Who can claim a casualty and theft loss deduction Top 1

Understanding Who Can Claim Casualty and Theft Loss Tax Deductions

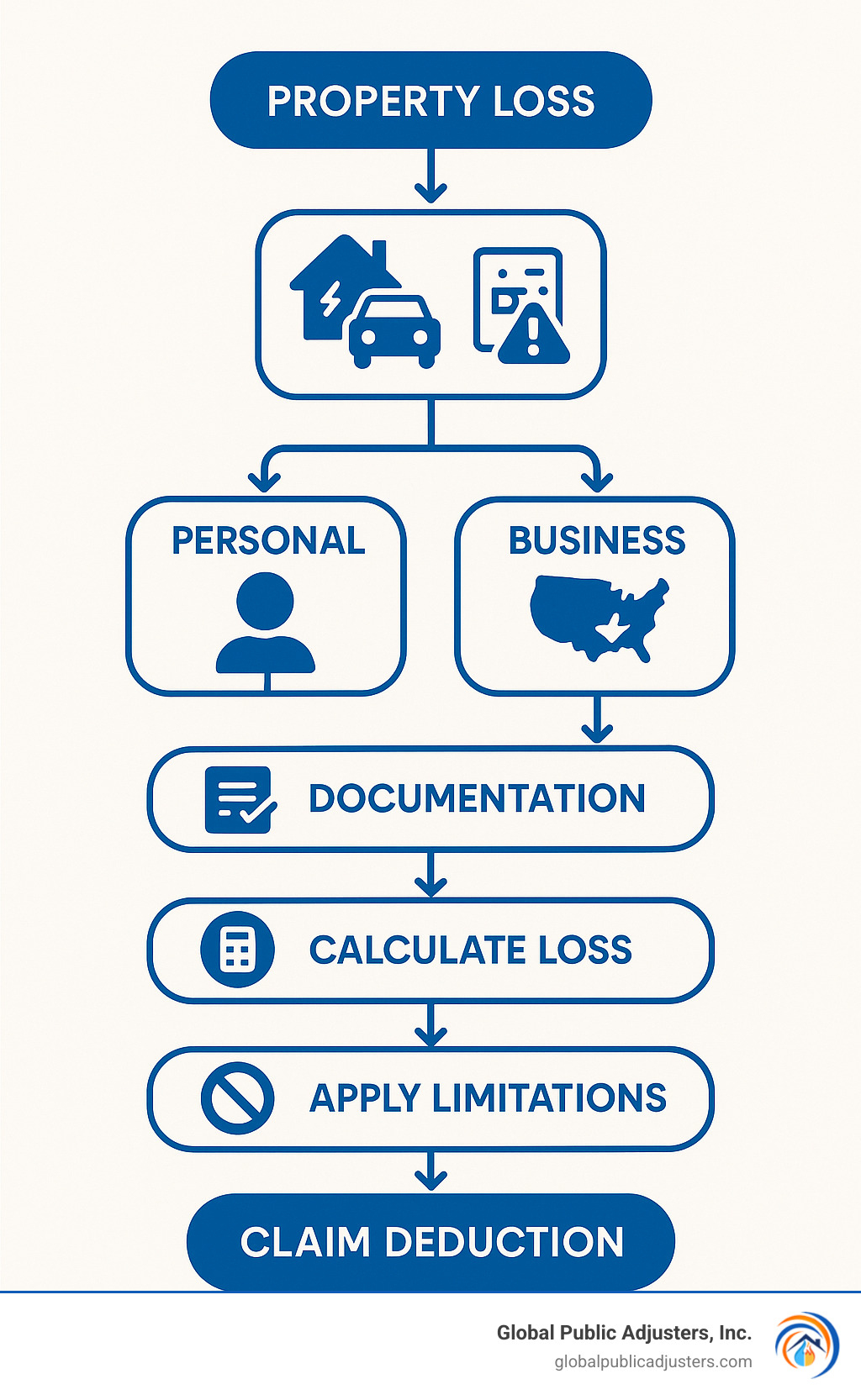

Who can claim a casualty and theft loss deductiondepends on several key factors that changed dramatically after the Tax Cuts and Jobs Act of 2017. Here’s the quick answer:

For Personal Property (2018-2025):

- Property owners who suffered losses in afederally declared disaster area only

- Must itemize deductions on Schedule A

- Subject to $100 per event and 10% AGI limitations

For Business/Income-Producing Property:

- Business owners and rental property owners

- No federally declared disaster requirement

- Includes losses from theft, Ponzi schemes, and bank failures

The rules are much stricter now than they used to be. Before 2018, you could deduct most casualty and theft losses regardless of whether the government declared your area a disaster zone. That changed when Congress passed new tax laws.

Acasualty losshappens when your property gets damaged from sudden, unexpected events like storms, fires, or accidents. Atheft lossoccurs when someone illegally takes your property with criminal intent.

During 2024 alone, FEMA declared 182 federal emergencies for natural disasters across the United States. If you weren’t in one of those declared areas, you generally can’t deduct personal property losses on your federal taxes.

The key distinction is between personal-use property (your home, car, belongings) and business property. Business losses still qualify for deductions without the federal disaster requirement, but personal losses face much tighter restrictions.

Related content aboutwho can claim a casualty and theft loss deduction:

- file a theft and loss claim

- how to claim theft loss of inventory on schedule c

- what year do you claim casualty theft losses

The Biggest Hurdle: The Federally Declared Disaster Requirement

The rules aroundwho can claim a casualty and theft loss deductionchanged dramatically in 2018, and honestly, it caught a lot of people off guard. Before that year, if a tree crashed into your living room during a storm or someone broke into your garage and stole your tools, you could potentially deduct those losses on your taxes—even if your insurance didn’t cover everything.

Those days are gone, at least temporarily. The Tax Cuts and Jobs Act of 2017 threw up a major roadblock that’s still in effect through 2025.

Here’s the new reality: if you want to deduct losses on yourpersonal-use property(your home, car, personal belongings), the damage or theft must happen in an area that receives afederally declared disasterdesignation from the President. No federal disaster declaration? No federal tax deduction. Period.

This distinction between personal property and business property is crucial. If you own a business or rental property, you’re in luck—those losses don’t need to meet the federal disaster requirement. But for everything else you personally own, Uncle Sam now requires that presidential stamp of approval.

We know this can feel incredibly frustrating. You’ve suffered a real loss, maybe thousands of dollars worth of damage, but because the President didn’t declare your area a federal disaster zone, you can’t get any tax relief. It’s one of those situations where the rules feel particularly harsh.

There is a silver lining for some taxpayers, though. While the federal government tightened these rules, many states decided to “decouple” their tax laws from the federal changes. States like New York still allow casualty and theft loss deductions even when there’s no federal disaster declaration. Check your state’s specific tax laws—you might still get some relief there.

Need to check if your area qualifies? TheDisasterAssistance.gov websitelets you search by address to see if you’re in a declared disaster area. TheIRS also maintains a list of areas affected by federally declared emergenciesthat’s worth bookmarking if you’re dealing with recent damage.

What is a Federally Declared Disaster?

A federally declared disaster isn’t just any bad weather day or unfortunate event. It requires apresidential declarationunder the Robert T. Stafford Act, which happens when disasters overwhelm what state and local governments can handle on their own. FEMA coordinates the federal response and assigns specific disaster declaration numbers to track everything.

The events that typically qualify paint a picture of serious, widespread destruction:hurricanesthat flatten entire neighborhoods,floodsthat swamp whole counties,tornadoesthat carve paths of devastation,wildfiresthat consume thousands of acres, andsevere stormsthat knock out power for weeks.Terrorist attackscan also receive disaster declarations, depending on the scope and impact.

Think about it this way—if CNN is covering it as a major disaster and federal emergency crews are being deployed, there’s a good chance it’ll get that presidential declaration. If it’s just your neighborhood dealing with damage from a bad storm, probably not.

Here’s a real-world example: When Hurricane Ian slammed into Florida in 2022, the widespread destruction earned a federal disaster declaration. Homeowners in the affected counties could potentially deduct their unreimbursed losses. But if a severe thunderstorm damages your roof and it doesn’t trigger a federal declaration, you’re generally out of luck for federal tax purposes.

If you’re dealing with property damage and need help navigating the claims process, check out our guide onnavigating property damage claims for a smoother process.

What Doesn’t Qualify as a Casualty?

The IRS has a pretty specific definition of what counts as a casualty, and it might surprise you what doesn’t make the cut. The magic phrase is“sudden, unexpected, or unusual”—and all three words matter.

Misplaced propertyandlost itemsdon’t count, no matter how valuable. If you can’t find your grandmother’s ring or your laptop disappears during a move, that’s not a casualty in the tax world’s eyes. There’s no sudden external force at work—just human forgetfulness.

Normal wear and tearis definitely out. Your 20-year-old water heater finally giving up the ghost? That’s expected, not sudden. Same goes forprogressive deteriorationlike termite damage that happens over months, rust that slowly eats away at metal, or land erosion that occurs gradually over time.

Here’s one that surprises people:damage from a family petusually doesn’t qualify. Your dog chewing up your favorite shoes or your cat scratching the furniture falls into the “you could reasonably expect this” category. The IRS figures pet ownership comes with certain predictable risks.

Accidental breakage under normal conditionstypically doesn’t count either. Drop a plate while doing dishes? Accidentally put your elbow through a window while cleaning? These happen during routine activities, so they’re not considered unusual enough.

The key is that sudden, unexpected element. A kitchen fire that starts when grease ignites? That’s sudden. Water damage from a pipe that bursts during a freeze? Unexpected. But damage that builds up slowly over time, even if you didn’t notice it happening, doesn’t meet the IRS standard for a deductible casualty loss.

Who Can Claim a Casualty and Theft Loss Deduction Under Current Tax Law?

Understandingwho can claim a casualty and theft loss deductionunder today’s tax laws can feel a bit like untangling a complicated knot. But don’t worry, we’re here to help make it clearer! The biggest thing to remember is that the rules are very different depending on whether your loss happened to your personal property (like your home or car) or to your business property.

When you’re ready to calculate your loss for tax purposes, you’ll typically use IRS Form 4684, called “Casualties and Thefts.” This form guides you through figuring out how much you lost. You’ll need to know your property’s original cost (its “adjusted basis”), its value right before and after the event (its “fair market value”), and any money you got back from insurance or other sources.

Here’s a quick look at the main differences in rules for personal versus business property:

| Feature | Personal-Use Property (e.g., home, car, personal belongings) | Business/Income-Producing Property (e.g., rental property, office equipment) |

|---|---|---|

| Who Can Claim? | Owners of personal items like your home, vehicles, furniture, clothing, and other personal belongings. | Business owners, as well as owners of rental properties or other assets used to make money. |

| Federally Declared Disaster? | YES, for tax years 2018 through 2025, your loss must be due to an event in a federally declared disaster area. | NO, there’s no federal disaster requirement for business property losses. |

| Types of Property Covered | Your main home, vacation home, personal vehicles, household goods. | Rental properties, office equipment, inventory, machinery, tools, and other assets used in a business. |

| IRS Form Used | Form 4684 (and generally Schedule A, Form 1040, if you itemize deductions). | Form 4684 (and generally Schedule C, E, or F, depending on your business type). |

| Other Notable Losses Covered | There’s a rare exception for “personal casualty gains” (when insurance pays you more than your loss). | Can include losses from things like Ponzi-type investment schemes and losses on deposits in insolvent banks or credit unions. |

For more in-depth help with your property damage claim, especially if it involves your home or business, check out our insights onProperty Damage Claims Orlando.

Who is eligible to claim a casualty and theft loss deduction for personal property?

If you own personal property – that’s anything not used for business or income-producing purposes, like your family home, your car, or your personal belongings – the rules for claiming a casualty or theft loss deduction are quite strict right now. From 2018 through 2025, the only way to claim a federal deduction for personal property losses is if the damage or theft was caused by an event in afederally declared disaster area.

This means if a tornado destroys your garage, and your area was declared a federal disaster, you might be able to deduct it. But if your car is stolen outside of a declared disaster, sadly, that loss won’t qualify for a federal tax deduction, even if it’s a huge financial hit. This rule applies to all your personal-use property, whether it’s your main home, a vacation home, your vehicles, or even your beloved personal items like furniture or jewelry.

There’s one small exception for personal casualty gains. This happens if your insurance reimbursement is actuallymorethan your adjusted basis in the property. It’s a bit unusual, but it can happen!

When disaster strikes your home or personal property, knowing who to call can make all the difference. Learn more aboutWho Do I Call For Residential Losses Or Damages?.

Who can claim a casualty and theft loss deduction for business property?

Now, if your loss involved business property or property you use to earn income, the rules are much more flexible. Business owners and those who own income-producing property (like rental property) can still claim a casualty or theft loss deduction without the need for a federally declared disaster. That’s a huge difference!

This means if your office equipment is stolen, your rental property is damaged by a non-disaster storm, or your inventory is ruined, you can generally deduct these losses on your federal taxes. The IRS treats these losses as part of the cost of doing business, and they’re not subject to the same tight restrictions as personal losses.

Beyond physical property, these deductions can also apply to some specific financial losses. For instance, if you’ve suffered losses fromPonzi-type investment schemes, or if you’ve lost money due todeposits in insolvent banks, credit unions, or other financial institutions, these can sometimes be claimed as theft losses on your tax return. It’s always best to consult with a tax professional for these more complex situations!