Commercial Tornado Damage Claims: Master 5 Smart Steps

Why Commercial Tornado Damage Claims Demand Expert Navigation

Commercial tornado damage claimsare among the most complex insurance challenges a business owner can face. When a tornado strikes, it doesn’t just damage property—it disrupts operations, devastates livelihoods, and creates financial chaos.

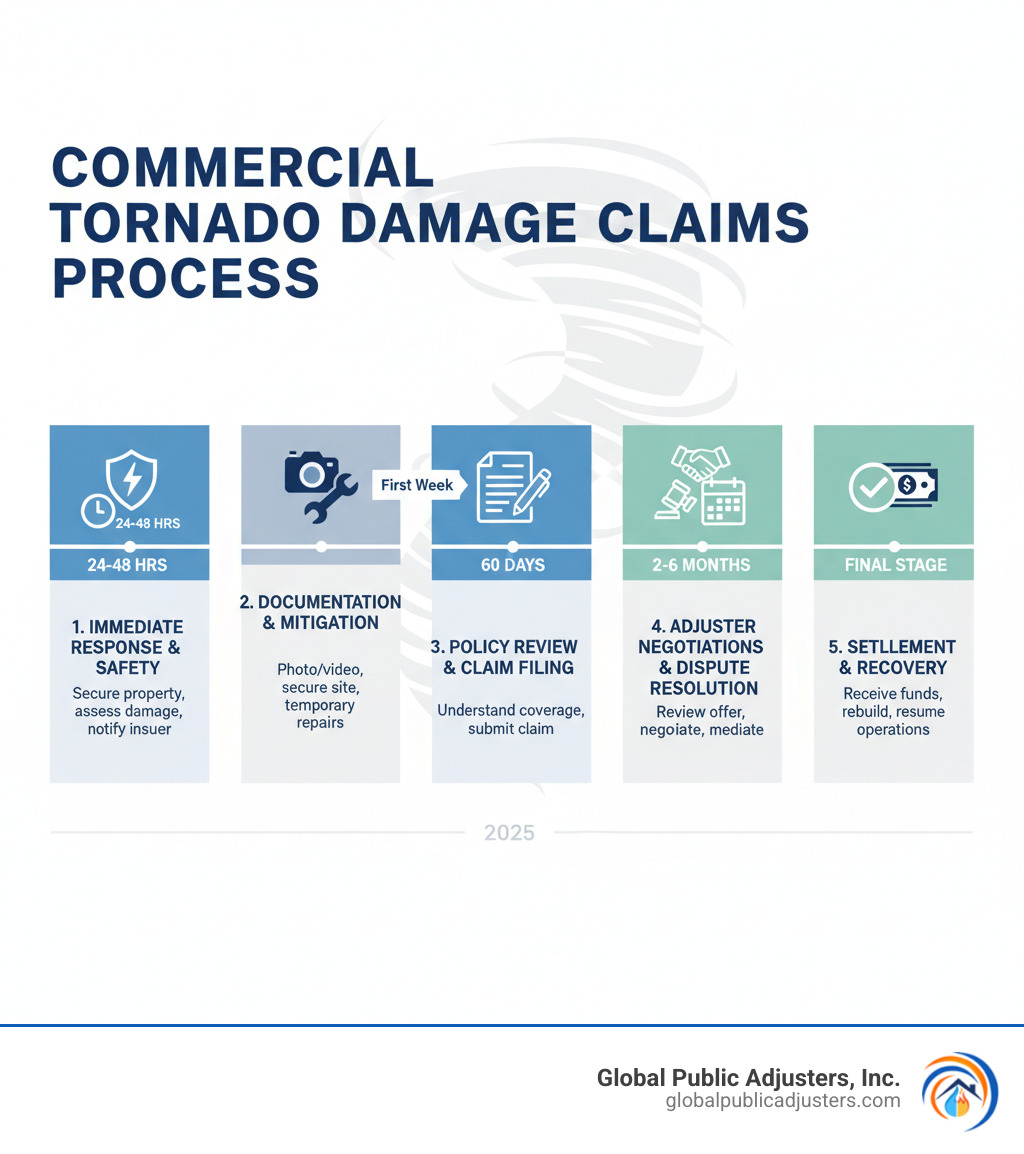

Quick Guide to Commercial Tornado Damage Claims:

- Immediate Actions: Ensure safety, document all damage, and notify your insurer promptly.

- Coverage Types: Building structure, business personal property, business interruption, and extra expenses.

- Key Deadlines: Notice of Loss and Proof of Loss deadlines are critical and vary by policy and state.

- Common Challenges: Unjustified claim denials, lowball settlements, and disputes over the cause of damage.

- Professional Help: Public adjusters can significantly increase settlement amounts, with studies showing an average increase of up to 747%.

Annually, about1,200 tornadoestouch down in the U.S., causing around$10 billion in property damage. Commercial properties are uniquely vulnerable, facing not only structural damage but alsobusiness interruption losses, equipment replacement, and inventory damage. Unlike residential claims, commercial policies often have percentage-based windstorm deductibles (e.g., 2-5% of the building’s insured value), which can mean a massive out-of-pocket expense.

Navigating this process requires strategic planning and meticulous documentation. Insurance companies have adjusters trained to minimize payouts. A proactive approach, armed with the right knowledge, is essential for a fair recovery.

This guide will help you understand every step, from the moment the storm passes to the final settlement check, turning a potential disaster into a manageable recovery process.

The Immediate Aftermath: First Steps to Protect Your Claim

After a tornado, clear thinking is your greatest asset for protecting yourcommercial tornado damage claims. While the scene may be overwhelming, the actions you take in the first few hours are critical.

Safety comes first.Before anything else, ensure everyone is safe. Check for structural hazards, downed power lines, or gas leaks. If the area is unsafe, evacuate and wait for authorities to give the all-clear.

Once the property is safe to enter, your insurance policy requires you tomitigate further damage. This means taking reasonable steps to prevent the situation from getting worse. Key actions include:

- Shut off utilitiesif there is structural damage to prevent fire or other hazards.

- Notify your insurance carrierpromptly, ideally within 72 hours.

- Secure the propertywith temporary fencing or security to prevent unauthorized access and looting.

- Tarp damaged roofs and board up broken windowsto protect the interior from weather.

- Begin water extractionif moisture has entered the building to prevent mold, which can grow within 24-48 hours.

- Start debris removalif it poses a safety risk or is causing ongoing structural stress.

Keep every receipt for these mitigation efforts, as they are typically reimbursable. For more guidance, see our resource onproperty damage claims.

Initial Communication with Your Insurer

When you call your insurer to providenotice of loss, stick to the facts: date of loss, property location, and a general description of damage. Avoid speculating on repair costs.Document every conversation: note the date, time, and the representative’s name and title. You are not required to give a recorded statement immediately; it’s often wise to wait until you fully understand the extent of your damages. Finally,request a complete copy of your policyto understand your coverages and obligations.

Understanding Your Commercial Policy: What’s Covered and What’s Not

Forcommercial tornado damage claims, your insurance policy is your roadmap to recovery. Unlike simpler homeowner’s policies, commercial policies are layered with specific coverages, endorsements, and exclusions that can dramatically impact your settlement.

Most commercial policies cover tornado damage under windstorm coverage. Key coverage types include:

- Building Structure Coverage: Protects the physical building, including the roof, walls, foundation, and permanent fixtures like HVAC systems.

- Business Personal Property (BPP): Covers contents like equipment, machinery, inventory, furniture, and office supplies.

- Debris Removal: Pays for the cost of clearing tornado debris, though it often has specific sub-limits.

- Ordinance or Law Coverage: This vital endorsement covers the extra cost to rebuild to current, stricter building codes, which is crucial for older properties.

Be aware ofwindstorm deductibles, which are often percentage-based (e.g., 2-5% of the building’s insured value) rather than a flat dollar amount. A 5% deductible on a $2 million property means you pay the first $100,000. For a deeper dive, visit our page oncommercial insurance claims.

Business Interruption and Extra Expense Coverage

While physical damage is obvious, the financial losses from being shut down can be even more devastating. This is where Business Interruption (BI) and Extra Expense coverage become critical. These coverages help with:

- Lost Net Income: Compensates for profits you would have earned if the tornado hadn’t occurred.

- Continuing Operating Expenses: Covers bills that don’t stop, like rent, loan payments, and key employee salaries.

- Relocation and Temporary Costs: Helps pay for moving to a temporary location, leasing space, and other costs to keep operations running.

Theperiod of restorationdefines how long these benefits last, typically until your business can reasonably resume normal operations. Successful BI claims require meticulous documentation, including profit and loss statements, sales records, and payroll information. Learn more aboutwhat business interruption insurance covers.

Common Exclusions and Limitations to Watch For

Even the best policies have limitations. Be aware of:

- Flood Damage: Damage from rising water is almost always excluded and requires a separate flood policy. Insurers often dispute whether damage came from wind-driven rain (covered) or flooding (excluded).

- Wear and Tear Arguments: Insurers may claim damage was pre-existing or due to poor maintenance, not the storm.

- Cosmetic vs. Functional Damage: Disputes can arise over whether damage that is only cosmetic, like dents in siding, warrants full replacement.

- Anti-Concurrent Causation Clauses: This tricky language can be used to deny a claim if a covered event (wind) and an excluded event (flood) happen at the same time.

Before assuming coverage,check the specifics of your tornado damage policy.

Building an Unshakeable Case for Your Commercial Tornado Damage Claims

Forcommercial tornado damage claims, the strength of your evidence determines the success of your settlement. Insurance companies operate on documented facts, not sympathy. As the policyholder, you must provide comprehensive proof of every loss. The financial impact of commercial damage is staggering, so your documentation must be bulletproof.

Building a strong case requires meticulous documentation of all damage, clear proof of causation, and accurate cost estimates.

| Feature | Residential Tornado Claims | Commercial Tornado Claims |

|---|---|---|

| Property Type | Single-family homes, condos | Office buildings, retail stores, warehouses, manufacturing plants |

| Coverages | Dwelling, personal property, ALE | Building, BPP, Business Interruption (BI), Extra Expense (EE) |

| Loss Valuation | Personal property (ACV/RCV) | Specialized equipment, inventory, raw materials, financial losses |

| Lost Income | Additional Living Expenses (ALE) | BI (lost profits, continuing expenses), EE (relocation costs) |

| Complexity | Generally simpler | Highly complex, involves financial forensics, supply chains |

| Deductibles | Flat dollar amount | Often percentage-based (2-5% of insured value) |

| Documentation | Photos, receipts | Extensive photos/videos, detailed inventories, financial records, expert reports |

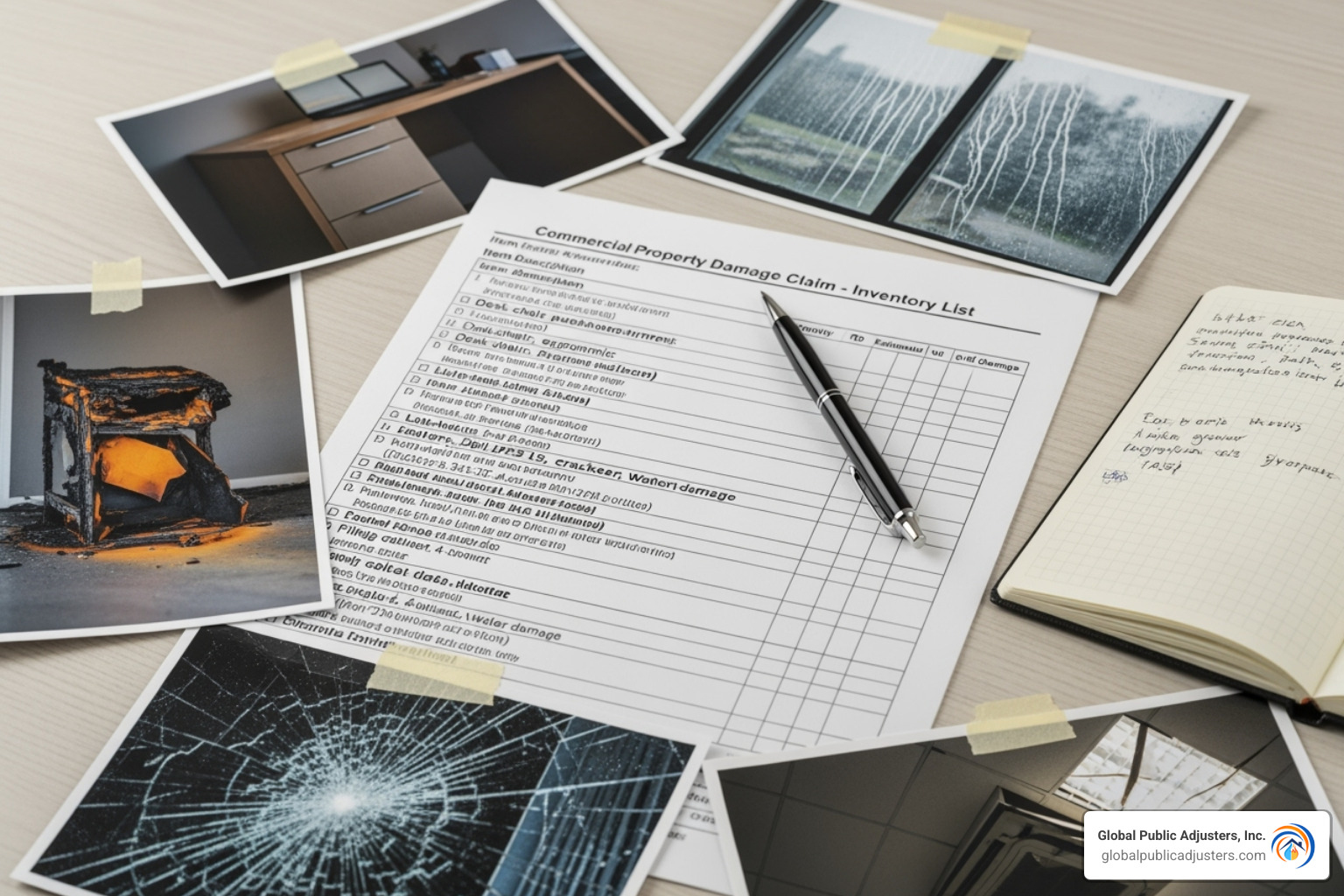

How to Effectively Document Tornado Damage

Your documentation is your most powerful tool. Start by gathering anybefore-and-after photosyou have. After the storm, take extensive, date-stamped photos and videos from multiple angles.Drone footageis invaluable for capturing roof and structural damage on large properties.

Create a detailed,room-by-room inventoryof everything damaged. For equipment and inventory, include brand names, model/serial numbers, purchase dates, and replacement costs. Gathersupplier invoicesfor damaged goods and materials. For your business interruption claim, you’ll needfinancial recordslike profit and loss statements, tax returns, and payroll records. Organize everything in a dedicated claim binder. For specific guidance, see our article onhow to document your BI losses.

Quantifying Your Total Losses

Putting a dollar figure on your losses is a critical step. Don’t rely solely on the insurance company’s adjuster. Instead, assemble your own team of experts:

- Structural Engineer Reports: Essential for identifying hidden damage to your building’s foundation, load-bearing walls, or roof structure.

- Independent Contractor Estimates: Get detailed written estimates from at least three licensed commercial contractors. Ensure they break down material and labor costs based on current market prices.

- Forensic Accountant Analysis: For complex BI claims, a forensic accountant can accurately model your lost revenue and extra expenses, creating a robust analysis that withstands insurer scrutiny.

Getting multiple expert opinions is key to understanding the true cost of recovery. For more on this,get multiple estimatesto build a comprehensive view of your losses.

Navigating the Claims Process: Deadlines, Disputes, and Bad Faith

Once you’ve documented your losses, you enter the core of thecommercial tornado damage claimsprocess. This phase is governed by strict deadlines and potential disputes. Missing a deadline can jeopardize your entire claim.

Key timelines to watch include theNotice of Loss(often required within days or weeks) and theProof of Loss, a sworn statement of damages typically due within 60-90 days. If you and your insurer disagree on the loss amount, your policy’sappraisal clauseallows for a binding arbitration-like process to resolve the dispute. Finally, be aware of your state’sstatute of limitationsfor filing a lawsuit against your insurer, which can be as short as one year.

For more tips on managing this phase, read our guide onNavigating Property Damage Claims: Tips for a Smoother Process.

Common Challenges in Commercial Tornado Damage Claims

Insurance companies are businesses, and their goal is to minimize payouts. Be prepared for common tactics:

- Claim Delays: Your file gets “lost” or your adjuster becomes unresponsive, hoping you’ll grow desperate and accept a low offer.

- Lowball Settlement Offers: The first offer is almost never the final one. It’s a starting point for negotiation.

- Unjustified Denials: Insurers may deny claims by alleging pre-existing damage, blaming an excluded peril like flooding, or misinterpreting policy language.

- Disputes Over Scope of Damage: The adjuster may only account for obvious damage while ignoring hidden structural issues or the full impact on your business operations.

Understanding these tactics is the first step in fighting back. Learn more aboutwhy insurance companies may minimize payouts.

The Role of a Public Adjuster in Commercial Tornado Damage Claims

A public adjuster is your advocate in the claims process, leveling the playing field against the insurance company’s team of experts. A public adjuster works for you to:

- Interpret Your Policy: They find all potential coverages you’re entitled to.

- Value Your Damage: They bring in engineers, accountants, and contractors to build a comprehensive and accurate assessment of your total loss.

- Negotiate on Your Behalf: They handle all communications with the insurer, counter lowball offers, and manage the entire process so you can focus on your business.

If your claim is large, complex, or has been denied or underpaid, hiring a professional is a smart move. Studies show policyholders who hire public adjusters receive significantly higher settlements. Find more aboutWhy Hire a Public Adjuster for Property Damage.

State-Specific Rules and Your Rights

While federal guidelines exist, state laws and regulations can significantly impact yourcommercial tornado damage claims. These laws dictate insurer response times, define “bad faith” practices, and provide crucial policyholder protections.

Most states have aPolicyholder Bill of Rightsand anUnfair Claims Settlement Practices Act. These establish your right to prompt communication, a thorough investigation, and clear explanations for any denial. They also prohibit insurers from misrepresenting facts or denying claims without a reasonable basis.

Prompt payment lawsset firm deadlines for insurers. For example, in Tennessee, an insurer must acknowledge communications promptly and provide updates on their investigation, preventing them from leaving you in the dark.

Why State Laws Matter: The Tennessee ‘Matching Rule’ Example

State-specific rules can dramatically increase your settlement. Tennessee’s “Matching Rule” is a perfect example. It requires an insurer to replace undamaged property if new materials used for repairs don’t match the existing materials in quality, color, or size, ensuring auniform appearance.

Imagine a tornado damages half of your building’s siding. The original siding is no longer available. Without the Matching Rule, the insurer might only pay to replace the damaged section, leaving you with a mismatched, unprofessional-looking building. With the rule, what starts as a partial repair claim can become a full siding replacement, significantly increasing your settlement.

This rule is often applied to roofing and siding claims and is essential for protecting your property’s value. Understanding and invoking these state-specific rules is critical for maximizing your claim. Learn more aboutTennessee’s Matching Rule explained.

Frequently Asked Questions about Commercial Tornado Claims

After a tornado hits your business, you’ll have urgent questions. Here are answers to the most common ones we hear regardingcommercial tornado damage claims.

How do windstorm deductibles work in a commercial policy?

Unlike the flat-dollar deductibles in many home policies, commercial policies often havepercentage-based windstorm deductibles. This means your deductible is a percentage (e.g., 2%, 3%, or 5%) of your property’s total insured value, not the amount of damage.

For example, a 5% deductible on a building insured for $2 million is $100,000. You would have to pay this full amount out-of-pocket before your insurance coverage begins, even if the damage is only slightly more than the deductible. It’s crucial to know your specific deductible for financial planning.

What should I do if my insurance company denies my claim?

A claim denial is not the final word. It’s often an opening negotiation tactic that can be overturned. Follow these steps:

- Request the denial in writing.You need a formal letter that specifies the reasons and cites the policy language used to justify the denial.

- Review your policy.Compare the insurer’s reasoning with the actual policy text. Ambiguities are often interpreted in favor of the policyholder.

- Gather counter-evidence.If the insurer claims wear and tear, provide maintenance records. If they blame flooding, show evidence of wind-created openings.

- Invoke the appraisal clause.If the dispute is over the cost of repairs, this policy provision can be used to get a binding decision from a neutral panel.

Appealing a denial is complex. Professional help from a public adjuster can make a significant difference. For more information, readWhat to Do When Your Home Insurance Claim is Denied.

How long do I have to file a commercial tornado damage claim?

Time is critical. Missing a deadline can void your claim. There are three key timelines to track:

- Notice of Loss:Your policy requires “prompt notice,” which usually means within a few days to a month. Report the damage immediately.

- Proof of Loss:This is a formal, sworn statement detailing your damages. You typically have 60 days from the date of loss or from when the insurer requests it to submit this form. Missing this deadline is a common reason for claim denial.

- Statute of Limitations:This is the state-mandated deadline for filing a lawsuit against your insurer, often one or two years from the date of loss or denial.

While policies provide these windows, waiting is never in your best interest. Filing quickly accelerates your recovery and makes it harder for insurers to dispute the cause of damage. Learn more about whypolicies set strict windows for claims.

Conclusion: From Recovery to Resilience

When a tornado strikes your business, the path forward can seem overwhelming. However, managingcommercial tornado damage claimseffectively can turn a disaster into a structured recovery.

Remember the key steps: prioritize safety, mitigate further damage immediately, and document everything. Understand the nuances of your commercial policy, especially the power of Business Interruption and Ordinance or Law coverage. Build an unshakeable case with expert reports and detailed records to counter the inevitable pushback from your insurer.

Know your rights under state law and be prepared to challenge claim delays, lowball offers, and unfair denials. Deadlines are absolute, and high percentage-based deductibles are common, so proactive planning is essential.

The truth is, most business owners are not equipped to battle an insurance company while also trying to run their business. A public adjuster works exclusively for you, leveling the playing field and navigating the complexities of the claims process. Studies show that this professional advocacy leads to significantly higher settlements—on average, 747% higher.

At Global Public Adjusters, Inc., we have over 50 years of experience turning insurance disasters into recovery success stories. We know the tactics insurers use and how to ensure you receive the full and fair settlement you are owed. Your business is your livelihood, and we fight to protect it.

The path from debris to dollars is achievable. With the right knowledge and advocacy, you can emerge from this challenge with the resources to rebuild and the resilience to thrive.