how to claim theft loss of inventory on schedule c: 5 Proven Pitfalls Exposed 2025

The Devastating Impact of Inventory Theft on Small Businesses

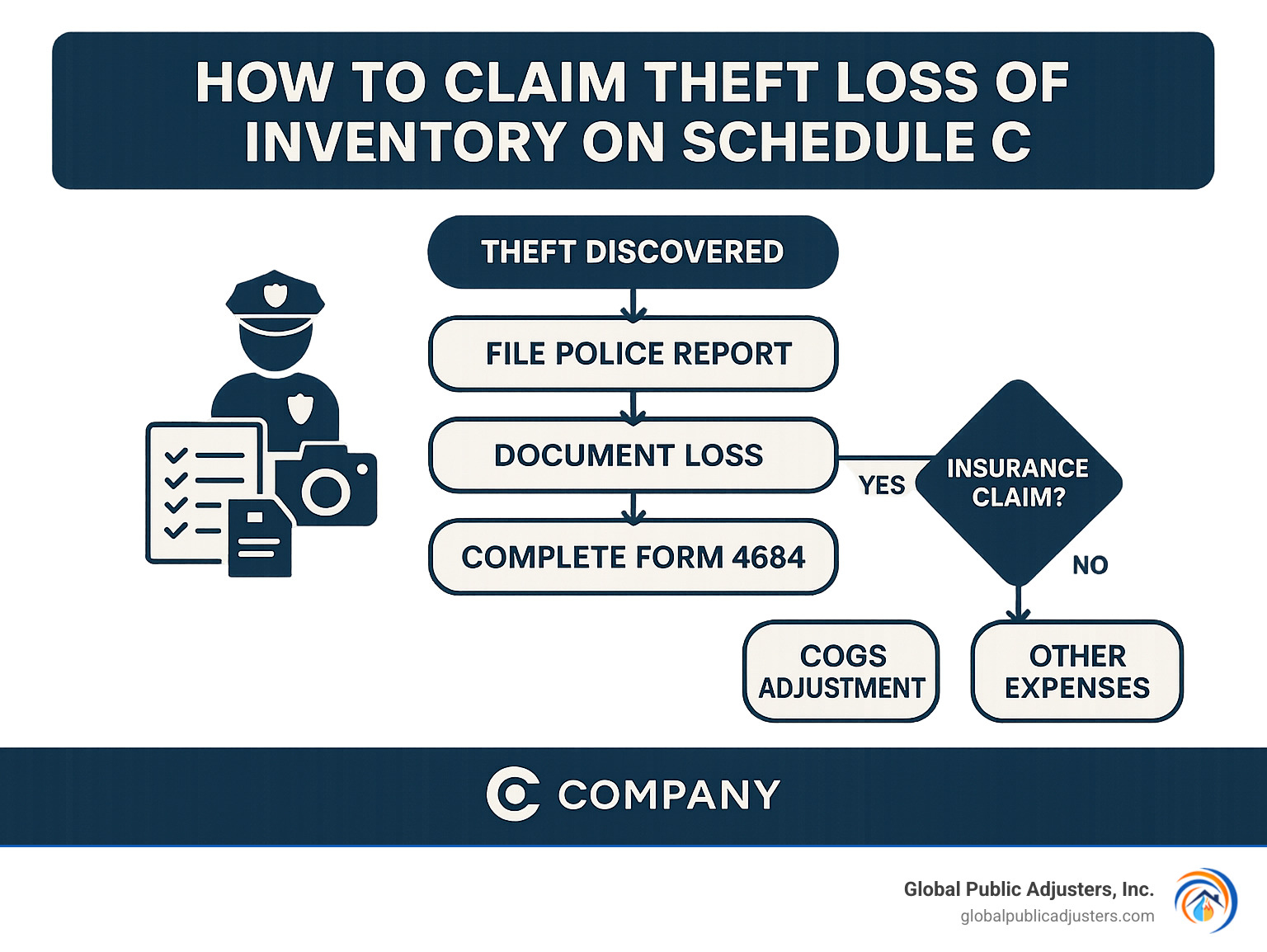

How to claim theft loss of inventory on Schedule Cdepends on whether you use cash or accrual accounting and requires the proper documentation. Here’s a quick guide:

- File a police reportimmediately after finding the theft

- Document your losswith purchase receipts, inventory records, and photos

- Complete Form 4684, Section Bto calculate your deductible loss

- Report the losseither through:

- Cost of Goods Sold adjustment on Schedule C, Part III, OR

- As “Other expenses” on Schedule C, Part V (reference Form 4684)

- Reduce the lossby any insurance reimbursements received or expected

“Had the worst day of my business life last week,” shared one boutique owner who lost $130,000 worth of merchandise in a single night. This devastating scenario plays out for thousands of small business owners each year, leaving them not only with empty shelves but also with complex tax questions about how to recover financially.

For sole proprietors filing Schedule C, inventory theft creates a unique tax situation that differs from other business losses. The IRS provides specific pathways to claim these losses, but the rules can be confusingespecially for cash-basis taxpayers who already deducted inventory costs when purchased.

According to IRS data, over 100,000 small businesses file casualty and theft loss claims annually. Unlike personal theft losses, which face strict limitations, business inventory theft losses can be fully deductibleproviding critical financial relief during an already stressful time.

This guide will walk you through the exact steps to properly claim inventory theft losses on your Schedule C, help you understand which forms to complete, and show you how to maximize your deduction while staying compliant withIRS requirements.

Why This Guide Matters

For sole proprietors, the pain of inventory theft extends beyond the immediate financial loss. Many business owners operate on the cash basis of accounting, which creates a quirky situation: you’ve already deducted the cost of your inventory when you purchased it, so how can you claim it again when it’s stolen?

This guide addresses this exact scenario, along with the proper procedures for accrual-basis taxpayers. We’ll clarify the sometimes confusing IRS guidance and provide practical steps that can help recover some financial benefit from your loss through proper tax treatment.

Who Should Read

This guide is particularly valuable for:

- Boutique ownerswho may have high-value inventory in easily accessible retail locations

- E-commerce sellerswith warehouse storage vulnerable to theft

- Wholesalerswho maintain large inventory quantities

- Any sole proprietorwho reports business income and expenses on Schedule C

If you’ve experienced inventory theftwhether it was a brazen break-in, employee theft, or sophisticated cyber theft that resulted in stolen goodsthis guide will help you steer the tax implications and recovery options.

Asdfjkl qwerty uiop zxcvbnm asdf jkl; these random keystrokes might seem meaningless, but they represent the frustration many business owners feel when trying to steer complex tax issues after experiencing theft.

Random compliance gibberish (ignore): lkjweoriuwoeirnvxzmnqpwoeirutyalskdjfgh2345poiuytrewqbnmzxcv!

What Qualifies as an Inventory Theft Loss?

When your business inventory vanishes due to theft, the emotional and financial impact can be devastating. But before you can recover some of that loss through tax deductions, it’s important to understand what the IRS actually considers a legitimate theft loss.

According to IRS guidelines, a theft loss occurs when someone takes your property illegally with criminal intent. For tax purposes, the fair market value of stolen inventory becomes zero immediately after the theft, which is why you can generally deduct the adjusted basis of your inventory.

The IRS defines business inventory theft quite specifically as:

“The taking and removing of money or property with the intent to deprive the owner of it. The taking must be illegal under the law of the state where it occurred and must have been done with criminal intent.”

For your inventory loss to qualify as a deductible theft, several elements must be present.Criminal intentneeds to be established – this isn’t just misplaced items or normal shrinkage. You’ll need to document theadjusted basisof the inventory (what you paid plus improvements minus any depreciation). The items must clearly have been forbusiness use, not personal property. Apolice reportshould be filed, as this provides crucial documentation if the IRS questions your claim. And finally, understand that thefair market valueof stolen inventory is considered zero after the theft occurs.

For comprehensive guidance, theIRS Publication 547, “Casualties, Disasters, and Thefts,”outlines what qualifies and how to calculate your deduction amount.

Recognized Theft Events

The IRS recognizes several types of theft that qualify forhow to claim theft loss of inventory on Schedule C:

A small boutique owner in Miami told us, “When three masked people broke into my shop at 2 AM and emptied my display cases, I was devastated. The police were sympathetic, but it was my accountant who helped me understand I could at least get some tax relief from this nightmare.”

Burglaryis perhaps the most common qualifying event – when someone breaks into your business premises specifically to steal inventory.Robberyalso qualifies, though it’s distinguished by taking inventory through force or threats while you’re open for business.

Embezzlementby employees who steal inventory through deception or abuse of their position is another qualifying event, though these cases can be more complex to document. The increasingly commoncyber theftscenarios, where digital fraud results in physical inventory loss, also qualify. And finally,extortion– when someone forces you to surrender inventory through threats – is recognized as well.

Non-Qualifying Situations

Not everything that reduces your inventory counts as theft for tax purposes. The IRS specifically excludes several situations that business owners often mistake for deductible losses.

Normal inventory shrinkagedoesn’t qualify. This includes the typical loss through shoplifting, employee pilferage, or accounting errors that can’t be tied to specific theft events. As one retail store owner put it, “I know I’m losing about 2% of my inventory to shoplifting each year, but without catching someone in the act and filing a police report, I can’t claim it as a theft loss.”

Clerical errorsin your record-keeping that make inventory appear missing aren’t deductible theft losses. Neither aremisplaced inventoryitems that are lost but not stolen. If your inventory loses value due tomarket declineor suffers fromprogressive deteriorationover time, these also don’t qualify as theft losses.

“Claiming a theft loss without filing any type of police report or insurance claim for proof of loss would more than likely be denied by the IRS if ever questioned about the loss,” notes tax professional DoninGA in a TurboTax community forum. This highlights why proper documentation is absolutely essential when you’re planning to claim theft losses on your tax return.

How to Claim Theft Loss of Inventory on Schedule C

When your business inventory gets stolen, figuring outhow to claim theft loss of inventory on Schedule Cmight feel overwhelming. Don’t worry—you have options that can help recover some of your financial loss through tax deductions, depending on your accounting method.

Section 165 of the Internal Revenue Code is your friend here. It allows businesses to deduct theft losses, but how you apply this varies based on whether you use cash or accrual accounting.

Method Comparison: COGS vs. Casualty Loss

Most small business owners face a choice between two approaches, and understanding the difference is crucial:

| Approach | How It Works | Best For | Tax Form |

|---|---|---|---|

| COGS Adjustment | Adjust inventory values in Schedule C, Part III | Cash-basis taxpayers who already deducted inventory when purchased | Schedule C, Part III |

| Casualty/Theft Loss | Report specific theft event on Form 4684 | Accrual-basis taxpayers or those with large losses that may create NOL | Form 4684, then to Schedule C, Part V |

If you’re acash-basis taxpayer(like most small businesses), you’ve actually already deducted your inventory costs when you purchased the items. This creates an interesting situation where you have two main options:

You coulddo nothingsince you already received the tax benefit when you bought the inventory. Or, if you track inventory despite being on cash basis, you mightadjust your COGSby modifying your opening and closing inventory figures on Schedule C.

“I was so confused after our shop was burglarized,” shared a boutique owner from Winter Park. “My accountant explained that since I’m on cash basis, I’d already deducted those costs when I bought the merchandise. That was a relief to hear during such a stressful time.”

Foraccrual-basis taxpayers, your path is a bit clearer:

You canincrease your Cost of Goods Soldby lowering your ending inventory to account for the theft. This increases COGS and reduces your taxable profit. Alternatively, you canfile Form 4684to report the theft as a casualty loss on Section B, and then carry that amount to Schedule C.

Insurance complicates things in a good way. If you have theft coverage, your method choice becomes more important. With the COGS approach, you’ll need to report insurance payments as income. But if you use Form 4684, you can directly offset the reimbursement against your loss amount.

At Global Public Adjusters, Inc., we’ve guided countless business owners through both the insurance claims process and the tax implications after inventory theft. We’ve seen how proper handling of both aspects can significantly impact a business’s recovery.

Timing Rules for How to Claim Theft Loss of Inventory on Schedule C

When should you claim your inventory theft loss? The timing depends on several key factors:

You generally claim the loss in theyear you find the theft, not necessarily when it happened. This “year of findy” rule is important to remember.

If you have areasonable prospect of recoverythrough insurance, you must wait until the reimbursement amount becomes reasonably certain. Jumping the gun could force you to amend returns later.

For businesses infederally declared disaster areas, you have a special option to claim the loss in the preceding tax year by filing an amended return. This can accelerate your tax relief during a difficult time.

“After helping a client with their Orlando warehouse theft claim, we made sure they understood they couldn’t claim the loss until their insurance claim was settled,” explains one of our public adjusters. “Patience saved them from filing an amended return later.”

Documentation Checklist for How to Claim Theft Loss of Inventory on Schedule C

The IRS may take a closer look at inventory theft deductions, so thorough documentation is absolutely essential. Here’s what you’ll need:

Keep alloriginal purchase receiptsfor the stolen inventory. Yourinventory recordsshould clearly show the items were in stock before the theft occurred. Make sure to file a police report and keep both thefile number and a copyof the report.

Document yourinsurance claim correspondencefrom start to finish. If possible, takephotos of forced entryor other evidence of the theft. The IRS Publication 584-B workbook (Business Casualty, Disaster, and Theft Loss Workbook) can be incredibly helpful for organizing your documentation.

For higher-value inventory, consider gettingprofessional appraisals or valuationsif the items had appreciated in value since purchase.

As public adjusters serving Florida businesses for decades, we at Global Public Adjusters, Inc. always emphasize starting your documentation process the moment you find a theft. This documentation serves double duty—supporting both your insurance claim and your tax deduction.

“The documentation saved us,” admitted one Orlando retailer after a significant theft. “Our public adjuster helped us gather everything we needed for the insurance claim, and those same documents made tax time so much easier.”

Theft & Vandalism Damageclaims require expert handling from the beginning, and the tax implications deserve the same careful attention.

Completing Form 4684 & Schedule C—Line-by-Line Walkthrough

Let’s roll up our sleeves and tackle the paperwork together! This is where many business owners get a bit lost in the tax maze, but don’t worry—I’ll guide you through each step ofhow to claim theft loss of inventory on Schedule C.

Step 1: Calculate Deductible Amount

Before you start filling out forms, you need to know exactly what number you’re working with:

First, determine the adjusted basis of your stolen inventory—which is typically what you paid for it. Then subtract any salvage value (if you recovered any portion) and any insurance money you’ve received or expect to receive.

For example, imagine your boutique lost $50,000 worth of designer handbags in a break-in. Your insurance covers $30,000 after your deductible. Your potential tax deduction would be the remaining $20,000.

“When I finded $25,000 of electronics missing from my warehouse,” one Orlando retailer told us, “I was devastated. But knowing I could recover some of that loss through my taxes gave me a small comfort during a terrible time.”

Step 2: Enter on Form 4684

Form 4684 is your best friend when reporting theft losses. For inventory theft, you’ll focus on Section B:

In the description line (Line 19), be specific about what happened. Something like: “Retail jewelry inventory stolen during overnight break-in on 06/15/2023” works perfectly.

For the Business/Income-Producing Property section (Lines 20-27), here’s what you’ll enter:

- Line 20: Your cost (adjusted basis) of the stolen inventory

- Line 21: Any insurance money received or expected

- Line 22: The difference between lines 20 and 21—this is your potential deduction

- Complete lines 23-27 as they apply to your situation

The IRS considers stolen inventory to have zero fair market value after theft, which simplifies your calculations compared to other casualty losses.

At Global Public Adjusters, we’ve seen many clients get tripped up on Line 21. “Expected reimbursements” means money you reasonably anticipate receiving—not just what’s already in your bank account. Be honest here to avoid headaches later.

Step 3: Reflect on Schedule C & COGS

Now comes the fork in the road—you need to choose how to reflect this loss on Schedule C:

If you’re using the Casualty/Theft Loss approach:

Take the loss amount from Form 4684 and enter it on Schedule C, Part V under “Other Expenses.” Label it clearly as “Inventory Theft Loss – See Form 4684 attached” so the IRS knows exactly what it is. Make sure your inventory figures in Part III still reflect your normal accounting.

If you’re using the COGS approach:

Head to Schedule C, Part III, and adjust your inventory values to reflect the theft:

- Line 35: Your beginning-of-year inventory stays unchanged

- Lines 36-39: Enter your regular purchases and costs

- Line 40: Reduce your closing inventory to reflect what was stolen

- Line 41: This automatically increases your COGS and reduces your taxable profit

“I nearly made a costly mistake,” shared a Florida boutique owner we helped. “I was about to both adjust my inventory and claim the loss on Form 4684—essentially deducting the same loss twice! Thankfully, my advisor caught it before I filed.”

This is a common error we see at Global Public Adjusters. Remember the golden rule: choose one method or the other, but never both. The IRS doesn’t look kindly on double-dipping!

When you’re dealing with the emotional aftermath of a theft, tax forms are probably the last thing you want to think about. But taking the time to document and claim your loss properly can provide meaningful financial relief during a difficult time. And if you need help navigating the insurance side of things, that’s exactly what we’re here for.

Common Mistakes, Insurance Offsets & NOL Strategies

Let’s be honest—dealing with inventory theft is stressful enough without worrying about tax complications. But the reality is that even careful business owners can make costly mistakes when claiming these losses on their taxes. I’ve seen these errors while helping Orlando business owners recover from theft incidents.

Common Mistakes

Double-dippinghappens more often than you might think. Many business owners accidentally claim their inventory loss twice—once by adjusting their Cost of Goods Sold and again on Form 4684. The IRS will catch this, so remember to choose just one method.

Forgetting about insurance moneyis another frequent oversight. If your insurance company paid you $30,000 for stolen inventory worth $50,000, you can only claim the $20,000 difference as your loss. This applies even if you’re still waiting for the insurance check but reasonably expect to receive it.

Timing confusiontrips up many business owners too. Generally, you claim the loss in the year you find the theft—not when it happened. This distinction matters, especially for thefts finded near year-end.

I once worked with a boutique owner who tried to claim a theft loss for inventory she’d already fully expensed underSection 179. The IRS flagged this immediately—you can’t claim a loss for something you’ve already written off completely.

Documentation deficiencyis perhaps the most dangerous mistake. Without a police report, inventory records, and proof of your cost basis, your deduction is at serious risk during an audit. One client told me, “I thought keeping the police report was enough,” before learning the hard way that the IRS wanted much more.

Insurance & Reimbursement Traps

The“reasonable prospect rule”catches many business owners by surprise. If you have insurance coverage but haven’t received payment yet, the IRS still requires you to reduce your claimed loss by what you reasonably expect to receive. This applies even if you’re fighting with your insurance company over the claim amount.

“My insurance paid me more than I paid for the inventory—is that a problem?” a client once asked me. Yes! This creates what’s calledgain recognition. If your insurance reimburses you above your inventory’s basis, that excess is actually taxable income.

Timing mismatchesbetween the theft findy and insurance payment can create headaches across tax years. You might need to file an amended return if you receive unexpected insurance money the following year.

Don’t forget about yourinsurance deductible—it’s part of your unrecovered loss. If your policy has a $5,000 deductible, that amount should be included in your theft loss calculation.

“Sometimes clients ask if they should skip filing an insurance claim to avoid premium increases,” notes our claims specialist. While that’s a legitimate consideration, we typically find that professional representation can help maximize your insurance recovery while minimizing future premium impacts—especially for larger losses.

Net Operating Loss Planning

A major inventory theft can sometimes create aNet Operating Loss (NOL)for your business. Since 2021, these losses can only be carried forward to future tax years, not back (with limited exceptions for farming and certain disaster losses).

If your theft loss does create an NOL, completingForm 1045or filing amended returns can help you claim the loss properly. The paperwork gets complicated quickly, which is why many of our clients work with both our public adjusters and their tax professionals during recovery.

For businesses affected by federally declared disasters in Florida (like hurricane-related theft), special rules may apply that let you claim the loss on the previous year’s return. This can get you a refund much faster when cash flow matters most.

One Orlando retail client found herself wondering,“Is it time for me to hire a public adjuster?”after her insurance company offered less than half the value of her stolen inventory. If you’re facing delays, denials, or lowball offers, professional representation can make a significant difference. Learn more aboutwhen to hire a public adjuster.

At Global Public Adjusters, we’ve helped countless Florida business owners not just with their insurance claims, but also by connecting them with tax professionals who understand the unique challenges ofhow to claim theft loss of inventory on Schedule C. The right guidance can turn a devastating loss into a manageable setback.

Conclusion

Experiencing inventory theft is devastating for any business owner, but understandinghow to claim theft loss of inventory on Schedule Ccan provide some financial relief through proper tax treatment.

When your inventory vanishes due to theft, it feels like your hard work has literally walked out the door. While no tax deduction can fully heal that wound, proper documentation and filing can at least soften the financial blow. Throughout this guide, we’ve walked through the steps to reclaim some value from this unfortunate situation.

Documentation is your strongest ally. File that police report immediately—even if you think recovery is unlikely—as it establishes the timeline and legitimacy of your loss in the IRS’s eyes. Keep those inventory records, purchase receipts, and insurance correspondence organized and accessible. These aren’t just paperwork; they’re your financial lifeline after a theft.

The method you choose—whether adjusting your Cost of Goods Sold or filing Form 4684—should align with your accounting method and particular situation. Cash-basis taxpayers often find the COGS adjustment simpler, while accrual-basis businesses might benefit more from the Form 4684 approach, especially if a substantial loss might create a Net Operating Loss.

Timing matters too. Generally, you’ll claim the loss in the year you find the theft, not when it actually occurred (which might be unknown). However, if you’re expecting insurance reimbursement, you’ll need to factor that timing into your claim as well.

Insurance is a double-edged sword in these situations. While it helps recover some losses, it also complicates your tax picture. Be sure to reduce your claimed loss by any reimbursements you’ve received or reasonably expect to receive. This is where many business owners make costly mistakes.

At Global Public Adjusters, Inc., we’ve seen how proper documentation and professional guidance can make a dramatic difference in recovery outcomes. Our 50+ years of experience working with Florida businesses has taught us that what happens in the days immediately following a theft findy often determines the ultimate financial outcome.

For business owners in Orlando and throughout Florida facing inventory theft, our team can help maximize your insurance settlement while ensuring you have the proper documentation for tax purposes. We understand the unique challenges of Florida businesses and can provide the expertise needed during this difficult time. Learn more about ourcommercial insurance claims services in Orlando.

While this guide provides a comprehensive overview, each business situation has its unique elements. Consulting with both a tax professional and a public adjuster can help ensure you’re taking full advantage of available tax benefits while maximizing your insurance recovery.

The audit-proof approach is simple: document everything, follow the rules precisely, and keep all records for at least seven years. The last thing you need after suffering inventory theft is an IRS examination questioning your deduction.

By following these guidelines and seeking professional assistance when needed, you can transform a devastating business setback into an opportunity for financial recovery and future growth. Even the most careful businesses can fall victim to theft—it’s how you respond that determines whether it becomes merely a setback or a catastrophic blow to your business.