Denied insurance claim Orlando: 5 Steps to Win!

When Your Safety Net Fails: Understanding Denied Insurance Claims in Orlando

Denied insurance claim Orlandosituations leave thousands of homeowners and business owners frustrated and financially vulnerable each year. If your insurance company has rejected your claim, you’re not alone—and you’re not out of options.

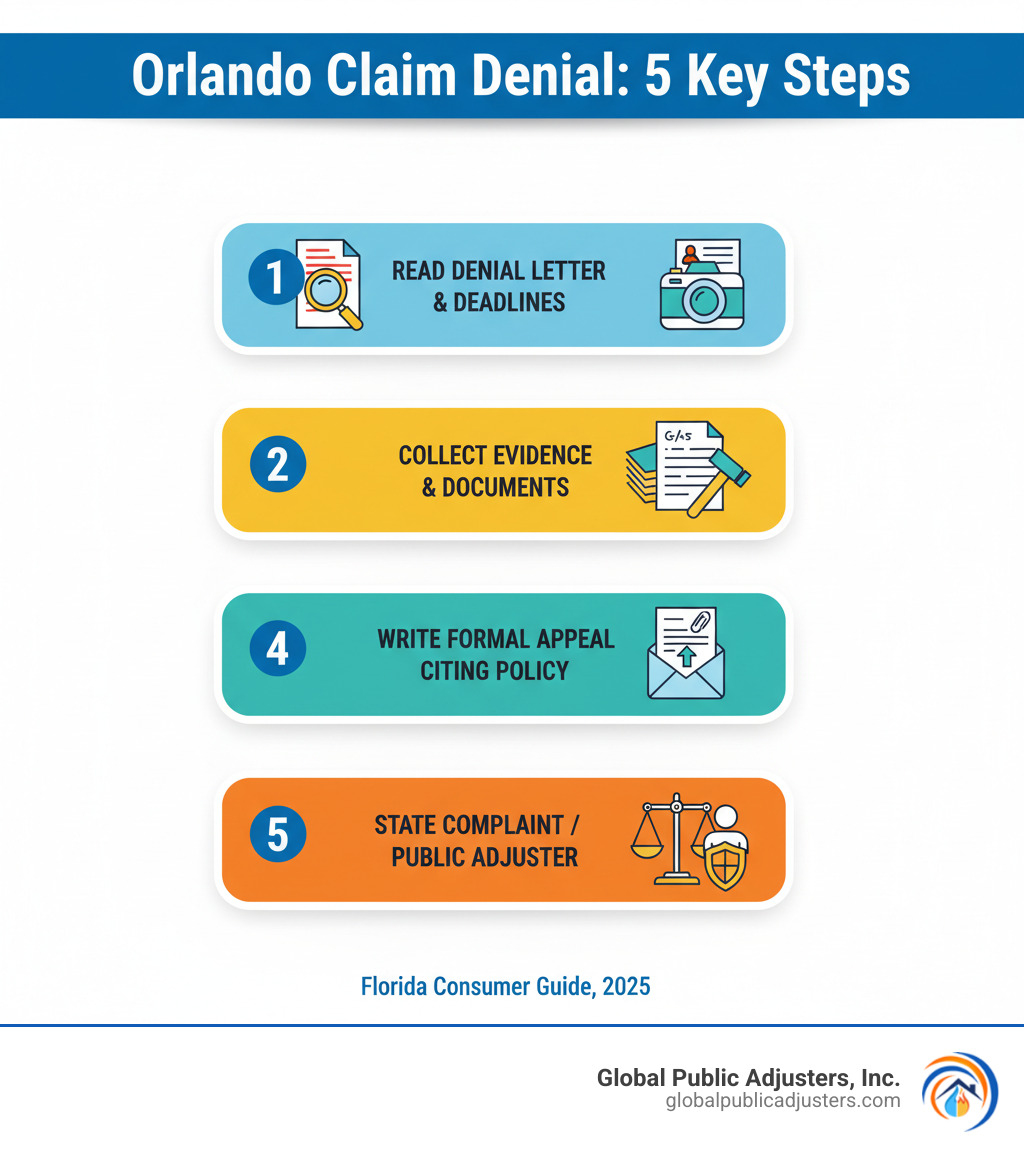

Quick Action Steps After a Claim Denial:

- Review the denial letter carefully– Note the specific reason cited and any appeal deadlines.

- Gather all supporting evidence– Collect photos, videos, receipts, repair estimates, and all correspondence.

- Submit a formal written appeal– Dispute the insurer’s reasoning with your policy language and evidence.

- File a complaint with Florida DFS– Use the state’s consumer protection resources if needed.

- Consider professional help– Public adjusters can negotiate on your behalf at no upfront cost.

You pay insurance premiums expecting a safety net for disasters like hurricane damage, fire, or water intrusion. Unfortunately, many Orlando residents find that getting their insurance company to pay a legitimate claim is far more difficult than anticipated. Insurers often deny or underpay claims, citing policy exclusions, insufficient documentation, or missed deadlines. Some denials are legitimate, but many are not, as insurers may count on policyholders not pushing back.

Florida law gives you the right to appeal, dispute, and challenge denied claims. Understanding these rights can mean the difference between absorbing thousands in losses or receiving the full compensation you’re owed. This guide walks you through how to fight adenied insurance claim Orlando, from understanding the rejection to building a winning appeal and knowing when to bring in professional help.

Why Was Your Orlando Insurance Claim Denied?

Opening a denial letter feels like a betrayal after you’ve faithfully paid your premiums. The truth is, insurance companies are businesses focused on profit, which often means finding reasons to minimize or deny payouts. This is why many Orlando property owners face adenied insurance claim Orlando.

Understanding the reason for denial is the first step to fighting back. Common reasons include:

- Policy Exclusions:Your contract specifically lists what isnotcovered. A standard Florida homeowners policy, for example, excludes flood damage from rising water, which requires separate insurance.

- Flood vs. Water Damage:This distinction trips up many homeowners. Water damage from a burst pipe is typically covered, but water rising from the ground is considered flood damage. Insurers may blur these lines to avoid paying.

- Insufficient Evidence:Your insurer might claim you haven’t proven your loss. Without clear photos, detailed repair estimates, and receipts, your claim is weak. For more details, see our guide onReasons Why Your Property Insurance Claim Can Be Denied.

- Missed Deadlines:Florida policies have strict timelines for reporting damage. Waiting too long gives your insurer grounds for denial.

- Pre-existing Damage / Wear and Tear:The insurer may argue the damage existed before the covered event, attributing it to normal wear and tear. A slow leak over months is wear and tear; a pipe that bursts overnight is sudden, covered damage.

Understanding Your Policy’s Fine Print

Your insurance policy contains the rules for payment. Key sections to review include:

- Declarations Page:This is a summary of your coverage types, limits, and deductibles.

- Coverage Limits:The maximum amount your insurer will pay for a loss. If repairs cost more than your limit, you’ll face a partial denial for the excess amount.

- Deductible:The amount you pay before insurance kicks in. If your repair cost is less than your deductible, your claim will be denied.

- Endorsements and Riders:These are additions or changes to your policy that might add or exclude specific risks.

- Ambiguous Language:Vague terms can work in the insurer’s favor, but they also create openings for a public adjuster to argue for the interpretation that protects you.

For help understanding your policy, explore ourHomeowners Claim Process Orlando FLresource.

Common Mistakes That Lead to Denial

Sometimes, honest mistakes give insurers easy reasons to deny a claim. Avoid these pitfalls:

- Late Reporting:Florida has strict deadlines. Report damage immediately, even if life is chaotic.

- Incomplete Forms:Missing information or inconsistent details can trigger delays or denials. Be thorough.

- Lack of Documentation:Document everything with photos, videos, and receipts before you clean up or make repairs.

- Making Permanent Repairs Too Soon:Make temporary repairs to prevent further damage (like tarping a roof), but do not start permanent work until the adjuster has inspected the property. Document all emergency repairs.

- Misrepresenting Facts:Be honest and accurate. Exaggerating damage can lead to denial and even fraud allegations.

For more guidance, visit ourProperty Damage Claims Orlandopage.

Your Step-by-Step Guide to Fighting a Denied Insurance Claim in Orlando

Adenied insurance claim Orlandois not the end of the road. It’s time to challenge the decision and stand up for the coverage you paid for. The formal appeal process is a straightforward path to making your insurance company do the right thing.

Responding strategically is key. For more perspective, our guide onWhat to Do When Your Home Insurance Claim Is Deniedoffers additional insights.

Step 1: Analyze the Denial Letter and Gather Evidence

Your denial letter is your roadmap. Read it carefully to understand the specific reason for rejection and note any policy clauses they cite. Most importantly, find theappeal deadline—often just 30-60 days—and mark your calendar. Missing it can end your chances.

Next, build a convincing evidence file:

- Photos and Videos:Document the damage from every angle, including wide shots and close-ups. “Before” photos are invaluable if you have them.

- Repair Estimates:Get at least three detailed estimates from licensed contractors that break down materials and labor costs.

- Receipts:Save every receipt for emergency repairs made to prevent further damage, such as tarping or water extraction.

- Witness Statements:If anyone saw the incident, get their contact information and a written statement.

- Communication Log:Keep a record of every interaction with your insurer, noting the date, time, person you spoke with, and what was discussed.

- Expert Reports:If you’ve hired a public adjuster or engineer, their reports are critical evidence.

- Full Insurance Policy:Request a complete copy of your policy to see every exclusion, definition, and endorsement.

Step 2: Build and Submit Your Formal Appeal

With your evidence organized, write a professional and factual formal appeal letter.

- State Your Intent:Clearly state that you are appealing the denial of your claim. Include your claim and policy numbers.

- Address Their Reasoning:Systematically counter each reason they gave for the denial, explaining why it doesn’t apply.

- Quote Your Policy:Refer to specific sections of your policy that support your claim. For example: “Section 3.2 of my policy covers sudden and accidental water damage, which applies to the burst pipe on January 15th, as documented in the attached report.”

- List Your Evidence:Explicitly list all the supporting documents you are including with your letter.

- Make a Clear Request:End by respectfully requesting that they reverse their denial and approve your claim for the full amount.

Send your appeal and all attachments viacertified mail with return receipt requested. This provides legal proof that it was sent and received. The strategies in our article onHow to Reverse a Denied Property Claim by Working with a Public Adjuster in Miamiare also effective for Orlando homeowners.

Step 3: Escalate Your Case if Necessary

If your appeal is denied, don’t lose heart. Florida law provides additional paths to put pressure on your insurer.

- File a Complaint with the Florida Department of Financial Services (DFS):The DFS oversees insurers and takes consumer complaints seriously. Filing a complaint atSubmit a Complaintcan trigger an investigation and mediation. The threat of state scrutiny often makes insurers more reasonable.

- Use the DFS Mediation Program:This program offers a structured conversation with a neutral mediator to help you and your insurer reach a settlement. It’s non-binding, faster, and less expensive than litigation.

- Leverage the Homeowner Claims Bill of Rights:This law (Florida Statute § 627.7142) sets legal deadlines for insurers, such as acknowledging a claim within 7 days and making a decision within 60 days. If they violate these rights, it strengthens your case. You can review the details in theHomeowner Claims Bill of Rightsguide.

Using these state resources is not being difficult—it’s using the tools the law provides to protect your rights.

Recognizing and Responding to Insurance Bad Faith

Sometimes adenied insurance claim Orlandoisn’t just a disagreement—it’s a sign of bad faith. This occurs when an insurance company unfairly denies a claim without a reasonable basis or uses deceptive tactics to avoid paying what they owe. In Florida, this is illegal.

Understanding the difference between a difficult claim and bad faith practices is crucial for protecting your rights.

What Constitutes Bad Faith in a Denied Insurance Claim Orlando?

Bad faith is when an insurer puts its profits ahead of its legal obligation to you. Red flags include:

- Unreasonable Delays:Stalling the process, repeatedly asking for the same documents, or going silent for long periods. Florida law sets clear deadlines for claim handling.

- No Proper Investigation:Denying a claim without sending an adjuster or thoroughly reviewing your evidence.

- Misrepresenting Policy Provisions:Deliberately twisting policy language or citing exclusions that don’t apply.

- Failing to Provide a Written Reason for Denial:Florida law requires a clear, written explanation for any denial.

- Lowball Settlement Offers:Offering a fraction of what your damages are worth, hoping you’ll accept out of desperation.

Florida Statute § 624.155gives you the right to sue your insurance company for these practices.

What Are the Potential Outcomes of a Bad Faith Claim?

If an insurer is found to have acted in bad faith, the consequences can be significant. You may be entitled to:

- The Full Original Claim Amount:The insurer will be forced to pay what they initially denied.

- Additional Damages:You can be compensated for financial losses caused by the delay, such as lost income or emotional distress. In some cases, you may recover up to three times your original claim amount.

- Attorney’s Fees and Costs:The insurance company is often required to pay your legal bills. This levels the playing field and allows you to fight back without financial risk.

Pursuing a bad faith claim holds the insurer accountable and sends a message that they cannot treat policyholders unfairly. At Global Public Adjusters, Inc., we know how to document these tactics and fight for the full compensation you deserve.

Assembling Your Team: When to Hire a Professional

Fighting adenied insurance claim Orlandoon your own can feel like an uphill battle. Insurance companies have vast resources dedicated to protecting their bottom line. While you can start the appeal process yourself, bringing in a professional can change the game, especially if the case is complex or the insurer is uncooperative.

Timing is critical. For a deeper dive, visitReasons to Call a Public Adjuster Right Away.

The Role of a Public Adjuster in a Denied Insurance Claim Orlando

We’re Global Public Adjusters, Inc., licensed professionals who work exclusively for you, the policyholder—not the insurance company. Our job is to advocate on your behalf and fight for the maximum settlement you deserve.

When you’re facing adenied insurance claim Orlando, a public adjuster acts as your equalizer. We:

- Review Your Policy:We scrutinize every coverage and exclusion to find where the insurer may be misinterpreting the terms.

- Conduct an Independent Damage Assessment:We perform our own detailed inspection to uncover all damage, including issues the company’s adjuster may have missed or undervalued.

- Handle All Documentation:We organize all your evidence—estimates, photos, reports—to build a bulletproof claim.

- Negotiate with the Insurer:We handle all communications, countering the insurer’s tactics and fighting relentlessly for a fair settlement.

To learn more, seeWhat Can a Public Adjuster Do For Me.

Here’s a straightforward comparison:

| Feature | Public Adjuster | Insurance Company Adjuster |

|---|---|---|

| Who They Represent | The Policyholder (YOU) | The Insurance Company |

| Primary Goal | Maximize your settlement | Minimize the company’s payout |

| Loyalty | To you | To the insurer |

| Fee Structure | Contingency fee (percentage of settlement) | Salary from the insurance company |

| Damage Assessment | Independent, comprehensive, policyholder-focused | Company-focused, may overlook or undervalue damage |

| Negotiation | Aggressive advocate on your behalf | Negotiates on behalf of the insurer, often to reduce costs |

We are on your team and only get paid when you do, motivating us to get you the best possible outcome.

When Additional Help May Be Necessary

While a public adjuster is your best first step, some situations may require an insurance attorney. We work closely with lawyers when cases escalate beyond negotiation.

Consider legal action if:

- The dispute is highly complexand involves intricate legal interpretations.

- The insurer refuses to negotiate fairlyor acts in bad faith, despite a rock-solid case presented by your public adjuster.

In these scenarios, an attorney can file a lawsuit for breach of contract or bad faith. We often work hand-in-hand with attorneys, handling the damage assessment while they manage legal proceedings. If you’re wondering about your situation, visitWhen to Hire a Public Adjuster Orlando FLfor more information.

With over 50 years of combined experience, we know how to fight back effectively. Your denied claim doesn’t have to stay denied.

Frequently Asked Questions about Denied Orlando Insurance Claims

Facing adenied insurance claim Orlandobrings up many questions. Here are answers to some of the most common concerns we hear from homeowners and business owners.

What are the time limits for appealing a denied insurance claim in Orlando?

Time is critical. Your insurance policy will specify a deadline for an internal appeal, often just 30 to 60 days. Beyond that, Florida law sets broader statutes of limitations:

- Breach of Contract:You generally havefive yearsfrom the date of denial to file a lawsuit.

- Hurricane Claims:You must provide notice of a hurricane claim to your insurerwithin one yearof the storm.

- Bad Faith Claims:You typically havefour yearsfrom when the bad faith occurred to take legal action.

These are hard deadlines. Act quickly and review your denial letter and policy immediately. For more guidance, see our resource on theHomeowners Claim Process Orlando FL.

Can I take further action if my insurance company denies my claim?

Yes. A denial is the insurer’s opening position, not the final word. Your options include:

- Filing a Complaint with the Florida DFS:Use theironline portalto trigger a state investigation. Insurers dislike regulatory scrutiny, which can prompt a resolution.

- Hiring a Public Adjuster:An expert advocate who works for you can build a compelling case and negotiate aggressively on your behalf.

- Using DFS Mediation:A neutral third party can help you and your insurer find a middle ground without going to court.

- Litigation:As a final option, you can file a lawsuit. In Florida, if you win, the insurer often has to pay your attorney’s fees, making this a viable path to justice.

Insurance companies often count on policyholders giving up. Pushing back strategically gets results.

How much does it cost to hire a professional to fight my denial?

Working with Global Public Adjusters, Inc. costs younothing upfront. We operate on a contingency fee basis, meaning our fee is a small, agreed-upon percentage of the settlement we recover for you.

If we don’t get you money, we don’t get paid.

This structure aligns our interests with yours—we are motivated to maximize your settlement. It makes professional representation accessible to everyone facing adenied insurance claim Orlando, regardless of their financial situation. You take on no financial risk. For more details, visit our page onWhy Hire a Public Adjuster for Property Damage.

Don’t Accept a Denial: Take the Next Step for Your Orlando Claim

Adenied insurance claim Orlandois a setback, but it is not the final answer. It’s the insurance company’s first word, not the last. As a Florida policyholder, you have substantial rights to challenge unfair denials and hold insurers accountable.

You don’t have to steer this complex process alone. Insurance companies have teams working to minimize payouts. Having an expert in your corner who fights exclusively for your interests can completely change the outcome.

That’s whereGlobal Public Adjusters, Inc.comes in. With over 50 years of combined experience, we have successfully overturned countless denials and recovered millions for Orlando homeowners and business owners. We know the insurers’ tactics and how to beat them.

We review your policy, conduct a comprehensive damage assessment, and negotiate aggressively on your behalf. We work on a contingency basis, so you pay nothing unless we win for you.

Your property matters. Don’t let an initial denial discourage you from getting what you’re rightfully owed. If you’re facing adenied insurance claim Orlando, take the next step.Contact us to get help with your Orlando insurance claimtoday for a free, no-obligation consultation. Let’s turn your insurer’s “no” into the “yes” you deserve.