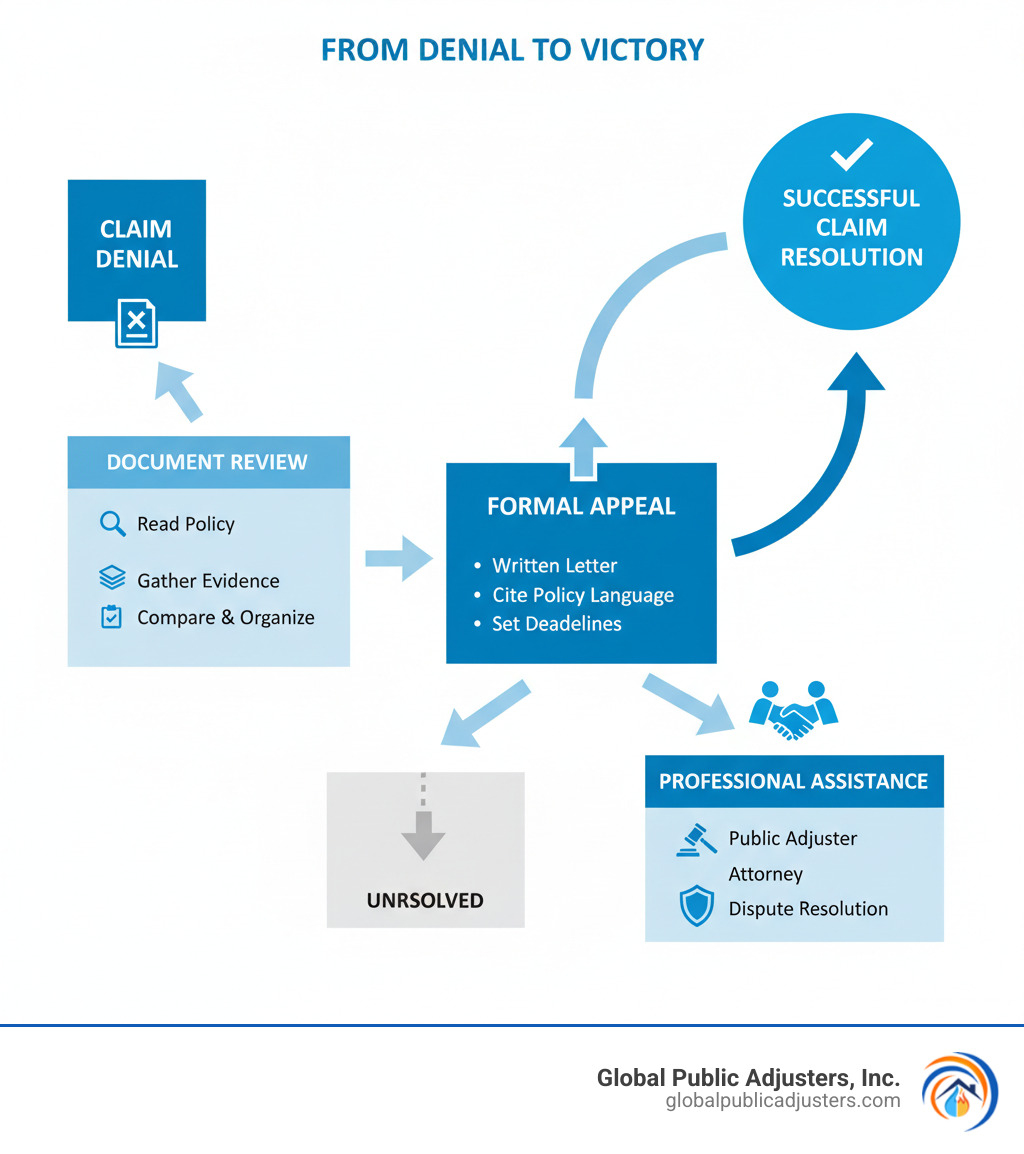

Fighting a Denied Insurance Claim: 3 Steps to Victory

A Denial Isn’t the Final Word

Fighting a denied insurance claimcan feel overwhelming, but most claim denials aren’t permanent. You have multiple ways to challenge them.

Quick Action Steps for Denied Claims:

- Read your denial letterto understand the specific reason.

- Review your insurance policyto see if the denial contradicts your coverage.

- Gather all supporting evidencelike photos, receipts, and repair estimates.

- File a formal written appealwith facts and policy language.

- Consider professional helpfrom a public adjuster to maximize your settlement.

Statistics reveal a troubling reality: research shows thatabout 60 percent of all insurance claims are unjustly denied, yet less than 1 percent of policyholders question a rejection. Most people simply accept “no” as the final answer, even when they shouldn’t.

Don’t assume the first “no” is final. Insurers must handle claims fairly, and you have rights as a policyholder. The appeals process exists for a reason, and many who challenge denials successfully reverse the decision or negotiate better settlements. Whether your claim was denied for policy interpretation or insufficient documentation, there are proven strategies to fight back. The key is understanding the process, staying organized, and knowing when to seek professional advocacy.

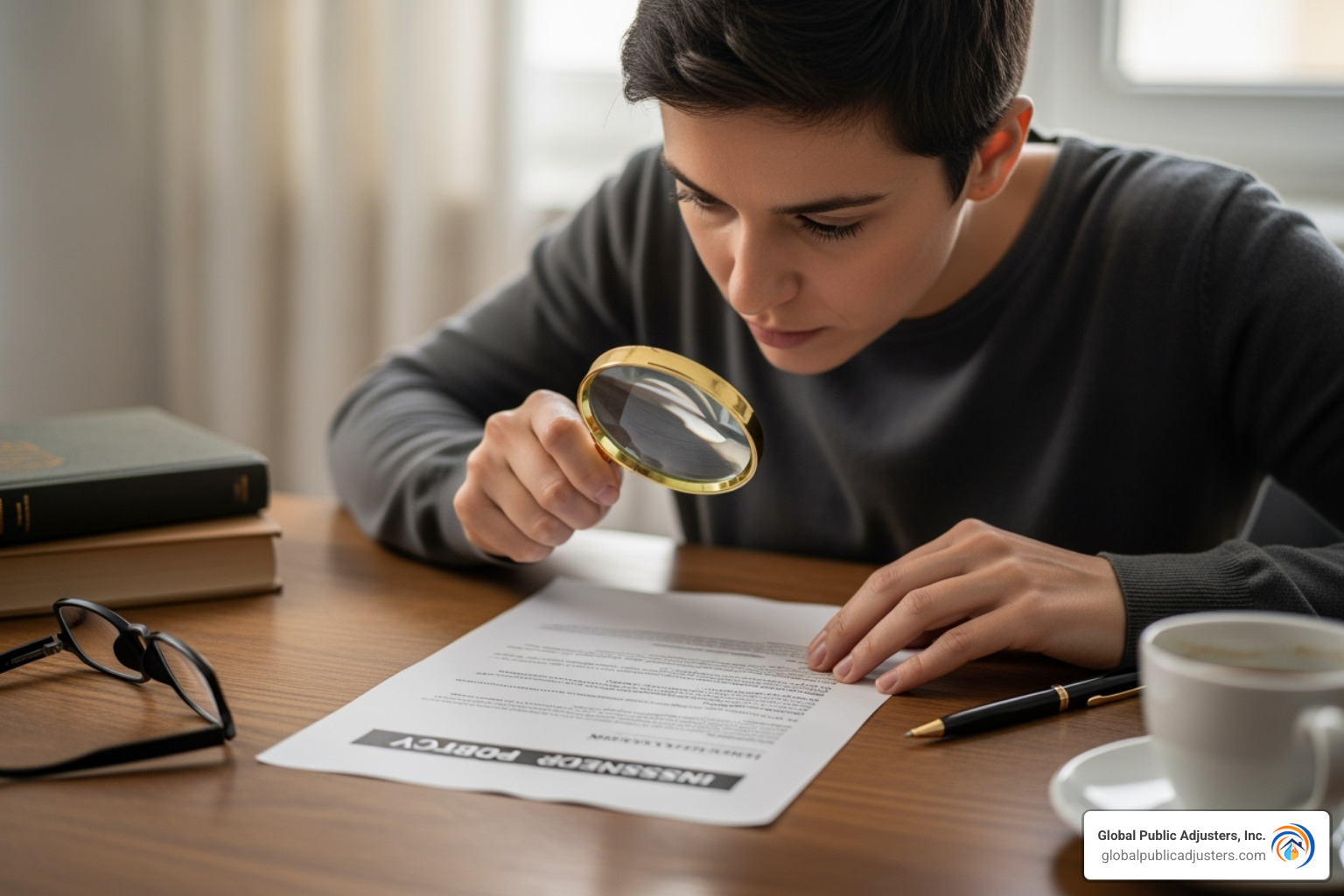

First Steps: Understanding Why Your Claim Was Denied

Receiving a denial letter is stressful, butfighting a denied insurance claimstarts with understanding exactly why they said no. Think of it as detective work: you need to gather clues before building your case.

Insurance companies deny claims for many reasons. The most common includepolicy exclusions(your situation isn’t covered),missed deadlinesfor filing, orinsufficient documentation. Other reasons might be undisclosedpre-existing conditions, failure to meetpolicyholder duties(like reporting the claim promptly), or the event not meeting the definition of a“covered loss.”

AsExperian points out, understanding the denial reason is a crucial first step for any type of insurance.

Decoding Your Denial Letter

Your denial letter is a legal document that must explain the decision clearly. Look for theinsurer’s specific reasonand anyquoted policy clausesthey use to justify it. Vague language like “not covered under your policy” without specifics is a red flag. If the reasoning is unclear,request clarification in writing. This creates a paper trail and forces the insurer to be more specific, which is invaluable for an appeal.

Reviewing Your Insurance Policy

Next, dive into your insurance policy—it’s your contract with the insurer. Start by checking yourcoverage limits, the maximum amount your policy will pay. Then, focus onexclusions and limitations, which state what isn’t covered. For example, many policies exclude flood damage unless you have separate coverage, as explained inour guide on property insurance claim denials.

Also, review yourpolicyholder duties, such as reporting claims promptly and protecting property from further damage. Finally, check the definition of a“covered loss.”Cross-reference the denial letter with your policy language. If you find a discrepancy in their interpretation, you have the foundation for a strong appeal.

Your Step-by-Step Guide to Fighting a Denied Insurance Claim

Fighting a denied insurance claimrequires a patient, organized, and strategic approach. Think of it as building a case piece by piece. Insurers have procedures they must follow, and understanding them gives you an advantage. Stay organized, communicate professionally, and don’t give up after the first “no.”

Step 1: Gather All Relevant Information

Every piece of evidence strengthens your position. Collect the following:

- Denial letter and original insurance policy: These are your primary documents.

- Photographs and videos of damage: Visual evidence is powerful.

- Repair estimates and contractor quotes: These provide concrete dollar amounts to counter lowball offers.

- Police or fire reports and witness statements: These neutral, third-party documents carry weight.

- All correspondence with your insurer: Emails, letters, and call notes create a timeline and can reveal inconsistencies. As our guide on5 Steps to Successfully File a Fire Damage Claim with Global Public Adjusteremphasizes, documentation is critical.

- Receipts for emergency repairs or temporary living expenses: These show you acted responsibly.

Step 2: Craft a Formal Appeal Letter

Your appeal letter should be professional and factual.

- Start by stating you are appealing the denial, including yourpolicy and claim numbers.

- Address each point from the denial letter, using facts and evidence to counter their reasoning.

- Reference specific policy sectionsthat support your claim. Explain why your interpretation of a clause is more accurate.

- Clearly state your desired resolution, such as, “I request that you reverse your denial and pay the full amount of my claim.”

- Send everything via certified mailwith a return receipt and keep copies for your records.

Step 3: Steer Communication with the Insurer

After submitting your appeal, stay proactive.

- Keep detailed records of every conversation: Note the date, time, person you spoke with, and what was discussed. Follow up with a confirmation email.

- Escalate to a supervisorif your initial contact is unhelpful. Be polite but persistent.

- File a complaint with yourstate insurance departmentif internal appeals fail. This is a free process that can get an insurer’s attention. Our article onThe Best Way to Deal with an Insurance Adjuster After a House Fireoffers more strategies.

Stay professional, even when frustrated.Fighting a denied insurance claimtakes time, but persistence often pays off. The insurance company is counting on you to give up—prove them wrong.

Appealing Your Denied Insurance Claim: Maximizing Your Chances

The internal appeal is your primary way to challenge a denial directly with your insurer. A strategic approach with solid documentation can dramatically improve your odds, as many claims are overturned at this stage. The appeal process gives the insurer a chance to correct mistakes, so don’t be discouraged by an initial denial.

The Internal Appeal Process

When you appeal, your claim is typically reviewed by a new team. This fresh perspective is an advantage, especially with new evidence.

- Benefits: Appealing is cost-effective and can lead to a faster resolution than other options.

- Drawbacks: The process can take weeks or months, and since it’s internal, the insurer’s interests still come first. Navigating policy language can also be challenging.

- Timeline: Varies by state and insurer but often ranges from 30 to 60 days.

- Best-case Scenarios: Appeals work well for fixing clerical errors, providing new evidence, or clarifying misunderstood policy terms.

A key advantage is theability to provide new evidence. Additional estimates or reports can be the deciding factor in reversing a denial.

When to Seek Further Help with Your Denied Insurance Claim

Whilefighting a denied insurance claimon your own is possible, professional help is invaluable for complex or high-value claims, or if your insurer is acting unreasonably.

| Criteria | Self-Advocacy | Working with a Public Adjuster |

|---|---|---|

| Cost | Primarily your time and effort | Contingency fee (percentage of settlement) |

| Timeline | Can be protracted, dependent on your availability and expertise | Often more efficient due to expertise and established processes |

| Complexity | High, requires deep understanding of policy and claim process | Low for policyholder, handled by expert |

| Potential Outcome | Variable, dependent on individual effort and insurer’s willingness | Often maximized settlement due to expert negotiation and valuation |

| Professional Help Needed | None (initially) | Full claim management and advocacy |

Sometimes, an insurer’s actions cross into“bad faith”—unreasonably denying a valid claim, failing to investigate, or delaying payment. According to theInsurance Information Institute, insurers have a duty to handle claims fairly. If they act in bad faith, you may be entitled toadditional compensationbeyond your policy benefits.

Consider professional help for large claims, complex damage, or suspected bad faith. A public adjuster works exclusively for you, using their expertise to maximize your settlement while you focus on recovery.

When to Call for Professional Help

If your best efforts to appeal are met with resistance, or the process feels overwhelming, it’s time to consider professional help. Understanding the different types of adjusters is crucial.

- Company adjusterswork for and are loyal to your insurance company.

- Independent adjustersare contractors hired by the insurance company.

- Public adjusterswork exclusively foryou, the policyholder. Their only job is to fight for your best interests.

Expert representation can be a game-changer whenfighting a denied insurance claim. It levels the playing field against a large corporation. At Global Public Adjusters, Inc., our 50+ years of experience in Orlando and across Florida have shown us how much difference professional advocacy makes, especially for complex or high-stakes claims.

The Role of a Public Adjuster

When you’refighting a denied insurance claim, a public adjuster is your dedicated champion.

- We become your voice, handling all communication with the insurer and decoding policy language.

- We manage the paperwork, freeing you to focus on recovery.

- We find damage others miss, as we’re trained to find all covered damage, not minimize the claim.

- We are negotiation specialists, countering the insurance company’s tactics to pay as little as possible.

- Our fees align with your success. We work on a contingency basis, meaning we only get paid if you do. This motivates us to maximize your settlement.

As we explain inWhat Can a Public Adjuster Do for Me?, we provide professional expertise and personal advocacy. You don’t have to fight a powerful insurance company alone.

Frequently Asked Questions about Fighting a Denied Insurance Claim

Whenfighting a denied insurance claim, many policyholders have the same pressing questions. Here are straight answers to the most common concerns.

How long do I have to file an appeal?

Time is critical. Your policy likely specifies a deadline to challenge a denial, often just30 to 60 days. This is a hard deadline you cannot miss. While state laws provide a longer statute of limitations (e.g.,four yearsfor property damage in Florida), your policy’s shorter deadline usually takes precedence. The golden rule is to act immediately. Waiting weakens your position, as evidence can be lost and memories fade. Check your policy for sections on “appeals” or “disputes” and assume you have less time than you think.

What is an insurance company’s “bad faith”?

Bad faith is a serious legal concept where an insurer breaks its promise to treat you fairly. It occurs when an insurerknowingly denies a valid claim, fails to investigate properly, or uses unreasonable delays hoping you’ll give up. Red flags include refusing to give clear reasons for denial, misrepresenting your coverage, or offering a settlement far below your actual damages. If an insurer acts in bad faith, they may owe you more than the original claim amount, including interest or other damages. Documenting every interaction is crucial evidence.

Can I reopen a claim that has been closed?

Yes,closed claims can often be reopened, especially with good reason. The most common cause is the findy ofnew damagethat wasn’t apparent initially, like mold found weeks after a water leak.Fresh evidence, such as an expert report contradicting the insurer’s assessment, can also justify reopening a claim. The process typically requires a formal written notice to your insurer with all supporting evidence. Time limits still apply, so act quickly on new information. A public adjuster can be invaluable in navigating this process and presenting your case effectively.

From Frustration to Fair Settlement

Fighting a denied insurance claimdoesn’t have to end in defeat. A denial is the start of a negotiation, not the final verdict. You are now armed with a clear strategy to decode denial letters, review your policy, and gather evidence to build a strong appeal.

You have real rights as a policyholder.Your insurance policy is a binding contract. You’ve paid your premiums, and you have the right to hold your insurer accountable. Insurance companies count on policyholders giving up after the first “no.” Your persistence and strategic approach can turn the tables.

Sometimes, however, even the most determined policyholder needs backup. That’s where professional advocacy from Global Public Adjusters, Inc. makes the difference. For over 50 years, we’ve turned denied claims into fair settlements by countering every insurance company tactic. We handle the paperwork, calls, and negotiations so you can focus on recovery.

Take control of your claim today.Don’t let a denial steal your peace of mind. Our team in Orlando, FL, and across Florida is ready to stand in your corner.Learn how to reverse a denied property claim by working with a public adjusterand see how expert advocacy strengthens your position. Every successful appeal begins with refusing to accept “no” as the final answer. Your fair settlement is waiting.