Commercial Property Insurance Claim: 7 Powerful Steps 2025

Why Filing Your Commercial Property Insurance Claim Correctly Matters

When disaster strikes your business, knowing how to file acommercial property insurance claimproperly can mean the difference between a fair settlement and financial devastation. Most business owners are unprepared for the complex process ahead.

Quick Overview: Commercial Property Insurance Claims Process

- Secure safety– Protect people and prevent further damage

- Notify insurer immediately– Most policies have strict time limits

- Document everything– Photos, videos, receipts, and detailed notes

- Work with adjuster– Present evidence and walk through damage

- Review settlement– Negotiate if offer seems inadequate

- Complete repairs– Keep all receipts for final payment

About 20% of all commercial property insurance claims are related to theft, while weather damage affects countless businesses. A single claim can increase your premiums by up to 20%, and costs compound quickly.

The burden of proof lies entirely with you, the policyholder. Insurance companies are legally bound to process claims timely, but they’re also looking for ways to minimize payouts. Without proper documentation and understanding of the process, even legitimate claims can be denied or severely underpaid.

Commercial property insurance claimterms to know:

–commercial insurance claim adjuster

–commercial insurance claims attorney

–commercial roof insurance claims

Understanding the Coverage Before Disaster Strikes

Your commercial property insurance policy is your business’s safety net – but only if you know exactly what it covers before you need it. Too many business owners find coverage gaps at the worst possible moment: right after filing acommercial property insurance claim.

Your policy likely covers direct physical damage from “covered perils” including fire, lightning, windstorm, hail, explosion, vandalism, and theft. Standard policies typically exclude floods, earthquakes, war, nuclear hazards, and intentional acts.

Business interruption coveragereimburses lost profits, keeps your payroll covered, and handles ongoing expenses like rent and utilities while you rebuild.

The choice between“open perils”and“named perils”policies can make or break your claim. Open perils coverage protects against everything except what’s specifically excluded. Named perils only covers losses from a specific list of causes.

Watch out forcoinsurance clauses– if you insure your property for less than the required percentage of its replacement value (typically 80-90%), you’ll face a coinsurance penalty that reduces your claim payment.

Business owners typically pay around $1,605 annually for commercial property insurance. Considering that theft alone accounts for about 20% of all commercial property insurance claims, adequate coverage is essential. For specific fire risk information, check outThe Many Dangers of Fire That Small Businesses Can Face.

Main Types of Commercial Property Coverage

Building coverageprotects your physical structure.Business Personal Property (BPP)covers furniture, equipment, inventory, and supplies.Equipment coveragehandles machinery, computers, and specialized tools.Stock and inventory coverageprotects raw materials and finished goods.

Civil authority coveragehelps when government orders prevent access to your building due to nearby damage.Inland marine coverageprotects property while traveling.Ordinance or law coveragepays extra costs to rebuild according to current building codes.

For comprehensive assistance with claims involving any of these coverage types, exploreour servicesto understand how professional help can maximize your recovery.

Risk-Reduction & Documentation Prep

Smart business owners prepare for potentialcommercial property insurance claimsbefore disaster strikes. Regular safety inspections should be routine – test fire protection systems, burglar alarms, and sprinkler systems regularly.

Photo and video inventorydocumentation is crucial during claims. Update it annually, documenting serial numbers, purchase dates, and current condition. Store this documentation off-site or in cloud storage.

Maintenance logsprove you’ve been a responsible property owner and can be crucial when insurers investigate whether damage resulted from covered perils or neglect.Alarm systemsdeter theft while potentially reducing insurance premiums.

For businesses in severe weather areas, seeHow To Shelter Your Small Business From Wind Damagefor specific preparation strategies.

Step-by-Step Commercial Property Insurance Claim Filing Process

When disaster strikes your business, the first few hours and days are critical for protecting both your immediate safety and your long-term financial recovery. Thecommercial property insurance claimprocess follows a specific sequence that, when handled correctly, maximizes your settlement and minimizes delays.

The key is acting quickly while staying organized. Every step you take can affect your claim’s outcome. Insurance policies typically require immediate notice of loss, and failing to meet these deadlines can result in claim denial.

For businesses in the Orlando area, our team specializes inCommercial Insurance Claims Orlandoand can guide you through this complex process.

1. Secure People & Property

When disaster hits your business,your first priority is always keeping people safe. Before you think about yourcommercial property insurance claim, ensure all employees, customers, and visitors are accounted for and out of harm’s way.

Once everyone is safe, takeemergency shutdown proceduresto prevent further damage. This might mean shutting off electricity if water is pouring through your roof, turning off gas lines after an explosion, or boarding up broken windows.

Don’t skip the police report– even if the damage seems straightforward. That official police report becomes crucial evidence for your insurance claim, especially for theft, vandalism, or criminal activity.

Your insurance policyrequires you to make temporary repairsto prevent further damage. Cover broken windows with plywood, throw tarps over damaged roofing, and pump out standing water. These are emergency measures only – don’t start permanent repairs until your adjuster inspects everything.

Keep every single receiptfrom your emergency response. Tarps, plywood, water pumps, and emergency contractor services are typically reimbursable under your policy. Take photos before and after temporary repairs to document both the original damage and your responsible actions.

2. Notify Insurer & Broker-Agent

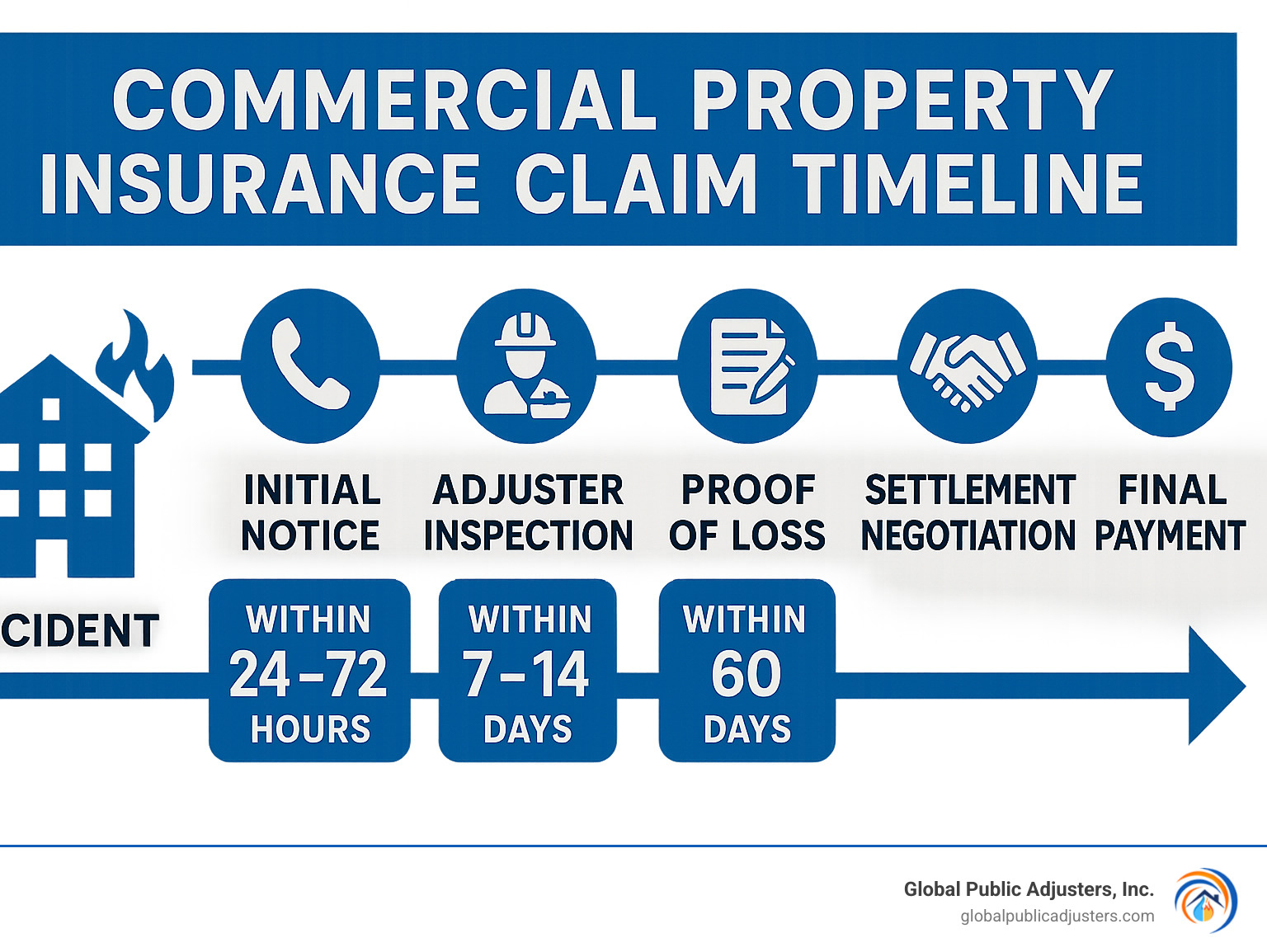

When you find damage to your business, the clock starts ticking immediately. Mostcommercial property insurance claimpolicies require “immediate” or “prompt” notice – typically 24-72 hours to report your loss.

Don’t wait until morning, Monday, or business hours. Call your insurance company’s 24-hour claims hotline right away.Gather your policy numberbefore calling, along with basic details about your business location, when you found the damage, and what caused it.

The insurance company will assign you aclaim numberduring this initial call. Write it down – you’ll need to reference this number in every future conversation and document.

Multiple coverage typesmight apply to a single incident. That kitchen fire could trigger building coverage, business personal property coverage, business interruption coverage, and civil authority coverage.

Contact both your insurance company and your broker or agent. Your broker knows your policy and can advocate throughout the process. Ask for your adjuster’s contact information and expected timeline for inspection.

Time limits aren’t suggestions– they’re strict policy requirements. Late reporting is one of the most common reasons for claim denials.

3. Document Everything

This is where yourcommercial property insurance claimcan make or break your financial recovery. Think of documentation as building your case – the more thorough you are, the harder it becomes for your insurer to dispute your losses.

Start with photos and videosimmediately, before the adjuster arrives. Capture damage from every angle – wide shots showing the big picture, then zoom in on specific problems. Don’t forget to photograph undamaged areas for context.

Look beyond obvious damage. Fire might leave smoke residue in areas that look fine. Water damage often hides behind walls or under flooring.

Create detailed inventory spreadsheetslisting every damaged item – what it is, age, original cost, and current replacement cost. Include model numbers and serial numbers when possible. For businesses with extensive inventory, tackle high-value items first.

Financial recordsbecome the foundation of business interruption claims. Gather profit and loss statements, tax returns, payroll records, and anything showing how your business performed before disaster struck.

Keep a claim journalfrom day one. Write down when you found damage, weather conditions, and circumstances. Track every conversation with your insurance company – who you talked to, when, and what they said.

Don’t throw anything awayuntil your adjuster approves. If damaged items create safety hazards and must be removed, photograph them thoroughly first.

For complex property losses, working with aProperty Loss Public Adjusterensures proper documentation and maximizes your settlement.

4. Meet the Adjuster & Present Evidence

The adjuster’s inspection is where yourcommercial property insurance claimcomes to life. This is your chance to tell your story and ensure every dollar of damage gets recognized.

The scope walkinvolves examining every affected area together. Don’t let anyone rush you. Point out obvious damage first, then look for subtle issues. That lingering smoke smell? Mention it. Water stains on ceiling tiles? Show them. Equipment that looks fine but isn’t running right? Definitely bring it up.

Hidden damageis incredibly common and often the most expensive to fix. Water might have seeped behind walls, smoke could have penetrated HVAC systems, or structural damage might not be visible until contractors start working. Ask how supplemental claims work if more damage is found later.

For lost income claims,business income databecomes crucial. Be ready to explain how your business actually operates – busy seasons, slow periods, and how damage affected your most profitable services.

Third-party estimatesfrom qualified contractors carry serious weight. Get at least two detailed estimates spelling out exactly what needs repair or replacement.

Don’t hesitate toask questionsduring inspection. If something doesn’t make sense or you disagree with the adjuster’s assessment, speak up immediately. After inspection,follow up in writingwith anything you forgot to mention.

5. Review, Negotiate & Sign Off

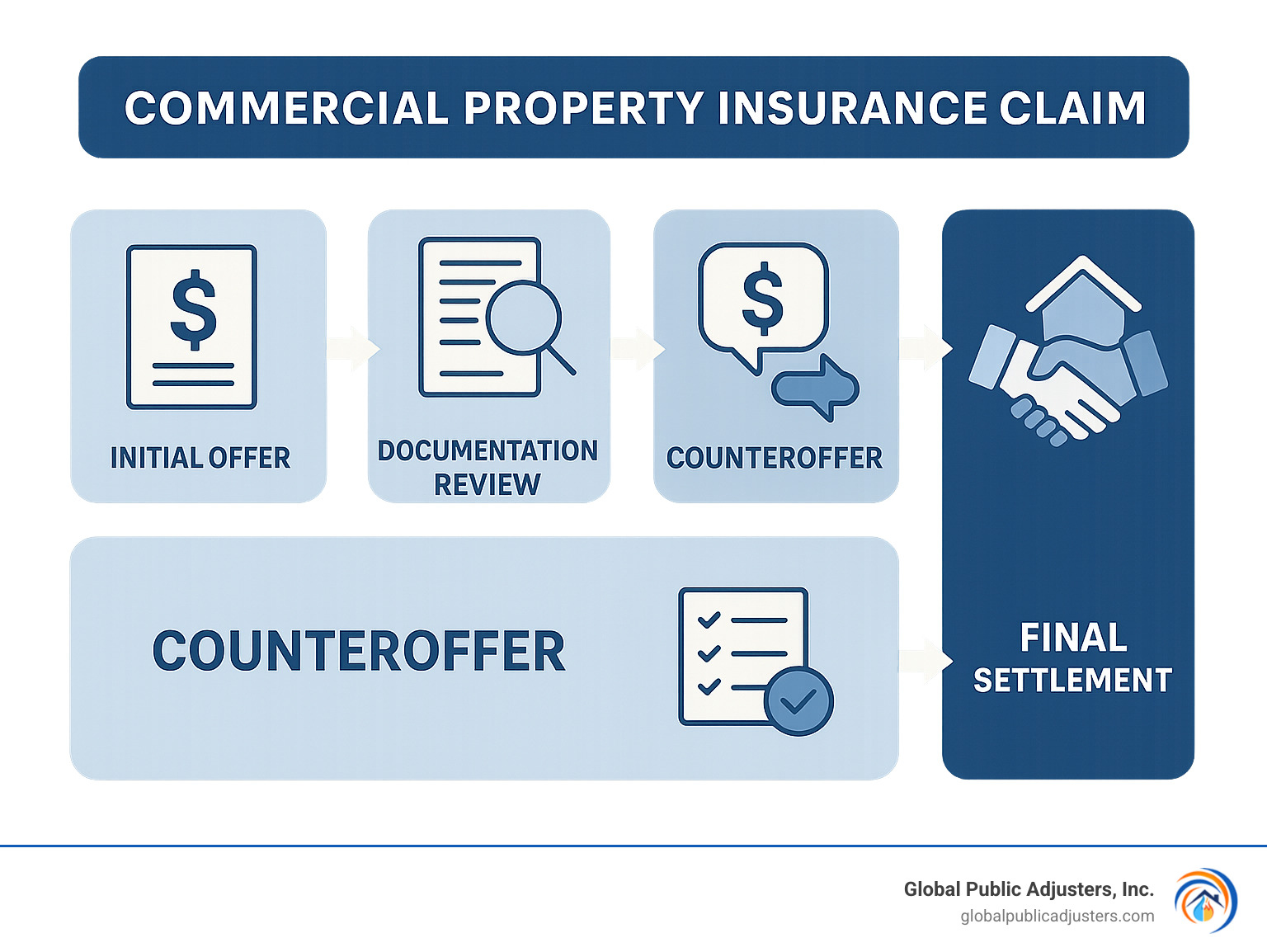

When your insurance company presents their settlement offer, remember this isn’t necessarily the end – it’s often just the beginning of negotiation. You have every right to question, challenge, and negotiate for a fair settlement.

Review your initial offerthoroughly. Compare what they’re offering against your documented losses, contractor estimates, and policy limits. Create a spreadsheet listing each damaged item, what you believe it’s worth, and what the insurer offered. Look for gaps or undervalued items.

Appraisal rightsexist in most commercial property policies for situations where you and your insurer can’t agree on loss value. You each hire an independent appraiser, and if they can’t agree, they select a neutral umpire for the final decision.

Supplemental paymentsbecome important when additional damage surfaces during repairs. Most policies allow for these supplemental payments, but you need to document additional damage thoroughly and notify your insurer promptly.

Document your positionclearly when disagreeing with their offer. Write a professional letter explaining why you believe the settlement should be higher. Attach contractor estimates, receipts, photographs, and other supporting evidence.

Sometimes the negotiation process feels overwhelming while you’re trying to rebuild your business. Professional help may be worth considering for complex claims or when you feel your insurer isn’t negotiating fairly.

Valuation, Deductibles & Getting Paid

Before that settlement check arrives, you need to understand how insurers calculate what they owe you and when you’ll see the money.

Replacement Cost Coveragepays the full cost to repair or replace damaged property with new materials of similar quality.Actual Cash Value Coveragetakes replacement cost and subtracts depreciation for age and wear.Market Value Coverageis less common but can work in your favor during certain market conditions.

Flat dollar deductiblesare straightforward – if you have a $2,500 deductible, that amount comes off your settlement.Percentage deductiblescan be shocking – a 2% deductible on a building insured for $500,000 means you pay the first $10,000.

Per-item versus per-occurrence deductiblesmake a huge difference. With per-item deductibles, you might pay $1,000 for each category of damaged property. With per-occurrence deductibles, you pay just one $1,000 deductible for the entire incident.

Claim payment schedulesrarely involve one lump sum. Most insurers pay in stages as work progresses – initial payment for damaged contents, then additional payments as contractors complete repairs.

| Coverage Type | What It Pays | Example |

|---|---|---|

| Replacement Cost | Full cost to replace with new | $50,000 roof → $50,000 payment |

| Actual Cash Value | Replacement cost minus depreciation | $50,000 roof, 50% depreciated → $25,000 payment |

| Market Value | Current market value | $50,000 roof in hot market → $55,000 payment |

Premium increasesafter claims can be expensive. A single claim can boost premiums by 20%, and multiple claims compound quickly. Sometimes it makes financial sense to pay smaller losses out of pocket rather than file claims.

When Your Commercial Property Insurance Claim Is Denied or Delayed

Claim denials and delays are unfortunately common, but they don’t necessarily mean your claim is invalid. Understanding common denial reasons and your options can help you recover deserved compensation.

Common Denial Reasonsinclude late notification, policy exclusions, inadequate documentation, suspected fraud, and claims below your deductible. Some denials are legitimate, but others may be based on incorrect policy interpretation.

Late Noticedenials can sometimes be overcome if you can show you reported as soon as reasonably possible.Exclusionsmust be clearly stated and apply specifically to your situation.Inadequate Documentationis often correctable – ask specifically what additional documentation they need.

Bad Faithoccurs when insurers unreasonably deny valid claims, fail to investigate properly, or delay payment without justification.Appeal Lettersshould be detailed, professional, and supported by evidence.

For complex property damage claims in the Orlando area, consider consulting with specialists inProperty Damage Claims Orlando.

Dispute & Appeal Options

Re-inspectionmay reveal missed damage.State Department of Insurance Complaintsprovide regulatory oversight.Public Adjusterrepresentation can level the playing field – they work exclusively for policyholders and often achieve higher settlements.

Attorney Consultationmay be necessary for high-value claims or bad faith situations.Civil Lawsuitsare typically last resort due to cost and time.Appraisal Processis often faster and less expensive than litigation for amount disputes.

When to Bring in Professional Help

High Dollar Lossestypically justify professional assistance because potential settlement increases often exceed representation costs.Complex Business Interruption Claimsrequire detailed financial analysis most business owners don’t possess.

Structural Issuesmay require engineering analysis.Insurer Stonewallingbecomes apparent when your insurer delays unreasonably or seems to be looking for denial reasons rather than payment reasons.

Our team of experiencedPublic Adjustershas handled thousands of commercial property claims and can evaluate whether professional representation would benefit your situation.

Frequently Asked Questions about Commercial Property Claims

What documents are mandatory with my initial filing?

Don’t panic if you don’t have every document ready when disaster strikes. The most important thing is toreport your claim immediately– you can submit additional paperwork later.

For your initial filing, you need yourpolicy number,basic description of what happened, and thedate and time you found the damage. Your insurance company will open a claim file with just this information.

Start gathering supporting documents quickly:police reportsfor theft or vandalism,photos and videosof damage,receipts for emergency repairs,financial recordsfor business interruption claims,contractor estimates, andinventory lists.

Most insurers give you60 days to submit formal Proof of Loss, but submitting documentation earlier speeds up the process.

How will filing affect my future premiums?

Filing acommercial property insurance claimwill likely increase your premiums, but that doesn’t mean you should avoid filing legitimate claims.

Premium increases typically range up to 20%for a single claim, taking effect at your next renewal. Multiple claims compound these increases significantly.Claim frequency matters more than claim sizeto most insurers.

Yes, premiums might increase, but paying 20% more on a $30,000 annual premium costs $6,000 per year. Compare that to paying a $100,000 property loss out of pocket – insurance claims exist to protect you from financial catastrophe.

Can I choose my own contractors instead of the insurer’s list?

Absolutely yes –you are never required to use contractors recommended by your insurance company.

Your insurer’s preferred contractors often provide guaranteed work and simplified payment arrangements. But you might prefer your own contractor for good reasons – local knowledge, verified reputation, or existing relationships.

If you choose your own contractor,get multiple written estimates,verify proper licensing and insurance, andensure they understand insurance work. The choice is entirely yours, and exercising this right often leads to better outcomes.

Conclusion

Filing acommercial property insurance claimsuccessfully requires preparation, attention to detail, and persistence. Understanding each step helps protect your business interests and maximize your recovery.

Don’t wait for disasterbefore understanding your coverage. Review your policy, understand your deductibles, and create a documentation system now.Quick action makes all the differencewhen disaster strikes – report immediately, secure your property, and start documenting everything.

You have rights as a policyholder. You can choose contractors, challenge settlement offers, and request additional inspections.Documentation is your best friendthroughout the process. Photos, videos, receipts, and detailed records create a paper trail that protects your interests.

Use claim experiences toevaluate and improve your risk management. Update property inventory, review coverage limits, and consider additional protections.

Complex claims often benefit from professional assistance, especially for business interruption calculations, structural damage assessments, or coverage disputes.

At Global Public Adjusters, Inc., we’ve spent over 50 years helping Florida business owners steer complex insurance claims and maximize settlements. Our licensed public adjusters work exclusively for policyholders – never for insurance companies.

When dealing with significantcommercial property insurance claimsin Orlando, Pensacola, or anywhere in Florida, professional representation often pays for itself many times over. Our experience frequently results in settlements substantially higher than what business owners achieve alone.

For more information about how we can help protect your business interests during the claims process, visitour services pageor contact us for a free consultation. Your business deserves every dollar your policy provides.