Can you negotiate a settlement with an insurance company #1

Can You Challenge Your Insurance Company’s Offer?

Can you negotiate a settlement with an insurance company?The short answer isyes, absolutely. You have every right to negotiate, and in most cases, you should. Insurance companies expect negotiation—it’s a standard part of the claims process, not an exception.

Quick Answer: What You Need to Know

- You can always negotiate– No insurance company requires you to accept their first offer.

- Initial offers are typically low– Insurers often start with offers 20-50% below fair value.

- Preparation is key– Document everything, gather evidence, and know your policy limits.

- Professional help is available– Public adjusters and attorneys can level the playing field.

- Time limits matter– Statutes of limitations vary by state (typically 2-5 years for property claims).

When you file a claim, you expect fair compensation, but the first offer you receive may barely cover your costs. With repair costs rising 7.6% between April 2024 and April 2025, insurance companies are under pressure to minimize payouts. Their first offer is rarely their best.

Most people don’t realize that negotiating isn’t just possible—it’s expected. Insurance adjusters work for the company, not for you. Their job is to protect the insurer’s bottom line, which means starting with low offers to see if you’ll accept. But you have power in this process. With the right preparation and strategy, you can negotiate a settlement that truly covers your losses, whether it’s for property damage, a totaled vehicle, or business interruption.

The Insurer’s Playbook: Why Initial Offers Are Often Low

Insurance companies are for-profit businesses, and understanding this is the first step in learning how to negotiate a settlement effectively. According to Value Penguin, claims adjusters who work for insurance companies try to pay the smallest amount possible. This isn’t personal; it’s a business procedure designed to protect the company’s bottom line while fulfilling policy obligations.

Insurance companies prefer to settle claims out of court because lawsuits are expensive and unpredictable. A quick settlement saves everyone time and money—but their strategy relies on you accepting their first offer without question. That initial offer is almost always lower than what your claim is worth. It’s an opening bid designed to test whether you understand your claim’s true value. If you counter with evidence, they know you’re serious and will adjust accordingly.

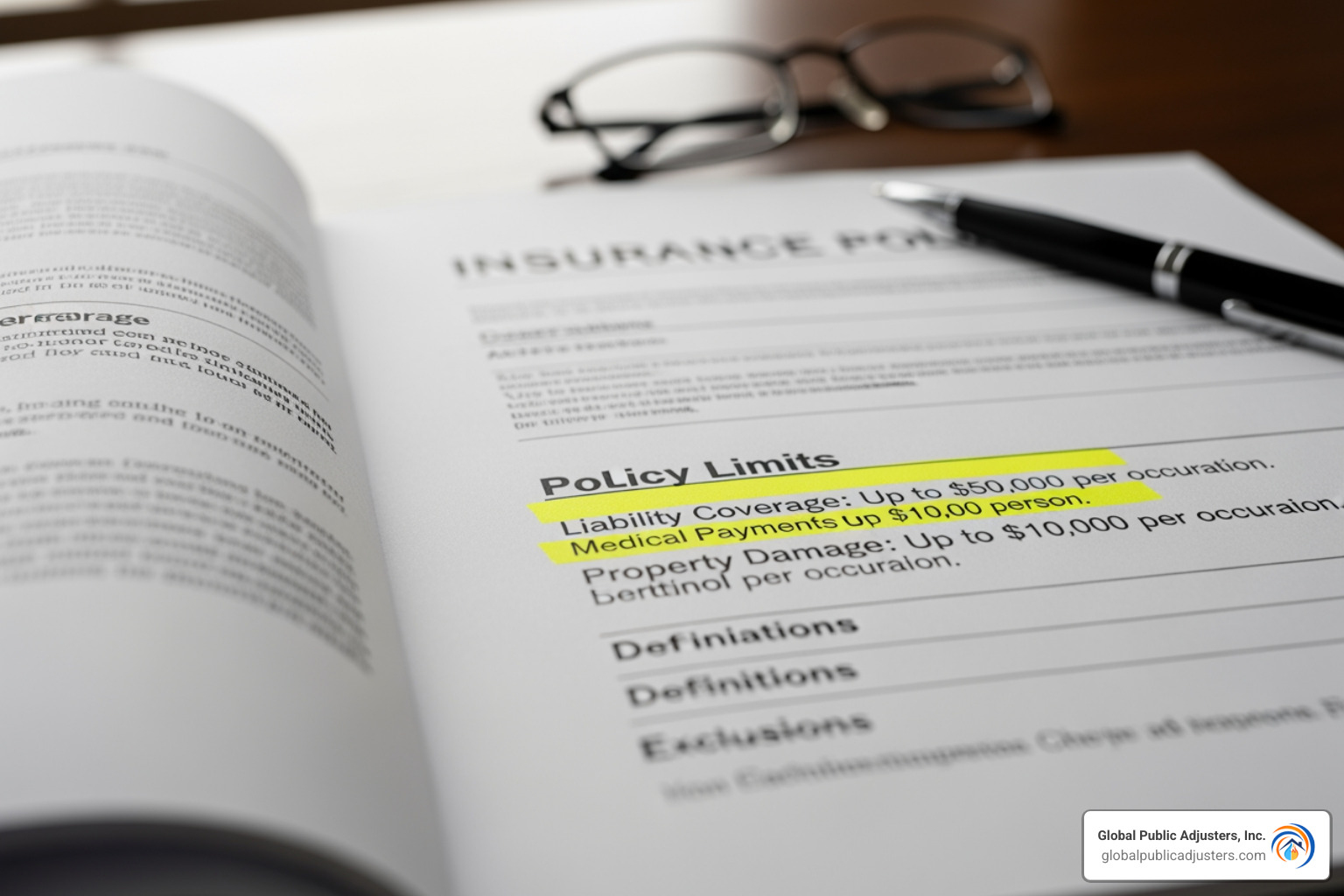

Understanding Policy Limits and Claim Value

Before negotiating, you must understand your insurance policy. Every policy haslimits that define the maximum payoutfor a covered loss. If your policy caps property damage at $100,000, you can’t negotiate for more. Know these limits.

For property damage, your settlement depends on how your loss is valued. There are two key concepts:

- Actual Cash Value (ACV)is your property’s worth at the time of loss, including depreciation. It’s the replacement cost minus depreciation, which often results in a lower payout.

- Replacement Cost Value (RCV)is the cost to replace your damaged property with a new, similar item without deducting for depreciation. RCV aims to restore your property to its pre-loss condition.

For personal injury claims, value is calculated using botheconomic and non-economic damages. Economic damages are tangible costs like medical bills and lost wages. Non-economic damages are subjective losses like pain and suffering. Methods like the multiplier or per diem method help estimate these, but this is where professional help from a public adjuster or attorney is invaluable.

Common Tactics Used by Insurance Adjusters

Insurance adjusters are professional negotiators who use common tactics to minimize payouts. Knowing what to expect is your best defense.

- Minimizing your damages:Suggesting your damages aren’t as severe as you claim or that some expenses aren’t related to the incident.

- Delaying the process:Dragging out the claim, hoping you’ll become frustrated and accept a lower offer just to be done with it.

- Disputing liability:Attempting to shift blame, even partially, to you to reduce their payout.

- The lowball initial offer:This is standard procedure. According to Value Penguin, you should never accept the first offer. It’s a test of your knowledge and resolve.

- Requesting unnecessary information:Creating bureaucratic problems to slow the process and test your patience.

- Pressuring for a quick settlement:Creating a false sense of urgency, suggesting their low offer is the best you’ll get.

- Claiming pre-existing conditions:For personal injury claims, attributing your current symptoms to a prior condition to reduce liability.

- Using confusing language:Employing jargon and complex policy terms to make you feel lost and more likely to defer to their “expertise.”

The adjuster works for the insurance company, not you. Their job is to settle the claim in a way that benefits their employer. For property claims, this is why many policyholders in Florida hire public adjusters to represent their interests. You can learn more about7 types of claims adjusters and their duties in Florida. Once you understand these tactics, they lose their power.

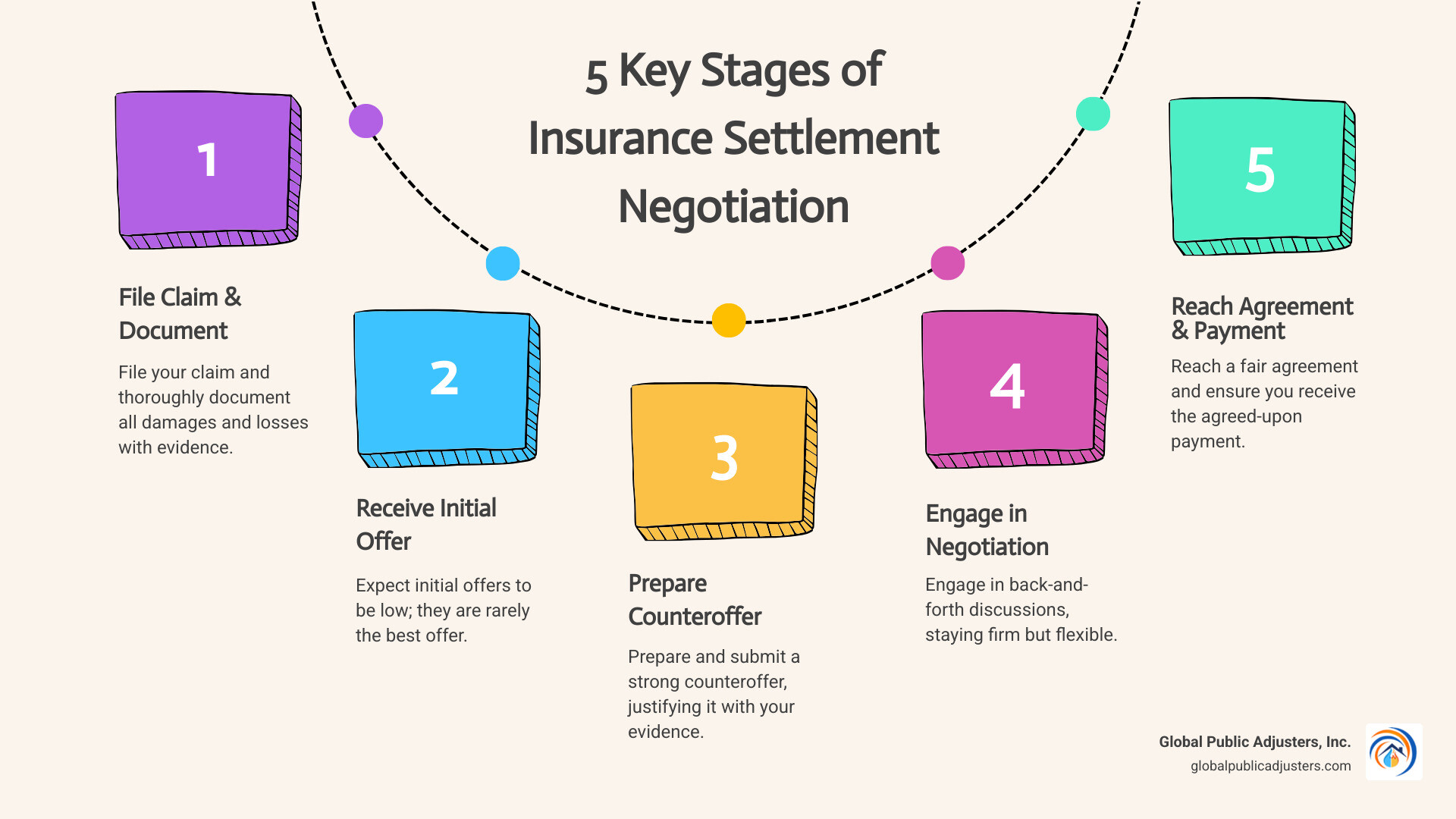

Your Step-by-Step Guide to a Fair Settlement

Getting a fair settlement is about following a clear process with patience and persistence. It’s an ongoing conversation that may involve multiple counteroffers and some frustration. By approaching it systematically, you put yourself in the strongest possible position.

Step 1: Prepare Your Case and Write a Demand Letter

Before negotiating, build your foundation bygathering all evidencerelated to your claim. This creates a complete picture of what happened and what it’s costing you.

- For property damage:Collect photos/videos of all damage, get repair estimates from at least two contractors, save all receipts for damaged items or temporary living expenses, and get writtenwitness statementsif available.

- For personal injury:Gather all medical records and bills, proof of lost wages, and documentation of how the injury affects your daily life.

Next,calculate your total damages. Add up all economic losses (bills, receipts, lost income). For non-economic damages like pain and suffering, research typical settlements or consult a professional.

Your opening move is thedemand letter. This document formally presents your case, details your damages, includes supporting evidence, and states the compensation you seek. A good tip is to set your initial demand25-100% higherthan your minimum acceptable amount. This gives you room to negotiate down. For guidance, Nolo offers a helpfulDemand Letter Form.

Step 2: Countering a Low Settlement Offer

When the first offer arrives, expect it to be low. This is a strategy to test your resolve.Do not accept the first offer.

Instead,politely declineand prepare a written counteroffer. The key is tojustify every dollaryou’re requesting by referring back to your evidence. If the adjuster gave specific reasons for their low offer, address each point directly with your documentation. For example, if they claim damage was pre-existing, provide proof to the contrary.

Always communicate in writing.Follow up any phone calls with an email summarizing the conversation. This creates a paper trail. Throughout the process,stay firm but flexible. You may need to make small concessions, but don’t compromise on your core needs. Emphasize both the hard evidence and the emotional impact of the loss. For more strategies, see our guide onnavigating property damage claims: tips for a smoother process.

Step 3: Navigating Impasses and Deadlines

Sometimes negotiations stall. The most critical deadline is thestatute of limitations—the legal time limit for filing a lawsuit. These deadlines vary by state (typically 2-5 years for property damage) but missing them means you lose your right to sue.

If you’re at an impasse, tryescalating to a supervisor. A fresh perspective can sometimes break a deadlock. If you believe the company is acting in bad faith, you canfile a complaintwith your state’s Department of Insurance.

Mediation or arbitrationare other options. Thesealternative dispute resolutionmethods use a neutral third party to help facilitate a settlement and are less formal and expensive than a lawsuit.

Rejecting a low offer isn’t the end of the road. You may need to file a lawsuit to preserve your rights before the statute of limitations expires, but many cases still settle before trial. It’s just another step in the process.

When to Hire a Professional for Your Negotiation

While you can handle simple claims on your own, complex situations often require professional help. When your claim involves extensive damage, disputed facts, or bad faith tactics from the insurer, an expert can transform your outcome.

The Role of a Public Adjuster

For property damage claims, a public adjuster is your secret weapon. They work foryou, not the insurance company, and act as your advocate throughout the claims process.

- Damage Assessment Expertise:A public adjuster knows what to look for and how to document it. They often find thousands of dollars in damages that the insurance company’s adjuster missed.

- Negotiation Specialists:Public adjusters have seen every tactic and know how to counter lowball offers with evidence the insurer can’t ignore. At Global Public Adjusters, Inc., we’ve managed over $250 million in large loss claims, giving us unparalleled negotiation experience.

- Maximizing Your Settlement:The goal is to get what you’re owed under your policy. We’ve helped policyholders increase their initial offers from $50,000 to $200,000 or more through thorough documentation and skilled negotiation.

- Leveling the Playing Field:Insurance companies have teams dedicated to minimizing payouts. A public adjuster evens the odds.

Firms like Global Public Adjusters, Inc. work exclusively for the policyholder. If your claim is large, complex, or you feel it has beenundervalued or underpaid, a public adjuster can make all the difference. We can also help you understand thereasons why your property insurance claim can be deniedand how to fight back. Learn more aboutwhat can a public adjuster do for me?

Deciding if You Need Legal Counsel

While public adjusters handle property claims, attorneys are often necessary for personal injury claims, especially in certain situations:

- When liability is disputed:An attorney can build a legal case to establish fault.

- For serious personal injuries:Cases involving traumatic brain injuries, permanent disability, or chronic pain require an attorney to accurately value future medical costs, lost earning capacity, and quality of life impacts.

- When negotiations break down:If you reach a complete impasse and need to file a lawsuit, you absolutely need an attorney to steer the legal system.

- To understand legal complexities:Personal injury law involves state-specific rules and precedents that an attorney understands.

Most personal injury attorneys offer free consultations and work on contingency, meaning they only get paid if you win. If you’re feeling overwhelmed or the insurer isn’t taking you seriously, a consultation is a wise step.

Frequently Asked Questions about Insurance Negotiations

How long does the insurance settlement negotiation process take?

The timeline varies, typically taking anywhere from a few weeks to several months. The length depends on the complexity of your claim, the insurer’s investigation time, and the back-and-forth of counteroffers. After a major event like a hurricane, delays are common due to high claim volumes. While patience is key to avoiding a lowball offer, if negotiations stall and a lawsuit is filed, the process can extend further, though many cases still settle before trial.

What are the benefits of settling versus going to trial?

Most claims settle out of court for several good reasons:

- Cost Savings:Trials are expensive, with legal fees, expert witness costs, and court charges. Settling avoids these.

- Time Efficiency:A trial can drag on for years, while a settlement allows you to move on much sooner.

- Certainty of Outcome:A settlement provides a guaranteed amount. A jury verdict is unpredictable; you could win big or get nothing.

- Reduced Stress:Litigation is emotionally draining. Settling provides peace of mind and avoids the stress of a trial.

Can you negotiate a settlement with an insurance company for any type of claim?

Yes,you can negotiate a settlement with an insurance companyfor virtually any type of claim. Negotiation is a standard part of the process for:

- Property damage claims:This is common for homeowners and businesses dealing with damage from fires, water, hurricanes, and more. Public adjusters at Global Public Adjusters, Inc. specialize in theseproperty damage claims.

- Personal injury claims:Whether it’s athird-party claimor with your own insurer, negotiation is expected.

- Auto accidents:Disputing repair costs or a vehicle’s total loss value often requires negotiation.

- Business interruption claims:Recovering lost income and extra expenses involves negotiating with your insurer.

The initial offer is a starting point, not the final word. You always have the right to question it and counter.

Conclusion

So,can you negotiate a settlement with an insurance company? The answer is a definitive yes. You are not powerless when you receive a low initial offer. With the right information, solid preparation, and a clear understanding of your rights, you can negotiate for the compensation you truly deserve.

Remember these key takeaways:

- Preparation is everything.Document your losses, gather evidence, and calculate your claim’s true value.

- Never accept the first offer.It is almost always a lowball starting point for negotiation.

- You have rights as a policyholder.You can question valuations, present new evidence, and seek professional representation.

Most importantly, you don’t have to do this alone. For property damage claims, public adjusters atGlobal Public Adjusters, Inc.work exclusively for you. With over 50 years of experience and more than $250 million managed in large loss claims, our expertise can mean the difference between an inadequate settlement and full, fair compensation.

The bottom line is that you are in control. Stand firm, stay informed, and remember that a fair settlement isn’t a gift—it’s what you’ve paid for. For expert guidance on your property claim, learn more about whatpublic adjusterscan do for you.