Property Damage Claims Lawyer Miami: Win in 2025!

When Property Damage Strikes Miami: Why Expert Legal Help Matters

When disaster strikes your Miami property, the rightproperty damage claims lawyer miamican be the difference between a fair settlement and financial ruin. Miami’s unique environment—from hurricanes and flooding to mold and fire—presents constant threats to property owners.

An experienced attorney handles these complex claims by reviewing your policy, documenting damage with experts, negotiating with insurers, and filing lawsuits when necessary. You should seek legal help if your claim is denied, underpaid, or delayed, or if the insurance company requests an Examination Under Oath (EUO).

Living in Miami means facing aperfect stormof challenges that insurance companies are prepared to fight. As one attorney noted,“Many homeowners only find out after a serious incident that they are not as protected as they thought.”This is a harsh reality for residents who find their insurer has a different idea of fair compensation.

Statistics show that property owners with legal representation recover significantly more from insurance companies. With billions recovered for Florida victims, professional help is essential to protect your largest investment. You shouldn’t have to fight the insurance company alone.

Property damage claims lawyer miamiword roundup:

Understanding Property Damage in Miami: When Do You Need a Lawyer?

When your Miami property is harmed, understanding your situation is the first step.Property damagecovers harm to your tangible assets, whether it’sreal property(your home, land) orpersonal property(furniture, electronics). While filing a claim seems straightforward, insurance policies are complex documents filled with exclusions and conditions. Many homeowners find they aren’t as protected as they believed, which is precisely when aproperty damage claims lawyer miamibecomes essential.

Why Miami’s Environment Creates Unique Property Challenges

Living in Miami means facing property risks that are unique to our subtropical, coastal location. These challenges often lead to claim denials and disputes with insurers.

- Hurricanes and Storms:The six-month hurricane season brings wind and rain, but the aftermath is often worse. Even minor water intrusion in ourconstant humiditycreates ideal conditions formold growth, a costly problem insurers often dispute.

- Coastal Risks:Saltwater corrosionconstantly attacks outdoor structures and plumbing. Frequent heavy rainfall exposes weaknesses in roofs and drainage systems, leading to water damage.

- Aging Infrastructure:Many older Miami homes rely oncast iron pipesprone to corrosion and collapse. When they fail, the resulting water damage can be significant, and insurance coverage for replacement often requires expert legal interpretation.

These factors lead to frequentinsurance disputesover denied or underpaid claims. When facing these issues, a knowledgeable advocate is crucial. If your claim was denied, our guide onWhat To Do When Your Home Insurance Claim Is Deniedcan help. For general tips, seeNavigating Property Damage Claims Tips For A Smoother Process.

Red Flags: Signs You Need a Property Damage Claims Lawyer in Miami

While public adjusters can manage much of the claims process, certain red flags signal it’s time for legal counsel. Hiring aproperty damage claims lawyer miamiis your best move when you see these signs:

- Claim Denial:The most obvious sign. A lawyer can challenge the denial and fight for your rights.

- Lowball Offers:If the settlement offer won’t cover your repairs, an attorney can negotiate for fair compensation.

- Delayed Responses:Insurers must adhere to legal timelines. A lawyer can enforce these deadlines and combat bad faith tactics.

- Complex Policy Language:An attorney can interpret confusing insurance jargon to clarify your coverage.

- Blaming Pre-existing Damage:Insurers may try to avoid paying by blaming old issues. A lawyer can use expert evidence to prove the damage is new and covered.

- Pressure to Sign:Never sign a release of claims without consulting a lawyer first.

- Examination Under Oath (EUO) Request:This is a major red flag. An EUO is a formal proceeding where the insurer’s lawyer questions you under oath, often to find reasons to deny your claim. You should never attend an EUO without your own legal representation.

Common Claims Handled by a Miami Property Damage Attorney

A skilledproperty damage claims lawyer miamihandles a wide range of issues, from minor leaks to catastrophic storm damage. They understand how to present each unique case to insurance companies to get results for bothresidential claimsandcommercial claims.

For businesses,business interruptioncoverage is crucial when property damage halts operations, and these claims require specialized knowledge to maximize recovery. Here are some of the most common claims an attorney handles:

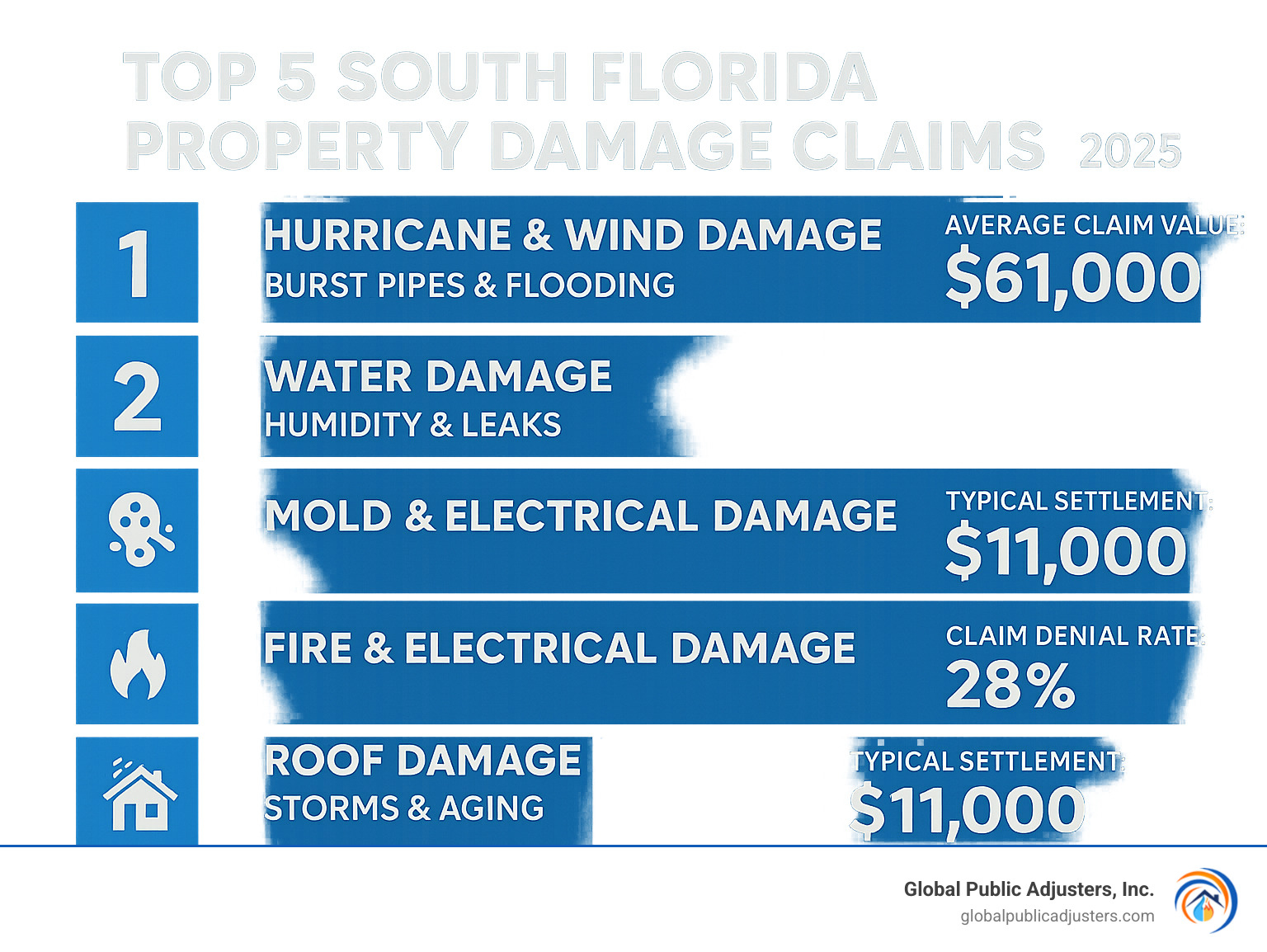

- Weather-Related Damage:This dominates the Miami landscape. Claims includeHurricane and wind damage,flood and water damagefrom rainfall, andstorm surge. Even smaller events causeroof leaksandhail damage.

- System & Appliance Failures:Miami’s aging infrastructure leads to many claims. These includeburst pipes,plumbing and AC leaks, andfire and smoke damagefrom electrical faults. A major concern iscast iron pipe failure, which can cause catastrophic water damage with little warning.

- External & Environmental Threats:Claims can also arise fromvandalism,theft,fallen trees, andstructural collapse. Miami’s humid climate makesmold damagea frequent and expensive issue, turning small leaks into major health hazards.Sinkhole damageandconstruction defectsalso lead to complex and challenging claims.

Each type of damage presents unique insurance challenges. Water damage from a burst pipe might be covered, while damage from a storm surge may be excluded. This is where professional expertise becomes invaluable, leveling the playing field against insurance companies that use policy details to minimize payouts.

The Claims Process Playbook: How Experts Win Against Insurance Companies

Dealing with insurance companies can feel like an unfair fight. A skilledproperty damage claims lawyer miamilevels the playing field with a proven strategic playbook.

1. Policy Review:It starts with a deep dive into your insurance policy. A lawyer deciphers the fine print to find all available coverage and identify potential roadblocks.

2. Damage Assessment and Evidence Collection:Instead of relying on the insurer’s adjuster, lawyers bring inindependent experts—contractors, engineers, and other specialists—to conduct a thorough damage assessment. This is crucial for building an ironclad case. They guide you in collecting powerfulphoto and video evidenceand detailedrepair estimates. This information is compiled into a comprehensivescope of lossdocument, which becomes the roadmap for your claim.

3. Negotiation and Litigation:Armed with solid evidence, your lawyer negotiates with the insurer. They know the tactics companies use to lowball claimants and have counter-strategies. If negotiations stall, thelitigation threatis a powerful tool. A lawyer willing to file a lawsuit shows you are serious about getting fair compensation. The goal is alwaysmaximizing settlements, and studies show that legal representation leads to significantly better financial outcomes.

While public adjusters are key for assessing damage and initial negotiations, a lawyer provides the legal firepower when things get tough. Learn more about why professional help matters with these7 Reasons To Hire A Public Adjuster When Facing Property Damage Claims.

Fighting Back: What Constitutes Insurance Bad Faith in Florida?

Sometimes, an insurer’s conduct crosses the line into illegality. Florida has strong protections against insurancebad faithpractices. These include:

- Unreasonable delaysin handling your claim.

- Failure to conduct a thorough investigation.

- Misrepresenting policy termsto deny a valid claim.

- Making lowball offersthat bear no reasonable relation to your actual damages.

UnderFlorida’s Bad Faith Statute, you havelegal recourse. You can sue for your original claim amount plusadditional damages, such as attorney’s fees and interest. Aproperty damage claims lawyer miamiknows how to identify bad faith and use the law to fight back effectively.

Navigating the Legal Process with a Property Damage Claims Lawyer Miami

Working with aproperty damage claims lawyer miamiis a straightforward process designed to take the burden off you.

It typically begins with afree consultationto assess your case. If you proceed, you’ll likely work on acontingency fee agreement, meaning you pay no upfront costs. The attorney only gets paid if they recover money for you.

Your lawyer then takes over, handling the case investigation, document gathering, and all communication with the insurance company. If a fair settlement cannot be negotiated, they are prepared tofile a lawsuit. The case may then proceed through findy, mediation, and further settlement talks. Should it be necessary, your lawyer will represent you attrialto fight for the compensation you deserve.

Key Florida Laws You Need to Know

Understanding a few key laws is vital. Thestatute of limitationsis the most critical deadline: for incidents after March 24, 2023, you have justtwo yearsfrom the date of loss to file a lawsuit. Missing this deadline can mean losing your right to compensation.

Florida’sHomeowner Claims Bill of Rightsalso provides important protections, setting specific timelines for insurers. PerFlorida Statute §627.7142, they must acknowledge your claim within 14 days, begin investigating within 30 days of receiving your proof of loss, and make a payment decision within 90 days. You can find more information onFlorida’s property insurance laws.

The Cost of Hiring a Property Damage Attorney

Many worry about legal costs, but thecontingency fee modelmakes professional help accessible. With this“no win, no fee”approach, there areno upfront costs. The attorney’s fee is a percentage of the money they recover for you.

While a portion goes to the attorney, their expertise typically results in a much higher settlement than you could achieve alone, often more than covering the legal fee. It’s an investment in your financial recovery. For more on the value of professional help, seeWhy Should I Hire A Public Adjuster.

Frequently Asked Questions about Miami Property Damage Claims

When facing property damage, it’s normal to have questions. Here are answers to some of the most common ones we hear from Miami property owners.

What’s the difference between a public adjuster and a property damage lawyer?

Understanding this distinction is key.Public adjusters(like us at Global Public Adjusters) are your insurance claim advocates. We are licensed professionals who work for you, not the insurer. Our role is to assess damage, interpret your policy, and negotiate with the insurance company to get you the best possible settlement.

Aproperty damage claims lawyer miamiis your legal advocate. Their power is most critical when a claim is denied, severely underpaid, or the insurer acts in bad faith. Lawyers can file lawsuits and represent you in court, which provides powerful leverage against an uncooperative insurance company.

Often,we work together. A public adjuster can build a detailed claim, and if the insurer refuses to be fair, a lawyer can take that well-documented case to court. It’s a powerful tag-team approach.

How long do I have to file a property damage claim in Florida?

This is a critical deadline. Thestatute of limitationsfor property damage claims in Florida istwo yearsfor incidents occurring after March 24, 2023. This clock starts on the date the damage happened.

While you have two years, it is crucial toact quickly. Delays can weaken your case, as evidence may disappear and insurers might argue you contributed to further damage by waiting. Procrastination is one of theReasons Why Your Property Insurance Claim Can Be Denied, so the sooner you start the process, the stronger your position will be.

Can I seek compensation for emotional distress over a property damage claim?

This is a common question, as fighting an insurer is incredibly stressful. However, most property damage claims are limited tofinancial losses—the cost to repair or replace your property. Compensation for emotional distress is not typically included.

The majorexception is in cases of insurance bad faith. If you can prove an insurer’s conduct was not just difficult but deliberately malicious or outrageous, causing you severe mental anguish, you may be able to sue for emotional distress damages. The standard of proof is very high. Aproperty damage claims lawyer miamican evaluate your situation to determine if such a claim is viable under Florida law.

Conclusion: Taking the First Step to Reclaim Your Property and Peace of Mind

For Miami property owners, damage from a storm, burst pipe, or mold is an inevitable risk. The difference between a successful recovery and a financial disaster often comes down to having the right professional team on your side.

Insurance companies rely on complex policies and negotiation tactics to minimize payouts, counting on you to feel overwhelmed and accept less than you’re owed. But you don’t have to face this fight alone.

Aproperty damage claims lawyer miamiprovides the legal muscle to fight denials and bad faith, while a public adjuster builds the foundation for a maximum settlement. Statistics confirm that property owners with professional representation recover significantly more.

This is about more than money—it’s about reclaiming your peace of mind. Your home or business is worth fighting for. Don’t let an insurance company dictate your recovery.

Take the first and most important step. We at Global Public Adjusters have over 50 years of experience helping Florida property owners stand up to insurers. Most consultations are free, and professionals often work on contingency, so you pay nothing unless you win.

Take control of your claim today.Get a professional assessment of your claimand find what fair compensation truly looks like.