Average insurance claim for burst pipe: Maximize 2025!

Why Understanding Burst Pipe Claim Costs Matters

Theaverage insurance claim for burst pipedamage ranges from$5,000 to $15,000, with the national average for water damage claims hitting$11,098. Severe cases can easily exceed $25,000, depending on the extent of the damage.

Quick Facts About Burst Pipe Insurance Claims:

- Minor damage: $1,000 – $5,000 (small leaks, limited area)

- Moderate damage: $5,000 – $15,000 (burst pipes, multiple rooms)

- Severe damage: $15,000+ (extensive flooding, structural damage)

- Average payout: $11,098 nationwide

- Claim frequency: Nearly 20% of home insurance claims involve water damage

When a pipe bursts, the financial impact extends far beyond the plumbing repair.Water damage spreads quickly, affecting floors, walls, furniture, and personal belongings. Resulting mold remediation, structural repairs, and temporary living expenses can add thousands to your claim.

Understanding these potential costs helps you make informed decisions. Knowing what to expect from your insurance claim puts you in a stronger position to recover fully.

Most homeowners insurance policies cover burst pipes if the damage issudden and accidental. However, insurers may undervalue claims or deny coverage over maintenance issues. This is why proper documentation and professional advocacy are crucial for securing fair compensation.

Understanding Your Insurance Coverage for Burst Pipes

Most homeowners insurance policies cover burst pipe damage, but with a critical catch: the damage must be“sudden and accidental.”Problems caused by neglect or gradual wear and tear are typically excluded. Understanding this distinction is key to a successful claim.

Your policy generally covers theresulting damagefrom the water—such as ruined floors, soaked drywall, and damaged furniture. However, the cost to fix the burst pipe itself often isn’t covered, especially if it failed due to age or poor maintenance.

Several parts of your policy activate after a burst pipe:

- Dwelling coverageprotects your home’s structure (walls, floors, ceilings).

- Personal property coveragehelps replace belongings like furniture and electronics.

- Additional Living Expenses (ALE)helps with hotel and meal costs if your home is uninhabitable during repairs.

What’s Typically Covered

Theaverage insurance claim for burst pipeincidents is between $5,000 and $15,000. Here’s what’s usually covered:

- Burst pipes:Damage from pipes that suddenly freeze, crack, or rupture is the classic covered event. Insurers expect you to take reasonable steps to prevent freezing, like keeping your heat on.

- Appliance malfunctions:Sudden failures of washing machine hoses, dishwashers, or water heaters are generally covered.

- Accidental overflows:Unexpected overflows from toilets, sinks, or tubs usually qualify for coverage.

- Structural and personal property damage:The policy covers repairs to your home’s structure and replacement of personal belongings caught in the flood.

For more details on what’s covered, you can learn more aboutwater damage claimsand how we help Orlando homeowners.

Common Exclusions and Limitations

Understanding what your insurance won’t cover can save you from surprises.

- Gradual damage:Slow leaks or drips that cause damage over time are often excluded. Insurance is for sudden events, not slow-developing problems.

- Lack of maintenance:If a burst pipe results from neglected plumbing or ignoring a known issue, your insurer may deny the claim. For example, if you leave your home unheated in winter and pipes freeze, coverage may be denied.

- Sewer backups and external flooding:Standard policies do not cover sewer backups or floods from storms or rising rivers. These require separate insurance endorsements or a flood policy. Differentpolicy typesoffer varying coverage.

- Mold damage:Most policies have specific, often low, limits on how much they will pay for mold remediation, even if it results from a covered water event.

The key takeaway is that regular maintenance and quick repairs can prevent many coverage headaches.

What is the Average Insurance Claim for a Burst Pipe?

When a pipe bursts, the repair itself is often the smallest part of the cost. The real expense comes from everything the water touches.

Water damage claims are among the most common and expensive for homeowners. Theaverage insurance claim for burst pipedamage is around$11,098nationwide, but this figure can vary dramatically. Nearly one in five home insurance claims involves water damage, with insurers paying out over $20 billion annually for these claims.

Your actual payout depends on your policy’s deductible, coverage limits, and claim documentation. For example, a $1,000 deductible is subtracted from your settlement, and depreciation on older materials can further reduce what you receive.

Factors That Influence the Average Insurance Claim for a Burst Pipe

Several key factors determine whether your claim will be on the lower or higher end of the spectrum.

| Factor | Minor Burst Pipe Damage (e.g., small leak in accessible pipe) | Severe Burst Pipe Damage (e.g., pipe bursts behind wall, extensive flooding) |

|---|---|---|

| Extent of Damage | Limited to a small area (e.g., under a sink, small wall section) | Spreads across multiple rooms, affecting flooring, drywall, insulation, electrical. |

| Water Contamination | Clean water (e.g., from a supply line) | Gray or Black water (e.g., from sewer backup, prolonged standing water) |

| Location of the Pipe | Easily accessible (e.g., exposed basement pipe) | Hidden behind walls, under concrete slabs, in ceilings, or main lines. |

| Type of Materials | Linoleum, laminate, painted drywall | Hardwood floors, custom cabinetry, plaster, valuable personal items. |

| Repair Complexity | Simple pipe patch or replacement | Extensive demolition, drying, mold remediation, structural repairs. |

- Extent of damage:A small leak under a sink may cost a few thousand dollars, but a pipe bursting in an attic and flooding multiple floors will be far more expensive.

- Water contamination:Cleanup costs rise significantly withgray water(from appliances) orblack water(from sewage), which pose health hazards and require specialized remediation.

- Location of the pipe:An exposed pipe is a simple fix. A pipe hidden behind a wall requires demolition and refinishing, adding thousands to the repair cost.

- Material types:Replacing basic vinyl flooring is much cheaper than restoring custom hardwood floors or intricate tile.

- Mold:Water damage can lead to mold, especially in humid climates. Remediation can cost $500 to $6,000 or more. Recognizing theSigns of hidden water damageearly is critical.

Burst Pipe Claim Payout Statistics

While theaverage insurance claim for burst pipedamage is around $11,098, payouts generally fall into these categories:

- Minor damage ($1,000 – $5,000):Small leaks affecting a limited area.

- Moderate damage ($5,000 – $15,000):The most common range, involving water in multiple rooms or significant drywall and flooring replacement.

- Severe damage ($15,000+):Extensive flooding, structural issues, or water affecting multiple floors, with some claims exceeding $25,000.

Industry data shows that large water damage claims (over $500,000) have doubled in recent years, reflecting larger homes and aging infrastructure. Regional differences also matter; cold climates see more frozen pipes, while Florida deals with aging pipes and appliance failures.

Water damage loss statisticsconfirm that water damage is a leading cause of claims. Understanding these numbers helps set realistic expectations, but proper documentation and advocacy are key to a fair settlement.

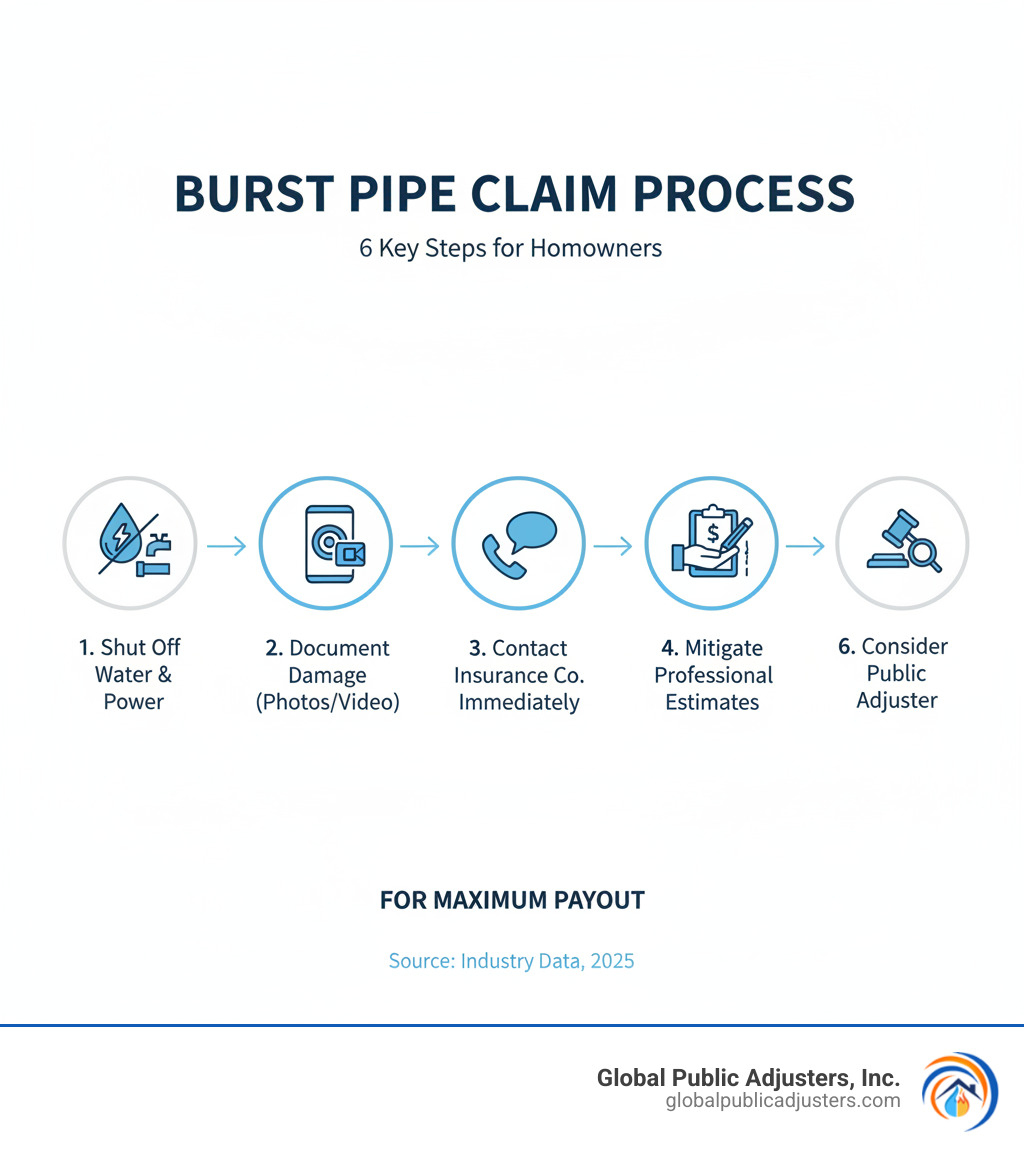

Step-by-Step Guide to Filing Your Burst Pipe Claim

When a pipe bursts, a clear action plan can help you manage the process and maximize youraverage insurance claim for burst pipepayout.

The claims process involves immediate damage control, thorough documentation, and communication with your insurer. Simple claims may take a few weeks, while complex cases can last several months. Understanding each stage helps you stay in control.

Immediate Steps to Protect Your Property and Claim

Your first actions are critical and are required by your policy to mitigate further damage.

- Shut off your main water supply.This is the most important step to stop the flow of water and prevent more damage.

- Turn off electricityto the affected area to avoid electrical hazards.

- Contain the water damage.Once safe, use towels or a wet/dry vac to remove standing water and move belongings to a dry area. Start the drying process with fans to prevent mold.

- Identify the source.Sometimes a burst isn’t obvious. Look for drops in water pressure, discolored water, or damp spots on walls. Our guide onhow to tell if a pipe has burstcan help.

- Contact your insurance companyas soon as the immediate emergency is handled to start the claims process.

How Documentation Impacts the Average Insurance Claim for a Burst Pipe

Solid evidence is the key to a fair settlement. Thorough documentation for youraverage insurance claim for burst pipecan add thousands to your payout.

- Take photos and videosof the damage before cleaning up. Capture wide shots and close-ups of affected areas and items.

- Create a detailed inventoryof every damaged item, including descriptions, brand names, and replacement costs.

- Keep all receiptsfor emergency repairs, cleaning supplies, and temporary living expenses.

- Get written estimatesfrom reputable contractors for all necessary repairs.

- Document all communicationwith your insurance company, including dates, names, and a summary of conversations.

Navigating the Claim with Professional Help

The insurance company’s adjuster works for them, not you. Their goal is to settle the claim for the lowest amount possible. This is where theinsurance company adjuster versus public adjusterdifference is crucial. A public adjuster works exclusively for you, the policyholder.

At Global Public Adjusters, Inc., we have over 50 years of experience fighting for homeowners. We know how insurance companies undervalue claims and how to counter their tactics.

Claim disputes and underpaid settlementsare common. Insurers may offer low initial settlements, deny parts of the claim, or underestimate repair costs. A public adjuster levels the playing field by conducting a thorough inspection, documenting all losses, and negotiating aggressively on your behalf.

The results are clear. We often see settlement offers increase dramatically after we get involved. In one recent case, an initial $30,000 offer for a sewage backup with mold became a $115,000 final settlement. Professional representation can be the difference between a partial repair and a full recovery. To learn more, seewhat a public adjuster can do for you.

Frequently Asked Questions about Burst Pipe Claims

When dealing with a burst pipe, you’re bound to have questions. Here are answers to the most common ones we hear about theaverage insurance claim for burst pipesituations.

How long does an insurance claim for a burst pipe take?

The timeline depends on the claim’s complexity.

- Simple claims:Typically resolve in2-4 weeksfor straightforward damage with good documentation.

- Moderate claims:Usually take1-2 monthsfor issues involving multiple rooms or minor structural work.

- Large or complex claims:Can stretch3-6 months or longer, especially with extensive damage, coverage disputes, or mold.

While states like Florida have timelines for insurers, complex claims still take time. A public adjuster can often speed up the process by submitting a complete and accurate claim from the start, reducing delays.

Will my insurance rates go up after a burst pipe claim?

Many homeowners worry about rate increases after filing a claim. Here’s what to consider:

- Claim history:A single claim, especially if it’s your first in years, is unlikely to cause a dramatic rate hike.

- Claim size:A smallaverage insurance claim for burst pipedamage has less impact than a massive one.

- Multiple claims:Filing several water damage claims in a short period will likely lead to rate increases or even non-renewal.

Don’t let fear of a rate increase stop you from filing a legitimate claim. This is what you pay your premiums for.

Should I get additional coverage for water damage?

Standard homeowners insurance has significant gaps. Additional coverage is often a wise investment.

- Sewer backup endorsement:This is crucial. Standard policies don’t cover damage from a sewer line backup. This affordable add-on can save you over $10,000.

- Water backup coverage:Protects against overflows from sump pumps and drains.

- Flood insurance:Essential for flood-prone areas, as standard policies exclude flood damage. You can get this throughFlood insurance from FEMA, but be aware of the30-day waiting period.

- Service line coverage:Protects the underground pipes between your home and the street, which can be a costly out-of-pocket repair.

Consider your home’s specific risks, like its age and location, when deciding on extra coverage. The small premium is often worth the peace of mind.

Conclusion: Taking Control of Your Water Damage Claim

A burst pipe can feel overwhelming, but you are not powerless. Understanding the claims process and taking the right steps can turn a crisis into a manageable situation.

We’ve seen that theaverage insurance claim for burst pipedamage ranges from $5,000 to $15,000, with severe cases climbing much higher. The key takeaway is that insurance covers sudden, accidental damage, but not gradual wear or neglect. This distinction is critical.

Prevention is your best defense, but when disaster strikes, your immediate response matters. Shutting off the water, securing the electricity, and documenting everything are essential first steps.

Many homeowners assume their insurer’s adjuster is on their side, but that adjuster works for the insurance company. Their job is to protect their employer’s bottom line.

This is where professional advocacy is invaluable.At Global Public Adjusters, Inc., we have over 50 years of experience fighting for homeowners. We know how to counter the lowball offers and overlooked damages that are common in these claims. The difference can be substantial—we’ve turned $30,000 offers into $115,000 settlements by finding hidden damage and negotiating effectively.

You don’t have to settle for less than you deserve. Your policy is a contract, and you have the right to full compensation for your covered losses. The stakes are too high to steer this process alone against an experienced insurance company.

Take control of your situation.Get professional help with your water damage claim in Orlandoand let Global Public Adjusters, Inc. fight for the settlement you deserve. Don’t fight the insurance battle alone.