What year do you claim casualty theft losses? 3 Key Mistakes

When Timing Your Tax Deductions Can Save You Thousands

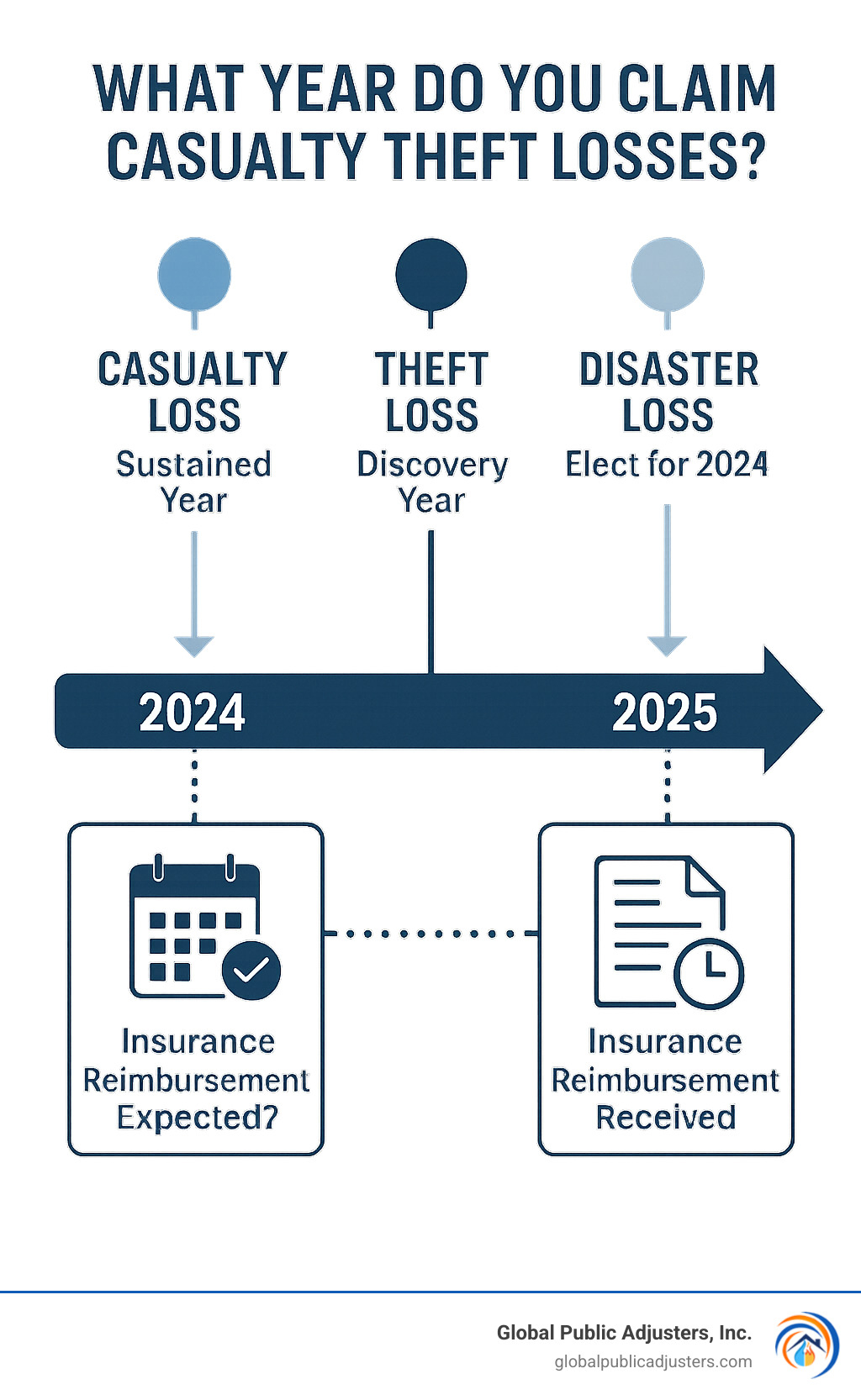

What year do you claim casualty theft lossesdepends on when the loss is “sustained” under IRS rules, not necessarily when the damage occurred. Here’s the quick answer:

Casualty Losses:Claim in the year you sustain the loss (when you know with reasonable certainty whether you’ll receive reimbursement)

Theft Losses:Claim in the year you find the theft (sometimes called the “findy” or “findy” rule in IRS commentary)

Disaster Losses:Can elect to claim in the preceding tax year for faster refunds

Reimbursement Delays:If insurance pays later, you may need to amend your return

Getting the timing wrong can cost you thousands in missed deductions or delayed refunds. The IRS has specific rules about when a loss is “sustained” versus when it actually happened.

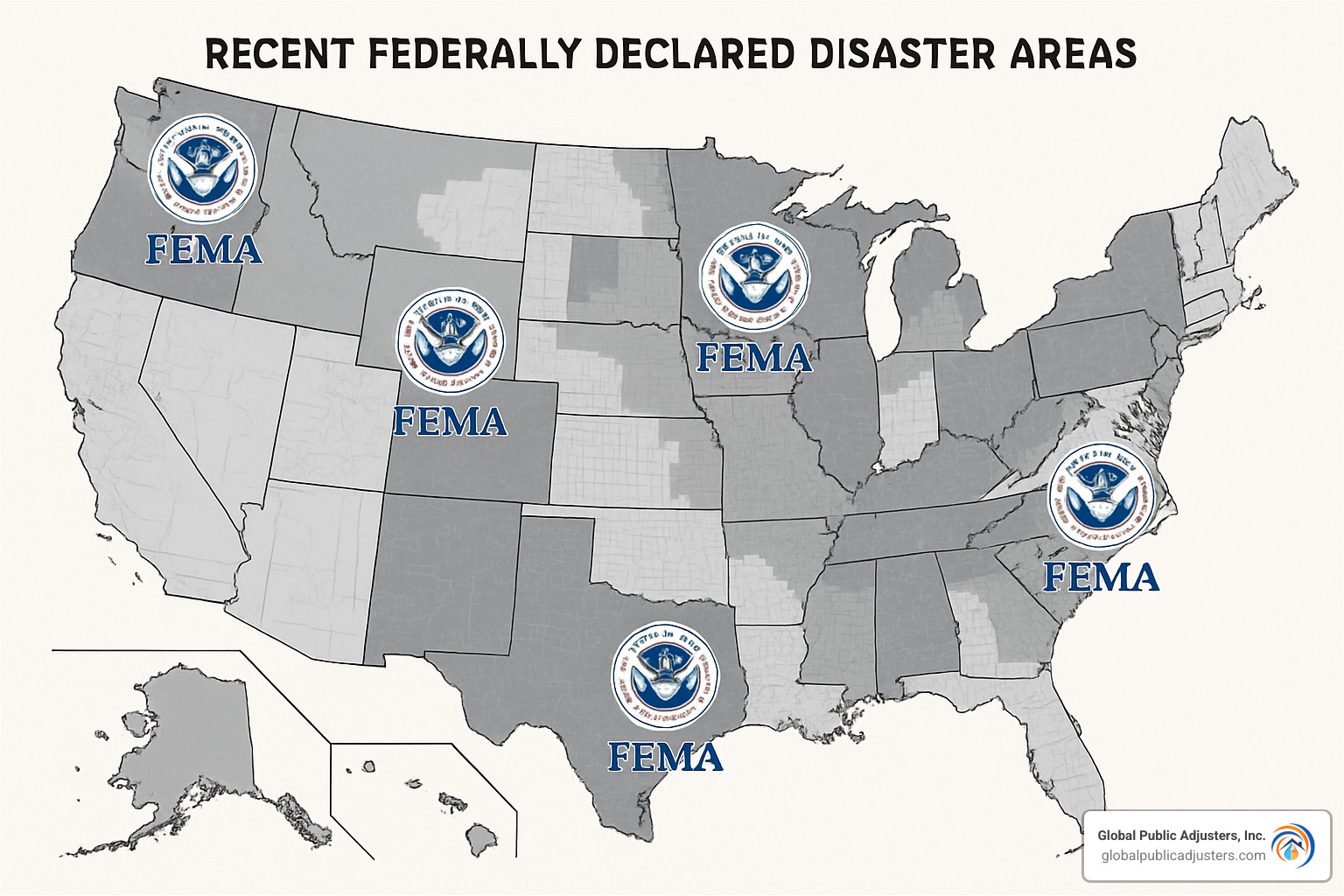

For homeowners dealing with storm damage, fire, or theft, understanding these timing rules is crucial.You might be able to claim your 2024 hurricane damage on your 2023 returnif it qualifies as a federally declared disaster.

The stakes are high. With personal casualty losses only deductible for federally declared disasters from 2018-2025, and theft losses following the findy rule, one wrong move can eliminate your deduction entirely.

What Year Do You Claim Casualty Theft Losses?

The answer towhat year do you claim casualty theft lossesisn’t as simple as “the year it happened.” The IRS uses a “year sustained” test that depends on when you know with reasonable certainty whether you’ll receive reimbursement.

Here’s what makes this complicated: a storm might damage your home in December 2023, but if your insurance company doesn’t deny part of your claim until March 2024, you’d claim the unreimbursed portion as a 2024 loss, not 2023.

This timing rule applies differently to casualty losses versus theft losses, and there are special elections available for federally declared disasters that can accelerate your refund.

Year to Claim a Casualty Loss: General Rule

For casualty losses, you claim the deduction in the year the loss is “sustained.” This is typically when:

- The casualty event occurs AND

- You know with reasonable certainty whether you’ll receive reimbursement

The key phrase is “reasonable prospect of recovery.” If you have insurance coverage and file a timely claim, you must wait until the insurance company responds before claiming any deduction.

Example:Your roof gets damaged by a hurricane in October 2024. You file an insurance claim immediately. In January 2025, your insurer pays $15,000 but denies coverage for $5,000 of the damage. You’d claim the $5,000 unreimbursed loss on your 2025 tax return, not 2024.

Year to Claim a Theft Loss: Findy (“Findy”) Rule

Theft losses follow the “findy” rule—you claim the deduction in the year you find the property was stolen, not necessarily when the theft occurred.

The findy year is when you:

- Become aware the property is missing

- Determine it was stolen (not just misplaced)

- Have no reasonable prospect of recovery

Important:Simply misplacing an item doesn’t qualify for a theft loss deduction. The IRS requires proof of criminal intent—typically a police report helps establish this.

Example:You find in March 2024 that valuable jewelry was stolen from your home sometime during 2023. You file a police report and determine there’s no reasonable prospect of recovery. You’d claim the theft loss on your 2024 return, the year of findy.

For theft losses, the amount you can deduct generally equals the property’s adjusted basis (what you paid for it, plus improvements, minus depreciation) because the fair market value after theft is considered zero.

What Year Do You Claim Casualty Theft Losses for Federally Declared Disasters?

Here’s where it gets interesting—and potentially very beneficial. For losses from federally declared disasters, you can elect to claim the deduction in the tax year immediately preceding the disaster year under Section 165(i) of the Internal Revenue Code.

This election can provide faster refunds by amending your prior-year return instead of waiting until you file your current-year return.

| Current Year Claim | Prior Year Election |

|---|---|

| Wait until filing 2024 return | Amend 2023 return immediately |

| Refund in 2025 | Refund in 2024 |

| Use 2024 income for 10% AGI test | Use 2023 income for 10% AGI test |

| Standard timing | Accelerated refund |

Example:Hurricane damage occurs in September 2024 in a federally declared disaster area. You can elect to claim this loss on your 2023 return (by filing Form 1040-X) instead of waiting to file your 2024 return. This gets you the refund about a year earlier.

What Year Do You Claim Casualty Theft Losses if Reimbursement Arrives Later?

When insurance or other reimbursement arrives in a different year than when you claimed the loss, you may need to make adjustments.

Scenario 1:You claim a $10,000 casualty loss in 2024, then receive $3,000 insurance reimbursement in 2025. You must report the $3,000 as income in 2025 (but only to the extent the original deduction provided a tax benefit).

Scenario 2:You don’t claim a loss in 2024 because you expect full reimbursement, but in 2025 the insurer only pays $7,000 of your $10,000 loss. You’d claim the $3,000 unreimbursed portion on your 2025 return.

Scenario 3:You claimed a loss in 2024 but receive additional unexpected reimbursement in 2026. You’d need to file Form 1040-X to amend your 2024 return or report the recovery as income in 2026.

The key is that the “sustained year” can shift based on when reimbursement certainty is established.

How Reasonable Prospect of Recovery Changes Everything

The concept of “reasonable prospect of recovery” is crucial for understandingwhat year do you claim casualty theft losses. This rule requires you to reduce your loss by any amount you reasonably expect to recover from insurance, salvage sales, or other sources.

According toIRS Publication 547, you must subtract from your loss:

- Insurance reimbursements received or expected

- Salvage value of damaged property

- Any other compensation or recovery

This creates a timing issue: you can’t claim a deduction until you know what you won’t recover.

The $100 and 10% AGI Rules:

After determining your unreimbursed loss, you must subtract $100 per casualty or theft event. Then, your total losses must exceed 10% of your adjusted gross income to be deductible (unless it’s a qualified disaster loss, which uses a $500 floor and no 10% AGI limit).

Casualty Gains:

Sometimes insurance pays more than your basis in the property. This creates a casualty gain, which may be taxable. However, you can often offset casualty gains against casualty losses from the same year.

Timing When You Receive Reimbursement in a Later Year

The IRS has specific rules for handling reimbursements received after you’ve claimed a loss deduction:

Tax Benefit Rule:You only report recovered amounts as income to the extent the original deduction provided a tax benefit. If you didn’t itemize deductions in the year you claimed the loss, recovery might not be taxable.

Adjustment to Basis:Any reimbursement reduces your basis in the property, which affects future gain or loss calculations if you sell the property.

Multiple Year Situations:For losses spanning multiple years (like ongoing litigation), you claim the deduction in the year you establish that recovery is not reasonably expected.

What If You Never File an Insurance Claim?

Here’s a critical point: if you have insurance coverage but fail to file a timely claim, the IRS may deny your casualty loss deduction entirely. The reasoning is that you had a reasonable prospect of recovery but chose not to pursue it.

This is where working with experienced professionals becomes crucial. As we often see in our practice, homeowners sometimes avoid filing claims due to fear of rate increases or claim denials. However, failing to file can eliminate your tax deduction entirely.

For more information about common claim issues, see our guide onReasons Why Your Property Insurance Claim Can Be Denied.

Special Situations: Disaster Elections, Ponzi Schemes & Business Property

Several special situations have their own timing rules forwhat year do you claim casualty theft losses:

Qualified Disaster Losses:For federally declared disasters, qualified disaster losses get special treatment:

- $500 floor per event (instead of $100)

- No 10% AGI limitation

- Can be claimed without itemizing other deductions

- Eligible for prior-year election

Ponzi-Type Investment Schemes:These follow special rules under Revenue Procedure 2009-20, with the deduction claimed in the findy year using either a 95% or 75% factor depending on potential third-party recovery.

Business Property:Different rules apply entirely—no $100 floor, no 10% AGI limitation, and losses are claimed as ordinary business deductions.

For more information about specific theft situations, see our resource ontheft & vandalism damage.

Disaster Loss Election Step-by-Step

To elect to claim a disaster loss in the preceding tax year:

- Verify Eligibility:Confirm your loss is from a federally declared disaster with a FEMA declaration number

- Complete Form 4684 Section D:Fill out the election section with disaster details

- File Form 1040-X:Attach Form 4684 to an amended return for the preceding year

- Meet Deadline:Election must be made by 6 months after the extended due date of the return for the disaster year

- Include Required Information:Disaster name, declaration date, and property location

Example:For a 2024 disaster loss, you have until October 15, 2025 to make the election on your 2023 return.

Ponzi-Scheme Theft Loss Timing

Ponzi-scheme losses have special timing rules:

- Deduction claimed in the findy year only

- Use 95% factor if no reasonable prospect of third-party recovery

- Use 75% factor if potential third-party recovery exists

- Must meet specific requirements under Revenue Procedure 2009-20

Business & Income-Producing Property Rules

Business property losses follow different timing rules:

- No $100 per-event reduction

- No 10% AGI limitation

- Claimed as ordinary business deductions

- Reported on Form 4797 instead of Schedule A

- May create net operating losses

Step-by-Step: Reporting Your Loss on Form 4684 & Schedule A

Once you’ve determined the correct year to claim your loss, here’s how to report it:

Form 4684 Sections:

- Section A: Personal-use property

- Section B: Business and income-producing property

- Section C: Ponzi-scheme losses

- Section D: Disaster loss election

Schedule A Line 15:Transfer personal casualty losses from Form 4684

Itemizing vs. Standard Deduction:You must itemize to claim most casualty losses, unless it’s a qualified disaster loss

Safe-Harbor Valuation Methods:The IRS provides simplified methods for valuing losses under Revenue Procedure 2018-08:

- De minimis method (up to $5,000)

- Estimated repair cost method (up to $20,000)

- Insurance appraisal method

- Contractor safe harbor method

For detailed guidance, seeUsing Form 4684 to report casualty and theft losses.

Documentation You’ll Need

Essential Records:

- Photos of property before and after the loss

- Appraisals or estimates of fair market value

- Police reports (for theft losses)

- FEMA declaration numbers (for disaster losses)

- Insurance correspondence and payments

- Receipts for property improvements

- Repair estimates and invoices

IRS Publication 584 Workbook:Use this to organize your records and calculations

Proof of Loss Requirements:

- Ownership documentation

- Evidence of the casualty or theft event

- Timing of findy or occurrence

- Amount of loss and basis in property

Avoiding Common Filing Errors

Common Mistakes:

- Missing FEMA declaration numbers for disaster losses

- Forgetting to apply the $100/$500 floor reduction

- Filing the election in the wrong year

- Claiming losses not attributable to federally declared disasters (2018-2025)

- Failing to reduce loss by expected insurance reimbursement

Professional Help:Complex casualty and theft losses often benefit from professional assistance. If your insurance claim has been denied, see our guide onWhat to Do When Your Home Insurance Claim is Denied.

Frequently Asked Questions about Claiming the Correct Year

Can I claim a casualty loss from 2024’s hurricane on my 2023 return?

Yes, if the hurricane was in a federally declared disaster area. You can elect under Section 165(i) to claim the loss on your 2023 return by filing Form 1040-X with Form 4684 Section D completed. This election must be made by October 15, 2025 (6 months after the extended due date for 2024 returns). This can provide a much faster refund than waiting to file your 2024 return.

Do the 2018–2025 TCJA limits mean theft losses are never deductible?

Not exactly. Personal casualty and theft losses are only deductible if attributable to federally declared disasters during 2018-2025. However, theft losses from transactions entered into for profit (like business inventory or investment property) remain deductible. Additionally, theft losses can offset casualty gains in the same year.

What happens if my insurer finally pays me after I already took the deduction?

You’ll need to report the recovery as income in the year received, but only to the extent the original deduction provided a tax benefit. If the recovery is in a later year, you report it as “other income” on your tax return. If it’s substantial, you might want to amend the original return instead, depending on which approach provides better tax treatment.

Conclusion

Understandingwhat year do you claim casualty theft lossescan mean the difference between getting the tax relief you deserve and missing out on valuable deductions. The timing rules are complex, but they’re designed to ensure you can’t double-dip on recoveries while still providing relief for genuine losses.

Remember the key principles:

- Casualty losses are claimed when sustained (when reimbursement certainty is established)

- Theft losses are claimed in the findy year

- Disaster losses can be elected to the prior year for faster refunds

- Always file insurance claims to preserve your deduction eligibility

At Global Public Adjusters, Inc., we’ve spent over 50 years helping homeowners and business owners steer both insurance claims and their tax implications. Our expertise in maximizing insurance settlements directly impacts your ability to claim proper tax deductions.

When you’re dealing with property damage, theft, or disaster losses, having experienced advocates on your side makes all the difference. We understand how insurance claim timing affects your tax deductions and can help ensure you don’t miss critical deadlines or opportunities.

For more information about how professional advocacy can help maximize your claim and preserve your tax benefits, see our guide onReasons to Hire a Public Adjuster for Property Damage.

Don’t let complex timing rules cost you thousands in missed deductions. Whether you’re dealing with hurricane damage, fire loss, or theft, getting both your insurance claim and tax timing right is crucial for your financial recovery.