Insurance Claim Help Advice: 10 Powerful Tips for Success 2025

Why Getting Expert Insurance Claim Help Advice Can Save You Thousands

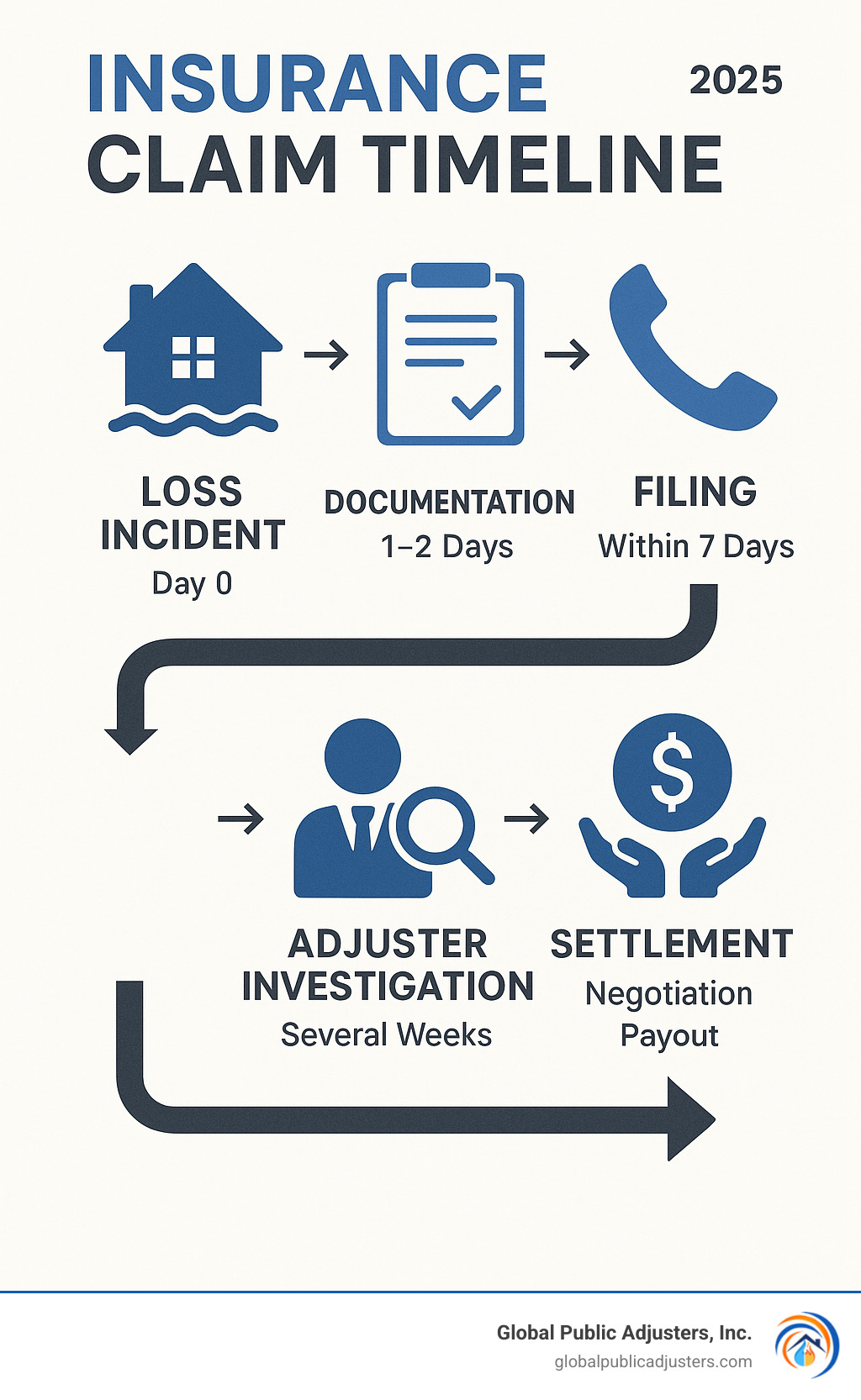

When disaster damages your home or business, the rightinsurance claim help advicecan be the difference between a fair settlement and an expensive setback. The key is acting fast, documenting thoroughly, and knowing when to push back.

Quick Insurance Claim Help Advice:

- Document everything– photos and video before any cleanup

- Contact your insurer within 7 days– sooner is always better

- Keep detailed records– receipts, estimates, emails, call logs

- Don’t accept the first offer– most settlements are negotiable

- Consider professional help– public adjusters often boost payouts

Insurers paid out$9.9 billionin Canadian property claims in 2022 alone, yet countless policyholders still walked away under-compensated because they misunderstood the process.

Complex policy language, strict deadlines, and adjusters looking to save their employer money can make claims feel overwhelming.With solid guidance, you can level the playing field.This article shows you when to file, how to document losses, and the smartest ways to maximize your settlement.

Easyinsurance claim help adviceword list:

–attorney to help with insurance claims

–does an insurance broker help with claims

–do insurance agents help with claims

Insurance Claim Help Advice: When, What & Whether to File

Think of an insurance claim as a conversation with your insurer where you’re saying, “Promise you made to help me when things go wrong? Well, things went wrong.” It’s simply your formal request for payment when something covered by your policy gets damaged, stolen, or destroyed.

But here’s where many people stumble –timing matters more than you might think. Most insurance companies give you somewhere between 90 days to a full year to report an incident. However, our bestinsurance claim help adviceis simple: don’t wait around. The sooner you pick up that phone, the smoother your entire experience will be.

Before you start dialing though, let’s talk about the math that could save you hundreds or even thousands of dollars. Picture this: a nasty hailstorm leaves your roof with $600 in damage, but your deductible sits at $500. Filing that claim would put exactly $100 in your pocket – but it might cost you much more down the road.

The numbers tell a sobering story. Research shows thata single home insurance claim can bump your premiums up by 7.5%, while two claims can push that increase over 10%. These rate hikes don’t just disappear after a year either – they typically stick around on your record for 5 to 7 years.

Let’s say your annual premium is $1,200. That 7.5% increase means you’ll pay an extra $90 every year for potentially seven years. Suddenly, that $100 payout doesn’t look so appealing when it could cost you $630 in higher premiums.

Different types of claims come with their own quirks and considerations.Auto claimsmight involve collisions, theft, or that shopping cart that seemed to have a magnetic attraction to your car door.Home claimsoften stem from fires, water damage, storms, or liability issues when someone gets hurt on your property.

Business claimscan be particularly complex, covering everything from property damage to lost income when you can’t operate.Health claimsare usually more straightforward – medical treatments, prescriptions, and hospital stays.Travel claimsmight involve trip cancellations or medical emergencies when you’re far from home.

| Factor | Self-Pay | File a Claim |

|---|---|---|

| Immediate Cost | Full repair cost | Just your deductible |

| Premium Impact | None | Potential 7.5-10% increase |

| Claims History | Stays clean | Goes on record for 5-7 years |

| Time Investment | Minimal | Significant documentation required |

| Future Insurability | Unaffected | May impact coverage options |

Key Moments to File or Skip a Claim

File immediately for major losses– anything over $2,000 to $3,000 above your deductible usually makes financial sense. Don’t let insurance companies benefit from your hesitation when you have a legitimate substantial claim.

Skip the small stuffwhere your payout minus deductible barely covers a nice dinner out. You might lose valuable claims-free discounts that could be worth more than that tiny payout.

Here’s a non-negotiable rule:always file liability claims, regardless of size. If someone slips on your icy walkway or you accidentally back into your neighbor’s prized rose garden, your insurance company needs to know immediately.

Weighing Deductible vs. Payout

Let’s crunch some real numbers. Imagine a severe storm causes $5,000 in damage to your home, and you have a $1,000 deductible. Your potential payout is $4,000 – that’s substantial money.

Now, if filing this claim increases your $1,500 annual premium by 7.5% for five years, you’ll pay an extra $562.50 in total premium increases. The claim still makes perfect financial sense because you’re netting over $3,400.

But flip the scenario: that same storm only causes $1,200 in damage with your $1,000 deductible. You’d receive just $200 from your insurer. Those same premium increases would cost you nearly three times what you’d collect from the claim – definitely not worth it.

Step-by-Step Guide: How to File and Track Any Insurance Claim

When disaster strikes your property, your world can feel like it’s turned upside down. But taking the right first steps can make all the difference in how your claim unfolds.

Safety always comes first.If you’re dealing with a fire, gas leak, electrical hazards, or structural damage that could collapse, get everyone out immediately and call 911. Your insurance claim can wait – your family’s safety cannot.

Once you’ve ensured everyone is safe, it’s time to become a detective.Start documenting everything before you touch or move anything.Walk through the damaged areas with your phone or camera, taking photos and videos from every angle you can safely access.

Capture wide shots that show the big picture – the flooded basement, the tree through your roof, or the fire damage throughout a room. Then zoom in for close-ups of specific damage like cracked walls, water stains, or burned materials.

Contact your insurance company within 24 hours if possible.Have your policy number handy – it’s usually on your insurance card or the first page of your policy documents. When you call, be ready to explain what happened, when it occurred, and what damage you can see so far.

Most insurance companies today make filing easier than ever. You can typically file through theironline portalswhere you upload photos directly, use theirmobile appsto file and track everything from your phone, call their24-hour claims hotline, or visit a local agent’s office in person.

Here’s some crucialinsurance claim help advice:keep a detailed log of every conversation.Write down the date, time, name of the person you spoke with, and what you discussed. Note any claim numbers, reference numbers, or follow-up actions they mention.

Insurance Claim Help Advice for Different Lines

Auto claimsrequire quick action, especially if you’re in an accident. If your car is drivable, move it to safety and turn on your hazard lights. Take photos of all vehicles involved, the accident scene, street signs, traffic lights, and any skid marks or debris.

Home claimsneed immediate attention to prevent further damage. If a storm blows out windows, cover them with plywood or plastic sheeting. If your roof is damaged, tarp it if you can do so safely. A burst pipe? Shut off the main water valve immediately.

Commercial property claimsoften involve more moving parts than home claims. You’re not just dealing with property damage – you might have business interruption, lost inventory, or specialized equipment to consider.

Role of the Claims Adjuster & How They Calculate Your Payout

After you file your claim, your insurance company assigns an adjuster to be your main point of contact. Think of them as the detective who investigates your loss and determines what the insurance company should pay.

The adjuster’s job involvesthree main tasks: confirming that your loss is covered under your policy, assessing how much damage actually occurred, and calculating your payout.

Understanding how adjusters calculate payouts helps you know what to expect. They’ll determine whether your policy covers losses atActual Cash Value (ACV)orReplacement Cost Value (RCV).

ACV factors in depreciation – if your 15-year-old roof gets damaged in a storm, you’ll receive what a 15-year-old roof is worth today, not what a brand new roof costs. RCV, on the other hand, pays to replace your damaged property with new materials of similar quality, regardless of age.

After You File: Dealing With Delays, Denials & Disputes

Let’s be honest – not every insurance claim goes smoothly. Sometimes you’ll face delays that drag on for months, or worse, you’ll get that dreaded denial letter in the mail. But here’s the thing:a “no” from your insurance company isn’t necessarily the final answer.

Understanding why claims get denied helps you avoid these pitfalls in the first place. The most common reasons includelack of coverage(your policy simply doesn’t cover what happened),policy exclusions(those fine-print clauses that eliminate certain types of coverage), orinsufficient proof(you can’t adequately show what happened or how much damage occurred).

Late notificationis another big one – insurance companies are sticklers for deadlines, and missing them can torpedo an otherwise valid claim. Sometimes they’ll deny claims forpoor maintenance, arguing that damage resulted from neglect rather than a covered event.

The good news? Most of these issues are fixable with the right approach and persistence. According toscientific research on consumer dispute resolution, consumers who follow proper escalation procedures have significantly better outcomes than those who simply accept initial denials.

Escalation Path if You Disagree With a Decision

When your claim gets denied or you receive a lowball settlement offer, don’t panic. The bestinsurance claim help advicewe can give is to follow a structured approach that gets results.

Start by asking detailed questions.Request a written explanation of exactly which policy clauses support their decision and how they calculated any settlement offer. Insurance companies must justify their decisions, and sometimes they can’t when pressed for specifics.

Gather and provide additional evidenceif you have it. Did the adjuster claim your roof damage was pre-existing? Pull out those photos you took during your last home inspection showing it was in perfect condition.

Negotiate everything in writing.Phone calls are convenient, but emails and letters create a paper trail that protects you. Present your case clearly and professionally, referencing specific policy language and attaching supporting documentation.

If direct negotiation fails,file a formal complaintwith your insurer’s complaint department. Every insurance company must have internal procedures for handling disputes, and sometimes a fresh pair of eyes will spot errors the original adjuster missed.

For major disputes, you canescalate to your state’s insurance regulatoror ombudsperson. These agencies have real power to investigate and sometimes force insurers to reconsider their decisions.

Preventing & Reporting Fraud

Unfortunately, disasters often attract scammers like flies to honey. These fraudsters prey on vulnerable property owners who are stressed, overwhelmed, and desperate to get their lives back to normal.

Be especially wary of contractorswho show up unsolicited after storms, demanding large upfront payments or pressuring you to sign contracts immediately. Legitimate contractors don’t need to chase storms – they have plenty of regular business.

Red flags include door-to-door solicitationimmediately after storms, demands for full payment upfront, no local address or proper licensing, and pressure to sign contracts on the spot. Be especially suspicious of anyone who offers to waive your deductible or suggests filing false claims – both are illegal and can void your coverage entirely.

If you suspect fraud, report it immediatelyto your insurance company, local law enforcement, and your state’s insurance fraud bureau.

Pro Tips to Speed Up & Maximize Your Settlement

After helping thousands of Florida homeowners and business owners steer the claims process over our 50+ years in business, we’ve learned exactly what separates successful claims from disappointing ones. The difference often comes down to preparation and knowing a few insider strategies.

Start with a detailed inventorybefore disaster strikes. Walk through your home or business with your phone, recording everything room by room. Keep receipts for major purchases in a safe place or cloud storage.

The moment damage occurs,become a documentation machine. Take extensive photos and videos from every conceivable angle – wide shots that show the big picture and close-ups that capture specific damage details.

Here’s someinsurance claim help advicethat might surprise you:get your own repair estimates. Yes, your insurance company will send contractors to assess the damage, but their job is to minimize costs. Independent contractors working for you will often find additional damage and provide more accurate pricing for quality repairs.

Never throw damaged items awayunless they pose a genuine safety hazard. We’ve seen too many claims where homeowners cleaned up quickly, only to have their adjuster question whether certain damage actually occurred.

Keep a simple claim diaryin a notebook or on your phone. Write down every conversation, email, and interaction related to your claim. Include dates, times, who you spoke with, and what was discussed.

When to Bring in a Public Adjuster

Sometimes you know immediately that you’re in over your head. Other times, it becomes clear gradually as your insurance company drags their feet or offers settlements that don’t come close to covering your actual losses.

Here are clearReasons to Call a Public Adjuster Right Away:your claim gets deniedwhen you know it should be covered,the settlement offer seems laughably low, oryour insurance company keeps stallinginstead of processing your claim promptly.

Large or complex damageover $25,000 almost always benefits from professional representation.Business interruption claimsare particularly tricky – calculating lost income and proving business impact requires expertise most business owners don’t have.

At Global Public Adjusters, Inc., we work on contingency – meaningwe only get paid when you do. Our fees typically range from 7-10% of the recovery, but we often increase settlements by far more than our fees cost.

Questions to Ask Before Signing Repair Contracts

Whether you’re considering your insurer’s preferred contractor or hiring your own, asking the right questions upfront prevents headaches later. TheseQuestions to Ask Your Public Adjusterwork just as well for contractors.

Verify licensing and insurancefirst – a legitimate contractor will happily provide proof of both.Ask about lien waiversand how they handle them as work progresses.

Workmanship warrantiesseparate professional contractors from fly-by-night operators. Good contractors stand behind their work for at least a year.Request referencesfrom recent similar projects and actually call them.

Get clear timelinesfor project completion andunderstand how change orders work. Storm damage often reveals additional problems once work begins, so know upfront how your contractor handles unexpected findings and additional costs.

Where to Get More Insurance Claim Help Advice & Resources

When you’re facing a complex insurance claim, knowing where to turn for help can make all the difference. The good news is that you have more support options than you might realize.

Government agenciesoffer some of the most reliableinsurance claim help adviceavailable. Your state insurance department’s website typically includes detailed guides explaining your rights as a policyholder, plus complaint forms if you need to escalate disputes.

For Canadian residents, theGovernment of Canada’s insurance claim guidewalks you through the entire process step-by-step. It’s particularly helpful for understanding your legal rights and the timelines insurers must follow.

Consumer advocacy groupscan be incredibly valuable allies. United Policyholders maintains an extensive library of free resources, including sample letters for disputing claims and guides for specific types of losses.

Professional helpbecomes essential when your claim is large, complex, or wrongfully denied. Public adjusters work exclusively for policyholders, not insurance companies. We understand the tactics insurers use to minimize payouts, and we know how to counter them effectively.

If you’re dealing with a denied claim,What to Do When Your Home Insurance Claim is Deniedprovides specific guidance for your situation. Sometimes a denial isn’t the end of the road – it’s just the beginning of a negotiation process.

Insurance attorneys specialize in coverage disputes and bad faith claims. While most claims don’t require legal action, having an attorney becomes important when insurers act in bad faith or when policy interpretation becomes contentious.

Regulatory oversightprovides another layer of protection. State insurance commissioners have broad authority to investigate complaints against insurers. These investigations can sometimes resolve disputes that seemed hopeless through normal channels.

You don’t have to choose just one resource. The most successful claim outcomes often result from using multiple sources of help andinsurance claim help advicestrategically throughout the process.

Frequently Asked Questions about Insurance Claims (3 Quick Answers!)

Let’s tackle the three questions we hear most often from Florida homeowners and business owners who needinsurance claim help advice. These answers can save you time, money, and a lot of stress.

How long do I have to file after an incident?

Here’s the truth:time matters more than most people realize. Most insurance policies give you somewhere between 90 days to 12 months to report a claim after damage occurs. But don’t let those generous-sounding deadlines fool you into waiting.

We always tell our clients to contact their insurer within24 to 48 hoursof finding damage. Why the rush? Fresh evidence is better evidence. Photos of hail on the ground, witnesses who saw the tree fall, and undisturbed damage scenes all strengthen your claim.

Some situations demand even faster action.Auto accidents often require reporting within just 7 days. If someone gets hurt on your property, you need to notify your liability insurer immediately – we’re talking hours, not days.

The golden rule forinsurance claim help adviceon timing? When in doubt, call sooner rather than later. Missing those policy deadlines can result in a flat-out denial, and trust us, fighting a denial based on late reporting is an uphill battle you don’t want to face.

Will one claim always raise my premiums?

This question keeps a lot of people awake at night, and honestly, the answer isn’t black and white.A single claim doesn’t automatically guarantee higher premiums, but it often leads to them.

The statistics tell an interesting story. Research shows that one home insurance claim typically bumps your premiums up byabout 7.5%. File two claims, and you’re looking at over10% increases. These rate hikes usually stick around for5 to 7 years, which can add up to serious money over time.

But here’s where it gets more hopeful. Several factors work in your favor.Some insurers offer “accident forgiveness” programsthat protect you from rate increases after your first claim. If you’ve been claims-free for years, you might have built up goodwill that cushions the impact.

The type and size of your claim matter too. A massive hurricane claim that pays out $50,000 might trigger a smaller percentage increase than multiple small claims that make you look like a frequent filer.

Our best insurance claim help advice?Don’t let fear of premium increases stop you from filing legitimate large claims. That’s exactly what you’ve been paying premiums to protect against.

Can I choose my own contractor instead of the insurer’s?

Absolutely, and don’t let anyone tell you otherwise.You have the legal right to choose any properly licensed contractor you wantfor repairs. Your insurance company might push their “preferred” or “approved” contractor list, but that’s for their convenience, not yours.

Here’s the catch though – and there’s always a catch with insurance companies. If your chosen contractor’s estimate comes in higher than what your insurer wants to pay,you might need to negotiate or cover the difference yourself. This is where having multiple estimates becomes your secret weapon.

Smart strategy:Get quotes from both your insurer’s preferred contractors and independent contractors you trust. This gives you the full picture of repair costs and puts you in a stronger negotiating position.

Sometimes insurance company contractors work out great – they know the claims process and can streamline repairs. Other times, you’ll get better quality work and more personal attention from contractors you choose yourself.

The bottom line?Your home, your choice. Just make sure whoever you pick is properly licensed, insured, and has solid references. At Global Public Adjusters, Inc., we’ve seen too many homeowners get stuck with shoddy work from both preferred and independent contractors, so do your homework regardless of which route you choose.

Conclusion

Dealing with insurance claims doesn’t have to feel like wrestling with a giant octopus. With the rightinsurance claim help adviceand a clear understanding of the process, you can steer even complex claims with confidence and secure the fair settlement you deserve.

The most important thing to remember?You’re not powerless in this process.You have rights, options, and resources available to help you fight for what’s rightfully yours. Whether it’s documenting every detail with photos and videos, understanding when to file versus when to pay out of pocket, or knowing how to escalate disputes when insurers try to lowball you.

Think of it this way: you’ve been faithfully paying your premiums, sometimes for years or even decades. When disaster strikes, it’s time for your insurance company to hold up their end of the bargain. Don’t let them take advantage of your stress or unfamiliarity with the claims process.

Sometimes though, the playing field isn’t level.Insurance companies have teams of adjusters, lawyers, and experts working to minimize what they pay out. When you’re facing a complex claim worth tens of thousands of dollars, dealing with a suspicious denial, or simply feeling overwhelmed by the paperwork and negotiations, it makes sense to get professional help.

At Global Public Adjusters, Inc., we’ve spent over 50 years helping Florida homeowners and business owners in Orlando, Pensacola, and throughout the state turn the tables on insurance companies. We know their tactics because we’ve seen them all before. More importantly, we know how to counter them effectively.

Here’s what sets us apart:we work on contingency, which means you don’t pay us a dime unless we successfully increase your settlement. Our interests are completely aligned with yours – the more we recover for you, the better we do. It’s that simple.

We’ve helped thousands of families and businesses recover millions of dollars in settlements that insurance companies initially tried to deny or underpay. Every case is different, but our commitment remains the same: fighting for every dollar you’re entitled to under your policy.

Get more information about hiring a public adjusterand find how we can help you secure the fair settlement you deserve. Because when it comes to your claim, you shouldn’t have to settle for less than what you’re owed.

Remember: it’s your property, your claim, and your choice.Make sure you’re getting everything you’re entitled to under your policy. Sometimes that means going it alone with goodinsurance claim help advice. Sometimes it means bringing in the professionals. Either way, don’t let insurance companies shortchange you when you need them most.