Flood Damage Adjuster: Maximize Your 2025 Claim

Understanding Flood Damage Adjusters: Who They Are and What They Do

AFlood damage adjusteris a licensed professional who investigates and negotiates insurance claims after a flood. They assess property damage, document losses, and determine the settlement amount. However, it’s crucial to know who they work for.

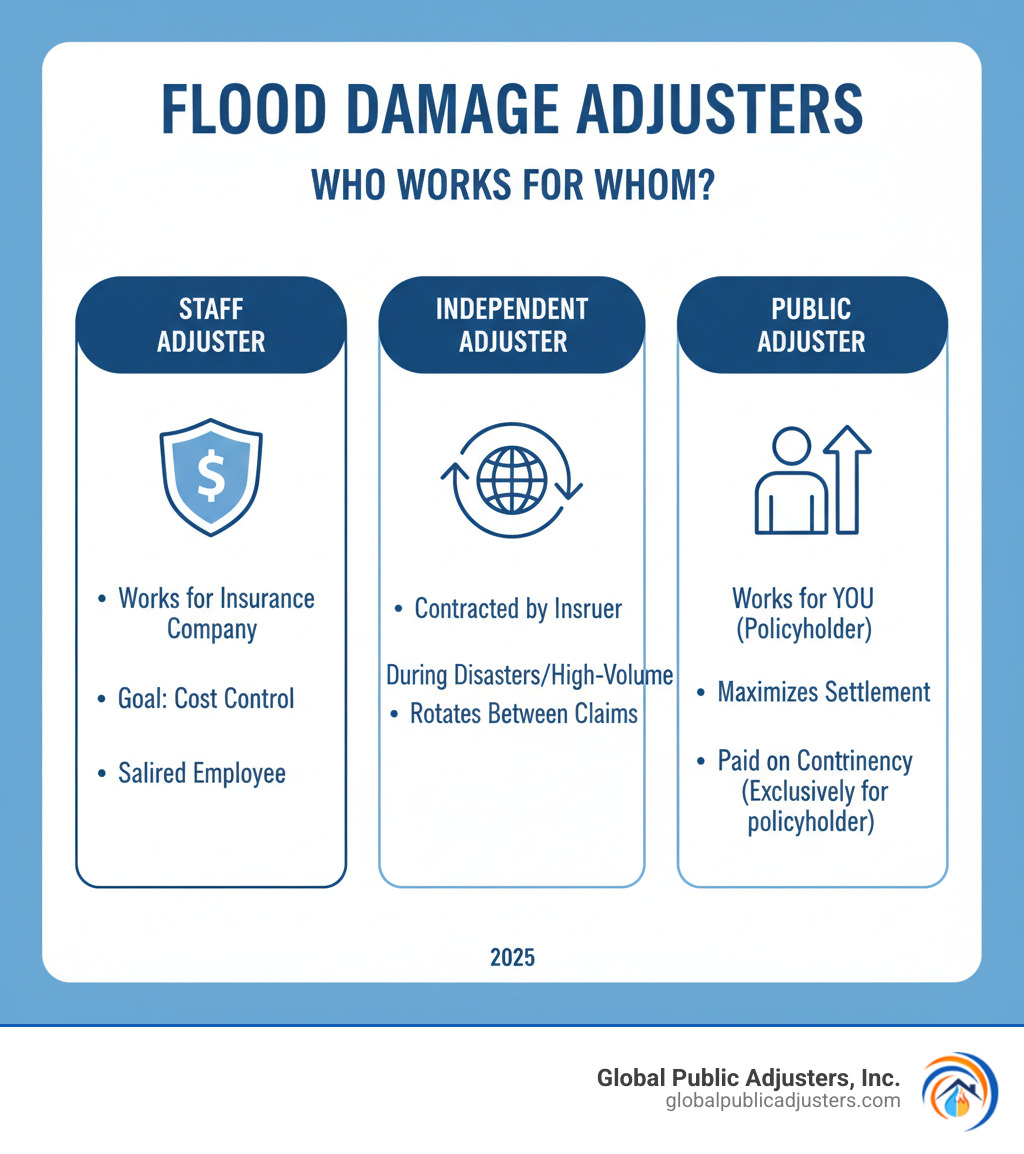

Three Types of Flood Damage Adjusters

- Staff Adjusters:Salaried employees who handle claims for their insurance company.

- Independent Adjusters:Contractors hired by insurers during high-volume disaster periods.

- Public Adjusters:Licensed professionals hired byyou, the policyholder, to advocate for your interests and maximize your settlement.

When floodwaters invade your property, you face not just physical damage but a complex insurance claims process. According to the National Flood Insurance Program (NFIP), millions of policyholders rely on flood insurance, yet many struggle to steer their claims effectively.

The adjuster handling your claim is critical to your financial recovery. They evaluate structural damage, personal property losses, and the overall scope of destruction. But here’s what many homeowners don’t realize:the adjuster sent by your insurance company works for the insurer, not for you.Their goal is often to process claims quickly and cost-effectively for their employer, which can leave you with an inadequate settlement. Understanding the different types of adjusters is the first step toward securing a fair outcome.

The Adjuster’s Role: Your Guide Through the Flood Claims Process

After a flood in Florida, aflood damage adjusteris the bridge between the devastation and the compensation your policy promises. They review your policy, assess the damage, and negotiate your settlement. For homeowners in areas like Orlando and Pensacola, understanding an adjuster’s role is key to recovery.

What is a Flood Damage Adjuster?

Aflood damage adjusteris a licensed professional who evaluates property damage from floods. They investigate the cause, determine the extent of damage, interpret your policy, and calculate repair costs.

However, not all adjusters are on your side.Insurance company adjusters(staff or independent) work for the insurer, and their loyalty lies with the company. This can lead to disagreements over the value of your claim.

In contrast,public adjusterswork exclusively for you. At Global Public Adjusters, Inc., we handle the entire claims process on your behalf—from documentation to aggressive negotiation—to maximize your settlement. With over 50 years of combined experience, we know how to steer complex flood policies. You can learnmore info about what public adjusters doon our site.

Key Responsibilities of a Flood Damage Adjuster Post-Event

After a flood, an adjuster’s work is critical. Their core responsibilities include:

- Initial Contact and Site Inspection:Promptly scheduling a visit to examine structural damage, check for hidden issues, and assess the overall situation.

- Damage Documentation:Taking detailed photos and videos to create a comprehensive record of every loss, which forms the backbone of your claim.

- Loss Quantification:Estimating repair costs, replacement values, and cleaning expenses, often using specialized software and consulting with contractors.

- Communication and Negotiation:Reporting findings to the insurer (for company adjusters) or presenting your claim and negotiating for a fair settlement (for public adjusters).

- Coordinating Emergency Measures:Guiding you on immediate steps like water extraction and drying to prevent further damage, such as mold growth.

- Gathering Documentation:Collecting all necessary paperwork, including receipts, inventories, and proof of ownership to support your claim.

A diligent adjuster sets the foundation for a strong claim, ensuring no detail is overlooked.

Assessing the Aftermath: How Adjusters Evaluate Flood Damage

Aflood damage adjusterperforms a detailed investigation to uncover both obvious and hidden problems. A thorough evaluation is what separates a fair settlement from one that leaves you paying for repairs out of pocket.

The Assessment Process Explained

An adjuster’s assessment is a systematic process:

- Visual Inspection:The adjuster walks the property, noting waterlines, buckled floors, damaged drywall, and impacts on foundations, electrical systems, and HVAC equipment.

- Technology-Assisted Detection:Since water seeps into hidden areas, adjusters usemoisture metersandthermal imaging camerasto find trapped moisture in walls and under floors. This is critical for preventingmold growth, which can begin within 24-48 hours.

- Water Categorization:The type of floodwater—clean, grey, or black—determines the cleanup process and what can be salvaged. Black water, from rivers or sewage, is the most contaminated and requires extensive remediation. Understandingsome different types of water damageis crucial.

- Estimating Repair Costs:Adjusters use specialized software to calculate labor and material costs. However, these estimates may not reflect real-world prices, especially after a widespread disaster when demand for contractors skyrockets.

- Personal Property and Business Interruption:The adjuster helps create a detailed inventory of damaged personal belongings. For businesses, they also evaluatebusiness interruptionlosses, such as lost income and continuing expenses.

Understanding NFIP Substantial Damage Criteria

For properties covered by the National Flood Insurance Program (NFIP), adjusters must determine if the building hassubstantial damage. This occurs when the cost to repair the structure equals or exceeds50% of its pre-flood market value(the “50% rule”).

This designation is critical because it triggers local floodplain management ordinances, which may require you to lift, floodproof, or even relocate your building. These mandates can add tens of thousands to your rebuilding costs.

Fortunately, NFIP policies includeIncreased Cost of Compliance (ICC)coverage, providing up to $30,000 to help pay for these required mitigation measures. NFIP-authorized adjusters follow specific guidelines outlined in theAdjuster Preliminary Damage Assessment Overviewand theofficial NFIP claims manual.

Understanding these complex NFIP regulations is essential for Florida homeowners. At Global Public Adjusters, Inc., we have over 50 years of experience navigating these rules to maximize our clients’ recovery.

Navigating the Claim: The Role of a Flood Damage Adjuster in Your Settlement

After the assessment, yourflood damage adjustershifts from investigator to strategist, guiding you through insurance negotiations. This phase is about building a strong case to prove your losses and secure the funds needed to rebuild. A skilled adjuster knows how to present this case in a way insurers can’t easily dismiss.

Crucial Documentation for Your Claim

A claim is only as strong as its supporting evidence. Aflood damage adjusterwill stress the importance of gathering the following:

- Notice of Loss:The initial notification to your insurer that starts the claim process.

- Proof of Loss Form:Your formal, sworn statement detailing your claim, as required by the NFIP Claims Handbook.

- Photos and Videos:Document everything before cleaning up, capturing both wide shots and close-ups of all damage.

- Detailed Inventory of Damaged Items:List each item with its age, original cost, and replacement cost. Pre-flood home inventories are invaluable.

- Receipts for Temporary Repairs:Keep records of all expenses for emergency measures like tarps or fans.

- Repair Estimates:Get multiple estimates from licensed contractors to counter the insurer’s potentially low figures.

If you’re in Orlando and need help, our team can provideAssistance with your Flood Damage Claim in Orlando.

The Negotiation and Settlement Timeline

Flood claims take time, especially after a major disaster. Here are the typical steps:

- Filing the Claim:You submit your Notice of Loss, and the insurer assigns an adjuster.

- Adjuster Inspection:The company adjuster inspects your property. Be present to point out all damage.

- Initial Settlement Offer:The insurer will make an offer, which may be an advance payment. These initial offers are often far lower than what you deserve.

- Negotiation:This is where a public adjuster is invaluable. We review the offer, identify discrepancies, and present a detailed counter-offer backed by evidence. This back-and-forth can take weeks or months.

- Final Settlement:Once an agreement is reached, the claim is settled. If negotiations fail, you have options like appraisal or filing an appeal with FEMA for NFIP policies. The NFIP Claims Handbook requires appeals within 60 days of a denial.

Common delays include claim backlogs after disasters and disputes over the cause of damage. A public adjuster acts as your advocate, pushing for the maximum your policy allows because we work for you.

Public vs. Insurance Adjuster: Understanding Who Works for You

When your property is flooded, the adjuster who arrives may seem helpful, but it’s critical to understand whose interests they represent.Not all adjusters work for you.The person your insurance company sends is working for them, and this distinction can mean the difference between a fair settlement and a financial shortfall.

| Feature | Insurance Company Adjuster (Staff or Independent) | Public Adjuster |

|---|---|---|

| Who they work for | The insurance company | The policyholder (you) |

| Primary Goal | To assess damage and settle the claim for the insurance company, often minimizing payout to protect company profits | To advocate for the policyholder, maximizing the settlement amount to fully cover their losses |

| How they are paid | Salary or fee paid by the insurance company | Percentage of the final settlement (contingency fee), paid only if you receive a settlement |

| Who benefits | The insurance company (by limiting payouts) | The policyholder (by receiving a fair and maximized settlement) |

The Insurance Company’s Adjuster

Aflood damage adjustersent by your insurer works for the insurance company. This creates an inherent conflict of interest. Their job is to protect the company’s bottom line by closing claims efficiently and cost-effectively.

This can result in outdated software being used for repair estimates, which fails to reflect real-world costs, especially after a disaster. During widespread events, these adjusters are often overwhelmed with cases, giving your claim minimal attention. The pressure to minimize settlements is a reality of their job. To learn more, see our guide on7 Types of Claims Adjusters and Their Duties in Florida.

When to Hire a Public Flood Damage Adjuster

Hiring your ownflood damage adjuster—a public adjuster—can dramatically change your outcome. Consider hiring one in these situations:

- The damage is complex or hidden.Public adjusters use advanced tools and expertise to find damage that company adjusters often miss, like moisture in wall cavities or potential mold growth.

- You have a large loss claim.For claims of $50,000 or more, the financial stakes are too high to rely on an adjuster working for the other side.

- Your claim was denied or underpaid.We specialize in overturning denials and renegotiating lowball offers. Don’t accept an unfair settlement. Learn more abouthandling an underpaid claim.

- You lack the time or expertise.The claims process is overwhelming and time-consuming. A public adjuster handles the paperwork, phone calls, and negotiations so you can focus on recovery.

- You feel overwhelmed.The emotional toll of a flood is immense. An advocate can provide peace of mind by managing the stressful insurance battle for you.

- There are disputes over the cause of damage.We provide the technical expertise to counter insurer arguments about whether damage was caused by wind, flood, or pre-existing conditions.

The best time to hire a public adjuster is right away, but it’s never too late to get help. Check out theseReasons to hire a public adjuster right away. Our fee is a percentage of your settlement, so we only get paid if you do.

Frequently Asked Questions about Flood Damage Claims

Navigating a flood damage claim raises many questions. Here are answers to some of the most common ones we hear from Florida policyholders.

What are the most common challenges policyholders face with flood claims?

Policyholders often face several frustrating problems:

- Lowball Offers:Initial settlements are frequently too low because insurers use outdated cost data or overlook hidden damage.

- Coverage Disputes:Insurers may argue about the cause of damage (e.g., flood vs. wind-driven rain) to limit what’s covered.

- Communication Delays:After a widespread disaster, adjusters are overwhelmed, leading to long waits for responses while damage worsens.

- Complex Policy Language:Confusing terms like “substantial damage” or “actual cash value” can cause policyholders to unknowingly accept less than they’re owed.

- Proving the Loss:Documenting every damaged item is an exhausting but necessary task that many struggle with while dealing with the flood’s aftermath.

A publicflood damage adjusteris equipped to handle these challenges on your behalf.

Does my standard homeowner’s policy cover flood damage?

No, a standard homeowner’s policy almost never covers flood damage.Flood damage is defined as water entering your home from an outside source, like rising rivers, storm surge, or heavy rainfall. This requires a separate flood insurance policy.

Most flood insurance is provided through the government’sNational Flood Insurance Program (NFIP), thoughprivate flood insuranceis also available. A homeowner’s policy typically only covers water damage from internal sources, like a burst pipe. This distinction is critical; learn more byUnderstanding different types of water damage. For Florida residents, a dedicated flood policy is essential protection.

What if I disagree with the insurance company’s settlement offer?

You are not stuck with an inadequate offer. You have several options:

- Request an Additional Payment:If you find more damage or get higher contractor estimates, you can submit this new evidence to the insurer.

- Invoke the Appraisal Clause:If you disagree on the amount of loss, both sides can hire an appraiser and a neutral umpire to reach a binding decision.

- File a FEMA Appeal (for NFIP claims):You have 60 days from a denial to appeal directly to FEMA for an independent review.

- Hire a Public Flood Damage Adjuster:This is often the most effective step. We conduct our own assessment and renegotiate with the insurer from a position of strength. We have a long track record of overturning denials and significantly increasing settlements. Learn more aboutHow to handle an underpaid claim.

- Consult an Attorney:A lawsuit is a final option, but the NFIP requires it to be filed within one year of a written denial.

You have rights as a policyholder. Don’t settle for less than you deserve.

Maximize Your Recovery and Rebuild with Confidence

Recovering from a flood is devastating, and the insurance claims process that follows can feel just as overwhelming. But you don’t have to face it alone.

This guide has shown the vital role aflood damage adjusterplays in your recovery and the critical difference between an adjuster who works for the insurance company and one who works for you. The most important lesson is thatnot all adjusters are on your side.The insurer’s adjuster is tasked with minimizing payouts, which can leave you with a settlement that falls thousands short of what you need.

Expert advocacy from a public adjuster changes everything. We work exclusively for you, fighting to document every loss, challenge inadequate offers, and negotiate a settlement that truly covers your damages. It’s about ensuring you receive everything your policy owes you.

At Global Public Adjusters, Inc., we have over 50 years of experience helping homeowners and businesses in Orlando, Pensacola, and across Florida. We handle the entire claims process—from inspection to final settlement—so you can focus on rebuilding. We find hidden damage, challenge lowball offers, and don’t get paid unless you do.

Don’t wait for the insurance company to tell you what your claim is worth. Let our experienced team fight for the fair compensation you deserve. Your recovery is too important to leave to chance.Get help with your Orlando property damage claim today.