Public adjuster insurance claim: 7x Maximize Payout

Why Understanding Public Adjuster Insurance Claims Matters When You’re Facing Property Damage

Public adjuster insurance claimassistance can be the difference between accepting a low settlement and receiving the full compensation you deserve after property damage. Here’s what you need to know when deciding whether to hire one:

Quick Answer: Should You Hire a Public Adjuster?

- What they do: Public adjusters work exclusively for you—not the insurance company—to assess damage, document losses, and negotiate your claim settlement

- When to hire: Consider a public adjuster for large claims (over $10,000), complex damage, denied claims, or when you’re too overwhelmed to handle the process

- What they cost: Typically 5-20% of your final settlement, paid only if you receive a payout

- The benefit: Homeowners who hired public adjusters for hurricane claims received an average of 747% more than those who didn’t

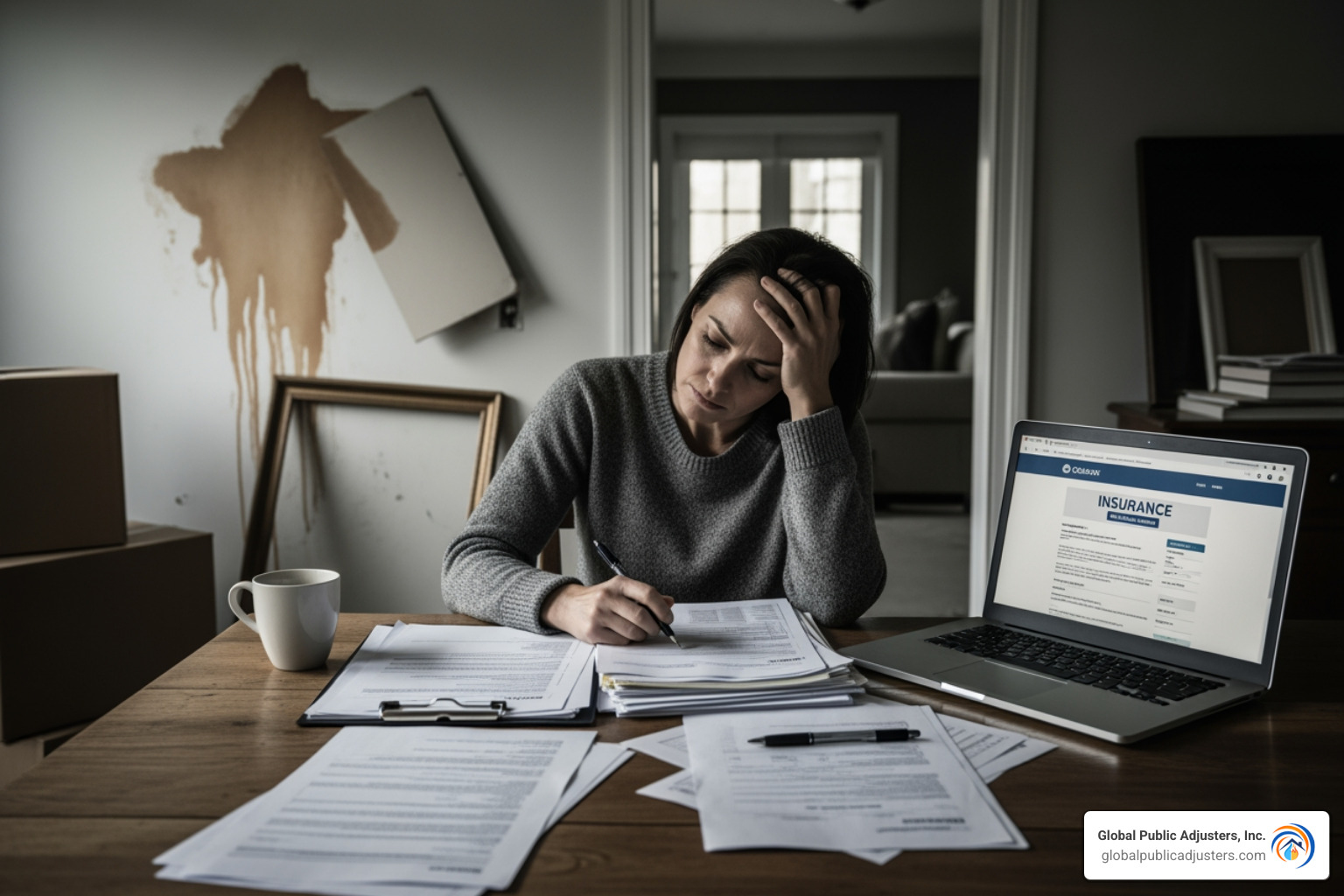

Dealing with property damage after a fire, storm, or flood is overwhelming enough. The insurance claims process can feel like a second disaster—confusing paperwork, endless documentation, and the nagging worry that you’re not getting what you’re owed.

You don’t have to steer this alone.While your insurance company sends their own adjuster to assess your damage, that person works for the insurer, not for you. Their job is to settle your claim as efficiently—and often as cheaply—as possible for their employer.

A public adjuster changes that dynamic entirely. These licensed professionals work on your behalf, using their expertise to ensure every dollar of damage is documented, every covered item is included, and your settlement reflects the true cost of your loss. They speak the insurance company’s language and understand policy fine print that most homeowners miss.

But hiring a public adjuster isn’t always necessary, and it comes with costs you need to understand. The decision depends on your claim’s complexity, the extent of your damage, and your confidence in handling negotiations with your insurer.

EssentialPublic adjuster insurance claimterms:

What is a Public Adjuster and How Do They Help?

When disaster strikes your property in Florida, whether it’s a hurricane, fire, or burst pipe, the path to recovery often starts with an insurance claim. This is where the crucial role of an adjuster comes into play. But not all adjusters are created equal. Understanding the different types is the first step in ensuring your interests are protected.

The Role of a Public Adjuster in Your Insurance Claim

At Global Public Adjusters, Inc., we understand that navigating the aftermath of property damage is stressful. That’s why we advocate for policyholders, acting as your dedicated representative throughout the entire insurance claim process. A public adjuster is a licensed professional you hire to help settle an insurance claim on your behalf. Unlike other adjusters, our allegiance is solely to you, the insured.

Our primary objective? To maximize your settlement. We do this by carefully assessing damage, documenting losses, and skillfully negotiating with your insurance company. We speak the complex language of insurance policies and use our expertise to present a comprehensive claim that reflects the true value of your damages.

Think of us as your personal claim manager, ensuring no detail is overlooked and every dollar you’re owed under your policy is accounted for. For a deeper dive into our services, exploreWhat Can a Public Adjuster Do For Me?and gain a clearer understanding of What is a public adjuster?.

Key Differences: Public vs. Company vs. Independent Adjusters

To fully grasp the value of a public adjuster, understand how they differ from other types of adjusters you might encounter:

| Adjuster Type | Who They Work For | Who Pays Them | Primary Objective |

|---|---|---|---|

| Company Adjuster | The Insurance Company | The Insurance Company | To represent the insurer’s interests and settle claims efficiently, often aiming to keep costs down for their employer. |

| Independent Adjuster | The Insurance Company (contracted) | The Insurance Company | To represent the insurer’s interests, often hired during peak times or for specialized claims. |

| Public Adjuster | You, the Policyholder | You, the Policyholder (from your settlement) | To advocate for your best interests, assess damages thoroughly, and maximize your claim settlement. |

The key takeaway here is allegiance. A company or independent adjuster is paid by and represents the insurance company. Their goal, while professional, aligns with the insurer’s bottom line. A public adjuster, like those at Global Public Adjusters, Inc., is hired and paid by you, making us fiercely dedicated to securing the best possible outcome for yourpublic adjuster insurance claim.

Specific Services a Public Adjuster Provides

Our comprehensive services ensure that every aspect of your claim is handled with precision and expertise. When you choose us, you can expect us to:

- Review Your Policy:We thoroughly examine your insurance policy to understand your coverage, limits, deductibles, and any specific conditions that apply to your loss. This step is critical to identifying all eligible benefits.

- Assess and Document Damage:We conduct a meticulous on-site inspection of your property in Orlando, Pensacola, or anywhere in Florida, documenting all damages with photos, videos, and detailed notes. This includes visible damage, as well as often-overlooked hidden issues.

- Estimate Repair and Replacement Costs:Using our extensive experience and industry tools, we accurately estimate the cost of repairs, replacements, and other related expenses. This helps ensure your claim reflects the true cost of restoring your property.

- Prepare and Present Your Claim:We compile all documentation, estimates, and policy interpretations into a comprehensive claim package, presenting it to your insurance company in a clear and compelling manner.

- Negotiate with the Insurer:We handle all communications and negotiations with your insurance company, challenging low offers and advocating for a fair settlement. We are experts in the claims process and are licensed by the Florida Department of Financial Services (DFS) to negotiate on your behalf.

- Manage Business Interruption and Extra Expense Claims:For business owners, we can also evaluate and document losses related to business interruption and extra expenses incurred due to property damage.

For more details on how we carefully manage every step, read aboutPublic Insurance Adjusters: What They Do.

When and Why to Hire a Public Adjuster

Deciding whether to hire a public adjuster is a significant step in your insurance claim journey. While not every claim requires one, certain situations make our expertise invaluable.

Scenarios Where a Public Adjuster is Most Beneficial

You might be wondering, “Is this the right time for a public adjuster?” Based on our experience serving homeowners and business owners across Florida, we’ve identified several key scenarios where our services are most beneficial:

- Large or Complex Claims:If your property has suffered extensive damage from a hurricane, fire, or major flood, the claim can be incredibly complex. These claims often involve multiple types of damage, intricate policy language, and significant repair costs. We excel at disentangling these complexities.

- Catastrophic Events:Following a widespread disaster like a hurricane hitting Florida, insurance companies are often overwhelmed. This can lead to delays, rushed assessments, or overlooked damages. A public adjuster ensures your claim gets the attention it deserves amidst the chaos.

- Underpaid Settlements:If your insurance company has made an offer that seems too low, or if you believe they’ve missed aspects of your damage, we can provide a second, independent assessment. We can often reopen claims and file supplemental claims to secure additional payments you’re entitled to.

- Denied Claims:A denied claim can be devastating. We investigate the reasons for denial, challenge the insurer’s decision, and work to get your claim approved.

- Lack of Time or Expertise:Dealing with property damage and an insurance claim is a full-time job. If you’re too busy, stressed, or simply lack the knowledge of insurance policies and construction costs, a public adjuster can handle the entire process for you.

- Business Interruption:For commercial property owners, damage can halt operations, leading to lost income and extra expenses. We specialize in documenting these complex losses to ensure your business recovers financially.

Many homeowners and business owners find that hiring us brings immense peace of mind and often a significantly better outcome. Find more reasons in7 Reasons to Hire a Public Adjuster When Facing Property Damage Claimsand specifically for fire damage inWhy Hire a Public Adjuster for Fire Damage?.

The Financial Impact: Can a Public Adjuster Secure a Higher Payout?

The numbers speak for themselves. One of the most compelling reasons to hire a public adjuster is the potential for a significantly higher payout. A report from the Florida Association of Public Insurance Adjusters (FAPIA) found that homeowners who hired their own adjusters for catastrophe claims received an average of747% more payoutthan those who didn’t. This isn’t just a slight increase; it’s a monumental difference that can profoundly impact your recovery.

How do we achieve such results?

- Expertise in Valuation:We have a deep understanding of construction costs, depreciation, and market values specific to Florida. We use sophisticated software and our experience to accurately price every aspect of your loss.

- Uncovering Hidden Damages:Often, the most costly damages aren’t immediately visible. From water damage behind walls to structural issues after a storm, we carefully inspect and document these hidden problems that an insurer’s adjuster might overlook or downplay.

- Leveling the Playing Field:Insurance companies have teams of experts working for them. By hiring a public adjuster, you gain an equally skilled advocate who understands the nuances of policy language and negotiation tactics. We ensure you’re not at a disadvantage.

If you’ve been underpaid, or suspect you might be, our services are specifically designed to help. Learn more about how we can assist if you’ve received an inadequate offer inShould I Hire a Public Adjuster If I Have Been Underpaid?.

Potential Downsides and Risks to Consider

While the benefits of hiring a public adjuster are substantial, it’s important to be aware of potential downsides and risks. We believe in full transparency so you can make an informed decision:

- Cost of Fees:Our services come with a fee, typically a percentage of your final settlement. This means the total amount you receive will be reduced by our fee. For smaller, straightforward claims, this might not be economically worthwhile. We’ll discuss this openly during your free consultation.

- Potential for Delays:While we strive for efficiency, bringing in a public adjuster can sometimes add a bit more time to the claims process, especially if significant negotiation is required. However, any slight delay is often outweighed by the increased settlement.

- No Guarantee of Success:While our goal is always to maximize your payout, we cannot guarantee a specific outcome. The final settlement depends on the specifics of your policy, the extent of damage, and the insurer’s willingness to negotiate. We work diligently to achieve the best possible result, but there are no absolute guarantees.

- Importance of Vetting:Like any profession, there are reputable and less reputable individuals. It’s crucial to thoroughly vet any public adjuster you consider to avoid potential issues. We’ll cover how to do this in the next section.

Understanding these points helps you weigh the decision carefully. For a balanced perspective, you might find this external resource helpful: What Is a Public Adjuster, and Do You Need One?.

The Process of Hiring and Working with a Public Adjuster

Choosing the right public adjuster is a critical step. At Global Public Adjusters, Inc., we want you to feel confident and informed throughout the entire process.

How to Find and Vet a Qualified Public Adjuster

Finding a qualified and trustworthy public adjuster is paramount. Here’s how we recommend you proceed in Florida:

- Verify Licensing:Always confirm that any public adjuster you consider is properly licensed by the Florida Department of Financial Services (DFS). You can contact the DFS directly to verify their license and check for any disciplinary actions.

- Check Professional Associations:Reputable public adjusters are often members of professional organizations like the National Association of Public Insurance Adjusters (NAPIA). You can use theNational Association of Public Insurance Adjusters (NAPIA) directoryto find licensed professionals in Orlando, Pensacola, and across Florida.

- Seek Referrals and Reviews:Ask friends, family, or trusted professionals for recommendations. Look for online reviews and testimonials, which can offer insights into an adjuster’s professionalism and success rate.

- Avoid Unsolicited Offers:Be wary of adjusters who solicit business door-to-door, especially right after a disaster. While not all are disreputable, it’s a practice that requires extra caution.

At Global Public Adjusters, Inc., we pride ourselves on our transparency and credentials. Feel free toFind a public adjuster through Global Public Adjusters, Inc.and we’ll be happy to provide all necessary verification.

Key Questions to Ask Before Hiring

Once you’ve identified a few potential public adjusters, it’s time to ask the right questions. This helps you gauge their expertise, approach, and compatibility with your needs. Here are some essential questions we encourage you to ask:

- “Are you licensed in Florida, and can you provide proof?”

- “How long have you been a public adjuster, and what is your experience with claims similar to mine (e.g., hurricane, fire, water damage)?”

- “Can you provide references from previous clients?”

- “How do you typically communicate with clients, and what is your availability?”

- “What is your fee structure, and are there any upfront costs or hidden fees?”

- “Will you be personally handling my claim, or will it be delegated to others?”

- “What is your estimated timeline for resolving a claim like mine?”

Asking these questions empowers you to make an informed decision. For more detailed guidance, seeWhat Questions Should You Ask Your Public Adjuster?.

Understanding the Public Adjuster Contract

Before signing any agreement, it’s crucial to thoroughly read and understand the public adjuster’s contract. This document outlines the terms of your agreement and your rights. Key elements to look for include:

- Scope of Services:The contract should clearly detail what services the public adjuster will provide, from damage assessment to negotiation.

- Fee Percentage:The percentage of the settlement that the public adjuster will charge should be explicitly stated. Be clear on whether this applies to the entire settlement or just the increase they secure.

- Cancellation Clause:In Florida, you typically have a right to cancel a contract with a public adjuster within ten (10) business days after it is executed. For claims resulting from a Governor’s declaration of a state of emergency, you may have even more time to cancel without penalty (30 days after the date of loss or 10 days after the contract is executed, whichever is longer). Ensure this right is clearly outlined.

- Payment Terms:Understand when and how the public adjuster will be paid. Fees are usually deducted from the insurance settlement.

We encourage you to take your time, ask questions, and ensure you’re comfortable with all terms before committing. For more insights into what to look for, refer to Public adjusters: What to know before you hire one.

Understanding the Costs and Legalities of a Public Adjuster Insurance Claim

Navigating apublic adjuster insurance claiminvolves not only understanding the services provided but also the financial implications and your legal rights.

How Much Does a Public Adjuster Cost?

The cost of hiring a public adjuster is a common concern for policyholders, and it’s an important one. Our fees are typically structured as a percentage of your final insurance settlement, meaning we only get paid if you receive a payout. This is known as a contingency fee basis.

- Percentage-Based Fee:Public adjusters generally charge between5% and 20%of the total value of your claim settlement. The specific percentage can vary based on the complexity of your claim and the extent of the damage.

- State Fee Caps:In Florida, there are specific regulations regarding public adjuster fees. For claims caused by a disaster declared a state of emergency by the Governor, fees are limited to10%of the claim payment for one year after the declaration. After that initial year, the limit may increase to20%. For reopened or supplemental claims, fees typically cannot exceed20%.

- Negotiable Fees:While there are typical ranges and state caps, our fees are often negotiable. We encourage you to discuss our fee structure openly during your initial consultation.

It’s crucial to remember that our fees arenotcovered by your insurance policy. The amount is deducted from the settlement payments made by your insurer. For example, if your claim settles for $100,000 and our fee is 15%, you would receive $85,000, and we would receive $15,000. Our goal is to secure a settlement that, even after our fee, leaves you with significantly more than you would have received on your own.

Your Legal Rights and Responsibilities as a Policyholder

As a policyholder in Florida, you have specific legal rights and responsibilities when working with a public adjuster:

- Right to Representation:You have the legal right to hire a public adjuster to represent your interests in an insurance claim. Your insurance company cannot prevent you from doing so.

- Contract Cancellation Rights:As mentioned, Florida law provides a window during which you can cancel your contract with a public adjuster. This is typicallyten (10) business daysafter signing, with extended periods for claims related to declared emergencies. Always confirm these details in your contract.

- Duty to Cooperate:While we handle the heavy lifting, you still have a responsibility to cooperate with your insurer and provide truthful information. We will guide you on what information is necessary and how to present it effectively.

- Ethical Standards:Public adjusters are bound by a code of ethics that mandates serving with objectivity and complete loyalty to your interests. While the specific code may vary slightly by state, the core principles of integrity and client advocacy are universal. You can learn more about these principles by reviewing the Public Insurance Adjuster Code of Ethics.

What to Do If You’re Unhappy with Your Public Adjuster

While we strive for exceptional service at Global Public Adjusters, Inc., it’s important to know your options if you ever become unhappy with a public adjuster’s services or the outcome of your claim:

- Communicate Directly:The first step should always be to communicate your concerns directly with your public adjuster. Many issues can be resolved through open discussion.

- Review Your Contract:Revisit your contract to understand the terms regarding termination of services and dispute resolution.

- Contact the Florida Department of Financial Services (DFS):If direct communication doesn’t resolve the issue, you can file a complaint with the DFS. They license and regulate public adjusters in Florida and can investigate complaints regarding unethical conduct or non-compliance with state laws.

- Seek Legal Counsel:In extreme cases, if contractual disputes or alleged misconduct cannot be resolved through other means, you may consider seeking legal advice. You can file a civil lawsuit against an adjuster if they don’t perform their job correctly.

Frequently Asked Questions about Public Adjuster Insurance Claims

We often hear similar questions from policyholders considering apublic adjuster insurance claim. Here are some of the most common:

Is it ever too late to hire a public adjuster?

It’s rarely “too late,” but timing can impact our effectiveness. Ideally, you should contact us as soon as possible after the damage occurs, or as soon as you feel overwhelmed or dissatisfied with your insurance company’s process. The earlier we get involved, the more control we have over documenting the initial damage and guiding the claim.

However, we can still help even if your claim has been denied or if you’ve already received a settlement offer you believe is too low. We frequently assist clients in reopening claims or filing supplemental claims to get them the additional funds they deserve. It can be harder to work on your behalf if you have already settled the claim and removed the damage, but we’re always here to assess your situation and advise on the best path forward.

Can a public adjuster also act as my repair contractor?

No. In Florida, licensed public adjusters are prohibited from acting as or having a financial interest in any repair or construction company that works on your property. This is a crucial ethical safeguard designed to prevent conflicts of interest and ensure that our assessment of your damages is completely objective. Our sole focus is on maximizing your claim, not on securing repair contracts. We can, however, help you negotiate with contractors you choose.

Does my insurance company have to accept the public adjuster’s estimate?

While we work diligently to provide a comprehensive and accurate estimate of your damages, your insurance company is not legally obligated to accept our assessment immediately. Just as you are not required to accept their initial estimate, the process involves negotiation. Our role is to present a well-substantiated claim, backed by evidence and expert valuation, and then to negotiate fiercely on your behalf. We challenge discrepancies and advocate for every dollar, but the final settlement is the result of this negotiation process.

Conclusion

Navigating apublic adjuster insurance claimcan feel like a daunting task, especially when you’re already struggling with property damage. But you don’t have to face it alone. As your dedicated advocates, we at Global Public Adjusters, Inc. are here to explain the process, carefully document your losses, and negotiate tirelessly on your behalf.

Our goal is simple: to ensure you receive the maximum settlement you’re entitled to under your policy, allowing you to rebuild and recover with confidence. With over 50 years of combined experience serving homeowners and business owners across Florida, including Orlando and Pensacola, we bring unparalleled expertise and a commitment to your peace of mind.

If you’re dealing with property damage, don’t steer the claims process alone. Learn more about how we can help with yourflood damage claims in Orlando.