Public Adjuster For Home Insurance Claim: 7 Powerful Reasons

Why Understanding Your Options After Property Damage Can Save You Thousands

Apublic adjuster for home insurance claimis a licensed professional who works exclusively for you, not your insurance company, to maximize your settlement after property damage. Unlike company adjusters who work for insurers, public adjusters advocate solely for policyholders and typically charge 5-20% of your final settlement.

Quick Answer: When to Consider a Public Adjuster

- Large lossesover $10,000 in damage

- Complex claimsinvolving multiple damage types

- Denied or underpaidinitial settlements

- Catastrophic eventslike hurricanes or fires

- Time constraintswhen you can’t manage the claim yourself

- Disputed coveragewhere policy interpretation matters

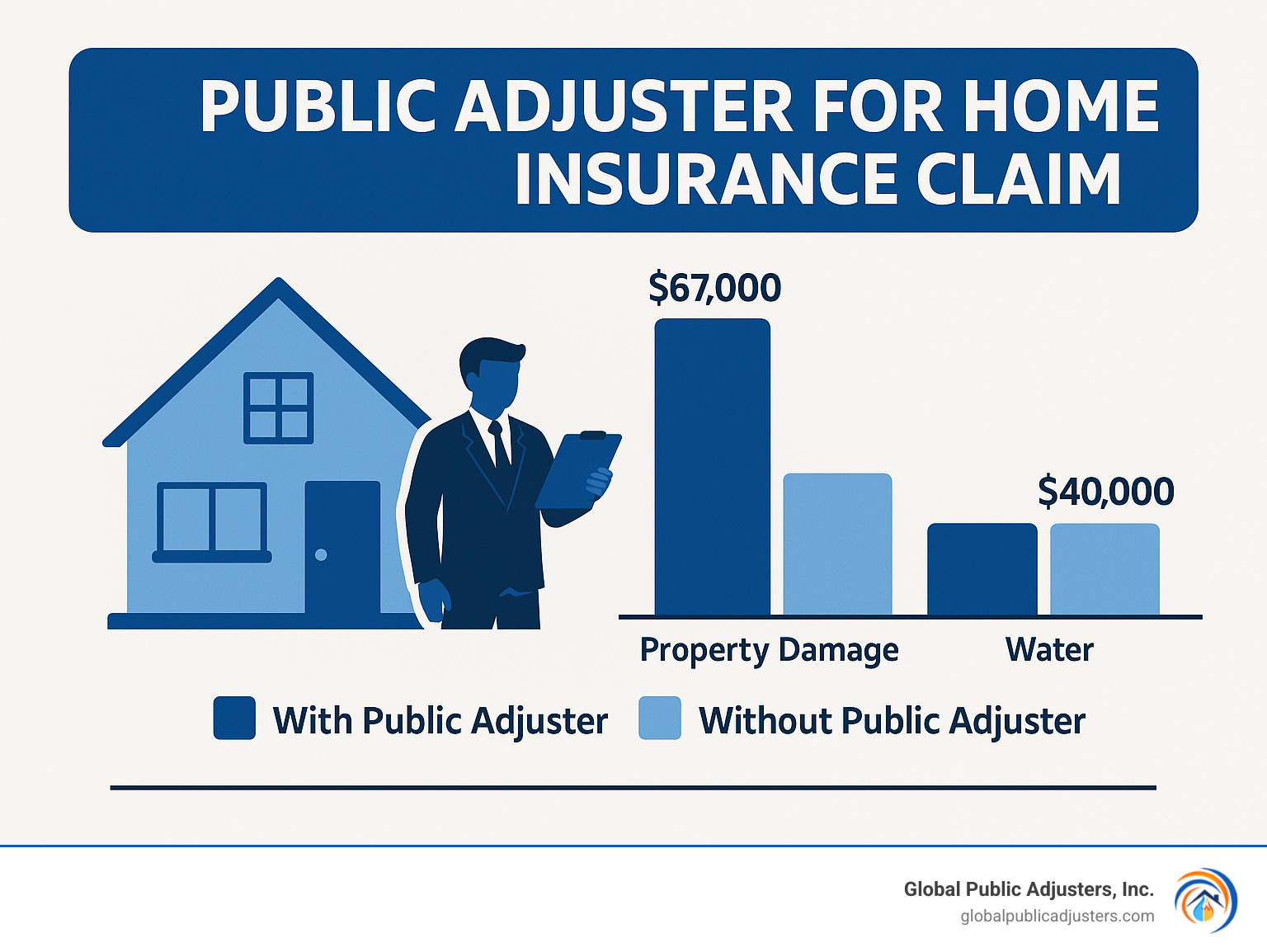

When disaster strikes your home, you face a critical choice that could impact your financial recovery by thousands of dollars. Research shows homeowners who hired public adjusters received average settlements of $22,266 compared to $18,659 for those who handled claims alone.

The insurance claims process can feel overwhelming after you’ve already dealt with property damage. You’re juggling emergency repairs, temporary housing, and trying to understand complex policy language – all while your insurance company’s adjuster works to minimize their payout.

Quickpublic adjuster for home insurance claimdefinitions:

Why This Guide Matters

We’ve seen countless homeowners struggle with insurance claims after disasters. The pain points are real: confusing policy language, overwhelming paperwork, and the nagging feeling that you’re not getting a fair settlement. With over 50 years of experience representing homeowners in Orlando, Pensacola, and throughout Florida, we understand these challenges intimately.

Peace of mind comes from knowing you have an expert advocate who speaks the insurance company’s language. The potential for higher settlements makes the difference between barely covering repairs and fully restoring your home to its pre-loss condition.

Adjuster Types: Who’s Really on Your Side?

When you file an insurance claim, you’ll quickly find that not all adjusters have your best interests at heart. Understanding who’s working for whom can mean the difference between a fair settlement and leaving money on the table.

Insurance company adjustersare full-time employees of your insurer. They receive salaries, benefits, and performance reviews from the same company that’s writing your settlement check. While they may be perfectly nice people, their job security depends on keeping claim costs manageable for their employer.

Independent adjustersmight sound more neutral, but don’t let the name fool you. These contractors get hired by insurance companies during busy periods – like after hurricanes sweep through Florida. Even though they’re not direct employees, they’re still paid by the insurance company and need to maintain good relationships to keep getting assignments.

Public adjusterswork exclusively for policyholders like you. We’re the only type of adjuster whose success depends entirely on maximizing your settlement. When apublic adjuster for home insurance claimnegotiations result in higher payouts, we do better too – creating a true partnership.

| Aspect | DIY Claim | Public Adjuster |

|---|---|---|

| Cost | No upfront fee | 5-20% of settlement |

| Time Investment | Significant | Minimal for homeowner |

| Expertise | Limited | Professional knowledge |

| Negotiation Power | Weak | Strong |

| Average Settlement | $18,659 | $22,266 |

| Stress Level | High | Low |

Company vs. Independent Adjusters

Both company and independent adjusters face the same fundamental conflict of interest. Whether they’re drawing a salary or working as contractors, their future depends on keeping insurance companies happy.

Company adjusters get evaluated on how well they control claim costs. Independent adjusters who approve too many large settlements might find themselves without work next hurricane season.

The Unique Role of a Public Adjuster

Apublic adjuster for home insurance claimrepresentation changes the entire dynamic. We bring specialized policy interpretation skills that level the playing field. After 50 years of experience in Florida, we’ve seen every tactic insurance companies use to minimize payouts.

Our expertise covers the technical aspects most homeowners struggle with. We know how to properly document hidden damage, interpret complex policy language, and prepare detailed estimates using the same professional software insurance companies use.

The difference is clear: we succeed only when you get the settlement you deserve. There’s no conflict of interest, no divided loyalty, and no pressure to settle for less than your policy provides.

More info about Why Should I Hire a Public Adjuster?

When to Hire a Public Adjuster for Home Insurance Claim

The numbers don’t lie – and they might surprise you. When Florida researchers studied insurance settlements after hurricanes, they found something remarkable: policyholders who hiredpublic adjusters for home insurance claimsreceived settlements that were747% higherfor reopened claims and574% higheroverall compared to those who went it alone.

Large lossesover $10,000 almost always benefit from professional expertise. At this level, the damage assessment becomes complex enough that small oversights can cost you thousands. The adjuster’s fee becomes a smart investment when it opens up significantly higher settlements.

When you’re dealing withcomplex damage– like a hurricane that brings both wind and water damage – you need someone who understands how to steer multiple policy coverages. Insurance companies love to point fingers at different causes to minimize what they pay.

Underpayment signsare often subtle but costly. Maybe the insurance company’s estimate seems reasonable at first glance, but they missed the water damage behind your walls or undervalued your home’s unique features.

Catastrophe eventscreate perfect storms of overwhelmed insurance companies, rushed inspections, and homeowners desperate for quick settlements. When disaster strikes your community, insurance companies often bring in temporary adjusters who don’t know local building codes or replacement costs.

Scientific research on settlement outcomesconsistently backs up what we see every day – professional representation pays for itself.

Should I Bring in a Public Adjuster Early?

Timing matters more than most homeowners realize. Bringing in apublic adjuster for home insurance claimearly in the process isn’t just helpful – it’s often the difference between a good outcome and a great one.

Proper documentationstarts from day one. We know exactly what photos to take, which receipts to save, and how to present evidence in ways insurance companies can’t ignore.

Avoiding pitfallsbecomes second nature when you’ve handled thousands of claims. We’ve seen homeowners accidentally void their coverage by saying the wrong thing to an adjuster, or accept settlements that barely cover half their actual damages.

Being present during the insurance company’s inspection gives us the chance to point out damage they might miss and ensure nothing gets mischaracterized in their report.

Can a Public Adjuster Help After a Denied Claim?

A denied claim isn’t the end of your story – it’s often just the beginning of getting what you deserve. Apublic adjuster for home insurance claimcan be your strongest ally in challenging an insurance company’s denial.

Remember those Florida statistics?Reopened claimshandled by public adjusters averaged 747% higher settlements. That’s because we know how to find coverage and damages that were initially missed, overlooked, or deliberately ignored.

Policy reinterpretationoften reveals coverage where insurance companies claimed none existed. They might deny your claim based on a narrow reading of policy language, but we can challenge those interpretations and present alternative readings that favor coverage.

More info about What to Do When Your Home Insurance Claim is Denied?

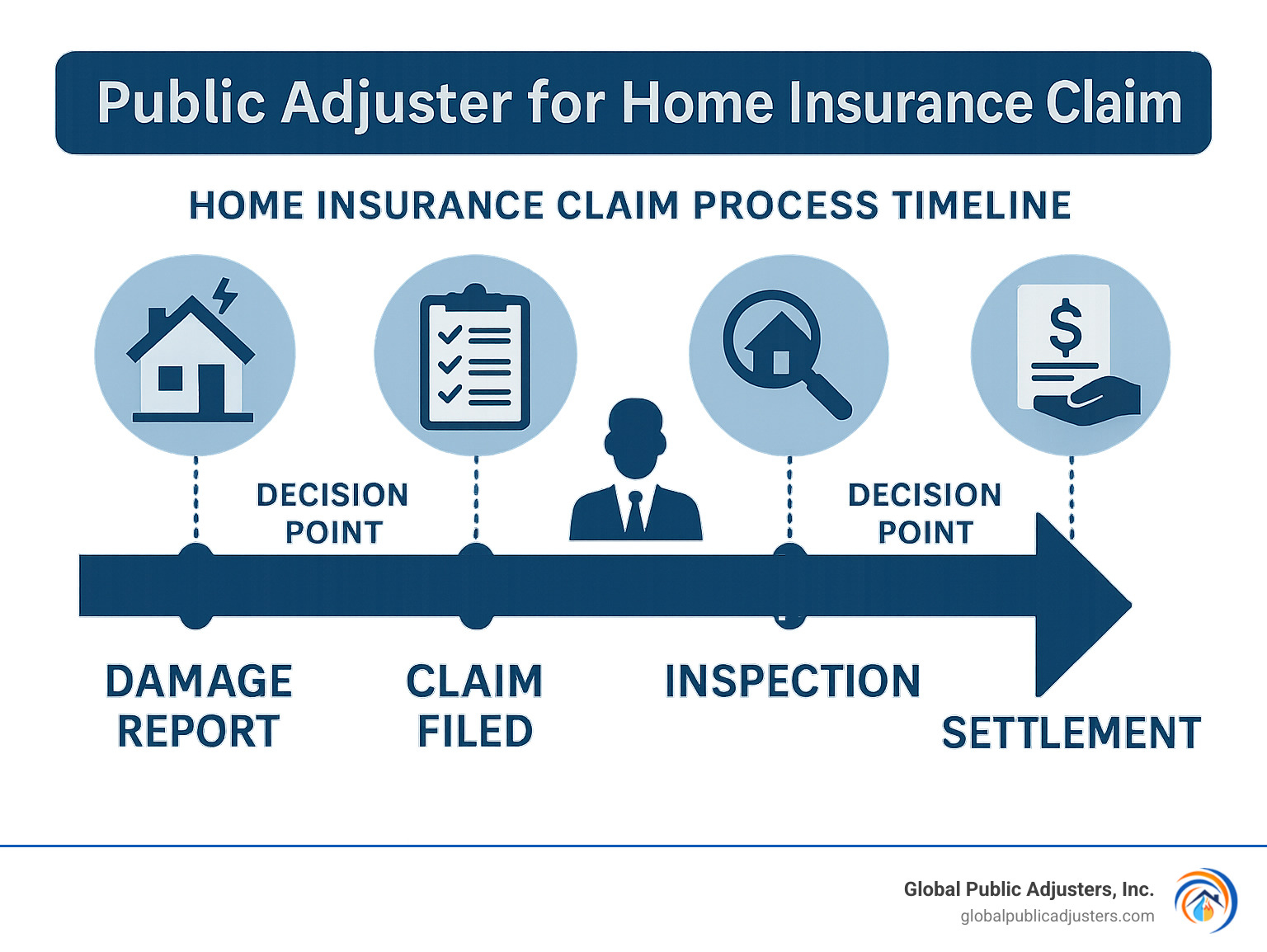

Step-By-Step: Working with a Public Adjuster

Think of hiring apublic adjuster for home insurance claimas bringing in a skilled advocate who knows exactly how to steer the insurance maze. The process is straightforward, and we handle the heavy lifting so you can focus on getting your life back to normal.

Everything starts with athorough inspectionof your property. We use advanced tools like thermal imaging cameras to spot hidden water damage, moisture meters to detect problems behind walls, and drone photography to safely assess roof damage. This comprehensive examination often reveals damage the insurance company’s adjuster missed.

Next comesdeveloping the complete damage scope. Every crack, stain, and broken item gets documented with detailed descriptions, precise measurements, and clear photographs.

Theestimate preparationphase is where our professional expertise really shines. Using industry-standard software like Xactimate (the same program insurance companies use), we create detailed repair estimates that include everything from materials and labor costs to additional living expenses.

All this information gets organized into acomprehensive claim packagethat presents your case in the strongest possible light. Then comes thenegotiation phase, where we handle all communications with your insurance company, presenting evidence, countering their arguments, and pushing for the settlement you deserve.

Finally, we reachsettlement– the moment when all our work pays off. We make sure the settlement terms are properly documented and help ensure payment is processed quickly.

The Onboarding Contract

Your contract with us sets the foundation for everything that follows. Mostpublic adjusters for home insurance claimswork oncontingency, which means we only get paid when you do. This aligns our interests perfectly with yours.

Thecancellation windowgives you breathing room. Many states require a 72-hour period after signing where you can change your mind without any penalty.

Your contract should clearly spell out thescope of workwe’ll provide. From that first inspection all the way through final settlement, you’ll know exactly what to expect from us.

More info about Questions to Ask Your Public Adjuster

Coordination With Contractors & Attorneys

One of the biggest advantages of working with us is that we become yourcommunication hub. Instead of juggling phone calls between contractors, attorneys, and insurance adjusters, you have one point of contact who keeps everyone aligned.

When it comes torepair bids, we work directly with contractors to ensure their estimates are comprehensive and properly formatted for insurance company review. If your claim requireslegal escalation, we work seamlessly with attorneys, providing all our documentation and expert testimony as needed.

Costs, Pros, Cons & State Rules

Let’s talk money – because that’s probably what you’re thinking about right now.Public adjuster for home insurance claimfees typically run between5-20% of your final settlement. Before you wince at that percentage, remember the research we mentioned earlier: homeowners who hired public adjusters received an average of $3,607 more than those who went it alone.

The exact fee depends on several factors.Larger claimsoften get lower percentage rates because the dollar amounts are bigger.State regulationsplay a big role too – some states put caps on what we can charge.

Texas caps public adjuster fees at 10%of the total settlement, which makes the decision easier for homeowners there.Florida allows higher feesbut requires specific disclosures to make sure you understand what you’re signing up for.

The timeline question comes up a lot. Will hiring a public adjusterspeed up or slow downyour claim? The honest answer is: it depends. Our expertise often speeds up the documentation phase because we know exactly what insurance companies need. But thorough negotiation takes time, and we won’t rush to accept a lowball offer just to close the file quickly.

Research consistently showshigher payoutswhen public adjusters are involved, so the wait often pays off financially.

TheNational Association of Public Insurance Adjusters directorycan help you locate licensed adjusters in your area, but make sure you do your homework before signing with anyone.

Pros & Cons Snapshot

On thepositive side, you’re looking athigher settlements– that average increase of $3,607 can more than cover our fees. You getstress reliefbecause we handle the complex paperwork and negotiations while you focus on getting your life back together.

Ourprofessional expertisemeans we understand policy language that might as well be written in ancient Greek to most homeowners. Thetime savingsalone can be worth it.

But there aredownsidesto consider. Thecostis real – that 5-20% comes out of your settlement.Potential delayscan happen when we’re being thorough with documentation and negotiation. There’s alsoscam riskfrom unscrupulous adjusters who prey on disaster victims, which is why vetting is so important.

And here’s something we always tell clients upfront: there’sno guaranteewe can work miracles. Even the best public adjuster can’t exceed your policy limits or create coverage that doesn’t exist.

State-Specific Regulations

Every state handles public adjuster regulation differently.Licensing requirementsexist everywhere, but some states are much stricter than others.Solicitation limitsprotect you from high-pressure tactics. Many states prohibit door-to-door solicitation immediately after disasters.

Bonding requirementsin most states mean we carry insurance that protects you financially if something goes wrong. At Global Public Adjusters, Inc., we maintain all required licenses and bonds across our service areas. With over 50 years of experience in Orlando, Pensacola, and throughout Florida, we understand both the regulations and the local insurance market dynamics that can affect your claim.

Finding and Vetting a Reputable Adjuster

Finding the rightpublic adjuster for home insurance claimcan make the difference between a smooth recovery and a frustrating experience. After working with thousands of homeowners over five decades, we’ve seen what separates great adjusters from the rest.

Start withtrusted referralsfrom people you know. Friends, family members, or neighbors who’ve used a public adjuster can give you honest feedback about their experience.

Professional associationsprovide another layer of credibility. The National Association of Public Insurance Adjusters (NAPIA) maintains standards for its members and requires ongoing education.

Every state maintainsonline license databaseswhere you can verify an adjuster’s credentials instantly. This simple step catches most unqualified practitioners, but don’t stop there. Look for any disciplinary actions or complaints that might reveal patterns of poor performance.

Watch out forred flagsthat signal trouble ahead. Door-to-door solicitation right after a disaster is illegal in many states and always unprofessional. Any adjuster who demands upfront payment, pressures you to sign immediately, or promises specific settlement amounts should be avoided.

Due-Diligence Checklist

Taking time for proper vetting protects you from costly mistakes.

- Verify licensing statusfirst – it takes just minutes online and eliminates obvious problems. Check not just current status but any past disciplinary actions.

- Call recent referencesand ask specific questions about communication, timeliness, and results. A good adjuster should readily provide three to five recent clients who are willing to share their experience.

- Better Business Bureau reportsoffer valuable insights, but read beyond the letter grade. Look at complaint details and how the adjuster responded to problems.

- Confirm professional insurancecoverage, including errors and omissions policies that protect you if the adjuster makes mistakes. Most states require bonding as well, which provides additional financial protection.

More info about How to Work with a Public Adjuster in Miami, Florida

Key Contract Clauses to Review

Your contract sets the foundation for everything that follows, so read it carefully before signing.

- Thefee percentageshould be clearly stated and reasonable for your claim size. In states with fee caps, make sure the percentage complies with local law.

- Services includedshould be spelled out in detail. Will the adjuster handle just the initial claim, or will they stick with you through appeals and potential legal action?

- Timeframe commitmentshelp ensure your claim moves forward promptly. While every claim is different, the adjuster should provide reasonable estimates for key milestones.

- Termination rightsprotect both parties if the relationship isn’t working. Most states require a 72-hour cancellation period after signing, but understand the terms for later termination as well.

A good public adjuster wants you to understand the contract completely. If someone rushes you through the signing process or discourages questions, that’s not the professional you want handling your claim.

Frequently Asked Questions about Public Adjusters

How does a public adjuster get paid?

Mostpublic adjuster for home insurance claimprofessionals work on a contingency fee basis, which means we only get paid when you do. It’s that simple – no settlement, no fee. This arrangement aligns our interests perfectly with yours because we’re motivated to get you the best possible outcome.

The fee is calculated as a percentage of your total settlement amount, typically ranging from 5-20% depending on your state’s regulations and the complexity of your claim.

Contingency feesare by far the most common arrangement. For most homeowners dealing with property damage, contingency makes the most sense because there’s no upfront cost when you’re already dealing with unexpected expenses.

Let’s say we help you secure a $100,000 settlement with a 10% fee structure. You receive $90,000, and we receive $10,000. In states like Texas, where fees are capped at 10%, you know exactly what to expect.

The beauty of this system is that we have every incentive to maximize your settlement. The more you receive, the more we earn. It’s a partnership that works.

Will hiring a public adjuster speed up or slow down my claim?

This is probably the most honest answer you’ll get: it depends on what you value more – speed or money in your pocket.

Ourprocess expertiseoften speeds up the early stages significantly. We know exactly what documentation insurance companies require, how they want it formatted, and what evidence carries the most weight. This prevents the back-and-forth delays that happen when claims are submitted with missing or inadequate information.

However, thenegotiation phasemight take longer because we don’t accept lowball offers. If the insurance company’s first offer is $15,000 but we believe your damage justifies $25,000, we’re going to fight for that extra $10,000. That takes time, but it also puts money in your pocket.

Documentation efficiencyis where we really shine. While you might spend weeks figuring out what photos to take or which forms to fill out, we handle this professionally and quickly.

The question becomes: would you rather have a fast settlement that leaves money on the table, or invest a bit more time to get every dollar you deserve? Most of our clients choose the latter, especially when they see the difference in settlement amounts.

What should I do if I’m unhappy with my public adjuster’s performance?

Start with a conversation.Many problems stem from mismatched expectations or communication gaps. Call your adjuster directly and explain your concerns. Most professional adjusters want to fix problems before they escalate.

Document everythingif the conversation doesn’t resolve your concerns. Send an email outlining specific issues and requesting a timeline for improvement.

Review your contractfor termination clauses. Most agreements allow you to fire your adjuster, though you may owe fees for work already completed.

State complaint optionsexist for serious issues. If you believe yourpublic adjuster for home insurance claimviolated regulations or professional standards, your state’s insurance department can investigate.

You hired an adjuster to reduce stress, not create more of it. If the relationship isn’t working, don’t hesitate to make a change.

Conclusion

When your home suffers damage, the choice between going it alone or hiring apublic adjuster for home insurance claimcan literally make the difference between struggling to rebuild and fully restoring your life.

The numbers don’t lie. Homeowners who work with public adjusters see average settlement increases of $3,607, with some cases showing recoveries that are574% higherthan those who handle claims themselves. These aren’t just statistics – they represent real families who were able to properly repair their homes instead of cutting corners due to inadequate settlements.

But this isn’t just about money. It’s abouthomeowner empowermentduring one of the most stressful times in your life. When you’re already dealing with the emotional toll of property damage, the last thing you need is the added burden of fighting an insurance company that speaks a language you don’t understand.

At Global Public Adjusters, Inc., we’ve spent over 50 years watching homeowners throughout Florida face these exact challenges. Whether it’s hurricane damage in Orlando, fire damage in Pensacola, or any other covered loss, we’ve seen how the right advocacy can transform a disaster recovery from a nightmare into a manageable process.

Settlement maximizationmeans having the resources to rebuild properly – not just patch things up and hope for the best. It means getting back to your normal life faster, with less stress and better results.

The insurance industry is built on a simple principle: collect premiums and minimize payouts. That’s not inherently evil – it’s just business. But when disaster strikes your home, you need someone who understands that business and can speak their language while fighting exclusively for your interests.

Disaster recoveryshouldn’t be something you have to figure out on your own while dealing with everything else a major loss brings. Having an experienced advocate in your corner levels the playing field and ensures you get the full compensation your policy promises.

More info about What Can a Public Adjuster Do For Me?

When you’re ready to explore your options – whether that’s before filing a claim or after receiving a settlement that doesn’t feel right – we’re here to help. Because at the end of the day, our job isn’t just about maximizing settlements. It’s about helping families get back on their feet with the resources they need to rebuild stronger than before.