Insurance public adjuster near me: Top 1 Maximize

Why Finding the Right Insurance Public Adjuster Matters When Disaster Strikes

When you’re searching for aninsurance public adjuster near me, you’re likely facing property damage and need help with a complex insurance claim. Here’s what you need to know:

Quick Answer: How to Find a Public Adjuster Near You

- Verify their license– Check with your state’s Division of Insurance (DOI) to confirm they’re licensed and bonded

- Check their experience– Look for adjusters with 15+ years of experience handling claims like yours

- Ask about fees– Most work on contingency (10-20% of settlement), meaning no recovery = no fee

- Get references– Request past client testimonials and case results

- Review their specialties– Ensure they handle your type of damage (fire, water, hurricane, etc.)

Property damage is overwhelming. Dealing with insurance companies, complex policy language, and documenting your loss is a full-time job you never asked for.

Here’s the reality:insurance company adjusters work for the insurance company, not for you.Their job is to protect their employer’s bottom line. A government study found that public adjusters help policyholders recover an average of 747% more than initial insurance offers.

When your property is damaged by fire, water, or storms, you face tight deadlines and complex paperwork. A licensed public adjuster acts as your advocate, working exclusively for you to document damages, interpret your policy, and negotiate the maximum possible settlement.

The difference between handling a claim yourself and hiring a public adjuster can mean thousands of dollars. For example, one condo complex negotiated a $500,000 claim on their own. After hiring a public adjuster, they secured an additional $1 million.

Insurance public adjuster near meword roundup:

What is a Public Adjuster and Why Do You Need One?

A public adjuster is a licensed professional who acts as your advocate during an insurance claim. Unlike adjusters employed by your insurance company, a public adjuster works exclusively for you, the policyholder. Our role is to represent your financial interests and ensure you receive the fairest settlement possible. We are independent professionals committed to getting you what you deserve.

When catastrophe strikes, who is watching out for you? Our team at Global Public Adjusters, Inc. represents homeowners and business owners in Orlando, Pensacola, and across Florida. With over 50 years of combined experience, we specialize in maximizing settlements and advocating against insurance companies. We exist to relieve your stress and ensure your claim is handled correctly.

We are legally authorized to investigate, negotiate, and settle property insurance claims on your behalf. We handle the documentation, communication, and negotiation, allowing you to focus on rebuilding.

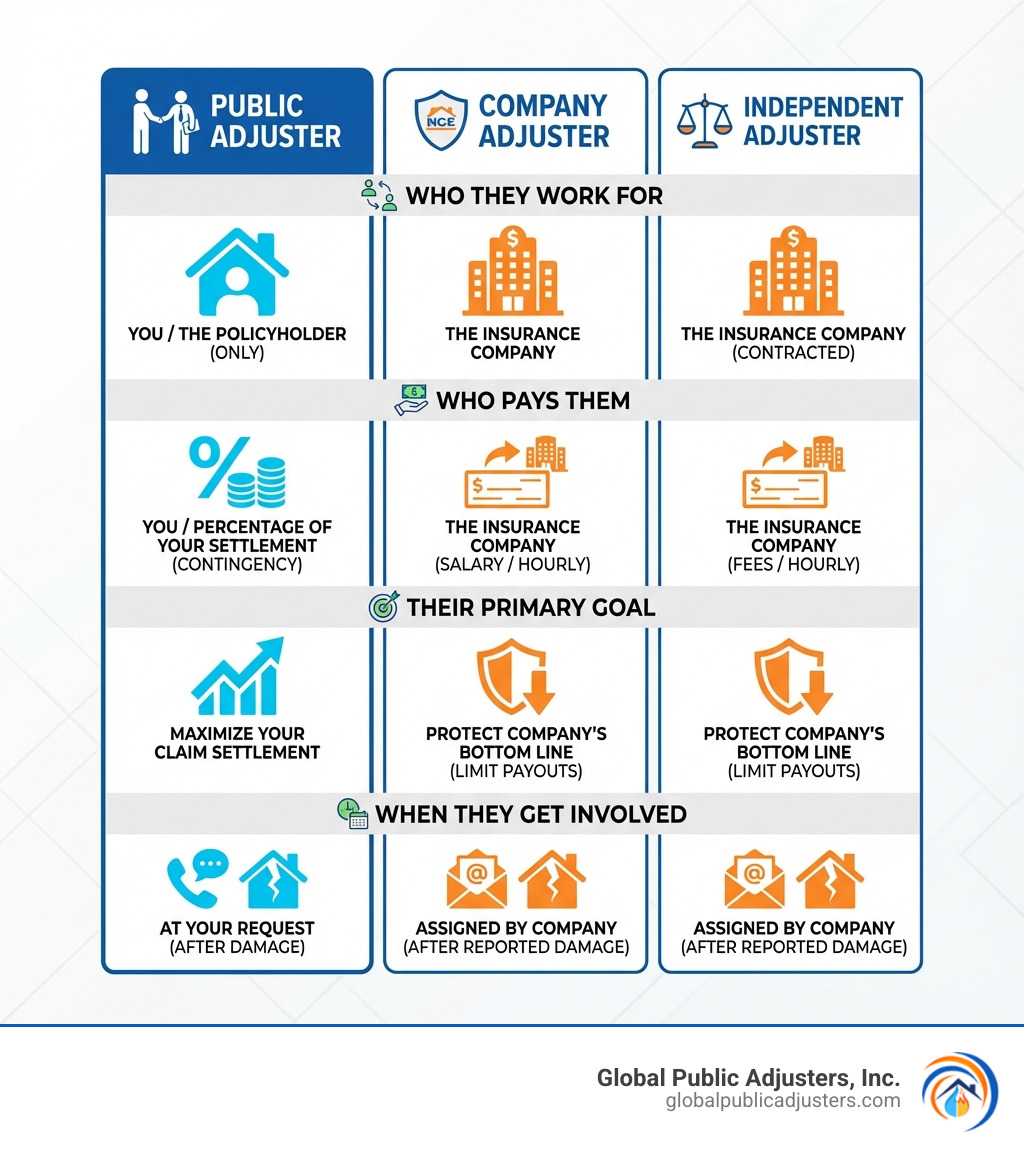

The Key Differences: Public Adjuster vs. Company Adjuster

Understanding the roles of different adjusters is crucial. There are three main types:

- Company Adjuster (Staff Adjuster):These individuals are employees of your insurance company. Their primary goal is to evaluate your claim and determine the amount their employer is liable to pay. Their allegiance is to the insurance company’s bottom line.

- Independent Adjuster:An independent adjuster is hired by your insurance company on a contract basis. Like staff adjusters, they represent the insurer’s interests, not yours. The insurance company pays them.

- Public Adjuster:This is where we come in. A public adjuster is an independent professional you hire directly. Our sole allegiance is to you, the policyholder. We work tirelessly to ensure you receive the maximum settlement you’re entitled to under your policy. We work foryou, not the insurance company.

The fundamental difference is who they work for. An insurance company’s adjuster is incentivized to save their employer money, creating a conflict of interest. You wouldn’t ask the IRS to do your taxes, so why let your insurer prepare your claim? As public adjusters, we are the only claims adjusters legally authorized to interpret policy, negotiate settlements, and represent your rights. Learn more in our article:What the Public Doesn’t Know About Public Insurance Adjusters.

When is it Time to Hire a Public Adjuster?

When do you need aninsurance public adjuster near me? While we can help with any claim, certain situations strongly warrant our involvement:

- Large or Complex Claims:For extensive damage from a hurricane, fire, or major water loss, the claim process is intricate. These claims involve substantial costs and complex policy interpretations best handled by an expert.

- Denied Claims:A denial isn’t always the final word. We can review your denied claim, find out why it was rejected, and work to overturn the decision with new evidence or policy re-interpretation. Many denials are due to flawed assessments or missed policyholder obligations.

- Underpaid Settlement Offers:If an insurance offer seems too low to cover repairs, you’re likely being underpaid. We review the insurer’s report and estimate to evaluate fairness and fight for the funds you deserve.

- Lack of Time or Expertise:Insurance policies are confusing and claims are time-consuming. If you lack the time or expertise to manage the process, a public adjuster can take this burden off your shoulders.

- Catastrophic Events:After major disasters like hurricanes, insurers are inundated with claims, leading to delays and undervalued settlements. Your own advocate ensures your claim gets the attention it deserves.

We urge you to hire aninsurance public adjuster near meat the start of your claim, especially for damages over $250,000. Early involvement allows for careful documentation and proactive negotiation, leading to a smoother, more favorable settlement. Orlando residents might find these insights helpful:Signs You Need Public Adjuster Orlando.

The Tangible Benefits of Hiring a Public Adjuster

Hiring aninsurance public adjuster near meis an investment that pays dividends. Our clients consistently experience significant advantages that lead to a more successful and less stressful claims process. We help maximize your settlement, reduce your stress, save you time, and provide expert negotiation to level the playing field against large insurance corporations.

Maximizing Your Settlement: The Financial Advantage

The most compelling benefit is the financial advantage. A government study found public adjusters help policyholders achieve an average747% increasein their settlement compared to initial offers. This statistic shows the value of our expertise.

How do we achieve such results?

- Detailed Damage Documentation:We carefully document all damages, visible and hidden, using advanced tools. This includes creating comprehensive estimates and gathering all evidence. We know the “dollars are in the details.”

- Uncovering Hidden Damages:After events like hurricanes or water leaks, many damages aren’t immediately apparent. We have the expertise to find hidden issues like mold or structural damage that company adjusters often miss.

- Policy Interpretation Expertise:Insurance policies are complex legal documents. We are experts at interpreting the fine print to ensure you receive everything you’re entitled to, challenging the insurer’s interpretations and advocating for the broadest coverage.

- Accounting for All Costs:We ensure your settlement includes all applicable expenses beyond direct repairs, such as business interruption, loss of income, additional living expenses, and replacing damaged personal property.

We review the carrier’s reports and offers to ensure you’re paid fairly. If not, we fight for the funds needed to restore your property. For a deeper dive, visit:Why Should I Hire a Public Adjuster?.

How Public Adjusters Are Compensated

Transparency about fees is paramount. We work on acontingency fee basis, meaning we only get paid if we recover a settlement for you. No recovery, no fee. This aligns our interests with yours, as we are motivated to secure the maximum possible settlement.

Our fee is a percentage of the claim payout, usually 10-30%, depending on claim complexity and state regulations. In Florida, fees are capped at 10% during a declared State of Emergency. For most new claims, our fee is 10% of the settlement (less your deductible). For supplemental claims, where we recover more money for you, our fee is a percentage of theadditionalfunds secured.

There are no upfront costs. Our fee is paid from the settlement funds, so you have no out-of-pocket expenses. This makes our services accessible when you need them most. For more details, see:What Can a Public Adjuster Do For Me?.

Navigating the Claims Process with an Insurance Public Adjuster Near Me

Dealing with property damage is stressful. When you partner with aninsurance public adjuster near mefrom Global Public Adjusters, Inc., we handle your claim so you don’t have to. Our process is streamlined, transparent, and effective.

Here’s a step-by-step overview of how we work with you:

- Free Site Inspection and Policy Evaluation:The first step is a complimentary, no-obligation inspection of your damaged property in Orlando, Pensacola, or anywhere in Florida. We’ll assess the damage and review your insurance policy to understand your coverage.

- Meticulous Documentation and Evidence Gathering:We gather all necessary evidence, including detailed photos, videos, and expert reports. We create a comprehensive and precise estimate of all damages, ensuring nothing is overlooked.

- Claim Submission and Communication:We prepare and file all necessary paperwork and handle all communication with your insurance company. We make the calls, send the emails, and attend all meetings on your behalf.

- Expert Negotiation:Armed with thorough documentation and an in-depth understanding of your policy, we negotiate directly with your insurance company. We challenge lowball offers and advocate relentlessly for the maximum settlement you are entitled to.

- Settlement Recovery:Once a fair settlement is reached, we ensure you receive the payment needed to repair and restore your property. We guide you through the final steps to ensure the process is completed efficiently.

Types of Claims an insurance public adjuster near me can handle

Our team at Global Public Adjusters, Inc. handles a wide array of residential and commercial property damage claims in Florida. Whatever the cause of your loss, we have the experience to help. Common claims we manage include:

- Fire Damage:We assess smoke, soot, and structural damage, as well as loss of contents and additional living expenses.

- Water Damage:This includes damage from burst pipes, leaks, appliance malfunctions, and broken cast iron pipes.

- Flood Damage:Flood claims can be tricky, often involving separate flood insurance policies. We help you steer these complexities.

- Hurricane, Wind, and Storm Damage:As Florida experts, we assess damage from high winds, hail, fallen trees, and associated water intrusion.

- Mold Damage:Often a secondary effect of water damage, we ensure proper remediation and repair costs are covered.

- Sinkhole Damage:We work with geotechnical engineers to prove the extent of the damage and secure funds for repair.

- Vandalism and Theft:We help document the loss and ensure your policy responds appropriately.

- Business Interruption:For commercial clients, we quantify lost income and other financial impacts from property damage.

This is not an exhaustive list. If you’ve experienced any property damage, we have the expertise to help. For a comprehensive look at our services, please visit:Services.

What if My Claim Was Denied or Underpaid?

It’s frustrating to have a claim denied or receive a lowball offer. Many assume this is final, but that’s often not the case. Aninsurance public adjuster near mecan be your most powerful ally in these situations.

- Reopening Claims:If your claim was denied or underpaid, we can often reopen it. Florida law typically allows claims to be reopened up to three years from the date of loss. We will review your original claim, denial letter, and policy to find grounds for appeal.

- Filing Supplemental Claims:If your settlement was insufficient to cover all damages, we can file a supplemental claim. We gather new evidence, prepare revised estimates, and negotiate for the additional funds needed.

- Overturning Wrongful Denials:Insurers deny claims for many reasons, some illegitimate, like “failure to meet policy obligations” or “insufficient documentation.” We investigate the denial, challenge policy misinterpretations, and present a compelling case to overturn the decision. We know the claims process is often intentionally difficult.

- Burden of Proof:The policyholder has the burden of proof. We take on this responsibility by carefully documenting your loss and presenting it clearly to the insurer. This includes expert reports, code analyses, and detailed estimates to justify the full repair cost.

Don’t despair over a denied or underpaid claim. A denial is not always final. We have experience in Orlando, Pensacola, and throughout Florida reversing these decisions and securing the compensation our clients deserve. Learn more about how we can help:What to Do When Your Home Insurance Claim is Denied.

Finding and Vetting the Right Public Adjuster

When you’re dealing with property damage, choosing the rightinsurance public adjuster near meis one of the most critical decisions you’ll make. A reputable, experienced, and trustworthy public adjuster can make all the difference.

How to Find a Reputable insurance public adjuster near me

Finding a top-rated public adjuster in Orlando, Pensacola, or anywhere in Florida requires due diligence. Here’s how:

- Online Search:Start with a targeted online search for “public adjuster Orlando FL,” “public adjuster Pensacola FL,” or “public adjuster Florida.” You can also review general background information on public adjusters on resources likeWikipedia’s Public adjuster pageto better understand their role.

- Referrals:Ask friends, family, real estate agents, contractors, or attorneys for recommendations.

- Checking Online Reviews and Testimonials:Look for adjusters with consistently positive reviews on platforms like Google, Yelp, and the Better Business Bureau.

- Professional Organizations:Organizations like the National Association of Public Insurance Adjusters (NAPIA) offer directories of their members.

- Contact Us:For a free consultation on your property damage claim, contact Global Public Adjusters, Inc. We have the experience to secure the compensation you deserve.Contact Global Public Adjusters for a Consultation.

Critical Questions to Ask Before Hiring

Once you have potential public adjusters, interview them. Asking the right questions helps you choose the best fit:

- Experience with Your Claim Type:“Have you handled claims similar to mine (e.g., hurricane, fire, water damage) in Florida?”

- References from Past Clients:“Can you provide references from previous clients?”

- Fee Structure and Contract Details:“What is your fee percentage, and how is it calculated? Are there any upfront costs?”

- Communication Process:“How often will you communicate with me, and how can I track my claim’s progress?”

- License and Insurance:“Are you licensed and bonded in Florida? What is your license number?”

For a more detailed list of questions, we recommend reviewing:What Questions Should You Ask Your Public Adjuster?.

Understanding State Regulations and Your Rights

Public adjusters are regulated professionals, and understanding Florida’s rules is crucial. In Florida, public adjusters are licensed and bonded by the Department of Financial Services (DFS), ensuring they meet specific educational, experience, and ethical standards.

Key regulations and rights to be aware of include:

- Licensing Requirements:Always verify aninsurance public adjuster near meholds a current license with the Florida Department of Financial Services (DFS), which you can check on the DFS website.

- Written Contracts:Florida law requires a signed contract outlining services and fees. Read this document carefully before signing.

- Right to Cancel:Consumers in Florida have rights regarding contract cancellation. You typically have a short period to cancel your contract after signing. Always confirm the specific cancellation rights with your chosen adjuster and your state’s DFS.

- Fee Caps During Emergencies:As mentioned, during a declared State of Emergency in Florida, public adjuster fees are capped at 10% of the settlement. This protects policyholders during widespread disasters.

We adhere to all Florida state regulations and pride ourselves on transparency and ethical practices.

Frequently Asked Questions about Public Adjusters

How long does it take to settle a claim with a public adjuster?

The timeline for settling a claim with aninsurance public adjuster near mevaries. Small claims might resolve in weeks, while large, complex claims (fire, hurricane, flood) can take 60 to 120 days. Heavily disputed cases could take from 3 months to 2 years to settle.

Factors that influence the timeline include:

- Complexity and Scope of Damage:More extensive damage requires more thorough documentation and negotiation.

- Insurer Cooperation:The responsiveness of the insurance company can impact the speed of the process.

- Need for Expert Reports:If specialists are required to assess damage, this can add to the timeline.

- Disputes:Disagreements over coverage or valuation will naturally take longer.

While we strive for efficiency, our priority is securing the maximum fair settlement, which can take time.

What’s the difference between a public adjuster and a contractor?

This is a common point of confusion, but the distinction is crucial.

- Public Adjuster:We are licensed professionals whovalue the loss and negotiate the insurance claimon your behalf. Our expertise is in policy interpretation, damage documentation, and financial recovery advocacy. We do not perform repairs.

- Contractor:A contractor’s role is toperform the physical repairsto your property. Their expertise is in construction and rebuilding.

In Florida and most states, contractors are legally restricted from negotiating insurance claims. While they can provide repair estimates, they cannot act as an adjuster for a property they are servicing, which prevents conflicts of interest. We can guide you on how to vet a licensed contractor, ensuring you hire a reputable professional for the reconstruction.

What information should I have ready when I call?

To make your initial consultation with aninsurance public adjuster near meas productive as possible, have this information ready:

- Your Insurance Policy Documents:This includes your declarations page and the full policy wording.

- Date of Loss:The exact or approximate date when the damage occurred.

- Description of the Damage:A brief overview of what happened and the type of damage sustained.

- Any Photos or Videos of the Damage:Visual evidence is incredibly helpful.

- All Correspondence from Your Insurance Company:This includes claim numbers, emails, letters, and any settlement offers or denial letters.

Conclusion

Navigating property damage and a complex insurance claim is an uphill battle, but you don’t have to face it alone. Hiring a top-ratedinsurance public adjuster near meprovides an expert advocate to protect your rights and maximize your settlement.

A public adjuster can drastically increase your recovery, save you time, and reduce stress. We level the playing field against insurers by handling everything from documentation to negotiation. We are your dedicated partner throughout the process.

Don’t settle for less. Take the next step towards a fair settlement. With over 50 years of combined experience in Orlando, Pensacola, and across Florida, the team at Global Public Adjusters, Inc. can secure the compensation you deserve.