Underpaid insurance claim: 4 Steps to Win!

Why Underpaid Insurance Claims Are More Common Than You Think

Underpaid insurance claimsettlements leave property owners struggling to cover repair costs. When you file a claim, you expect fair compensation, but many receive settlement offers that fall drastically short of the actual costs.

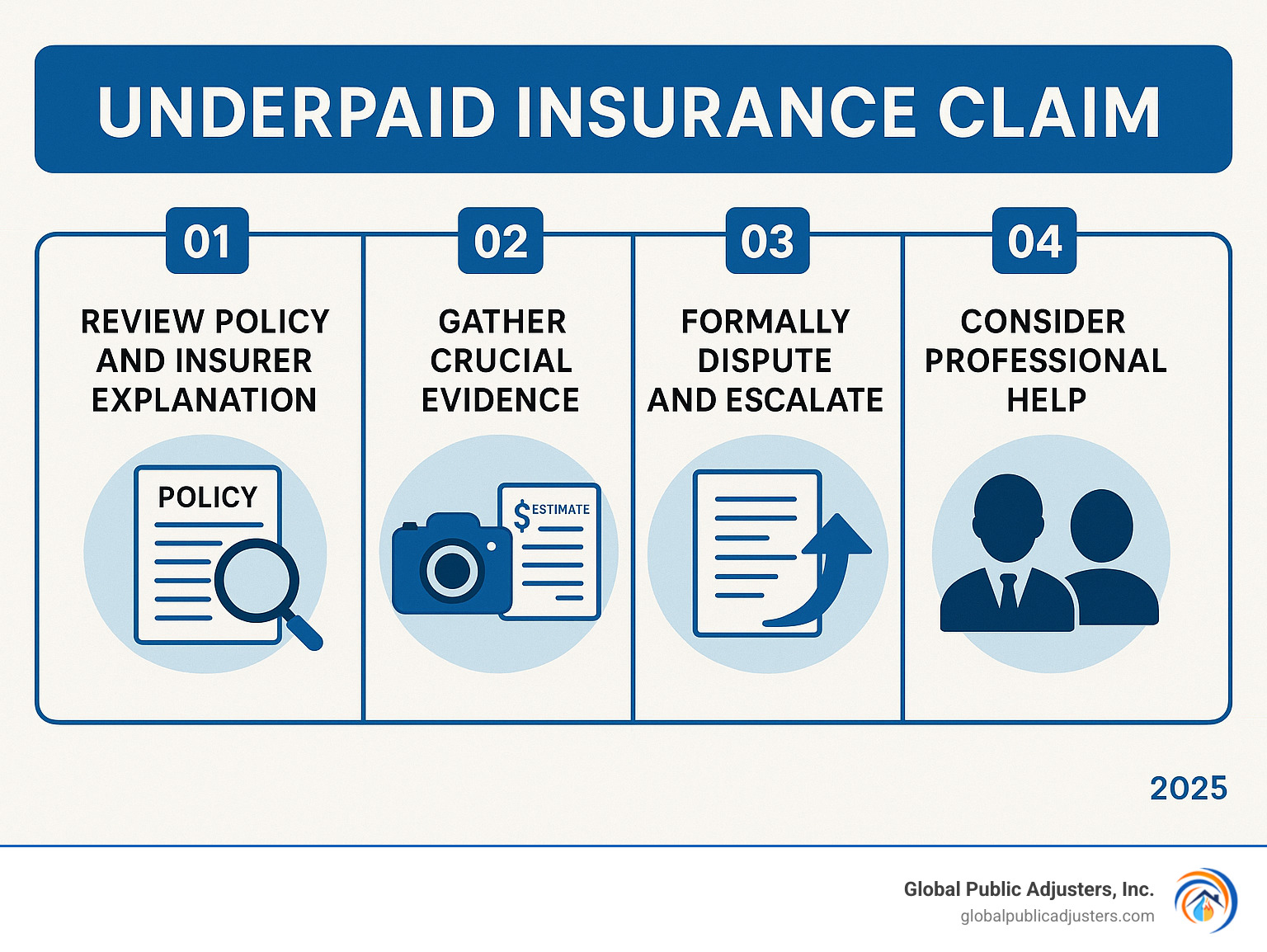

Quick Answer: What to Do About an Underpaid Insurance Claim

- Reviewyour policy and request a detailed explanation of the settlement.

- Gather evidenceincluding independent repair estimates and documentation.

- Dispute formallythrough your insurance company’s appeals process.

- Consider professional helpfrom a licensed public adjuster.

- Know your rightsunder Florida’s insurance laws.

Research shows thatunderpayment of insurance claims occurs five to ten percent more often than wrongful denials. Insurance companies are for-profit businesses that save money by offering low settlements, counting on policyholders to accept inadequate offers rather than fighting for what they’re owed.

“When your home suffers damage, you trust your homeowners insurance to provide the financial support needed to repair and recover. Unfortunately, insurance companies don’t always uphold their promises,”notes one insurance law expert.

The good news is that you have options. This guide will show you how to challenge an underpaid settlement and get the compensation you deserve.

Why Insurance Companies Underpay Claims and How to Spot It

When a settlement check feels too small, it’s usually not personal.Insurance companies are businesses focused on profit, and every dollar they don’t pay out improves their bottom line. This creates a conflict of interest where they aim to minimize payouts while you need fair compensation.

One common tool iscomplex policy language. Policies can be over 80 pages long, filled with jargon and modified by specialforms called “endorsements”. They also usedepreciation tactics, applying it unreasonably or attributing clear damage to “normal wear and tear.” Sometimes, the issue is simpleadjuster error or inexperience, where an overworked adjuster rushes an inspection and misses hidden damage.

For proven strategies to fight back, explore our comprehensive guide on Tips for Handling Underpaid Claims Effectively.

Common Reasons for Underpayment

- Actual Cash Value (ACV) vs. Replacement Cost (RCV):ACV is replacement cost minus depreciation. RCV policies should pay for new replacements, but insurers often pay ACV first, hoping you won’t pursue the rest.

- Disputed Cause of Damage:Insurers may claim damage came from a non-covered event (e.g., a slow leak) instead of a covered one (a burst pipe).

- Policy Exclusions:Policies exclude many events, and companies interpret these exclusions broadly to deny or reduce payments.

- Undervaluing Repair Costs:Adjusters may use outdated pricing, miss the full scope of damage, or ignore regional cost differences.

Red Flags: Signs Your Claim Was Underpaid

- Lowball Estimates:Your insurer’s estimate is significantly lower than quotes from local contractors.

- Rushed Inspections:The adjuster spends very little time assessing extensive damage.

- Vague Explanations:The insurer can’t clearly justify their low settlement amount.

- Pressure to Accept:You’re pushed to accept an offer quickly, often framed as a “final offer.”

- Poor Communication:The adjuster is unresponsive, dismissive, or causes unreasonable delays.

Your Step-by-Step Action Plan to Dispute an Underpaid Insurance Claim

When your insurance company’s settlement offer won’t cover your repairs, you have the right to challenge it. Insurers often count on you accepting their first offer, but a structured dispute can lead to a fair settlement.

Step 1: Review Your Policy and the Insurer’s Explanation

Your insurance policy is your contract. Start with thepolicy declaration pagefor a summary of your coverage limits and deductibles. Then, review the policy details, paying close attention to endorsements and exclusions.

Crucially,request a detailed written explanation for the settlement amountfrom your insurer. This document should break down their calculations, including how they valued items, what depreciation they applied, and why certain damages were not covered. This step alone often reveals errors you can challenge. For more detailed guidance, check out our guide on What if the Insurance Company Underpaid My Claim?.

Step 2: Gather Crucial Evidence to Build Your Case

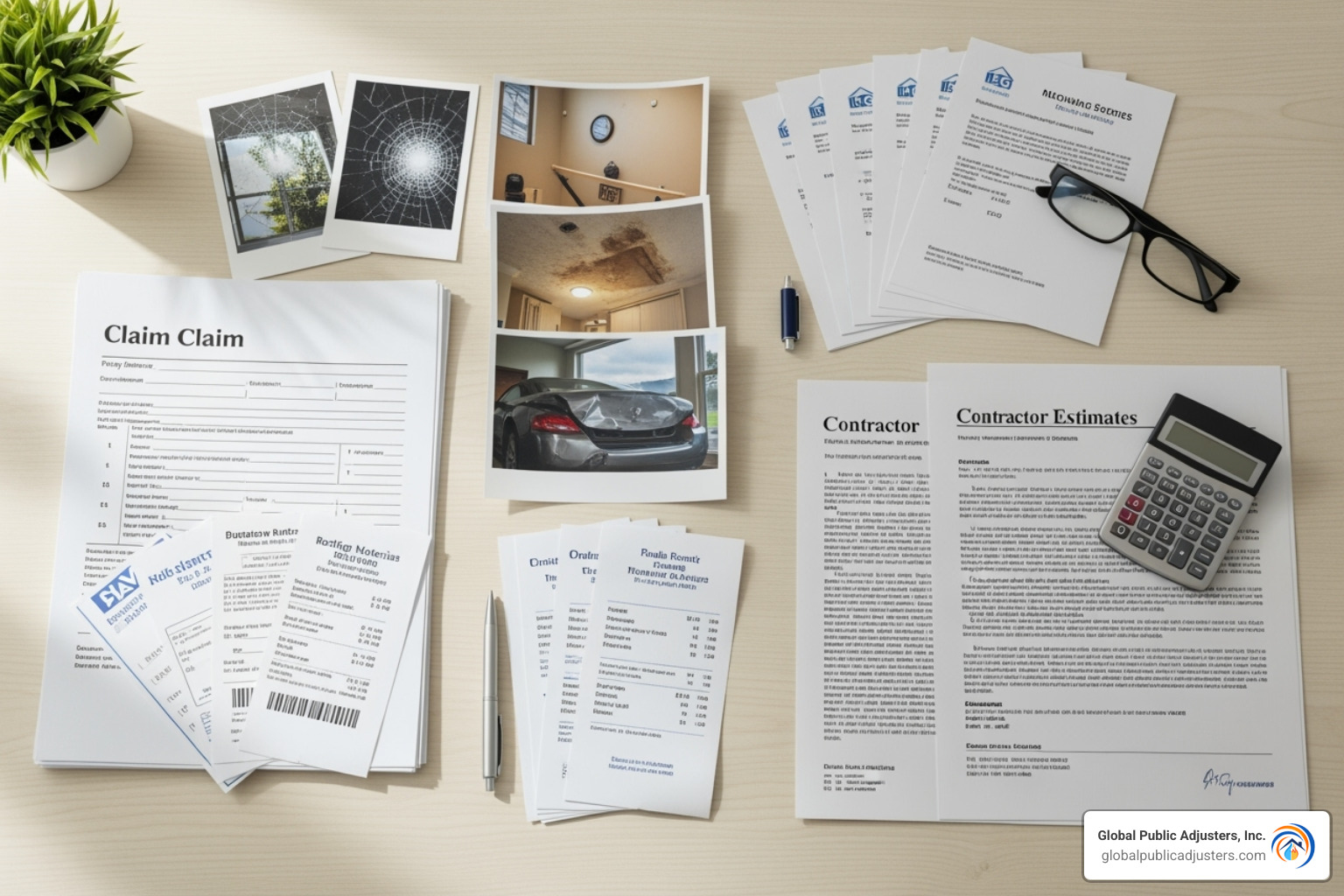

To dispute anunderpaid insurance claim, you need strong evidence. Your goal is to present a complete picture of your damages and their true repair costs.

- Photos and Videos:“Before” photos establish the prior condition of your property, while detailed “after” photos should document all damage from multiple angles.

- Independent Repair Estimates:Get line-by-line estimates from at least two reputable contractors. These real-world costs often expose the gap in the insurer’s valuation.

- Receipts for Temporary Repairs:Keep records of any expenses you incurred to prevent further damage, such as tarping a roof or boarding windows.

- Communication Log:Maintain a detailed record of all interactions with your insurer, including dates, names, and summaries of conversations. Follow up calls with emails to create a paper trail.

Step 3: Formally Dispute the Settlement and Escalate if Necessary

With your evidence organized, it’s time to formally state your case.

- Write a formal rebuttal letterexplaining why you believe the claim was underpaid and specifying the amount you are owed. Attach copies of your supporting documents.

- Submit your new evidenceandrequest a re-inspectionby a different adjuster.

- If the insurer doesn’t respond favorably,file an internal appealthrough their formal process.

If the process becomes overwhelming,consider contacting a licensed public adjuster. At Global Public Adjusters, Inc., we have over 50 years of experience negotiating for maximum settlements. If you suspect bad faith, you can alsofile a complaint with the Florida Department of Financial Services.

Your Rights as a Policyholder in Florida

As a Florida policyholder, you have powerful legal protections against unfair insurance practices. Understanding these rights is crucial when dealing with anunderpaid insurance claim.

At the core of these protections is the“duty of good faith and fair dealing.”This is a legal requirement that your insurer must handle your claim fairly, promptly, and reasonably. They cannot intentionally stall, lowball your settlement without cause, or misrepresent policy language to avoid paying what they owe.

Florida’s laws recognize the power imbalance between a large insurance company and an individual policyholder. These safeguards are designed to level the playing field.

Understanding Insurance Bad Faith

Insurance bad faith is not just a mistake; it’s when an insurer deliberately acts against your interests. Common examples include:

- Unreasonable delaysin processing your claim.

- Misrepresenting policy termsto make it seem like you’re not covered.

- Failing to investigate thoroughly, leading to an incomplete assessment of your damages.

- Offering low settlements without justificationand refusing to explain their calculations.

- Using a“deny first, negotiate later”strategy, hoping you’ll give up.

Your Legal Protections for an Underpaid Insurance Claim

Florida law provides real solutions for policyholders. Insurers who act in bad faith face seriousconsequences, giving them an incentive to treat you fairly.

If you successfully challenge anunderpaid insurance claim, you canrecover the full claim valueyou were owed. In cases of proven bad faith, you may also be entitled toadditional damagesfor the stress and financial hardship caused by the insurer’s actions.

Most importantly, Florida law includes a provision for therecovery of attorney’s fees and costs. This means if you win your case, the insurance company often has to pay your legal bills. This protection makes it financially possible for you to fight back and ensures you can afford experienced representation.

Getting Professional Help: The Role of Public Adjusters

When you file a claim, the adjuster sent by your insurance company works for them, not you. Their primary goal is to protect their employer’s financial interests by minimizing payouts. This creates an uneven playing field.

Apublic adjuster is a licensed professional who works exclusively for you, the policyholder. We act as your advocate, assessing your damages, interpreting your policy, and negotiating with the insurance company to secure the maximum settlement you deserve. At Global Public Adjusters, Inc., we have been leveling this playing field for Florida policyholders for over 50 years.

Learn more aboutwhat can a public adjuster do for me?.

When to Hire a Public Adjuster for an Underpaid Insurance Claim

Consider hiring a public adjuster in these situations:

- Disputes over damage valuation:There is a large gap between the insurer’s estimate and contractor quotes.

- Complex claims:Your claim involves multiple types of damage (e.g., wind and water) or confusing policy language.

- Lack of time or expertise:You are already stressed and don’t have the time to become an insurance expert to fight for a fair settlement.

Our goal is tomaximize your settlement. Clients often recover significantly more than their initial offers. Read more aboutwhy should I hire a public adjuster?.

How Public Adjusters Help You Get a Fair Settlement

We handle every aspect of your claim, from assessment to negotiation. Our services include comprehensive damage assessment, expert policy interpretation, professional documentation, and skilled negotiation. We know the tactics insurers use and how to counter them effectively. Our fee structure is contingency-based, meaning we only get paid if we increase your settlement.

| What We Do | When You Need Us | How We’re Paid |

|---|---|---|

| Complete damage assessment, policy review, evidence gathering, and aggressive negotiation | Claim disputes, complex damage, or when initial offers seem too low | Contingency-based – we only get paid when you do |

Why Insurance Companies Underpay Claims and How to Spot It

Insurance companies are for-profit businesses, which creates an incentive to minimize claim payouts. They may use tactics like leveraging complex policy language, applying depreciation unfairly, or relying on inexperienced adjusters who miss key details. Understanding these strategies is the first step toward securing a fair settlement. For more details, see our guide on Tips for Handling Underpaid Claims Effectively.

Common Reasons for Underpayment

Insurers often underpay by disputing the cause of damage, broadly applying policy exclusions, or undervaluing repair costs. A major point of confusion is the difference between Actual Cash Value (ACV), which pays a depreciated amount, and Replacement Cost Value (RCV), which should cover the cost of new replacement items. Insurers may also use complex policy add-ons calledforms called “endorsements”to limit coverage.

Red Flags: Signs Your Claim Was Underpaid

Be alert for these warning signs:

- The insurer’s estimate is far below your contractor’s quotes.

- The adjuster conducted a rushed or incomplete inspection.

- You receive vague explanations for the low payment amount.

- The insurer pressures you to accept an offer quickly.

- The adjuster is difficult to contact or dismissive of your questions.

Your Step-by-Step Action Plan to Dispute an Underpaid Insurance Claim

If you’ve received a low settlement offer, don’t despair. Follow these steps to build a strong case for the compensation you deserve.

Step 1: Review Your Policy and the Insurer’s Explanation

Start by understanding your coverage. Review your policy declaration page for limits and deductibles. Most importantly, request a detailed written explanation from the insurer that breaks down how they calculated your settlement. For more information, read What if the Insurance Company Underpaid My Claim?.

Step 2: Gather Crucial Evidence to Build Your Case

Evidence is your most powerful tool. Collect before-and-after photos, get independent repair estimates from contractors, save all receipts for temporary repairs, and keep a detailed log of every communication with your insurer.

Step 3: Formally Dispute the Settlement and Escalate if Necessary

Submit a formal rebuttal letter to your insurer with all your new evidence. In the letter, clearly state why you believe the settlement is insufficient and request a re-inspection. If that fails, file an internal appeal. If you continue to face resistance, consider seeking professional help from a public adjuster or filing a complaint with the Florida Department of Financial Services.

Your Rights as a Policyholder in Florida

As a Florida policyholder, you are not powerless when facing anunderpaid insurance claim. The state has robust laws designed to protect you from unfair insurance practices.

Florida law requires insurance companies to operate under a“duty of good faith and fair dealing.”This is a legal obligation for your insurer to handle your claim honestly, promptly, and reasonably. They cannot drag their feet, lowball you without cause, or twist policy language to avoid paying what you’re owed. These protections exist to level the playing field between you and your large insurance company.

Understanding Insurance Bad Faith

Insurance bad faith occurs when your insurer deliberately acts against your interests. It’s more than a simple disagreement; it’s intentional misconduct. Common tactics include:

- Unreasonable delaysin handling your claim.

- Misrepresenting policy termsor citing exclusions that don’t apply.

- Failing to investigate thoroughly, leading to an underpaid claim.

- Offering low settlements without justificationand refusing to explain their math.

Your Legal Protections for an Underpaid Insurance Claim

Florida doesn’t just recognize bad faith—it punishes it. The state has specific laws that hold insurance companies accountable.

Consequences for insurerswho act in bad faith can be severe, including fines and additional damages. As a policyholder, you canpotentially recover your full claim value, not just the lowball offer. In some cases, you may also receiveadditional damagesfor emotional distress or other hardships caused by the insurer’s conduct.

Crucially,Florida statutes allow you to recover attorney’s fees and costswhen you win a case against your insurer. This provision makes it financially feasible for everyday Floridians to challenge large insurance companies and fight for the fair treatment they deserve.

Getting Professional Help: The Role of Public Adjusters

Your insurance company’s adjuster works to protect their employer’s bottom line. A public adjuster is a licensed professional who works exclusively for you, the policyholder. Our role is to be your advocate, ensuring your claim is valued correctly and you receive the maximum settlement you are entitled to under your policy. To learn more, seewhat can a public adjuster do for me?.

When to Hire a Public Adjuster for an Underpaid Insurance Claim

You should consider hiring a public adjuster if you face disputes over the value of your damages, if your claim is complex, or if you simply lack the time and expertise to manage the process. Our goal is to maximize your settlement and remove the stress of fighting the insurance company alone. Find out more aboutwhy should I hire a public adjuster?.

How Public Adjusters Help You Get a Fair Settlement

We handle the entire claims process on your behalf. This includes a detailed valuation of damages, expert documentation, and aggressive negotiation with your insurer. We operate on a contingency fee basis, so we only get paid when you do.

| Scope of Work | When to Hire | Fee Structure |

|---|---|---|

| Valuation, Documentation, Negotiation | Claim Disputes, Complex Claims | Contingency-Based |

Frequently Asked Questions

Here are answers to common questions aboutunderpaid insurance claims.

Can I reopen a claim if I already accepted a check?

Yes, in many cases, you can still fight for more money after cashing a check. Cashing a check does not automatically finalize your claim unless you also signed a document with“full and final release” language. Without signing such a release, you typically retain the right to pursue additional compensation. Florida’s statute of limitations generally gives you five years from the date of loss to file a lawsuit for breach of contract, providing a significant window to take action.

What’s the difference between Actual Cash Value (ACV) and Replacement Cost Value (RCV)?

This distinction is often at the heart of underpaid claims.

- Actual Cash Value (ACV)is the cost to replace your property minus depreciation. It pays you what your 10-year-old roof was worth, not the cost of a new one.

- Replacement Cost Value (RCV)pays the full cost to replace your property with new materials. Many RCV policies first pay the ACV, then pay the remaining amount (recoverable depreciation) after you complete repairs. Understanding your policy type is crucial.

How can I proactively prevent my claim from being underpaid?

Taking steps before a disaster can make a huge difference.

- Create a detailed home inventorywith photos and videos of your belongings.

- Conduct annual policy reviewswith your agent to ensure your coverage is adequate.

- Document all property maintenanceand improvements with receipts and photos to counter claims of neglect.

- Understand your duties after a lossby reading your policy now. This includes reporting claims promptly and protecting your property from further damage.

Getting expert help from the start often leads to better outcomes. Our guide on7 Reasons to hire a public adjuster when facing property damage claimsexplains why.

Get the Fair Settlement You Deserve

You now understand the truth aboutunderpaid insurance claims: you have rights and options. You do not have to accept an insurer’s lowball offer. Underpayment is a business strategy, but knowledge and action give you the power to fight back.

Demanding what you’re legally owed can be daunting, especially while dealing with property damage.You don’t have to fight the insurance company alone.

At Global Public Adjusters, Inc., we have over 50 years of experience standing up for policyholders. We know the tactics insurers use and how to counter them effectively. We understand that behind every claim is a person trying to rebuild their life or business.

The fair settlement you deserve is achievable.We work on a contingency basis, so our success is tied directly to maximizing your settlement. If we don’t get you more money, you don’t pay us.

Ready to stop settling for less? Explore ourresidential and commercial claim servicesto see how we can help you get the fair compensation you need to recover.