Residential insurance adjuster: 3 Pro Secrets

Understanding the Role of Residential Insurance Adjusters

Aresidential insurance adjusteris a licensed professional who investigates property damage claims and determines fair settlement amounts for homeowners. These professionals serve as the bridge between you and your insurance company when disaster strikes your home.

Key Facts About Residential Insurance Adjusters:

- Primary Role: Investigate claims, assess damage, and determine settlement amounts

- Types: Staff adjusters (work for one insurer), independent adjusters (contractors), and public adjusters (work for homeowners)

- Investigation Process: Property inspection, damage documentation, policy review, and settlement negotiation

- Timeline: Can take 60+ days for complex claims

- Licensing: Required in most states with continuing education requirements

When a storm damages your roof or a tree falls on your home, you’ll likely encounter a residential insurance adjuster. But here’s a critical fact:not all adjusters work for you. The claims process is often overwhelming. Understanding who your adjuster represents can mean the difference between a fair settlement and paying for repairs out of pocket. Insurance companies are only obligated to reimburse you for covered damages per your policy. Knowing the adjuster’s role is key to protecting your financial interests.

The Three Faces of Claims Adjusting: Who’s Working on Your Claim?

When you file a claim, you might think “an adjuster is an adjuster.” Not quite. While their core task is the same, who they work for—and whose interests they represent—varies significantly. There are two main types: those who work for the insurance company and those who work for you. Understanding this difference is key to navigating the claims process.

Let’s break down the different types ofresidential insurance adjusterprofessionals:

| Adjuster Type | Who They Work For | How They Are Paid | Primary Objective |

|---|---|---|---|

| Staff Adjuster | Directly employed by one insurance company | Salary + Benefits from the insurer | To investigate and settle claims efficiently for their employer, ensuring fair payouts according to policy terms while managing the insurer’s financial interests. |

| Independent Adjuster | Contracted by multiple insurance companies | Fee-based per claim from the insurer | To provide claims adjusting services on a freelance basis for various insurers, often during high-volume periods or in areas where the insurer lacks a local office. They represent the insurer’s interests. |

| Public Adjuster | Directly employed by the policyholder | Percentage of the settlement (from the policyholder) | To represent solely the financial interests of the insured, advocating for the maximum possible settlement from the insurance company and assisting the policyholder through every step of the claims process. They are your advocate. |

Staff and Independent Adjusters: Working for the Insurer

Staff Adjusters(or Company Adjusters) are salaried employees of a single insurance company. They investigate claims for their employer, assessing damage and determining payouts with the insurer’s financial interests in mind.Independent Adjustersare third-party contractors hired by insurance companies, often during high-claim periods like after a hurricane. Also known as ‘catastrophe’ or ‘CAT’ adjusters, they also represent the insurer’s interests. Both types inspect damage, review policies, and submit their findings to the insurance company.

To learn more about the different roles within the adjusting world, you can explore the7 Types of Claims Adjusters and Their Duties in Florida.

Public Adjusters: Your Advocate in the Claims Process

Unlike Staff or Independent Adjusters, aPublic Adjusterworks exclusively for you, the policyholder. We are hired directly by you to represent your financial interests. Our goal is to maximize your settlement, ensuring you receive the full and fair compensation you deserve. A Public Adjuster is paid a percentage of the final settlement, so our interests are aligned with yours—we only get paid when you do. At Global Public Adjusters, we bring over 50 years of experience representing homeowners in Orlando, FL, and throughout Florida. We are your expert advocates, standing up to insurance companies on your behalf. If you’re wondering how a Public Adjuster can make a difference in your claim, learn more aboutwhat a public adjuster can do for you.

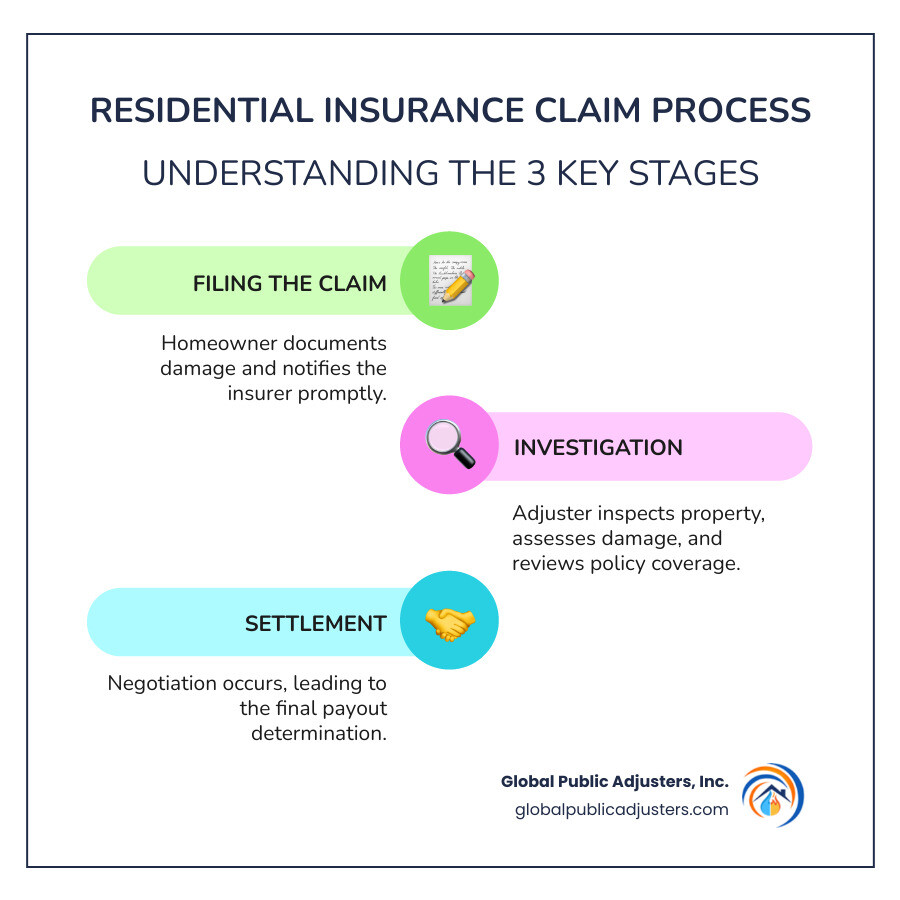

The Anatomy of a Claim: An Adjuster’s Investigation Process

So, you’ve filed a claim. What happens next? Aresidential insurance adjusterbegins a detailed, multi-step investigation to understand the full scope of your loss and determine a fair payout amount.

An adjuster’s daily tasks are varied, including investigating property damage, determining the insurer’s liability based on your policy, compiling information, creating damage estimates, and negotiating settlements.

For a smoother process from start to finish, understanding theHomeowners Claim Process Orlando FLcan be incredibly helpful.

The Investigation Playbook

When an adjuster arrives, they follow a specific playbook to gather facts:

- Property Inspection: The adjuster thoroughly inspects the damaged areas to find the cause and extent of the loss.

- Damage Documentation: They take extensive notes, photos, and videos, which form the basis of their report.

- Policy Review: The adjuster reviews your policy to understand coverages, limits, and exclusions.

- Evidence Gathering: This may include reviewing police reports, weather data, or contractor invoices.

- Submitting Findings: All information is compiled into a detailed report for the insurer with a settlement recommendation.

- Creating Estimates: Adjusters use specialized software to generate repair estimates detailing the scope of work and costs, which directly impacts your payout.

For those dealing with property damage claims in Orlando, understanding this process is key to a successful outcome. You can find more specific guidance onProperty Damage Claims Orlando.

The Role of a Residential Insurance Adjuster in Different Claim Scenarios

The specifics of an adjuster’s investigation shift depending on the type of damage:

- Fire Damage: The adjuster determines the fire’s origin and assesses structural, smoke, and water damage from firefighting efforts, plus personal property loss.

- Water Damage: A key task is identifying the water’s source (e.g., burst pipe vs. flood) to determine coverage, as flood damage often requires a separate policy.

- Storm and Wind Damage: The focus is on damage from wind, hail, or falling trees to roofs, siding, and other structures, often corroborated by weather reports.

- Hail Damage: Adjusters look for subtle signs of impact like bruising on shingles or dents in siding that an untrained eye might miss.

- Vandalism Claims: The adjuster reviews police reports and assesses property damage or loss, often requiring an itemized list of stolen goods.

No matter the cause, theresidential insurance adjusteraims to accurately assess the damage and apply your policy’s terms. If you’re wonderingWho do I call for residential losses or damages?, knowing the adjuster’s specific role in these scenarios can help you prepare.

For Homeowners: Navigating the Claims Process Like a Pro

Dealing with property damage and an insurance claim is stressful. However, with preparation, you can steer the process effectively. Key considerations include knowing your policy, documenting everything, and preparing for challenges like underpayment, delays, or unfair denials. Being proactive and informed is your best defense.

For comprehensive guidance on making the process smoother, take a look at our tips forNavigating property damage claims: tips for a smoother process.

Best Practices for Filing and Interacting with an Adjuster

Here are some best practices we recommend:

- File Promptly: File your claim as soon as possible to meet policy deadlines.

- Document Everything: Before cleanup, take extensive photos and videos of all damage. Create an itemized list of lost or damaged items with receipts if possible.

- Be Present and Engaged: Be there for the inspection to walk the adjuster through the property and point out all damages.

- Take Detailed Notes: Log all communications with your insurer and adjuster, noting the date, time, person, and discussion topics.

- Be Honest: Be truthful and never claim damages that didn’t occur. Insurance fraud has severe consequences.

- Avoid Admitting Fault: Stick to the facts of what happened and avoid statements that imply you were responsible for the damage.

- Understand Your Coverage: Review your policy to know your deductibles, limits, and exclusions before the adjuster arrives.

For more helpful insights, check out theseHelpful tips for filing a claim.

How to Prepare for the Adjuster’s Inspection

Being well-prepared can significantly streamline the process. Here’s a checklist of items to have ready:

- Insurance Policy: Have a copy of your policy ready for reference.

- Visual Documentation: Provide your comprehensive photos and videos of the damage.

- Home Inventory: Share an updated list of damaged items.

- Repair Receipts: Keep receipts for any emergency repairs made to prevent further damage (e.g., tarping a roof).

- Contractor Estimates: Share any repair estimates you’ve already obtained.

- Keep Damaged Items: Don’t throw away damaged property until the adjuster has inspected it.

- Mitigate Further Damage: Take reasonable steps to prevent more damage, as this is often a policy requirement.

What to Do if You Disagree with the Settlement Offer

It’s not uncommon to disagree with an initial settlement offer. You have options and should not feel pressured to accept an unfair amount.

Here’s what you can do:

- Request a Detailed Breakdown: Ask the adjuster for an itemized explanation of the settlement offer to identify areas of disagreement.

- Provide Your Own Evidence: Present your own documentation, such as higher contractor estimates or additional photos, to support your position.

- Ask for a Second Inspection: You can often request a second inspection, potentially with a different adjuster or with your contractor present.

- Negotiate: Don’t be afraid to negotiate. Use your evidence to explain why the offer is insufficient.

- Use the Appraisal Process: Your policy may have an “appraisal clause” for resolving disputes, where both sides hire an appraiser to settle the amount of loss.

- Hire a Public Adjuster: For complex claims or failed negotiations, a Public Adjuster is your strongest advocate. We can review the insurer’s assessment, build a comprehensive claim, and negotiate directly with the insurance company to secure a fair settlement.

If your home insurance claim has been denied, or you’re facing a lowball offer, understanding your rights and options is paramount. We have more information onWhat to do when your home insurance claim is denied.

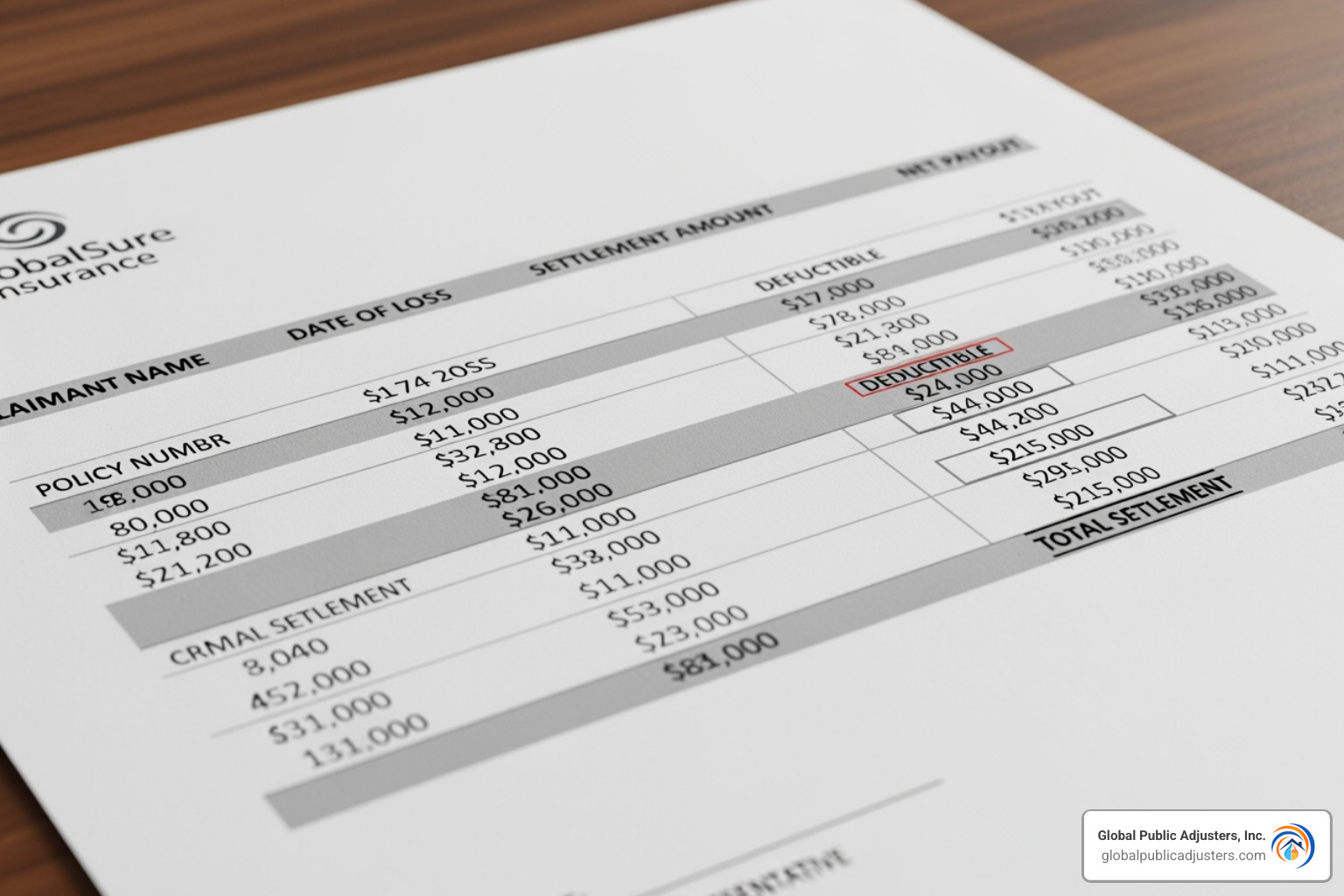

The Bottom Line: How a Residential Insurance Adjuster Determines Your Settlement

At the heart of every claim is the question: How much will I get? Aresidential insurance adjusterplays a pivotal role in answering this by assessing the loss and ensuring the insurer provides indemnity—reimbursement for repairs or replacement as outlined in your policy.

Several key factors influence their calculation:

- Replacement Cost Value (RCV) vs. Actual Cash Value (ACV): RCV is the cost to replace property with new, similar items. ACV is the replacement cost minus depreciation (for age and wear). Most policies pay ACV first, then the rest of the RCV after repairs are done.

- Depreciation: This is the reduction in value due to age and use, which an adjuster calculates to determine the ACV.

- Deductibles: The adjuster subtracts your deductible—the amount you pay out-of-pocket—from the total approved loss.

- Policy Limits: The settlement cannot exceed the maximum amounts specified in your policy for different coverage categories.

- Contractor Estimates: The adjuster’s settlement is based on repair estimates. If your contractor’s estimate is higher, you may have to cover the difference.

- Proof of Loss Form: You must submit this form detailing your losses. The adjuster uses it for their calculations, and the insurer typically has 60 days to pay after receiving it.

Understanding your insurance coverage needs before a loss occurs is paramount. We can help you determineHow to determine your insurance coverage needs.

Legal and Ethical Obligations

Residential insurance adjustersoperate under significant legal and ethical obligations to ensure fairness and transparency.

- Duty of Good Faith: Insurers and their adjusters must handle your claim fairly, promptly, and reasonably.

- Fair Dealing: Adjusters must ensure the settlement is equitable and aligns with the policy terms.

- Prompt Communication: They are obligated to keep you informed about your claim’s status and respond to you in a timely manner.

- Avoiding Conflicts of Interest: An adjuster must avoid any conflict of interest that could compromise their impartiality.

- Adherence to State Regulations: Adjusters are licensed and regulated by state bodies and must follow specific rules and codes of conduct.

- Consequences of Bad Faith: If an insurer acts in “bad faith” by unfairly handling a claim, they can face severe penalties, including punitive damages.

A Career in Claims: Becoming an Adjuster

Becoming aresidential insurance adjusteris a challenging but rewarding career involving investigation, negotiation, and problem-solving. Salaries vary by experience and location but average around $70,000 annually. The career path often progresses from entry-level roles requiring a high school diploma to specialist and managerial positions that may require a degree and extensive experience. The job outlook is stable, attracting people from diverse backgrounds like construction and contracting due to the need for strong analytical and communication skills. For more insights, take a look at the claims adjuster career path.

Becoming a Licensed Residential Insurance Adjuster

The path to becoming a licensed adjuster involves specific qualifications that vary by state.

- Licensing: Most states require independent and public adjusters to be licensed.

- Education: A high school diploma is often sufficient for entry-level roles, but a college degree can lead to advanced positions.

- Training: Most adjusters receive on-the-job training to learn claims investigation and settlement procedures.

- Continuing Education (CE): Licensed adjusters must complete regular CE credits to stay current and maintain their license.

- Designated Home State (DHS) License: Adjusters working in multiple states often get a DHS license. For example, the Florida 70-20 Non-Resident DHS Adjuster license is common for professionals working claims in Florida and other states with reciprocity, a frequent path for adjusters in our region.

It’s a career that demands diligence, empathy, and a keen eye for detail, making it a vital component of the insurance ecosystem.

Conclusion

Understanding the role of aresidential insurance adjusteris your first line of defense after property damage. We’ve covered the key differences between adjusters who work for the insurer (Staff and Independent) and those who work for you (Public Adjusters). We’ve also outlined the investigation process and how settlements are calculated based on your policy.

For homeowners, preparation, documentation, and knowing your rights are crucial for navigating challenges like underpayment or delays. If you disagree with a settlement, you have options, including hiring your own advocate.

The ultimate goal is a fair settlement to restore your home and peace of mind. For complex claims or when an insurer’s offer falls short, the expertise of a public adjusting firm is invaluable. Global Public Adjusters, Inc. brings over 50 years of experience representing homeowners in Orlando, FL, and throughout Florida. We are dedicated to maximizing your settlement and providing expert advocacy.

Empower yourself with knowledge, and when needed, partner with an expert who works for your best interests.