Average Insurance Claim for Water Damage: Top 2025 Guide

Why Understanding Water Damage Insurance Payouts Matters

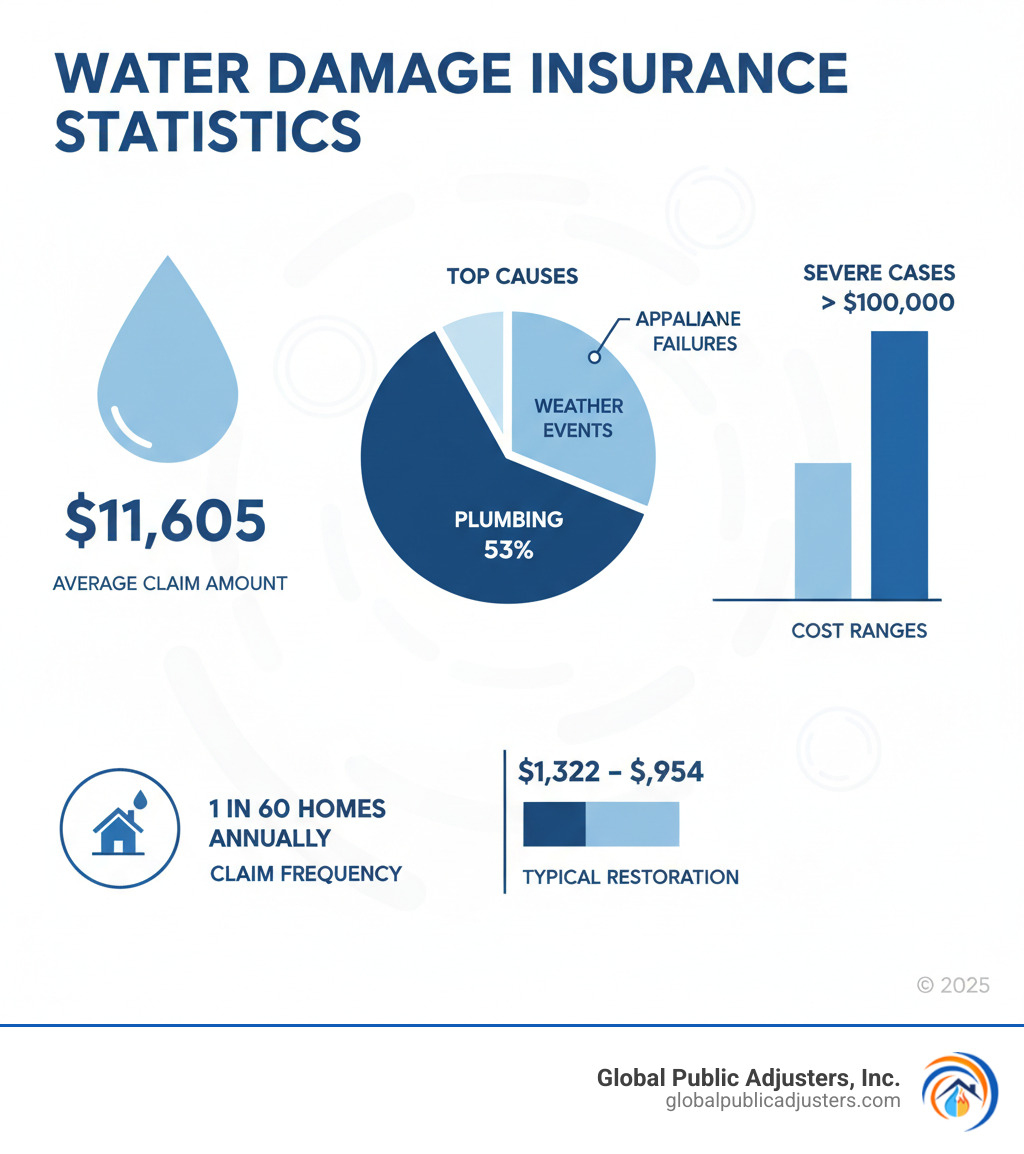

When water damages your home, your first concern is stopping the leak. But once the immediate crisis is over, you face the challenge of navigating your insurance claim. Theaverage insurance claim for water damageis $11,605, but your payout can vary dramatically.

Quick Answer: Average Water Damage Insurance Claims

- Average payout: $11,605 (most recent data)

- Claim frequency: 1 in 60 homes file claims annually

- Claim percentage: Nearly 24% of all homeowners insurance claims

- Cost range: $1,322 – $5,954 for typical restoration

- Severe cases: Can exceed $100,000+ for extensive damage

Water damage is thesecond most frequenthome insurance claim, affecting about 14,000 people daily in the U.S. and costing insurers around $13 billion annually. This reflects the high frequency and severity of these incidents.

The complexity of your insurance policy, with its specific coverages and exclusions, will determine your final payout. Understanding these details is crucial for securing a fair settlement and avoiding a financial disaster.

This guide explains everything you need to know about water damage insurance payouts, from factors influencing your claim to maximizing your settlement. You’ll learn how to effectively manage the claims process for any type of water damage.

Understanding the Average Insurance Claim for Water Damage

When your home suffers water damage, the first question is always about cost and insurance coverage. The numbers are significant: theaverage insurance claim for water damageis around$11,605, with recent data showing an average of$12,514between 2017 and 2021. These figures reflect the serious financial impact of water damage.

What’s more concerning is its frequency. As thesecond most common home insurance claim, water damage accounts for nearly 24% of all claims. About1 in 60 insured homesfiles a water damage claim annually, affecting roughly 14,000 people daily in the U.S. This widespread issue costs insurers about$13 billion annually, making it a persistent threat to homeowners everywhere. For more statistics, see theInsurance Information Institute.

Factors That Influence Your Payout

Your actual payout will differ from the average based on several key factors.The extent of damageis the most significant. A small leak is far less costly than a burst pipe flooding an entire floor. Damage is categorized into four classes:

- Class 1:A small, localized area with minimal moisture.

- Class 2:An entire room is affected, with water wicking up walls less than two feet.

- Class 3:Extensive saturation with water climbing walls over two feet.

- Class 4:Catastrophic damage requiring specialized drying for dense materials like concrete.

Water contamination levelalso heavily influences costs and health risks. Clean water (Category 1) from burst pipes is the least hazardous. Gray water (Category 2) from appliances contains contaminants. Black water (Category 3) from sewage is highly hazardous and requires extensive cleanup. Learn more aboutSome Different Types of Water Damageand their impact on your claim.

Here’s how contamination levels typically impact restoration costs per square foot:

| Water Category | Description | Average Cost Per Sq. Ft. |

|---|---|---|

| Category 1 (Clean) | From sanitary sources like burst pipes. Minimal health risks. | $3 – $4 |

| Category 2 (Gray) | Contains contaminants from appliances or toilets. Can cause illness. | $4 – $6.50 |

| Category 3 (Black) | Highly contaminated from sewage or floods. Serious health risk. | $7 – $7.50 |

Your policy limits and deductiblescreate the financial framework for your claim. Your deductible is what you pay out of pocket before insurance kicks in. Policy limits cap how much your insurance will pay. If damage exceeds these limits, you’re responsible for the difference.

The Average Insurance Claim for Water Damage vs. Restoration Costs

The average insurance payout is a baseline; actual restoration costs can vary significantly. While typical restoration ranges from$1,322 to $5,954, severe cases can exceed $15,000 or more. This potential gap between payout and cost highlights the need for a thorough claim.

- Basement restoration:$500 to over $80,000, depending on severity.

- Ceiling repairs:$350 to $1,250.

- Plumbing repairs:$1,000 to $4,000.

- Drywall replacement:$100 to $5,000.

For detailed cost breakdowns, seeHow much does water damage restoration cost?. Out-of-pocket expenses arise from deductibles or when costs exceed policy limits. This is why professional representation is vital. At Global Public Adjusters, Inc., we document all damages to ensure your claim reflects the true cost of your loss, helping bridge the gap between average payouts and your actual needs.

What Your Policy Covers (and What It Doesn’t)

Water damage insurance isn’t as straightforward as many homeowners hope. Policies don’t cover all types of water damage, and insurers have specific rules. The key phrase is“sudden and accidental”damage. If the event was unexpected and not your fault, you’re likely covered. However, if the damage developed slowly or resulted from poor maintenance, your claim will probably be denied. Insurers cover sudden disasters, not problems caused by neglect.

Covered Perils: When Your Insurance Steps Up

Your insurance should cover damage that is sudden and accidental. Common covered scenarios include:

- Burst pipes:Damage from pipes that rupture due to freezing, age, or sudden failure is usually covered. Learn to spot the signs with our guide onHow to Tell if a Pipe Has Burst in Your Home.

- Appliance malfunctions:Unexpected overflows from a washing machine, water heater, or dishwasher typically qualify.

- Ice dams:Water backing up under shingles due to ice buildup is generally covered. For more on this, see our article onRoof Ceiling Leaks.

- Storm-related water entry:If wind or hail damages your home’s exterior, allowing water inside, the resulting damage is usually covered.

- Other events:Water damage from firefighting efforts or vandalism also qualifies as sudden and uncontrollable.

Common Exclusions: Why Your Claim Might Be Denied

Knowing your policy’s exclusions is critical to avoid a denied claim. Common reasons for denial include:

- Gradual damage:Slow leaks behind walls or persistent drips are considered maintenance issues, not sudden events.

- Negligence:Ignoring a known problem or failing to perform basic maintenance will likely lead to a denial. Learn to spot issues early with our guide onSome Signs That You Have Water Damage in Your Home.

- Overland flooding:Standard policies do not cover floods from heavy rain, overflowing rivers, or storm surges. This is a major misconception.

- Sewer backup and sump pump failure:Damage from backed-up drains or a failed sump pump is typically excluded.

- Earth movement:Water damage resulting from earthquakes, landslides, or sinkholes is not covered by standard policies.

Special Coverage for Floods and Sewer Backups

To protect against common exclusions, homeowners can purchase additional coverage.

- Flood insurance:Available through the National Flood Insurance Program (NFIP), this covers overland flooding. With just one inch of floodwater causing up to $25,000 in damage, this is crucial coverage. The average NFIP payout was $66,000 between 2016-2023. UseFEMA flood risk datato assess your risk.

- Sewer backup endorsement:This inexpensive add-on covers damage from backed-up drains, which involves hazardous black water.

- Other riders:Endorsements for overland water coverage or sump pump failure can fill other gaps.

Reviewing your risks and policy is key. The team at Global Public Adjusters, Inc. can help you understand your policy to ensure you have the right coverage before a disaster.

How to File a Successful Claim and Maximize Your Payout

When water damage occurs, your actions in the first few hours are critical for securing a fair settlement. While your insurer isn’t an enemy, they are a business focused on minimizing payouts. Your goal is to ensure you are paid fairly.

Here are the immediate steps to take:

- Prioritize Safety:If water is near electrical outlets, shut off the power at the breaker box. Avoid standing water to prevent electrocution.

- Stop the Water:Turn off the main water shutoff valve to prevent further damage from a burst pipe or faulty appliance.

- Mitigate Damage:Move furniture and belongings to a dry area. Do not throw anything away, as it is evidence for your claim.

- Document Everything:This is crucial. Take extensive photos and videos of the water source, all damaged areas, and ruined belongings. Create a detailed list of damaged items with their age and estimated value. Keep receipts for any emergency repairs.

- Notify Your Insurer:Call your insurance company promptly. Stick to the facts of what happened and what was damaged. Do not speculate or admit fault.

You will be assigned a claims adjuster who works for the insurance company. Be helpful, but remember their job is to protect the company’s interests. Document all your conversations.

How Common Causes Affect the Average Insurance Claim for Water Damage

The source of the water damage significantly affects your claim.

- Plumbing Issues:Accounting for 53% of non-weather claims, burst pipes and failed connections are typically covered as “sudden and accidental” events.

- Appliance Failures:Leaking water heaters, overflowing washing machines, and faulty dishwashers are also common covered claims. For AC leaks, see our guide on How to Tell if Your Air Conditioning is Leaking.

- Severe Weather:Water entering through a storm-damaged roof or window is usually covered, unlike natural flooding from the ground up.

- Clogged Gutters:This is a gray area. Coverage depends on whether the clog was sudden or due to long-term neglect.

Theaverage insurance claim for water damagevaries by cause. A clean water burst may be near the average, but a black water sewer backup will be much costlier.

The Impact of Making Multiple Water Damage Claims

Filing multiple water damage claims can have serious consequences. Insurers track your claim history, and too many can affect your coverage and costs.

- Premium Increases:A substantial claim will likely raise your premiums, as you’ll be seen as a higher risk.

- Non-Renewal:Insurers may choose not to renew your policy if you file too many claims, making it difficult and expensive to find new coverage.

- Higher Deductibles:Your insurer might renew your policy but with a much higher deductible specifically for water damage, such as $5,000 or $10,000.

- Uninsurability:In extreme cases, you could become uninsurable for water damage.

This makespreventative maintenance critical. Annual inspections can protect your insurability. It’s about balance: file legitimate claims for significant damage, but consider paying for smaller repairs out of pocket to avoid long-term premium hikes.

The Future of Water Damage: Climate Change and Prevention

Climate Change Impact

Climate change is increasing the frequency and severity of water damage.Increased extreme weather events, such as intense rainfall and severe storms, are becoming the new normal, as documented in reports like Canada’s Changing Climate Report. This trend directly leads torising insurance costs, as insurers adjust rates to cover higher and more frequent payouts. The economic impact is huge, with flood damage alone costing the U.S. hundreds of billions annually. Furthermore,aging home infrastructurein many communities is ill-equipped to handle these new stresses, creating a perfect storm for water damage disasters.

Proactive Prevention: Taking Control

While you can’t stop climate change, you can take proactive steps to protect your home and lower your insurance risk.

- Install Smart Leak Detectors:Place these devices near water heaters, washing machines, and toilets. They send alerts to your phone and can even automatically shut off your main water supply to prevent major damage.

- Perform Regular Maintenance:Routinely inspect pipes for corrosion and appliance hoses for wear. Replacing them is far cheaper than a flood.

- Maintain Your Home’s Exterior:Clean gutters and downspouts to ensure proper drainage. Check your roof for damage and test your sump pump regularly.

- Improve Landscaping and Drainage:Ensure your yard slopes away from the foundation to prevent water from pooling near your house.

- Know Your Water Shut-Off Location:Make sure everyone in your household knows how to turn off the main water supply in an emergency.

Taking these steps shows insurers you are a responsible homeowner, which can positively impact your rates and help you avoid filing a claim.

Frequently Asked Questions about Water Damage Claims

Over our 50+ years of experience, we’ve noticed the same questions come up time and again. Here are the answers to the most common concerns we hear.

What are the most common causes of water damage claims?

The most common causes we see are:

- Plumbing Failures:These account for 53% of non-weather claims and include burst pipes, leaky connections, and overflowing fixtures.

- Appliance Malfunctions:Water heaters, washing machines, dishwashers, and refrigerators are frequent sources of damage.

- HVAC Issues:Blocked or failed condensation drainage from AC units can cause significant damage to ceilings and walls. Our guide on How to Tell if Your Air Conditioning is Leaking can help you spot issues.

- Roof Leaks:Storms can damage roofs, allowing water to enter. This is different from ground-level flooding and is often covered.

Does homeowners insurance cover basement flooding from rain?

Unfortunately, the answer is usuallyno. Standard homeowners insurance does not cover basement flooding from rain if the water enters from the ground up (e.g., rising groundwater, surface water runoff). This is considered “flood damage” and requires a separateflood insurance policy, typically from theNational Flood Insurance Program (NFIP). The average NFIP flood claim payout was $66,000 from 2016 to 2023.

To cover other gaps, you can purchase endorsements foroverland water(surface runoff) orsewer backup. These add-ons can be crucial. Our articleHow Can Water Damage My Home?explores these scenarios in more detail.

What should I do immediately after finding water damage?

Your actions in the first few hours are critical. Follow these steps:

- Ensure Safety:If water is near electrics, turn off the power at the breaker. Avoid wading through deep water.

- Stop the Water Source:Turn off your main water supply to stop indoor leaks.

- Document Everything:Before cleaning, take extensive photos and videos of the damage and affected items. Do not throw anything away. This is vital evidence.

- Contact Your Insurer:Notify your insurance company promptly to start the claims process. Keep notes of all conversations.

- Begin Mitigation:Remove standing water, use fans and dehumidifiers to dry the area, and move salvageable items. Keep receipts for all emergency expenses, as they may be reimbursable.

Proper documentation and quick action are key to receiving the full settlement you deserve. Theaverage insurance claim for water damageis $11,605, but your outcome depends on how you handle the initial crisis.

Secure Your Fair Settlement

Understanding theaverage insurance claim for water damageis a good start, but securing a fair payout for your specific situation is the real challenge. Your insurance company’s adjuster works for them, not you. Their goal is to settle claims cost-effectively for their employer.

Key Takeaways:

- The average payout is just a baseline.

- Knowing your policy’s coverage and exclusions is critical.

- Documenting damage immediately is essential for a strong claim.

This is where a public adjuster makes a difference. At Global Public Adjusters, Inc., our 50+ years of experience are dedicated to fighting for homeowners. We understand how insurers operate and how to build the strongest possible claim for you. Too often, homeowners accept low settlements because they’re overwhelmed. Our team handles the entire process—paperwork, documentation, and negotiations—to ensure every cost is accounted for, from repairs to temporary housing.

We specialize in water damage claims in Orlando, Pensacola, and throughout Florida. We work on a contingency basis, so we only get paid if we increase your settlement.

Don’t let your insurer dictate your recovery.Contact us for a free water damage claim consultationand let us fight for the settlement you deserve.