact with them, you can read more abouthow to deal with an insurance adjuster.

The Public Adjuster

Apublic adjuster for fire damage, on the other hand, is a licensed expert whose sole responsibility is to representyourbest interests. We work exclusively for property owners, acting as your advocate throughout the entire claims process. When you hire us, our goal is to maximize your settlement, ensuring you receive every dollar you’re entitled to under your policy to fully repair or rebuild your property and replace your belongings.

We are paid on a contingency basis, meaning our fee is a percentage of the final settlement you receive. This aligns our interests directly with yours: the more we secure for you, the more we earn. This model ensures we are highly motivated to achieve the largest possible settlement. As an expert source states,a public insurance adjuster is an expert hired by the policyholder.

Below is a quick comparison to highlight the key differences:

| Feature | Insurance Company Adjuster | Public Adjuster |

|---|---|---|

| Who they work for | The insurance company | The policyholder (you) |

| Primary goal | Minimize the insurance company’s payout | Maximize the policyholder’s settlement |

| How they are paid | Salary or fee from the insurance company | Contingency fee (percentage of your settlement) |

| Policy expertise | Interprets policy for the insurance company’s benefit | Interprets policy for the policyholder’s benefit and rights |

The Core Benefits of Hiring a Public Adjuster for Fire Damage

After a fire, the thought of navigating complex insurance policies and negotiating with adjusters can feel like an impossible task. This is precisely where apublic adjuster for fire damagebecomes an invaluable asset. Our expertise, dedication, and advocacy can significantly improve your recovery process. We play an essential role in your fire damage recovery, as highlighted inthis article on the essential role of public adjusters.

Maximizing Your Settlement Payout

One of the most compelling reasons to hire a public adjuster is our ability to significantly increase your insurance settlement. Insurance companies, by their nature, aim to minimize payouts. Without an expert on your side, you might inadvertently accept a settlement that doesn’t fully cover your losses.

We conduct a detailed and objective damage assessment that often goes beyond what an insurance company’s adjuster might provide. This includes:

- Identifying Hidden Damage:Fire damage isn’t just about what you can see. We carefully search for hidden issues like smoke and soot damage that can penetrate walls, HVAC systems, and personal belongings. We also assess water damage from firefighting efforts, which can lead to mold and structural problems if not properly addressed.

- Structural Issues:We evaluate the structural integrity of your property, identifying damage that might not be immediately apparent but could compromise safety and require extensive repairs.

- Policy Expertise:Our deep understanding of insurance policies, including all coverages, endorsements, and exclusions, ensures that every aspect of your loss is properly documented and claimed. This often uncovers funds for items or repairs you didn’t even know were covered.

- Negotiation Skills:We are expert negotiators. We know the tactics insurance companies use to minimize payouts and are prepared to counter them with thoroughly documented evidence and strong arguments. Our goal is to secure the maximum possible settlement for you.

While we can’t promise specific figures, it’s widely recognized that public adjusters can sometimes land larger settlement claims for their clients. Many policyholders find their settlements are significantly higher with a public adjuster’s involvement. You can findmore information on the benefits of a public adjuster for fire damage here.

Saving You Time and Reducing Stress

Dealing with a fire is emotionally and physically exhausting. The last thing you need is the added burden of managing a complex insurance claim. Apublic adjuster for fire damagehandles virtually every aspect of the claim process, allowing you to focus on rebuilding your life and caring for your family.

We manage all communication with your insurance company, prepare and submit all necessary paperwork, and attend all inspections. This significantly reduces your stress and frees up your valuable time. We become your single point of contact for the claim, providing expert guidance and support every step of the way. Our goal is to alleviate the emotional burden, letting you concentrate on recovery while we handle the intricate details.

Navigating Complex Policy Language

Insurance policies are notoriously complex documents, filled with jargon, legalistic phrasing, and intricate clauses. Understanding what is and isn’t covered, the limits of your coverage, and any specific endorsements can be a daunting task for the average policyholder.

We are experts in deciphering this complex language. We carefully review your policy to identify all applicable coverages, ensuring that no potential avenue for compensation is overlooked. We understand how policy exclusions might be unfairly applied and can argue effectively on your behalf. This expertise is crucial for ensuring all covered losses are claimed and you receive the full benefit of your policy. For a deeper dive into why this expertise is critical, explorewhy you should hire a PA for your claim.

The Fire Damage Claim Process with a Public Adjuster

When you hire Global Public Adjusters, Inc. for yourfire damageclaim, we become your dedicated partner, guiding you through every step of the process. Our proactive approach ensures that your claim is handled efficiently and effectively, aiming for the best possible outcome.

Step 1: Policy Review and Initial Assessment

Our process begins with a free, no-obligation consultation. During this initial meeting, we’ll discuss the details of your fire damage and provide an expert assessment of your situation. The most critical next step is an in-depth review of your insurance policy. We carefully analyze your policy documents to identify all applicable coverages, endorsements, and exclusions related to fire, smoke, and water damage. This comprehensive review ensures we understand your rights and obligations, laying the groundwork for a robust claim. Understanding your policy is the first step inhow to file a homeowners insurance claim after a fire.

Step 2: Comprehensive Damage Documentation

Accurate and thorough documentation is the backbone of any successful fire damage claim. Our team conducts a meticulous on-site inspection of your property in Orlando or Pensacola, Florida. This isn’t just about visible damage; we use specialized tools and expertise to identify:

- Structural Damage:Assessing the integrity of your home’s framework, roof, and foundation.

- Smoke and Soot Damage:Documenting the pervasive nature of smoke and soot, which often extends far beyond the fire’s origin and can cause long-term health issues and odor problems. We are experts inhandling smoke damage claims.

- Water Damage:Evaluating damage caused by firefighting efforts, which can be extensive and lead to mold growth if not promptly addressed.

- Personal Property Inventory:We assist you in creating a detailed inventory of all damaged or destroyed personal belongings, including their estimated value, condition before the fire, and replacement costs.

- Additional Living Expenses (ALE):If your home is uninhabitable, we help you document and claim all eligible ALE, such as temporary housing, meals, and other necessary expenses.

We gather all necessary documentation, including photos, videos, repair estimates from trusted contractors, and expert reports, to build a compelling case for your claim.

Step 3: Claim Submission and Negotiation

Once all damages are thoroughly documented, we prepare a detailed Proof of Loss statement and a comprehensive claim package. This package is then submitted to your insurance company.

Our role doesn’t end there. We handle all communications and negotiations with your insurer. We present your claim with irrefutable evidence, counter any lowball offers, and challenge unfair depreciation or coverage denials. We are persistent and strategic, ensuring that your voice is heard and your claim is given the attention it deserves.

We understand that negotiating a fire insurance claim requires thorough documentation, understanding your policy, and persistence. For more insights, refer totips for a fire insurance claim. Our goal is to secure a fair and prompt settlement that allows you to fully recover from the disaster.

Practical Considerations Before You Hire

Deciding to hire apublic adjuster for fire damageis a significant step towards a smoother recovery. To make an informed decision, it’s important to understand the practical aspects, including costs and how to choose the right professional.

Understanding the Costs of a Public Adjuster for Fire Damage

One of the most common questions we hear is about cost. We understand that after a fire, financial concerns are paramount. That’s why we, like most reputable public adjusters, operate on a contingency fee basis. This means:

- No Upfront Costs:You pay nothing out-of-pocket to hire us. We only get paid if and when we successfully secure a settlement for you.

- No Recovery, No Fee:If we can’t win you a larger settlement, you owe us nothing. This model ensures our interests are fully aligned with yours.

- Typical Percentage Fee:The fee for apublic adjuster for fire damageis typically a small percentage of the total claim settlement, generally ranging from 10% to 15%. This percentage is agreed upon in a clear contract before we begin any work.

This fee structure ensures that our services are accessible when you need them most, without adding to your immediate financial burden.

How to Choose the Right Public Adjuster for Fire Damage

Choosing the right public adjuster is crucial for the success of your fire damage claim. Here are key steps to ensure you select a qualified and trustworthy professional in Florida:

- Verify State Licensure:Always confirm that the public adjuster is licensed in Florida. You can check with the Florida Department of Financial Services to verify their credentials. This ensures they meet the state’s requirements for expertise and ethical conduct.

- Check for Experience with Fire Claims:Fire damage claims are particularly complex, involving specialized knowledge of structural issues, smoke, soot, and water damage. Look for a firm with extensive experience specifically in handling fire claims. At Global Public Adjusters, Inc., we have over 50 years of experience advocating for Florida homeowners and businesses.

- Read Reviews and Ask for References:Seek out testimonials and reviews from previous clients. A reputable public adjuster should be able to provide references from satisfied customers.

- Look for Members of Professional Organizations:Membership in organizations like the National Association of Public Insurance Adjusters (NAPIA) indicates a commitment to professional standards and ongoing education.

- Ensure a Clear and Fair Contract:Before signing anything, thoroughly review the contract. It should clearly outline the scope of services, the contingency fee percentage, and all terms and conditions. Don’t hesitate to ask questions until you fully understand everything.

Can a Public Adjuster Help After an Initial Settlement Offer?

Yes, absolutely! Many policyholders contact us after they’ve already received an initial settlement offer from their insurance company, or even after a claim has been settled. If you believe your settlement is too low, or if new damages become apparent after the initial assessment, we can still help.

We can:

- Review Your Settlement:We’ll analyze the initial offer to determine if it accurately reflects the full extent of your losses, often identifying overlooked damages or undervalued items.

- File Supplemental Claims:If additional damage is finded during repairs, or if the initial settlement didn’t account for all costs, we can prepare and submit a supplemental claim on your behalf.

- Reopen Claims:In some cases, if you were significantly underpaid or if your claim was wrongly denied, we may be able to reopen your claim and negotiate for a higher settlement.

Even if a check has been issued, it’s often not too late to seek additional compensation, especially within the statute of limitations for filing claims in Florida.

Frequently Asked Questions about Public Adjusters

We often hear similar questions from homeowners and business owners struggling with fire damage. Here are some of the most common ones, answered directly to help clarify the role and benefits of apublic adjuster for fire damage.

Will my insurance company be upset if I hire a public adjuster?

It’s a common concern, but no, your insurance company will not be “upset” or retaliate if you hire a public adjuster. It is your legal right as a policyholder to have professional representation throughout the claims process. Insurance companies are required by state regulations in Florida to engage and negotiate with any licensed public adjuster you appoint. They understand that a public adjuster speaks their language and can present a credible, fully documented claim. While they might prefer to deal directly with you to minimize costs, they cannot legally penalize you for exercising your right to expert advocacy.

What’s the difference between a public adjuster and a contractor?

This is an important distinction! Apublic adjuster for fire damageis a licensed insurance professional. Our expertise lies in interpreting insurance policies, assessing the full scope of your losses, documenting every detail, and negotiating the settlement amount with your insurance company. We are experts in policy language and claims procedures.

A contractor, on the other hand, is an expert in construction and repairs. They provide estimates for rebuilding or repairing your property. While a contractor can tell you how much it will cost to fix the damage, they cannot legally interpret your insurance policy or negotiate your claim settlement on your behalf. We often workwithcontractors to ensure their estimates accurately reflect the full cost of repairs, but our roles are distinct.

How long does a fire damage claim take with a public adjuster?

The timeline for a fire damage claim can vary significantly based on its complexity. Simple claims might be resolved in a few months, while more complex residential claims or large commercial claims involving extensive damage, business interruption, or unique policy nuances can take longer, potentially up to several months or even a year.

However, having apublic adjuster for fire damageinvolved often helps to streamline the process. Because we carefully document everything upfront, prepare comprehensive claim packages, and proactively engage with the insurance company, we can often accelerate the resolution. Our detailed submissions speak the technical language insurers understand, which can speed up negotiations and reduce back-and-forth delays, ultimately leading to a faster and fairer settlement for you.

Conclusion: Your Partner in Recovery

Experiencing fire damage to your home or business in Florida can be one of the most challenging events you’ll ever face. The path to recovery is often fraught with emotional stress, complex paperwork, and the daunting task of negotiating with your insurance company.

This is where apublic adjuster for fire damagesteps in as your unwavering advocate. We empower policyholders like you, taking control of the claims process to ensure you receive the full and fair settlement you deserve. Our commitment is to maximize your payout, save you invaluable time, and significantly reduce your stress, allowing you to focus on rebuilding your life.

At Global Public Adjusters, Inc., we bring over 50 years of experience to the table, helping homeowners and businesses in Orlando, Pensacola, and throughout Florida steer these difficult times. Our expertise ensures that every detail of your fire damage is carefully documented, every policy nuance is understood, and every negotiation is handled with your best interests at heart.

Don’t face your insurance company alone. Let us be your trusted partner in recovery. Contact us today toget professional help with your claim.

Connect with us: