Public Adjuster Florida: Best 2025 Guide

Why Florida Property Owners Need Expert Help With Insurance Claims

Public adjuster floridaprofessionals are licensed insurance experts who work exclusively for you—not your insurance company—to help maximize your property damage claim settlement. If you’re dealing with hurricane damage, water leaks, fire loss, or denied claims in Florida, here’s what you need to know:

Quick Answer: What is a Public Adjuster in Florida?

- Who they represent: You (the policyholder), not the insurance company

- What they do: Document damage, estimate repair costs, file claims, and negotiate settlements

- How they’re paid: Typically 10-20% of your settlement (no upfront costs)

- When to hire: For claims over $10,000, denied claims, or when you feel overwhelmed

- Licensing: Must be licensed by Florida Department of Financial Services

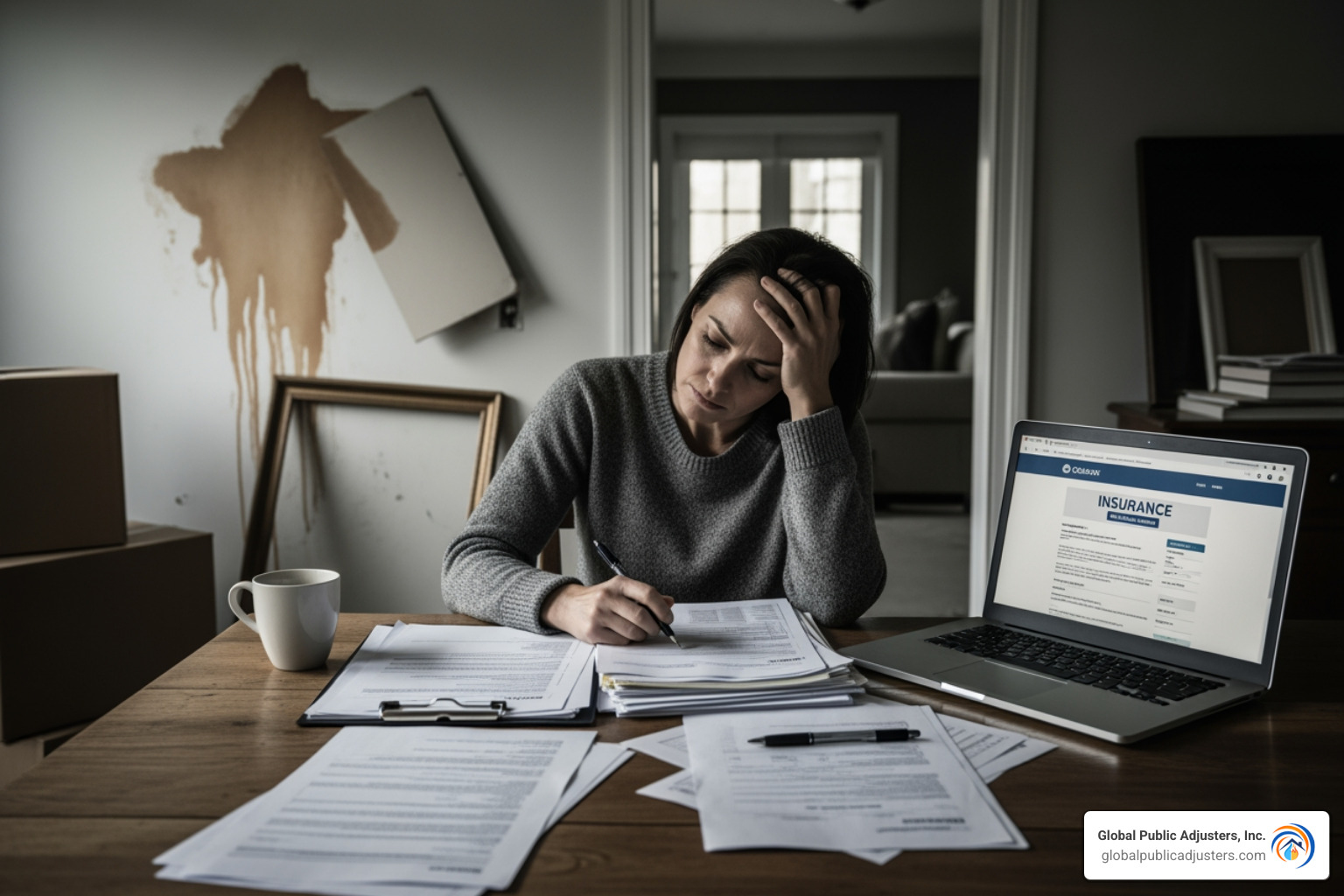

When disaster strikes your Florida property, navigating the insurance claims process is overwhelming. Your insurance company sends its own adjuster to evaluate the claim. That adjuster works for the insurer, and their goal is to protect the company’s interests, which often means minimizing your payout.

This creates an uneven playing field. A public adjuster levels it. We are experts who inspect your property, document the full extent of the damage, prepare detailed repair estimates, and negotiate aggressively with your insurer. Studies show that policyholders who hire public adjusters receive significantly higher settlements—often by several hundred percent.

Best of all, most public adjusters work on a “no recovery, no fee” basis, so you only pay if they successfully increase your settlement. Florida has specific regulations to protect consumers, including fee caps and strict licensing requirements, ensuring you have a trusted advocate on your side.

Understanding the Role of a Public Adjuster in Florida

When you’re dealing with property damage, apublic adjuster floridais your personal advocate in the complex world of insurance claims. We are licensed professionals who workexclusivelyfor you, the policyholder. Our goal is to ensure you get every dollar you deserve to recover from your losses.

Our role is defined by Florida Statute 626.854, which outlines that we are theonlytype of adjuster licensed to represent your side of a claim. We translate confusing policy language, explain your rights, and work to secure the maximum possible settlement to restore your property and peace of mind.

The numbers prove our value. A state-run study by the Office of Program Policy Analysis & Government Accountability (OPPAGA) found that policyholders who hired a public adjuster received574% morefor non-catastrophe claims. For catastrophe claims, the payout jumped by a massive747%compared to those who handled claims alone. You can learn more by readingWhy Should I Hire a Public Adjuster?.

The Key Difference: Public Adjuster vs. Company Adjuster

The most important distinction is who we work for. As public adjusters, we workexclusivelyfor you. Our legal and ethical duty is to your best interests, and we’re paid only when you get your settlement.

Company and independent adjusters, on the other hand, are paid by your insurance company. Their job is to protect the insurer’s financial interests, creating a clear conflict of interest. They may try to minimize your payout to save the company money. You need an advocate fighting foryourrecovery, not limiting it. For a closer look, read our article on the7 Types of Claims Adjusters and Their Duties in Florida.

Core Services Offered

We manage every detail of your claim so you can focus on getting back to normal.

Our core services include:

- Policy Review: We dive deep into your policy to identify all coverages and benefits you’re entitled to.

- Damage Assessment: Our team conducts a thorough on-site inspection, documenting all visible and hidden damages.

- Detailed Cost Estimates: We create comprehensive, itemized estimates reflecting the true cost to restore your property.

- Claim Documentation: We handle all the paperwork, from proof of loss forms to submitting all supporting evidence correctly and on time.

- Negotiation with Insurer: We negotiate directly with your insurance company, challenging lowball offers and fighting for a fair settlement.

- Settlement Management: Once a settlement is reached, we guide you through the final steps to ensure you are paid correctly.

For a complete list of how we can help, visit ourServicespage.

When and Why to Hire a Public Adjuster for Your Florida Claim

Your insurance company has a team of experts protecting their bottom line. Shouldn’t you have an expert fighting for yours?

Knowing when to call apublic adjuster floridacan make a huge financial difference. Consider hiring one in these situations:

- Complex Claims: If your damage involves multiple issues, like wind and subsequent water damage, a public adjuster can steer the complexities to ensure all aspects are covered.

- Large Losses (over $10,000): The larger the claim, the more incentive the insurer has to reduce the payout. Professional representation is a smart financial move.

- Denied or Underpaid Claims: Don’t accept a denial or lowball offer as final. We specialize in reopening claims and have successfully overturned countless unfair decisions.

- Time Constraints or Feeling Overwhelmed: Handling a claim is a full-time job. We take the burden off your shoulders so you can focus on your family or business.

In Florida you haveup to five yearsto reopen an old claim. If you feel you were underpaid, it’s not too late to seek help. Learn more in our guide:Is It Time For Me To Hire A Public Adjuster?

Common Claim Types Handled by a public adjuster florida

We have experience with every type of property damage claim common in Florida:

- Hurricane Damage: We document everything from wind and water intrusion to structural compromise.

- Water and Flood Damage: We handle claims from burst pipes, roof leaks, and flooding, acting quickly to prevent further issues like mold.

- Mold Contamination: We fight to ensure proper remediation costs are included in your settlement.

- Fire and Smoke Damage: We account for all structural damage, destroyed belongings, and the high cost of smoke and soot remediation.

- Roof Leaks: We ensure all related damages to insulation, ceilings, and walls are included in your claim.

- Vandalism and Theft: We help document property damage and lost valuables to ensure you are fully compensated.

- Sinkholes: We manage these technically complex claims, which often require specialized engineering assessments.

- Business Interruption: We calculate lost revenue, continuing expenses, and other financial impacts to your business.

Explore these in more detail on ourClaims Typepage.

Assisting with Residential vs. Commercial Claims

Whether you’re a homeowner or a business owner, apublic adjuster floridaprovides essential advocacy, though the approach differs.

Forhomeowners, we understand your home is your sanctuary. We document damage to the structure and personal belongings and fight to maximize additional living expense coverage if you’re displaced. OurResidential Damage Claim in Orlandopage offers more insight.

Forcondominium associations, we steer the complex master policies to ensure common areas like roofs, pools, and clubhouses are fully restored.

Forbusiness owners, the stakes are even higher. Beyond physical damage, we build a comprehensive case for your business interruption losses, including lost income, ongoing expenses, and damaged inventory. An inadequate settlement can mean closing your doors permanently, which is why we fight so hard to protect your livelihood. See ourCommercial Insurance Claims Orlandopage for details.

The Process and Costs of Working with a Public Adjuster Florida

When you hire apublic adjuster florida, you’re getting a partner to lift the burden of the claims process off your shoulders. Our process is designed to be simple and stress-free for you.

It begins with afree, no-obligation consultation and inspection. We’ll visit your property, conduct a thorough assessment of the damage, and review your insurance policy to understand your coverage. We look for both obvious and hidden issues that company adjusters often miss.

From there, we handle everything. We build your case through meticulousdamage documentation, including photos, videos, and written reports. We then prepare adetailed cost estimatethat reflects the true cost of repairs. Finally, we manage the entireclaim filing and negotiationprocess, using our expertise to counter lowball offers and secure a fair settlement.

Once asettlement payoutis agreed upon, we ensure the funds are released promptly. And remember, Florida law gives you up to5 years to reopen an old claim. If you were underpaid in the past, we can review the claim and potentially recover additional funds.

Understanding Fees and Payment Structure

One of the best parts of working with apublic adjuster floridais the payment structure. We work on a“No Recovery, No Fee”basis. This is a contingency fee model, meaning you pay us nothing upfront. Our fee is a percentage of the settlement we recover for you. If we don’t win you any money, you owe us nothing.

This system ensures our interests are perfectly aligned with yours. We are motivated to get you the maximum possible settlement.

Florida law protects consumers by capping our fees:

- 20% of the claim paymentfor standard claims.

- 10% of the claim paymentfor claims related to a declared state of emergency.

Even after our fee, our clients typically walk away with significantly more than they would have recovered on their own. There are no hidden costs or surprises.

What to Prepare Before Contacting an Adjuster

To help speed up the process, it’s helpful to have a few items ready before you call apublic adjuster florida:

- Your completeinsurance policy documents, including the declarations page.

- Anyphotos or videosyou’ve taken of the damage.

- Allcorrespondence with your insurer, such as emails, letters, or settlement offers.

- Anycontractor estimatesyou may have already received.

Don’t worry if you don’t have everything; we can help you gather what’s needed. For more tips, see our page onQuestions to Ask Your Public Adjuster.

How to Choose a Reputable and Licensed Public Adjuster

Choosing the rightpublic adjuster floridais a critical decision. You need an advocate who is experienced, trustworthy, and dedicated to your recovery.

Look for a team with a proven track record. At Global Public Adjusters, Inc., we bring over50 years of combined experiencehelping Florida property owners steer their claims. Experience like this means we know how to handle even the most complex situations. Professionalism is also key; a good adjuster communicates clearly and never pressures you. Membership in organizations like the Florida Association of Public Insurance Adjusters (FAPIA) is another mark of quality, as it shows a commitment to a strict code of ethics. Finally, check client testimonials to see what past clients have to say.

To learn more, read our article:What the Public Doesn’t Know About Public Insurance Adjusters.

Verifying Credentials in Florida

This step is non-negotiable:always verify your public adjuster’s license.In Florida, every legitimate public adjuster must be licensed by theFlorida Department of Financial Services (DFS). This protects you from fraud and unqualified individuals.

Ask for their license number and check it yourself on the state’s official database:Check a license on the official Florida database. Also, check their photo ID to ensure you’re dealing with the right person. It is illegal for anyone to act as a public adjuster without a license, and doing so could jeopardize your entire claim.

Key Consumer Protections for apublic adjuster florida

Florida law provides strong consumer protections when you hire apublic adjuster florida. These rules ensure the process is fair and transparent.

- Solicitation Hours: Public adjusters can only contact you between 8 a.m. and 8 p.m., Monday through Saturday.

- Contract Cancellation Rights: You have 10 business days to cancel a standard contract. For claims related to a state of emergency, you have 30 days after the loss to cancel.

- Written Estimate Requirement: Your adjuster must provide a detailed written estimate of your damages within 60 days of signing the contract.

- Fee Limitations: Fees are capped at 20% for standard claims and 10% for claims made during a declared state of emergency.

These protections empower you and ensure you are treated fairly. For more details, visitFlorida’s consumer protection info.

Frequently Asked Questions about Public Adjusters in Florida

We understand that hiring apublic adjuster floridais a big decision. Here are answers to the questions we hear most often.

How much more money can I get with apublic adjuster florida?

While every claim is unique, the data is clear. A study by Florida’s Office of Program Policy Analysis & Government Accountability (OPPAGA) found that policyholders with a public adjuster received dramatically higher settlements.

- Fornon-catastrophe claims, those with a public adjuster received an average of$9,379versus$1,391for those without—a574% increase.

- Forcatastrophe claims(like hurricanes), the difference was even greater:$17,187with a public adjuster versus$2,029without—a747% increase.

This difference comes from our thorough documentation of all damages, expert negotiation skills, and deep knowledge of insurance policies, which we use to counter the tactics insurers use to underpay claims.

What if my insurance claim was already denied or underpaid?

It’s not too late. In Florida, you generally have up to5 yearsfrom the date of loss to reopen a claim. We have successfully reopened countless claims that were denied or underpaid.

Our process involves reviewing the insurer’s decision, identifying missed damages or misinterpretations of your policy, and challenging the company with new evidence. We can also filesupplemental claimsfor damages that appear later, such as hidden mold or structural issues. We specialize in finding what company adjusters missed and fighting to get you the compensation you rightfully deserve.

Learn more about how we can help by reading our guide onHow to Reverse a Denied Property Claim.

Can a contractor help me with my insurance claim?

This is a critical point of confusion. The answer isno. While contractors are essential for repairs, they arenot legally allowedto negotiate an insurance claim in Florida unless they also hold a public adjuster license.

Florida Statute 626.854 makes theunlicensed practice of public adjusting illegal. This law exists to protect you. A contractor’s job is to estimate repair costs and perform the work. Apublic adjuster florida‘s job is to manage the entire claim, interpret the policy, and negotiate a settlement with the insurance company.

Using a contractor to negotiate your claim can lead to serious financial and legal problems. For proper claim management, you need a licensed professional with the legal authority and ethical duty to represent your best interests. We work with your contractor to ensure our negotiated settlement covers the full cost of their high-quality repairs.

Conclusion

Dealing with property damage in Florida is stressful enough without battling your insurance company for a fair settlement. Trying to steer the claims process alone can lead to underpaid or denied claims, leaving you unable to fully recover.

Apublic adjuster floridais your most valuable ally in this fight. We are your dedicated advocates, handling every detail from documenting damage to negotiating with the insurer, lifting that heavy burden from your shoulders.

Our “No Recovery, No Fee” promise means our goals are perfectly aligned with yours—we only get paid if we successfully increase your settlement. The data shows that policyholders who hire a public adjuster receive significantly higher payouts, empowering them to restore their property and peace of mind.

At Global Public Adjusters, Inc., we bring over 50 years of experience to the table, specializing in maximizing settlements for homeowners and businesses across Florida. You don’t have to face your insurance company alone.Contact a licensed public adjuster for a free claim reviewtoday and let us fight for the full and fair settlement you deserve.