insurance claim help: 7 Powerful Steps to Stress-Free Success

Navigating the Insurance Claim Maze: A Practical Guide

Looking for insurance claim help? Here’s a quick overview:

- Safety first:Secure property and prevent further damage

- Document everything:Take photos, videos, and keep receipts

- Contact your insurer:File claim promptly (within policy timeframes)

- Gather evidence:Prepare home inventory and damage details

- Consider professional help:Public adjusters can increase settlements by 574% on average

Insurance claim helpis essential when disaster strikes your home or business. Whether you’re dealing with fire damage, water intrusion, storm destruction, or theft, knowing how to steer the claims process can mean the difference between a fair settlement and financial hardship.

According to the Insurance Information Institute, the average property insurance claim takes 30-60 days to settle, but complex claims can drag on for months or even years. This is where proper guidance becomes invaluable.

Most homeowners feel overwhelmed when facing the insurance claim process. The paperwork, deadlines, adjuster meetings, and settlement negotiations create stress during an already difficult time. A 2022 J.D. Power study found that while 87% of homeowners were satisfied with straightforward claims, satisfaction dropped to just 67% when delays or disputes occurred.

The claims journey begins the moment damage occurs and continues through documentation, filing, adjuster inspection, negotiation, and finally, settlement. Each step requires attention to detail and knowledge of your policy rights.

In this guide, we’ll walk you through a simplified approach to handling insurance claims that puts you in control and maximizes your chances of a fair settlement.

Step 1: Secure Safety & Prevent Further Loss

When disaster strikes your home, nothing matters more than making sure everyone is safe. Only after you’ve confirmed your family’s wellbeing should you turn your attention to protecting your property from additional damage.

“The steps you take right after a loss can significantly impact your insurance claim,” says our experienced team lead at Global Public Adjusters, Inc. “We often see homeowners accidentally hurt their chances of a fair settlement simply because they didn’t know how to properly protect their property after the initial damage.”

Emergency Repairs

Did you know your insurance policy actually requires you to take reasonable steps to protect your property from getting worse? This is called your “duty to mitigate,” and it’s not just insurance terminology – failing to follow this requirement could give your insurer grounds to deny parts of your claim.

Smart emergency measures include boarding up broken windows to keep rain out and thieves away, placing tarps over damaged roof sections, turning off the water supply if pipes have burst, removing standing water before mold can grow, and securing any loose structural elements that could cause more damage.

Important:Keep every receipt from these emergency fixes! These expenses are typically reimbursable under your policy’s Additional Living Expenses (ALE) coverage. Just be careful not to jump into permanent repairs before your insurance adjuster has seen the damage – this could seriously complicate your claim or even lead to denial.

Need guidance on disaster assistance? The federal government offers resources atDisaster assistance resources.

Auto & Property First-Response Checklist

When dealing with auto damage, first move your vehicle to safety if possible. Exchange information with other drivers including license, registration and insurance details. Take plenty of photos of the accident scene, all vehicles involved, and license plates. Make note of the time, date, and weather conditions, and collect contact information from any witnesses. Don’t forget to file a police report if required.

For property claims, your first moves matter. Shut off utilities if there’s any risk of further damage. Take extensive photos and videos before you clean anything up. Document exactly when you found the damage and note weather conditions for storm-related claims. If your home isn’t safe to stay in, arrange temporary lodging and track all related expenses – they’re likely covered under your policy.

Protecting Evidence for Your Insurance Claim Help

Good documentation is your best friend when seekinginsurance claim help. Think of evidence as the currency you’ll use to “purchase” your fair settlement.

Start by taking wide-angle photos that show the full scope of damage, then get close-ups of specific damaged items. Walk through your property with your smartphone video recording, narrating what you see and pointing out specific damage. The timestamp on these videos can be valuable evidence.

Don’t rush to throw away damaged items until the adjuster has seen them or given you permission. If something must be discarded for safety reasons (like moldy materials), photograph it thoroughly first.

If neighbors or others witnessed the event that caused your damage, politely ask for written statements while the details are fresh in their minds. For storm claims, save official weather reports showing conditions in your area at the time of damage. And if you have maintenance records that prove you’ve properly cared for your property, keep those handy to counter any potential claims that the damage resulted from neglect.

Creating a simple home inventory now – even after damage has occurred – can help establish what you’ve lost. Take photos of rooms and belongings, list major items with approximate purchase dates, and store this information in cloud storage so you can access it even if your devices are damaged.

The more thoroughly you document your loss from the start, the stronger position you’ll be in throughout the entire claims process.

Step 2: Notify Your Insurer & Open the Claim

Once you’ve secured your property and begun documenting the damage, it’s time to reach out to your insurance company. Most policies require you to provide “prompt notification” of a loss, though the exact timeframe can vary depending on your insurer.

Before You Call

Take a deep breath and grab your policy documents first. A quick review of your coverage can save you time and potential headaches later. Look for:

Your coverage limits– knowing these numbers helps set realistic expectations from the start.Your deductible amountis equally important – this is what you’ll pay out of pocket before insurance kicks in. Pay attention tospecific exclusionsthat might apply to your situation, and note anyrequired timeframesyour policy mentions for filing claims.

Sometimes, the math simply doesn’t work in your favor. If your deductible is $1,000 and your damage is estimated at $900, filing a claim wouldn’t make financial sense. Also worth considering: multiple claims within a short period can trigger premium increases or even policy non-renewal. It’s a calculation worth making before you pick up the phone.

What to Say (and Not Say)

When you’re ready to report your claim, honesty matters – but so does precision.

DOstick to the facts about what happened. Be clear about when the damage occurred and describe what you’ve found so far. Ask about next steps and get a timeline if possible. Always request your claim number and your adjuster’s contact information before ending the call.

DON’Tventure guesses about causes you’re unsure of – “I think maybe…” statements can come back to haunt you. Avoid accepting blame or responsibility, and politely decline giving recorded statements until you’re fully prepared. This first call isn’t the time to agree to settlement amounts or sign documents without careful review.

How to File (Auto, Home, USPS, etc.)

Today’s insurers offer multiple pathways to file your claim, each with its own advantages:

Many companies now provideonline portalsthrough their websites where you can submit claims 24/7 and receive immediate confirmation. Theirmobile appsoften go a step further, allowing you to upload damage photos, track claim status, and communicate with adjusters all in one place.

The traditional method ofphone reportingremains effective and gives you a human connection from the start. Keep a notepad handy to jot down important information like claim numbers and next steps.

For mail-related claims, the USPS has its own specific procedures. You’ll need to file within 60 days for damaged or missing contents, while lost mail claims have varying windows (7-75 days depending on service type). Decisions typically arrive within 5-10 business days, with approved payments following 7-10 days later. You can find complete details at theUSPS claim filingpage.

Key Deadlines & Statutory Clocks

Time matters tremendously in the claims process. Missing deadlines can jeopardize your entire claim, so mark these important timeframes on your calendar:

Yournotice of losstypically needs to happen quickly – most policies require notification within 24-72 hours, though some may allow up to 14 days. The formalproof of lossdocument (detailing your claim amount with supporting evidence) usually must be submitted within 60 days of the insurer’s request.

Each state has its ownstatute of limitationsgoverning how long you have to file a lawsuit related to an insurance claim, usually ranging from 1-5 years from the date of loss. If you have a mortgage, you’ll also need to inform yourmortgage companyabout significant property damage as soon as possible.

Here’s a practical tip that can save you countless headaches: create a dedicated claim communication log. A simple notebook where you track every conversation, email, and letter with dates, times, and the names of representatives you speak with. This single habit can prove invaluable if disputes arise later.

Getting properinsurance claim helpearly in the process sets the foundation for everything that follows. Clear communication and meticulous record-keeping are your strongest allies in navigating the claims maze.

Step 3: Gather Documentation & Submit Proof

Your claim’s success hinges on the quality of your documentation. This is where many homeowners unknowingly leave thousands of dollars on the table – by not fully documenting what they’ve lost.

Building a Bulletproof Claim File

Think of your claim file as telling the complete story of your loss. Without good documentation, it’s like trying to win a court case without evidence.

“The single biggest mistake I see homeowners make is underestimating how detailed their documentation needs to be,” says our senior adjuster at Global Public Adjusters. “Insurance companies require proof of everything you claim.”

Your file should include your complete policy documents with all endorsements and declarations pages. These papers are your contract – they define what you’re entitled to receive. Next, include all your damage documentation – those photos and videos you took right after the incident are worth their weight in gold.

One of the most challenging parts is creating a thorough property inventory. For each damaged item, you’ll need to document:

Don’t forget to gather at least two independent repair estimates from contractors. Insurance adjusters often use software that calculates the lowest possible repair costs, so having your own estimates provides crucial leverage.

Keep every receipt related to your claim – from tarps and plywood for emergency repairs to hotel bills and restaurant charges if you’re displaced. These expenses often fall under your Additional Living Expenses coverage.

Finally, maintain that communication log we mentioned earlier. It will prove invaluable if disputes arise about who said what and when.

Home Inventory Tips

Creating a home inventory after a loss feels overwhelming – like trying to remember everything in your refrigerator without opening the door. Start with a room-by-room mental walkthrough, listing items you can recall.

Your credit card and bank statements can jog your memory about major purchases. Check your social media accounts and family photos – you’d be surprised how many of your possessions appear in the background of everyday pictures.

Friends and family who’ve visited your home can also help remember items you might forget. Your cousin might recall that beautiful vase you bought on vacation, or your neighbor might remember your patio furniture set.

Pro tip:Once this claim is settled, create a detailed inventory with photos for future reference. A 10-minute video walkthrough of your home today could save you countless hours of stress after a future loss. Store this information in cloud storage or a safety deposit box where it can’t be damaged in the same event that harms your home.

Releasing Funds Held by Your Mortgage Lender

If you have a mortgage, prepare for an extra layer of complexity. Your insurance check will likely include your mortgage company as a payee, giving them control over when and how you receive the money for repairs.

Most lenders have a multi-step process for releasing these funds. They’ll typically send an inspector to verify the damage before releasing any money. For large claims, they’ll often release funds in installments – perhaps 1/3 upfront, another third when repairs are 50% complete, and the final payment after completion.

Insurance claim helpis particularly valuable during this phase, as navigating mortgage company requirements can be frustrating and time-consuming.

To speed things along, contact your mortgage company’s loss draft department immediately after filing your claim. Request their specific requirements in writing so there’s no confusion. Submit all requested documentation promptly, and follow up weekly on the status of fund releases.

Mortgage companies have a vested interest in ensuring proper repairs – they want to protect their collateral. Their involvement, while sometimes frustrating, can actually provide an extra layer of protection against contractor fraud.

Insurance Claim Help: What to Expect From Start to Finish

Filing an insurance claim can feel like navigating a maze. But with the rightinsurance claim help, you can move through the process with confidence instead of confusion. Let’s walk through what typically happens from the moment you file until you receive your settlement.

The Adjuster’s Role

After you’ve filed your claim, you’ll meet one of the most important people in your claims journey: the insurance adjuster. Think of them as the investigator of your case. They’ll determine if your policy covers the damage, assess how bad things are, and calculate what your claim is worth.

Not all adjusters are created equal, though. There are three distinct types you might encounter:

Company adjusterswork directly for your insurance company. While professional, their loyalty is to their employer.Independent adjustersaren’t employees but contractors hired by insurance companies to handle claims. And then there arepublic adjusters(like us at Global Public Adjusters, Inc.) who work exclusively for you, the policyholder. Our only job is making sure you get every penny you deserve.

Preparing for the Adjuster’s Inspection

The adjuster’s visit is your moment to shine. Before they arrive, gather your documentation and have copies ready to share. Create that detailed list of damaged items we talked about earlier, and consider marking damaged areas with tape or sticky notes so nothing gets overlooked.

When the adjuster finally knocks on your door, stick to them like glue during the inspection. This isn’t the time to be shy! Point out every bit of damage, even things that seem minor. Water stains on the ceiling? Show them. Cracked window frame? Point it out. Take notes about what they photograph and what they might miss.

“I always tell my clients to be their own best advocate during the inspection,” says our senior adjuster at Global Public Adjusters. “But also remember that you don’t have to accept the first assessment as final.”

Before the adjuster leaves, ask about next steps and when you can expect to hear back. Request a copy of their inspection report—this is your right as a policyholder.

Settlement Offers and Timelines

Patience is definitely a virtue during the claims process. According to the National Association of Insurance Commissioners (NAIC), you can typically expect:

- Initial adjuster contact within 1-3 days after filing

- An inspection scheduled within 3-14 days

- A first settlement offer about 7-30 days after inspection

- Total claim resolution in about 30-60 days (though complex claims often take longer)

When that settlement offer arrives, take a deep breath before responding. Compare it carefully against your documentation and contractor estimates. If you spot discrepancies (and many people do), request clear explanations for the differences. This is where your detailed documentation becomes your best friend.

Did you know that about 5-10% of all insurance claims are disputed by policyholders? That’s often because the initial settlement offer doesn’t match the true cost of repairs.

When to Seek Professional Insurance Claim Help

Sometimes, you need a pro in your corner. Consider bringing in a public adjuster like Global Public Adjusters, Inc. when your claim starts feeling overwhelming or the numbers just don’t add up.

Professionalinsurance claim helpmakes particular sense for complex situations involving major fire or water damage, when settlement offers seem suspiciously low, or when your claim has been denied outright. Many people also seek help simply because they’re already dealing with the emotional and practical fallout of a disaster—they don’t need the added stress of fighting with an insurance company.

The numbers speak for themselves: According to a Florida Office of Program Policy Analysis & Government Accountability report, public adjusters increase claim payouts by an average of 574% compared to claims handled without professional help. That’s not just a little bump—it’s the difference between partial recovery and being made truly whole again.

Tracking Your Case: Insurance Claim Help Tools & Updates

Staying organized isn’t just helpful—it’s essential. Most insurance companies now offer online portals or mobile apps where you can check your claim status, upload additional documentation, and communicate with your adjuster.

Create a simple system for yourself. Set calendar reminders to follow up if you haven’t heard anything in a week. Keep a dedicated notebook or digital document where you record every phone call, including who you spoke with and what was discussed. Save emails in a special folder. This level of organization might seem excessive until the day you need to reference a conversation from three weeks ago.

Common Roadblocks: Delays, Reductions, Denials

Even with perfect preparation, you might hit some bumps in the road. Common challenges include:

Insufficient evidencecan stall your claim. The more documentation you have, the smoother things go.Policy exclusionsmight come as an unwelcome surprise—that’s why understanding your policy before disaster strikes is so important.Missed deadlinescan derail even the most legitimate claims, so stay on top of all time requirements.

Watch out forbetterment charges, where the insurer reduces your payout claiming repairs would improve your property beyond its pre-loss condition. And be alert to potentialbad faith practices—unreasonable delays, denials, or underpayments that seem designed to wear you down until you accept less than you deserve.

The claims process doesn’t have to be a battle. With the rightinsurance claim help, preparation, and persistence, you can steer it successfully and get back to normal life sooner rather than later.

What If Your Claim Is Denied or Underpaid?

If you receive a denial letter or an offer that seems unfair, don’t give up. You have options, and this might just be the beginning of the negotiation process, not the end.

Step-by-Step Appeal Process

Getting that denial letter can feel like a punch to the gut, especially when you’re already dealing with property damage. Take a deep breath—this happens more often than you might think, and there’s a clear path forward.

Start by requesting a detailed written explanation of why your claim was denied or underpaid. Insurance companies must provide this by law. With this information in hand, carefully review your policy language to see if the denial aligns with what’s actually in your contract.

Now it’s time to build your case. Gather additional evidence that directly addresses their reasons for denial. This might include more detailed photos, contractor statements, or expert opinions. Think of yourself as a detective collecting proof that can’t be ignored.

When you’re ready, submit a formal appeal letter that cites specific policy provisions and includes all your supporting evidence. Be professional but firm—remember, this is a business negotiation. Many claims are denied initially but approved on appeal.

If you’re still hitting a wall, request a re-inspection with a different adjuster. Sometimes a fresh set of eyes can make all the difference. Most policies also include an appraisal clause specifically designed for resolving disputes about damage amounts—consider invoking this option.

Still no luck? It might be time to file a complaint with your state’s Department of Insurance if you believe your claim was handled improperly. These agencies exist to protect consumers and can often help move things along.

Throughout this process, documenting everything remains crucial. Save emails, record phone calls (where legal), and keep a detailed log of all communications. This paper trail can prove invaluable if your case escalates further.

The Appraisal Process Explained

The appraisal clause is your secret weapon when you can’t agree on the amount of your loss. Think of it as a mini-arbitration process built right into your policy.

Here’s how it works: You select an independent appraiser who understands construction costs and insurance policies. The insurance company selects their appraiser. Then these two appraisers select a neutral umpire to serve as a tiebreaker.

The beauty of this process is that any two of these three professionals can make binding decisions about your loss amount. It bypasses the endless back-and-forth with adjusters and can resolve disputes much faster than litigation.

While you’ll have to pay for your appraiser (and half the umpire’s fee if needed), this investment often pays for itself many times over in higher settlement amounts. Just be sure to choose an appraiser with specific experience in your type of loss—expertise matters tremendously here.

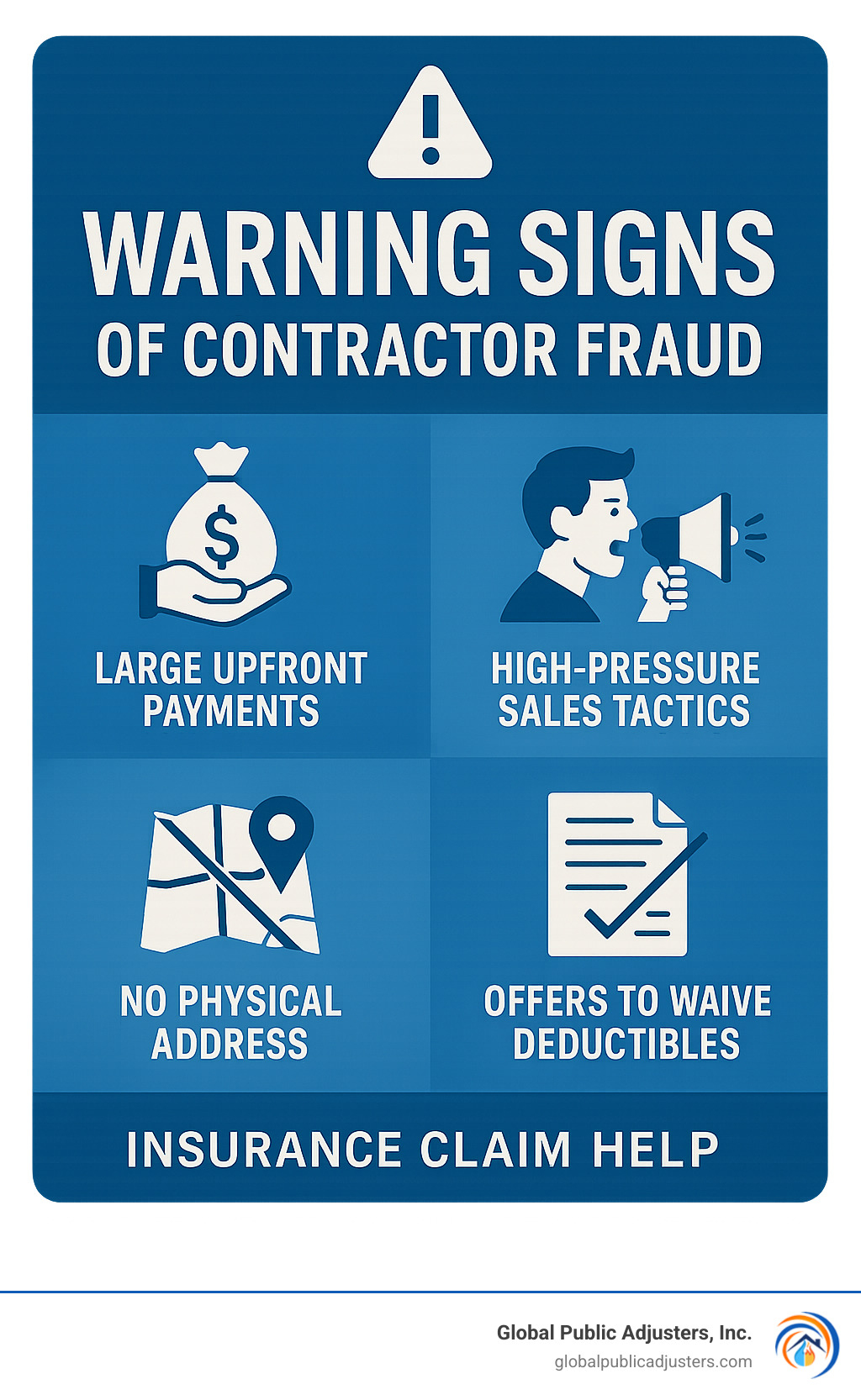

Avoiding Post-Disaster Fraud & Contractor Scams

Unfortunately, the aftermath of a disaster creates the perfect hunting ground for scammers. They know you’re vulnerable, stressed, and eager to rebuild—a dangerous combination that can lead to costly mistakes.

Always verify credentialsbefore hiring anyone. Check their license status with your state’s contractor board, confirm they have proper insurance, and call their references. A legitimate contractor will welcome this due diligence.

Never accept verbal quotesor handshake deals, no matter how trustworthy someone seems. Get detailed written estimates that spell out exactly what work will be done, with what materials, and on what timeline.

Be extremely cautious about upfront payments. While some deposit is normal, be wary of contractors demanding large sums before work begins. Structure payments to align with completed work milestones instead.

Read every word of any contractbefore signing. If something doesn’t make sense, don’t sign until you get clarification. Consider having a trusted friend or family member review it as well—a second set of eyes can catch red flags you might miss.

Your alarm bells should ring loudly if someone shows up at your door uninvited after a disaster, pressures you to sign immediately for a “special deal,” or offers to waive or absorb your deductible. This last one isn’t just suspicious—it’s actually insurance fraud in most states.

Also be wary of companies with no physical business address or local presence. After major disasters, out-of-town contractors (sometimes called “storm chasers”) may appear. While some are legitimate, others disappear once they’ve collected payments, leaving homeowners with unfinished or substandard work.

If you’re feeling overwhelmed by the process or unsure about how to proceed with a denied claim, professionalinsurance claim helpmay be your best option. At Global Public Adjusters, Inc., we’ve guided thousands of homeowners through this exact situation, oftenhelping them recover from denied claimsthat initially seemed hopeless.

Frequently Asked Questions about Insurance Claim Help

What are my rights during the claims process?

You might feel like David facing Goliath when dealing with insurance companies, but remember – you have solid rights backing you up.

As a policyholder who’s faithfully paid premiums, you’re entitled to receive your complete policy documents whenever you request them. Your insurer must handle your claim promptly and fairly – not at their convenience. When decisions are made about your claim, you deserve clear explanations in plain English, not insurance jargon.

If you’re unhappy with a denial or settlement offer, you have every right to appeal it.You can hire professional helpat any point in the process – whether that’s day one or months in. Many policyholders don’t realize they can file complaints with their state’s insurance department if they believe they’re being treated unfairly.

And yes, legal action remains your right if other avenues fail to resolve your situation fairly. Your policy is a contract, and both parties have obligations to fulfill.

How long do insurers have to pay after settlement is reached?

Once you’ve shaken hands on a settlement amount, the clock starts ticking for your insurer to pay up. Most states give insurance companies about 30 days to deliver your funds after reaching an agreement.

Florida homeowners enjoy even more protection – insurers must pay within 20 days of settlement. What many policyholders don’t realize is that in several states, when payments are delayed beyond these timeframes, you may be entitled to collect interest penalties on the overdue amount.

The exact timeline varies depending on where you live, so it’s worth checking your state’s specific regulations. This is another area whereinsurance claim helpfrom professionals can ensure you’re not left waiting unnecessarily for funds you need to rebuild.

When should I hire a public adjuster or attorney?

Imagine trying to steer a maze while blindfolded – that’s how many people feel during complex insurance claims. Professional help makes sense in several situations.

When your damage exceeds about $10,000, the potential settlement improvement often outweighs the cost of hiring help. If you’re facing a claim denial that seems unjustified, a professional can spot policy provisions that support your case. Many homeowners call us when they receive settlement offers that are shockingly lower than contractor estimates.

Time constraints are another common reason – managing a complex claim properly can feel like a part-time job. Persistent delays or communication problems with your insurer often signal it’s time for professional backup. Claims involving unique circumstances, like historic homes or specialized equipment, particularly benefit from expert advocacy.

At Global Public Adjusters, Inc., we typically work on contingency, meaning our fee is a percentage of what we recover for you. This arrangement aligns our interests perfectly – we only succeed when you get a better settlement.

What’s the difference between Replacement Cost and Actual Cash Value?

These terms might sound like insurance jargon, but understanding them can mean thousands of dollars difference in your settlement.

Replacement Cost Value (RCV)is straightforward – it’s the amount needed to repair or replace your damaged property with similar materials and quality, without factoring in depreciation. It’s what you’d pay to buy the item new today.

Actual Cash Value (ACV)takes a different approach. It’s the replacement cost minus depreciation based on the item’s age, condition, and expected lifespan. Think of it as the “garage sale value” of your belongings.

Here’s where it gets tricky: most policies initially pay only the ACV, holding back the depreciation amount until you complete repairs or replacement. This “depreciation holdback” (the difference between RCV and ACV) can be substantial for older items like roofing or appliances.

This two-step payment process catches many homeowners off guard when they’re trying to fund repairs with insufficient initial payments. Getting properinsurance claim helpcan ensure you understand exactly what to expect and when.

Can I do the repairs myself and keep the difference?

The DIY approach appeals to many homeowners, especially those with renovation skills. If you have replacement cost coverage, you’re generally entitled to the full replacement amount only when repairs are actually completed.

That said, many policies will allow you to perform some work yourself, as long as the repairs meet professional standards. The potential savings can be significant – but don’t grab your tools just yet. Always check with your adjuster before starting DIY repairs, as policies vary widely on this point.

Some insurers may require professional licensing for certain repairs, particularly those involving electrical, plumbing or structural elements. Others might request detailed documentation of your work hours and materials. Taking the time to understand these requirements can prevent headaches down the road.

Safety should always come first – even if you’re hoping to save money, some repairs are best left to professionals with proper equipment and training.

Conclusion

Navigating the insurance claim process doesn’t have to be overwhelming. By following these steps and understanding your rights, you can significantly improve your chances of a fair settlement:

- Safety first:Secure your property and prevent further damage

- Document thoroughly:Take photos, videos, and keep detailed records

- File promptly:Notify your insurer within policy timeframes

- Stay organized:Maintain a comprehensive claim file

- Be persistent:Follow up regularly and keep communication open

- Know when to seek help:Complex claims often benefit from professional assistance

At Global Public Adjusters, Inc., we’ve helped thousands of homeowners and business owners throughout Florida steer the claims process and recover the full value they deserve. With over 50 years of combined experience, our team understands the tactics insurers use to minimize payouts and how to counter them effectively.

The insurance claim process is a negotiation. Insurance companies have teams of professionals working to minimize their payouts, and you deserve the same level of expertise on your side. Whether you choose to handle your claim yourself or seek professionalinsurance claim help, being informed and prepared is your best strategy for success.

If you’re facing a challenging claim or simply want to ensure you’re receiving the maximum settlement you’re entitled to, we’re here to help. Our Orlando-based team serves clients throughout Florida, including Pensacola and surrounding areas.

For more information about our services and how we can assist with your insurance claim, visit ourservices pageor contact us for a free consultation.