Public Insurance Adjuster: 5 Powerful Benefits in 2025

Understanding the Role of Public Insurance Adjusters

Apublic insurance adjusteris a licensed professional who works exclusively for policyholders—not insurance companies—to help maximize claim settlements and steer the complex claims process.

Quick Answer: What is a Public Insurance Adjuster?

–Who they work for:You (the policyholder), not the insurance company

–How they’re paid:Typically 5-20% of your settlement (no recovery = no fee)

–What they do:Inspect damage, document losses, estimate costs, and negotiate with insurers

–When to hire:For large/complex claims, denied claims, or when you lack time/expertise

–Key benefit:Studies show settlements can be 300-1500% higher with professional representation

When disaster strikes your home or business, you’re suddenly thrust into a world of insurance jargon, claim forms, and negotiations with adjusters who work for the insurance company. It’s an overwhelming process that can leave you feeling outmatched and undercompensated.

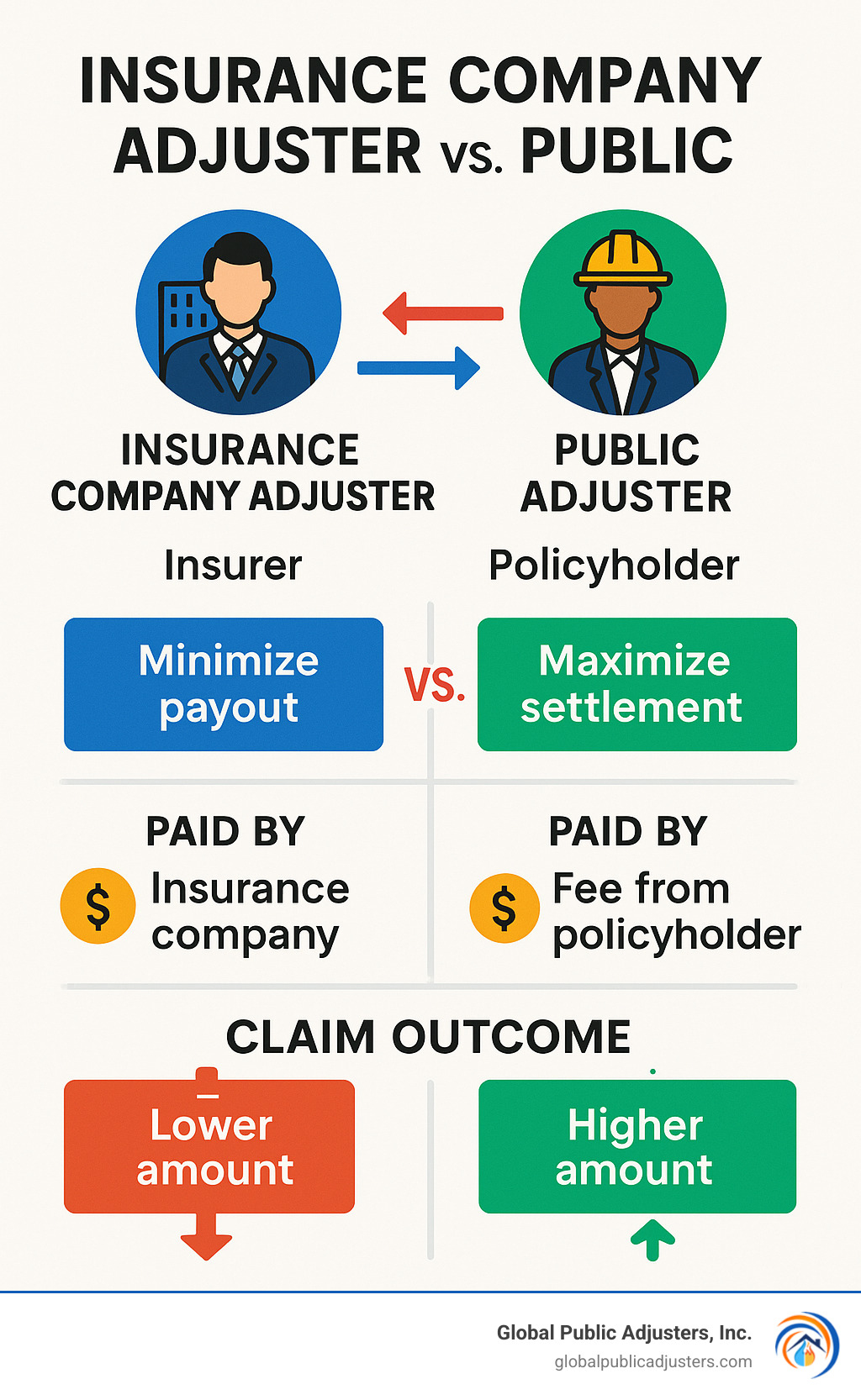

The insurance company will sendtheiradjuster to assess your damage. But here’s what many people don’t realize:you can hire your own adjuster too.

That’s where public insurance adjusters come in. Think of them as your advocate in what can often feel like an adversarial process. While the insurance company’s adjuster represents the insurer’s interests, a public adjuster representsyours.

According to research from Hurricane Katrina claims, policyholders who used public adjusters received settlements that were, on average,747% higherthan those who didn’t. That’s not because public adjusters perform magic—it’s because they understand policy language, know how to properly document losses, and can spot coverage that untrained eyes might miss.

This guide will help you understand when hiring a public adjuster makes sense, how the process works, what it costs, and how to avoid scams in this largely unregulated industry.

Simplepublic insurance adjusterglossary:

–home insurance adjusters near me

–licensed insurance adjusters

–what do insurance adjusters do

What Is a Public Insurance Adjuster?

Think of apublic insurance adjusteras your personal advocate in the often confusing world of insurance claims. While your insurance company sends their own adjuster to evaluate your damage, you have the right to hire your own professional too—someone who works exclusively for you, not them.

Here’s the simple truth: when disaster strikes, you’re dealing with professionals who handle claims every single day. They know the ins and outs of policy language, coverage limits, and settlement strategies. Meanwhile, you’re probably filing your first major claim, feeling overwhelmed and unsure if you’re getting a fair deal.

Apublic insurance adjusterlevels that playing field. These licensed professionals work solely for policyholders, earning their fee as a percentage of your settlement—typically between 5-20%. This means they only get paid when you do, and the bigger your settlement, the more they earn. Talk about aligned interests!

| Type of Adjuster | Who They Work For | How They’re Paid | Primary Goal |

|---|---|---|---|

| Company/Staff Adjuster | Insurance Company | Salary from insurer | Minimize claim payouts |

| Independent Adjuster | Insurance Company (contract) | Fee from insurer | Process claims efficiently for insurer |

| Public Adjuster | Policyholder | Percentage of settlement | Maximize policyholder recovery |

How a public insurance adjuster differs from other adjusters

The difference between a public adjuster and the insurance company’s adjuster isn’t subtle—it’s night and day.Public adjusters work for you, period. They have no financial ties to insurance companies and no incentive to minimize your claim.

Insurance company adjusters, whether they’re staff employees or independent contractors, get paid by the insurer. Their job is to settle claims quickly and cost-effectively for their employer. That’s not necessarily bad—it’s just business. But it means their interests don’t always align with yours.

Public adjusters operate on contingency, meaning they only earn money when they successfully recover funds for you. If they can’t improve your settlement, you typically owe them nothing. This creates a powerful incentive for them to fight for every dollar you deserve.

They also bring specialized expertise that most homeowners simply don’t have. They understand policy language that can be deliberately confusing, know current construction costs, and can spot damage that untrained eyes might miss. They’ve seen every trick in the book and know how to counter them.

Services a public insurance adjuster provides

A skilledpublic insurance adjusterdoes far more than just inspect your damage and submit paperwork. They become your advocate throughout the entire claims process, handling everything from the initial assessment to final settlement negotiations.

Damage assessment is where their expertise really shines.They don’t just look at obvious damage—they use moisture meters, thermal imaging, and other specialized tools to find hidden problems that could cost you thousands down the road. Water damage, for instance, often extends far beyond what’s visible to the naked eye.

Policy review and coverage analysisis another critical service. Many homeowners are surprised to learn about coverage they didn’t even know they had. Things like additional living expenses, building code upgrades, or special endorsements can add significantly to your settlement.

Cost estimationis where public adjusters often find the biggest gaps in insurance company offers. They prepare detailed repair estimates using current market rates and proper construction methods. It’s not uncommon for their estimates to be 50% or more higher than what the insurance company initially offers.

They handle all the paperwork and communicationwith your insurance company, which is a huge relief when you’re already dealing with the stress of property damage. They know exactly what documentation is needed and how to present it for maximum impact.

Negotiation is their specialty.While you might accept the first offer out of frustration or uncertainty, public adjusters know when to push back and how to justify higher settlements. They speak the insurance company’s language and aren’t intimidated by delay tactics or lowball offers.

They can even reopen settled claimsif you find additional damage or realize you were underpaid. Many people don’t know this is possible, but experienced adjusters can often secure additional compensation even after you thought your case was closed.

For more detailed information about these services, check out our comprehensive guide onwhat public insurance adjusters do.

How the Claims Process Works & When to Hire

Picture this: your roof gets torn off in a storm, or water floods your basement. Your first instinct is probably to call your insurance company and hope for the best. But understanding how the claims process actually works can make the difference between getting fairly compensated and leaving thousands of dollars on the table.

The typical insurance claim follows a predictable path.First, you report the lossto your insurance company—usually within 24 to 72 hours of finding the damage.Next comes emergency mitigation, where you take immediate steps to prevent further damage (think tarping a damaged roof or extracting standing water).

Then your insurance company sends their adjuster to inspect the damage. This is followed by theproof of loss phase, where you document all damages and costs. After that comessettlement negotiation—often the most challenging part—followed by payment, which frequently arrives in multiple checks as repairs progress.

Here’s the thing most people don’t realize:the best time to hire a public insurance adjuster is right at the beginningof this process, not after you’ve already been lowballed or denied.

Early involvement allows us to properly document everything from day one, prevent common mistakes that could hurt your claim, and ensure nothing gets overlooked. It’s much harder to go back and fix problems after the insurance company has already made up their mind about your claim’s value.

There are some timing rules to keep in mind, though. In many states,public insurance adjusters can’t knock on your door immediately after a disaster. California, for example, prohibits adjusters from soliciting residential contracts for seven days after a declared disaster unless you contact them first. This “cooling off” period protects homeowners from high-pressure tactics during vulnerable times.

The good news? You havecancellation rights. In California, you can cancel a public adjuster contract within three business days for any reason and get a full refund within five business days.

Step-by-step claims journey with a public insurance adjuster

When you work with us at Global Public Adjusters, Inc., the process becomes much smoother and more thorough than going it alone.

We start with a free consultationwhere we evaluate your claim’s potential. No sales pitch—just an honest assessment of whether our services make sense for your situation. We’ll review the damage, examine your policy, and explain exactly how we work and what we charge.

If immediate action is needed,we coordinate emergency mitigation serviceslike roof tarping, water extraction, or board-up work. These emergency costs are typically covered by your insurance policy, and proper documentation from the start protects your claim.

Once you decide to move forward,we execute a clear contractthat spells out our fee structure, what services we’ll provide, and your cancellation rights. No fine print surprises.

We then formally notify your insurance companythat we’re representing you. This puts them on notice that they’ll be dealing with experienced professionals who understand the claims process inside and out.

The real work begins withcomprehensive damage documentation. We conduct detailed inspections, photograph everything, measure affected areas, and create thorough damage reports. We use advanced technology like Matterport 3D scanning to create permanent records that can’t be disputed later.

Duringjoint inspections with the insurance company’s adjuster, we ensure they don’t miss anything and that damage gets properly categorized. Having apublic insurance adjusterpresent during these inspections often reveals damage that might otherwise be overlooked.

We prepare detailed repair estimatesusing current market pricing and proper construction methods. You’d be surprised how often insurance company estimates significantly undervalue the true cost of quality repairs.

Thenegotiation phaseis where our experience really pays off. We negotiate directly with insurance adjusters and management, often going through multiple rounds of back-and-forth to secure maximum recovery.

Before you accept any settlement,we review everythingto ensure all damages are addressed and all policy benefits are maximized. And if additional damage surfaces during repairs—which happens more often than you’d think—we handle supplemental claimsto ensure complete recovery.

When should a policyholder consider a public insurance adjuster

After 50+ years in this business, we’ve seen certain patterns emerge. Some claims really benefit from professional representation, while others might not justify the cost.

Large or complex lossesare prime candidates for professional help. Think hurricane damage involving both wind and water, or fires that affect multiple areas of a building. These claims require extensive documentation and often involve multiple types of coverage that need to be coordinated.

If yourclaim gets denied or you receive what seems like a lowball offer, that’s a red flag. Insurance companies sometimes deny valid claims hoping policyholders won’t fight back, or they offer quick settlements that don’t fully address all damages.

Time constraintsmake professional representation valuable. Properly documenting damage, researching policy coverage, and negotiating with adjusters takes significant time and energy. If you’re dealing with the stress of major property damage while trying to maintain your job and family life, professional help can be a lifesaver.

Lack of expertiseis nothing to be ashamed of—insurance policies are intentionally complex documents filled with technical language. Most people have never filed a major claim before, so they don’t know what to look for or how to properly document losses.

Business interruption claimsare particularly tricky, requiring detailed financial documentation and projections. These claims almost always benefit from professional assistance because the calculations can be complex and the stakes are high.

Deadline pressureis real in insurance claims. Some policies have strict deadlines for filing or providing documentation, and missing these deadlines can void your coverage entirely.

For more detailed information about when professional representation makes sense, check out our guide onthe top four reasons to hire a public insurance adjuster.

The bottom line? If your claim is significant enough that an underpayment could cause financial hardship, or if the process feels overwhelming, it’s worth having a conversation with apublic insurance adjusterto understand your options.

Fees, Regulations & Verifying Credentials

Let’s talk about money—specifically, what hiring apublic insurance adjustercosts and how to make sure you’re working with someone legitimate.

Most public adjusters work on what’s called acontingency fee basis. This means we only get paid when you do, and our fee comes as a percentage of your insurance settlement. Think of it as having a lawyer who only gets paid if they win your case.

Typical fees range from5% to 20%of your total settlement, though they can be as low as 2% for very large claims or as high as 25% for complex cases. The exact percentage depends on factors like the size of your claim, its complexity, and your state’s regulations.

Here’s why this fee structure works in your favor: we haveskin in the game. If we don’t increase your settlement, we don’t get paid. If we get you a bigger settlement, we earn more. Our success is directly tied to yours.

But here’s what many people don’t realize—even after paying our fee, you typically end up with significantly more money than you would have received on your own. Remember those studies showing settlements 300-1500% higher with professional representation? Even after fees, you’re usually far ahead.

Typical fee models for a public insurance adjuster

While percentage-based fees are standard, there are several ways these can be structured:

Percentage of Total Recoveryis the most common approach. If we get you a $100,000 settlement and our fee is 10%, we receive $10,000 and you receive $90,000. Simple and straightforward.

Percentage of Incremental Recoveryis sometimes called the “overage basis.” This means we only take a percentage of the amount above what the insurance company initially offered. If they offered $50,000 and we get you $100,000, our fee applies only to that extra $50,000. This can be fairer but isn’t always available.

Sliding Scale Feeswork like tax brackets—the percentage decreases as the settlement amount increases. For example, 15% on the first $100,000, then 10% on anything above that. This approach is common for very large claims.

Flat Fee arrangementsare rare but sometimes used for smaller claims where a percentage might seem disproportionate. Some adjusters also use hourly rates for consulting services, though this is uncommon for full claim representation.

At Global Public Adjusters, Inc., we believe incomplete transparencyabout our fees. We’ll explain exactly how our compensation works before you sign anything, and there are never any hidden costs or surprise charges.

State-specific rules: California, Florida & beyond

Every state regulates public adjusters differently, and these rules can significantly impact your experience. Understanding your state’s regulations helps you know what protections you have and what to expect.

Californiaallows fees ranging from 2% to 25% or more, depending on the claim’s size and complexity. The state gives you strong consumer protections, including athree-day cancellation periodwhere you can back out of any contract for any reason. California also prohibits adjusters from knocking on doors for seven days after declared disasters—a rule designed to protect vulnerable homeowners from high-pressure sales tactics. All public adjusters must be licensed, bonded, and pass state examinations. You can verify any adjuster’s license through the California Department of Insurance website.

Floridahas been particularly active in regulating public adjusters, especially after major hurricanes revealed widespread fraud. The state requires licensing and bonding, and has strict rules about post-disaster solicitation. Florida also extended the deadline for hurricane claims—homeowners now have two years from hurricane landfall to file claims, giving families more time to assess damage and make decisions.

Other statesvary widely in their approach. Some states like Kansas and Arkansas actually restrict or ban public adjusters for home claims entirely. Most states require licensing, continuing education, and bonding, butfee caps vary dramatically. Some states have no caps at all, while others limit fees to specific percentages.

For current California regulations, you can reference theCalifornia Insurance Code Section 15007, which outlines the legal requirements and scope for public insurance adjusters.

TheNational Association of Public Insurance Adjusters (NAPIA)maintains standards for the industry and provides a member directory where you can verify credentials and find licensed professionals in your area.

Red flags to watch forinclude adjusters who demand payment upfront, promise unrealistic results, use high-pressure sales tactics, or can’t provide proof of licensing and bonding. Legitimate public adjusters are happy to provide references, explain their process clearly, and give you time to make an informed decision.

Hiring apublic insurance adjusteris a significant decision that can impact your financial recovery for years to come. Take time to understand the fees, verify credentials, and choose someone with a proven track record of success.

Pros, Cons & Real-World Scenarios

Every homeowner facing property damage eventually asks the same question: “Should I handle this claim myself or hire apublic insurance adjuster?” It’s a fair question, and the honest answer is: it depends on your situation.

Let’s start with the good news. When you hire a professionalpublic insurance adjuster, you’re typically looking atsignificantly higher settlements. We’re not talking about small improvements here—industry research shows settlements can be 300% to 1500% higher with professional representation. That Hurricane Katrina study we mentioned earlier? The 747% increase in settlements wasn’t a fluke.

Why do settlements increase so dramatically?It comes down to expertise and time. We know how to spot damage that insurance company adjusters might miss or downplay. We understand policy language that can open up additional coverage. And we have the time to thoroughly document everything while you’re dealing with the stress of property damage.

Thetime savings alonecan be worth our fee. Managing an insurance claim properly is essentially a part-time job. Between documenting damage, researching policy coverage, communicating with adjusters, and negotiating settlements, many homeowners spend dozens of hours on their claims.

We also bringspecialized knowledgethat most people simply don’t have. Insurance policies are written by lawyers for lawyers. We translate that complex language into plain English and make sure you’re getting every benefit you’re entitled to.

But let’s be completely honest about thepotential downsides. Our fees do come out of your settlement, which means less money in your pocket upfront. However, if we increase your settlement by 300% and charge a 15% fee, you’re still coming out way ahead.

There’s also the reality thatwe can’t create coverage that doesn’t exist. If your policy has low limits or specific exclusions, even the best public adjuster can’t magically make those problems disappear. We can maximize what’s there, but we can’t perform miracles.

Fraud is a real concernin our industry, unfortunately. Some unscrupulous operators use high-pressure tactics or make unrealistic promises. That’s why it’s crucial to verify credentials and trust your instincts. If something feels off, it probably is.

Scenarios where hiring a public insurance adjuster shines

After 50+ years in this business, we’ve seen certain situations where professional representation consistently provides tremendous value.

Hurricane damageis probably our bread and butter. When you’re dealing with both wind damage and potential flood damage, you’re often coordinating between your homeowners policy and a separate flood policy. Each insurer tries to push costs onto the other policy, leaving you caught in the middle. We make sure both policies are properly used and you get maximum recovery from each.

Fire claimsare another area where we excel. A house fire isn’t just about replacing burned materials. There’s smoke damage throughout the property, water damage from firefighting efforts, potential business interruption if you run a home business, and additional living expenses while repairs are made. Insurance companies often focus only on the obvious damage and miss these other covered expenses.

Business interruption claimsare particularly complex. You need to prove not just that your business was interrupted, but exactly how much income you lost and for how long. This requires detailed financial analysis and projections that most business owners aren’t equipped to handle while also trying to get their business back up and running.

We’ve had great success withdenied roof leak claimstoo. Insurance companies love to blame roof leaks on “normal wear and tear” or “lack of maintenance.” But often, what looks like a maintenance issue was actually caused by wind damage or other covered perils. We know how to investigate the real cause and present evidence that supports coverage.

Mold claims following water damagecan be tricky because the relationship between the original water damage and resulting mold growth isn’t always obvious to untrained eyes. We understand how to document this relationship and pursue coverage for both the original damage and resulting complications.

Situations where DIY or other help may suffice

Here’s where we practice some tough love: we’re not always the answer. There are definitely situations where hiring apublic insurance adjusterdoesn’t make financial sense.

Small claims below your deductibleare the obvious example. If your damage is $2,000 and your deductible is $2,500, there’s no insurance money to recover, so our fees wouldn’t be justified.

Simple theft claimswith clear police reports and good documentation are often straightforward enough to handle yourself. If someone stole your laptop and you have receipts and a police report, that’s usually not complex enough to warrant professional help.

When yourinsurance company responds quicklywith what seems like a fair offer and the coverage is clear-cut, you might not need us. Some insurers do handle straightforward claims fairly and efficiently.

Very small claimscan be problematic too. If the total potential recovery is only a few thousand dollars, our percentage fee might consume a significant portion of that recovery.

If you happen towork in construction or insuranceyourself, you might have enough knowledge to effectively represent yourself. Though we’d still recommend at least getting a consultation to make sure you’re not missing anything.

The key is being honest about your situation. We’d rather tell you upfront that you don’t need our services than take your money for a claim you could handle yourself. That’s just good business and the right thing to do.

Frequently Asked Questions about Public Insurance Adjusters

When you’re dealing with property damage and considering whether to hire apublic insurance adjuster, you probably have questions. We’ve been helping homeowners and business owners for over 50 years, and these are the questions we hear most often.

How are public insurance adjuster fees paid and are there caps?

Here’s the straightforward answer:public insurance adjusterfees come directly from your settlement, not your pocket. We typically charge between 5% and 20% of whatever we recover for you. If we don’t increase your settlement, you don’t pay us anything. It’s that simple.

Think of it this way—if your insurance company offers you $50,000 and we negotiate that up to $100,000, our fee comes from that $100,000. You still end up with significantly more money than you would have received on your own, even after paying our fee.

Fee caps vary quite a bit depending on where you live.In California, fees can range anywhere from 2% all the way up to 25%, depending on how complex your claim is. Some states have stricter caps, while others let the market decide. A few states don’t allow public adjusters at all for certain types of claims.

The beauty of our fee structure is that our interests are completely aligned with yours. We only make money when you do, and the more we recover for you, the more we earn. This gives us every incentive to fight for the maximum settlement possible.

What questions should I ask before signing a contract?

Before you hire anypublic insurance adjuster, you want to make sure you’re working with someone legitimate and experienced. Here are the key questions that will help you separate the professionals from the pretenders.

Start with licensing and credentials.Ask if they’re properly licensed in your state and whether they carry errors and omissions insurance. Any hesitation on these basic questions should be a red flag.

Get crystal clear on fees and costs.Ask exactly how much you’ll pay and whether there are any additional costs beyond their percentage fee. Make sure you understand what happens if your claim is denied or if you’re not satisfied with their services.

Ask about their experience with claims like yours.A fire damage claim is very different from a hurricane claim or a business interruption claim. You want someone who has handled similar situations successfully.

Find out who will actually work on your claim.Will you be dealing with the person you’re talking to, or will your file be handed off to someone else? There’s nothing wrong with having a team, but you should know who your main contact will be.

Request recent references.Any reputable adjuster will gladly provide contact information for recent clients who had similar claims. Actually call these references—it’s worth the few minutes it takes.

For a more comprehensive list of questions that can help you make the best decision, check out our detailed guide onquestions to ask your public adjuster.

How can I verify a public insurance adjuster’s license and avoid fraud?

Unfortunately, disasters bring out both the best and worst in people. While mostpublic insurance adjustersare honest professionals trying to help, there are some bad actors who prey on people when they’re vulnerable.

The first step is always checking their license.Every state maintains an online database where you can verify that an adjuster is properly licensed and that their license is current. This takes just a few minutes but can save you from major headaches later.

Look up their complaint historywith your state insurance department and the Better Business Bureau. A few complaints over many years might not be concerning, but a pattern of problems definitely is.

Trust your instincts about high-pressure tactics.Legitimate adjusters will give you time to make an informed decision. Be very wary of anyone who shows up at your door uninvited after a disaster or who pressures you to sign immediately. Good adjusters are busy enough that they don’t need to use high-pressure sales tactics.

Watch out for these red flags:Anyone asking for money upfront, promising specific settlement amounts, or suggesting you inflate your claim. These are signs of either inexperience or dishonesty—neither of which you want representing you.

Read any contract carefully before signing.Make sure you understand the fee structure, what services are included, and your cancellation rights. In most states, you have a few days to cancel without penalty if you change your mind.

At Global Public Adjusters, Inc., we’re proud of our 50+ year track record and are always happy to provide references and verify our credentials. When you’re dealing with a major loss, the last thing you need is to worry about whether your adjuster is legitimate.

Conclusion

When disaster strikes your home or business, you shouldn’t have to face the insurance company alone. A qualifiedpublic insurance adjustercan level the playing field, ensuring you receive every dollar you’re entitled to under your policy—not just what the insurance company wants to pay.

Think about it: insurance companies have entire teams of professionals working to minimize payouts. They have adjusters, attorneys, and experts all focused on protecting their bottom line. Why wouldn’t you want your own professional advocate working just as hard to protect yours?

At Global Public Adjusters, Inc., we’ve spent over 50 years helping homeowners and business owners in Orlando, Pensacola, and throughout Florida steer the complex world of insurance claims. We’ve seen how insurance companies operate, we understand their tactics, and we know how to effectively counter them.

Our experience has taught us thatthe difference between adequate compensation and full recoveryoften comes down to having someone who truly understands the process on your side. We know which questions to ask, what documentation is needed, and how to spot coverage that might otherwise be overlooked.

The most important thing is choosing the right professional. Look for someone who islicensed and experienced, someone who will be transparent about fees and realistic about outcomes. Avoid anyone who makes promises they can’t keep or pressures you to sign immediately.

Not every claim needs professional representation—we’re honest about that. But for large claims, complex coverage situations, or when you’re facing a denied or underpaid claim, apublic insurance adjustercan often make all the difference.

We offerfree consultationsto evaluate your situation. No obligation, no pressure, no sales pitch—just an honest assessment from professionals who understand what you’re going through. Sometimes that conversation alone can save you thousands of dollars in mistakes.

If you’re dealing with an insurance claim and wondering whether you’re getting a fair shake, we’re here to help. Visit ourservices pageto learn more about how we can assist with your specific situation, or contact us directly for that free consultation.

Remember: when disaster strikes, you have choices. You can go it alone, or you can have an experienced advocate in your corner. We know which option gives you the best chance of a fair outcome.