Fire Damage Claim: 5 Essential Steps for Success

When a Fire Turns Your World Upside Down

Afire damage claimis your pathway to financial recovery after a devastating fire. The process can be complex and overwhelming, especially when you’re already dealing with trauma and loss.

Quick Overview: How to Handle Your Fire Damage Claim

- Report immediately– Contact your insurance company within 24-48 hours.

- Document everything– Take photos and videos of all damage before cleanup.

- Protect your property– Make temporary repairs to prevent further damage.

- Understand your coverage– Review what your policy covers.

- Work with professionals– Consider hiring a public adjuster for large claims.

- Keep all receipts– Save documentation for all related expenses.

- Don’t accept the first offer– Insurance companies often start with low settlements.

In 2022, home structure fires caused an estimated$7.9 billion in property damagein the U.S. Behind each statistic is a family facing the task of rebuilding while navigating a complicated insurance claim. Many policyholders struggle to receive fair compensation due to claim delays, low offers, or unfair denials. Understanding your rights is essential for your financial recovery.

This guide walks you through every stage of your fire damage claim, from the initial response to the final settlement. You’ll learn what your policy covers, how to avoid common pitfalls, and when to seek professional help to confidently steer the path from flames to funds.

Explore more aboutfire damage claim:

First Response: Immediate Steps After a House Fire

In the aftermath of a fire, your first actions are crucial for your safety and the success of yourfire damage claim. Taking these immediate steps can make a significant difference.

First, ensure everyone is safe and out of the house. Once secure, call 911. Never re-enter a fire-damaged property until fire officials have declared it safe, as structural integrity may be compromised and embers can reignite.

Next, notify your insurance company as soon as possible, typically within 24-48 hours. This call initiates thefire damage claimprocess. Have your policy number and a brief description of the incident ready.

After the fire department clears the scene, secure your property to prevent further damage or theft. This may involve boarding up windows or tarping the roof. Your policy requires you to mitigate further damage, and failure to do so could affect your coverage. Keep all receipts for these emergency repairs, as they are often reimbursable.

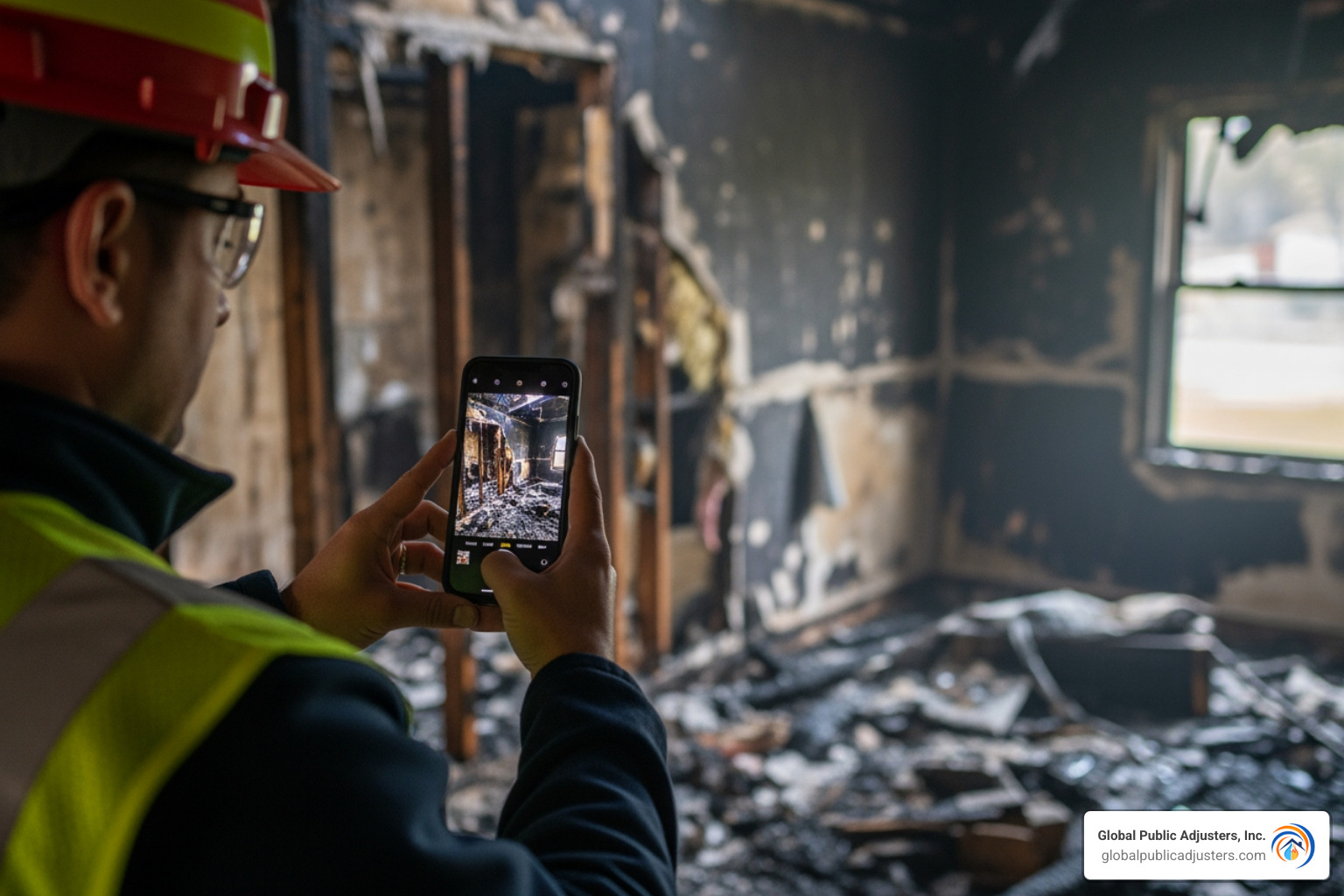

Before any cleanup, take detailed photos and videos of all damage as soon as it’s safe. This visual evidence is invaluable for your claim. Do not discard any damaged items until your insurance adjuster has assessed them, as this can prevent disputes over the scope of your loss.

Finally, keep meticulous records of all emergency expenses, including temporary lodging, meals, and clothing. These costs are typically covered under “Additional Living Expenses” (ALE), which we will discuss later.

For more information on how to file a claim after a fire, you can visit our guide:More info about how to file a claim after a fire.

Navigating Your Fire Damage Claim: A Step-by-Step Process

Filing afire damage claimcan feel like navigating a maze. Understanding the steps involved will help you move through the process with more confidence.

The journey begins when you file the claim with your insurer, who then assigns an adjuster. This adjuster, who works for the insurance company, investigates the damage, assesses repair costs, and recommends a settlement amount.

During the property inspection, the adjuster will survey the damage. Be present for this visit and show them all your documentation, including photos, videos, and inventory lists. Point out all damage, even if it seems minor. Smoke and water damage can hide behind walls or in ventilation systems and are often more pervasive than the fire itself.

Following the inspection, the adjuster will provide an estimate. Do not feel pressured to accept this first offer. You have the right to challenge their assessment with your own independent estimates from qualified contractors. This is a critical point where many policyholders under-recover because they don’t know they can negotiate.

The goal is a fair settlement that allows you to repair or rebuild your home and replace your property to its pre-fire condition. With over 50 years of experience, we at Global Public Adjusters, Inc. are experts in maximizing settlements, ensuring you get what you’re owed.

Understanding how to effectively interact with your adjuster and advocate for your claim is key. Here’s more onThe best way to deal with an insurance adjuster.

Crucial Documentation for Your Fire Damage Claim

Thorough documentation is the backbone of a successfulfire damage claim. The more organized your records, the stronger your negotiating position.

Here’s a list of essential documents:

- Proof of Loss Form:A formal statement to your insurer detailing the loss. Be accurate and complete.

- Home Inventory List:A detailed, room-by-room list of all damaged personal property. Include brand names, purchase dates, and values. Photos from before and after the fire are critical.

- Photos and Videos:Comprehensive visual evidence of all structural, personal property, smoke, and water damage.

- Receipts for Repairs and ALE:Keep every receipt for temporary repairs, emergency purchases, and all additional living expenses.

- Contractor Estimates:Obtain detailed, written estimates from reputable, licensed contractors in Florida for all necessary repairs.

- Police and Fire Reports:The official report confirms the date, time, and cause of the fire.

- Policy Documents:Have your insurance policy handy to understand your coverage limits, deductibles, and specific clauses.

We also advise keeping a log of all communications with your insurance company. Send important communications in writing and keep copies.

For more information, you can also consult general resources likeResidential Property Claims Information Guides.

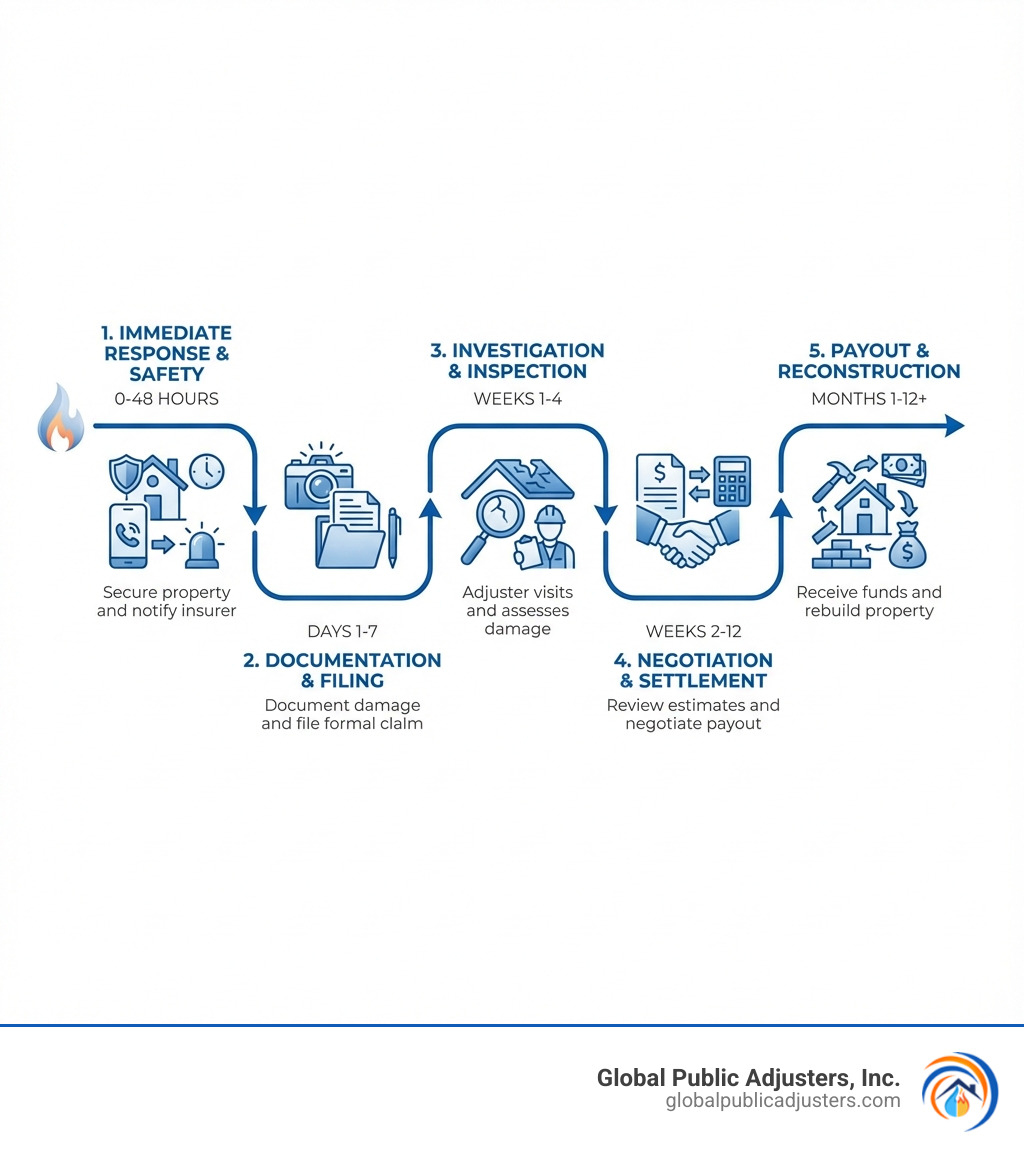

Understanding the Fire Damage Claim Timeline

The timeline for afire damage claimvaries, but understanding the typical stages helps manage expectations.

- Initial Contact (First 24-48 hours):You notify your insurer, who assigns an adjuster.

- Investigation Period (Days to Weeks):The adjuster visits your property to assess the damage.

- Adjuster’s Estimate (Weeks 2-6):The adjuster provides their estimate of repair or replacement costs.

- Negotiation Phase (Weeks 4-12):You review the estimate and negotiate if it’s too low, often providing your own contractor estimates.

- Payout (Months 1-3+):Once a settlement is agreed upon, the insurance company issues payment, which may come in multiple checks.

- Rebuilding (Months 3-12+):With funds in hand, you can begin repairing or rebuilding your home.

While Florida has its own set of regulations, it’s important to know that claim timelines can be complex. For significant damage or disputes, the process can extend considerably, sometimes taking many months or even over a year to resolve.

Decoding Your Policy: Key Coverages and Payouts

Understanding your insurance policy is like having a roadmap for yourfire damage claim. It outlines what’s covered, what’s excluded, and how much you can expect to receive. We can help you decipher the dense legal jargon.

Most homeowners insurance policies in Florida include fire coverage. Here are the typical coverage types you’ll encounter:

- Dwelling Coverage:Covers the physical structure of your home, including the roof, walls, and floors, to pay for repairs or rebuilding.

- Personal Property Coverage:Covers your belongings, such as furniture, clothing, and electronics. A detailed home inventory is crucial for this part of your claim.

- Debris Removal:Covers the cost of clearing debris, including hazardous materials like soot and ash.

- Landscaping & Outdoor Property:Damage to outdoor structures, landscaping, and trees can also be covered, though often with specific limits.

- Smoke Damage:Smoke can be more pervasive than fire, seeping into materials and leaving odors and discoloration. Most policies cover smoke damage, but disputes can arise over whether to clean or replace items. We are experts in handlingsmoke damage claims in Orlandoand can ensure these damages are properly assessed.

Replacement Cost vs. Actual Cash Value (RCV vs. ACV)

One of the most critical distinctions in yourfire damage claimis whether your policy provides Replacement Cost Value (RCV) or Actual Cash Value (ACV) coverage. This difference significantly impacts your payout.

| Feature | Replacement Cost Value (RCV) | Actual Cash Value (ACV) |

|---|---|---|

| Definition | Pays the cost to replace damaged property with new, similar items, without deducting for depreciation. | Pays the depreciated cost to replace damaged property (current market value). |

| Payout Amount | Higher, as it aims to restore your property with new materials. | Lower, as it accounts for wear and tear and age. |

| Depreciation | Not deducted upfront. You typically receive an initial ACV payment, then the recoverable depreciation once items are replaced. | Deducted upfront. You receive the item’s value at the time of loss. |

| Example | A 10-year-old roof costs $15,000 to replace. With RCV, you get $15,000 (minus deductible) after replacement. | A 10-year-old roof costs $15,000 to replace, but its depreciated value is $5,000. With ACV, you get $5,000 (minus deductible). |

Depreciation Explained:Depreciation is the decrease in an item’s value over time due to age and wear. ACV policies pay out this depreciated value. RCV policies aim to cover the cost of a new replacement.

Recoverable Depreciation:With an RCV policy, you’ll often get an initial payment for the ACV. After you replace the item or repair the property, you submit receipts to your insurer to receive the “recoverable depreciation”—the difference between ACV and RCV. Be mindful of policy time limits for claiming this.

Policy Endorsements:Check for “Ordinance and Law” coverage, which helps pay extra costs to rebuild your home to meet current building codes, as standard policies often don’t cover this.

For a broader understanding of post-disaster claims, thePost-Disaster Claims Guide from NAICoffers valuable insights.

How ‘Additional Living Expenses’ (ALE) Works

When a fire makes your home uninhabitable, ‘Additional Living Expenses’ (ALE), or ‘Loss of Use’ coverage, is a critical part of yourfire damage claim.

ALE reimburses you for theincreasein living expenses you incur because you cannot live in your home. It covers the extra costs above your normal spending.

What does ALE typically cover?

- Temporary Housing:Hotel bills or temporary rental payments.

- Restaurant Meals:The increased cost of eating out if you lack a kitchen.

- Relocation and Storage:Costs to move and store belongings.

- Other Increased Costs:Extra transportation, pet boarding, or laundry services.

The key is to keep meticulous records and receipts for everything. ALE coverage has limits, either a dollar amount or a time frame (e.g., 12 or 24 months), so be sure to understand your policy.

In some widespread disasters, FEMA may offer lodging reimbursement, but your primary source for ALE will be your homeowners policy. For more information, you can consult theFEMA fact sheet on lodging reimbursement.

Overcoming Problems: Common Claim Problems and Solutions

Even with good preparation, afire damage claimcan present challenges. We’ve seen homeowners in Orlando and Pensacola face frustrating delays and low offers. Being aware of common problems and knowing how to respond is crucial.

Proactive communication is your best defense. Maintain a detailed log of every interaction with your insurer to create a clear record if disputes arise. Understanding your rights as a policyholder is the first step in protecting your investment.

One common issue isunderinsurance, where policy limits are too low to fully cover rebuilding costs. Another ishidden damagefrom smoke, soot, and water, which can affect HVAC systems, wiring, and structural integrity. If these damages are overlooked, your initial settlement will be insufficient.

Understanding how to effectively deal with your insurance adjuster and advocate for your claim is key. Here’s more onUnderstanding how to deal with an insurance adjuster after a house fire.

Common Problems When Filing a Fire Damage Claim

Navigating afire damage claimcan be difficult. Here are some common problems policyholders face:

- Claim Delays:Insurers may drag their feet, prolonging your financial strain by requesting excessive documentation or conducting slow investigations.

- Lowball Settlement Offers:It’s common for insurers to make an initial offer that is far below the actual cost of repairs, hoping you’ll accept out of desperation.

- Underpayment:This occurs when the insurer’s estimate doesn’t cover the full scope of damages, especially hidden issues like smoke in ductwork or water damage.

- Unfair Claim Denials:An insurer might deny yourfire damage claimwithout a valid reason, alleging arson without proof or claiming the damage isn’t covered.

- Disagreements Over Scope of Damage:You and your insurer may disagree on the extent of damage, such as whether smoke-damaged items should be cleaned or replaced.

You don’t have to accept these outcomes. Being informed and proactive is your best defense. For additional guidance, Consumer Reports offers insights onHow to File an Insurance Claim After a Wildfire.

Identifying and Fighting Bad Faith Insurance Practices

Sometimes, an insurer’s actions cross the line from standard business practice into “bad faith.” This occurs when an insurer fails to handle claims honestly, fairly, and promptly.

Here are red flags that might indicate bad faith:

- Unreasonable Delays:Consistently slow responses or prolonged investigations without justification.

- Misrepresenting Policy Terms:Distorting your policy language to deny coverage or reduce your payout.

- Failure to Investigate Properly:Ignoring evidence, refusing to inspect all damages, or failing to conduct a thorough investigation.

- Denial Without Valid Reason:Denying a claim without a clear, written explanation.

- Lowballing and Coercion:Offering a settlement far below the true value and pressuring you to accept it.

If you suspect bad faith, document everything. Keep records of all communications and request all decisions in writing. You can also contact the Florida Department of Financial Services, Division of Consumer Services, to investigate complaints against insurance companies.

When to Hire Professional Help: Public Adjusters

Dealing with afire damage claimis a monumental task. The paperwork, complex policy language, and emotional toll can be overwhelming. This is where a public adjuster can make all the difference.

You should consider hiring a public adjuster if:

- Your Claim is Complex or Large:For significant structural damage or a total loss, the claim will be intricate and high-stakes.

- You Suspect Bad Faith:If you’re facing unreasonable delays, lowball offers, or unfair denials, an advocate can protect your rights.

- You Feel Overwhelmed:A public adjuster can take the burden off your shoulders, handling all communication, documentation, and negotiation.

- You Want to Maximize Your Settlement:Our primary goal at Global Public Adjusters, Inc. is to ensure you receive the maximum settlement you are entitled to under your policy.

A public adjuster works solely for you, the policyholder, not the insurance company. We estimate damage, review your coverage, and negotiate on your behalf to prioritize your interests.

At Global Public Adjusters, Inc., we are a public claims adjuster in Orlando, FL, specializing in representing homeowners and business owners across Florida. We focus on maximizing settlements, offering expertise and advocacy against insurance companies.

To learn more about the crucial role we play, read aboutThe Essential Role of Public Adjusters in Fire Damage Recovery. If you’re facing afire damage claim, don’t hesitate toContact Global Public Adjusters, Inc. for assistance.

Frequently Asked Questions about Fire Damage Claims

What does a typical fire damage claim include?

Afire damage claimtypically includes coverage for several key areas:

- Dwelling:The physical structure of your home.

- Personal Property:Your belongings, such as furniture, clothing, and electronics.

- Additional Living Expenses (ALE):Increased living costs if your home is uninhabitable, like temporary housing and meals.

- Debris Removal:The cost to clear away fire-damaged debris.

- Other Structures:Detached structures like garages or sheds.

- Smoke and Water Damage:Damage caused by smoke, soot, and firefighting efforts.

The specifics and limits for each area depend on your individual insurance policy.

How long does it take to settle a fire damage claim?

The timeline for settling afire damage claimvaries significantly. Simple claims might be resolved in a few weeks, but complex claims involving extensive damage or disputes can take many months, sometimes a year or longer. Factors influencing the timeline include the complexity of the damage, your insurer’s responsiveness, and how quickly you provide documentation.

What’s the difference between a company adjuster and a public adjuster?

This is a crucial distinction for yourfire damage claim:

- Company Adjuster:This individual is an employee of your insurance company. Their role is to investigate your claim with the insurance company’s interests in mind.

- Public Adjuster:This is an independent professional you hire to representyourinterests. A public adjuster works for you to assess the damage, prepare your claim, and negotiate with the insurance company to ensure you receive the maximum settlement you are entitled to. We, Global Public Adjusters, Inc., are public adjusters dedicated to advocating for policyholders in Florida.

Conclusion: Rebuilding Your Life with Confidence

Experiencing a fire is traumatic, but navigating yourfire damage claimdoesn’t have to add to your distress. By understanding the process, documenting your losses, and knowing your rights, you can take control of your financial recovery.

We’ve covered the immediate steps, crucial documentation, claim timeline, and key policy coverages. We’ve also highlighted common problems like lowball offers and how to fight back.

The journey from flames to funds can be challenging, but you don’t have to face it alone. At Global Public Adjusters, Inc., we bring over 50 years of experience advocating for homeowners and business owners across Florida, including Orlando and Pensacola. We level the playing field and are committed to maximizing your settlement, allowing you to focus on rebuilding your life.

Don’t let the complexities of afire damage claimoverwhelm you. Take control of your recovery, and let us help you steer the process with confidence.

For expert assistance with yourfire damage claimin Orlando, reach out to us today:Get help with your fire damage claim in Orlando.