Orlando Public Adjusters: 7 Powerful Reasons to Choose Experts

Why Orlando Public Adjusters Are Essential for Property Damage Claims

Orlando public adjustersare licensed professionals who work exclusively for policyholders to maximize insurance claim settlements after property damage. Unlike insurance company adjusters who work for your insurer, public adjusters advocate for your interests and typically help clients receive significantly more compensation than they would on their own.

Here’s what Orlando public adjusters do for you:

- Inspect and documentall visible and hidden damage to your property

- Review your insurance policyto identify all available coverages

- Prepare detailed estimatesusing industry-standard software like Xactimate

- Negotiate directlywith your insurance company for maximum settlement

- Handle all paperworkand communications throughout the claims process

- Work on contingency– you pay nothing unless they recover money for you

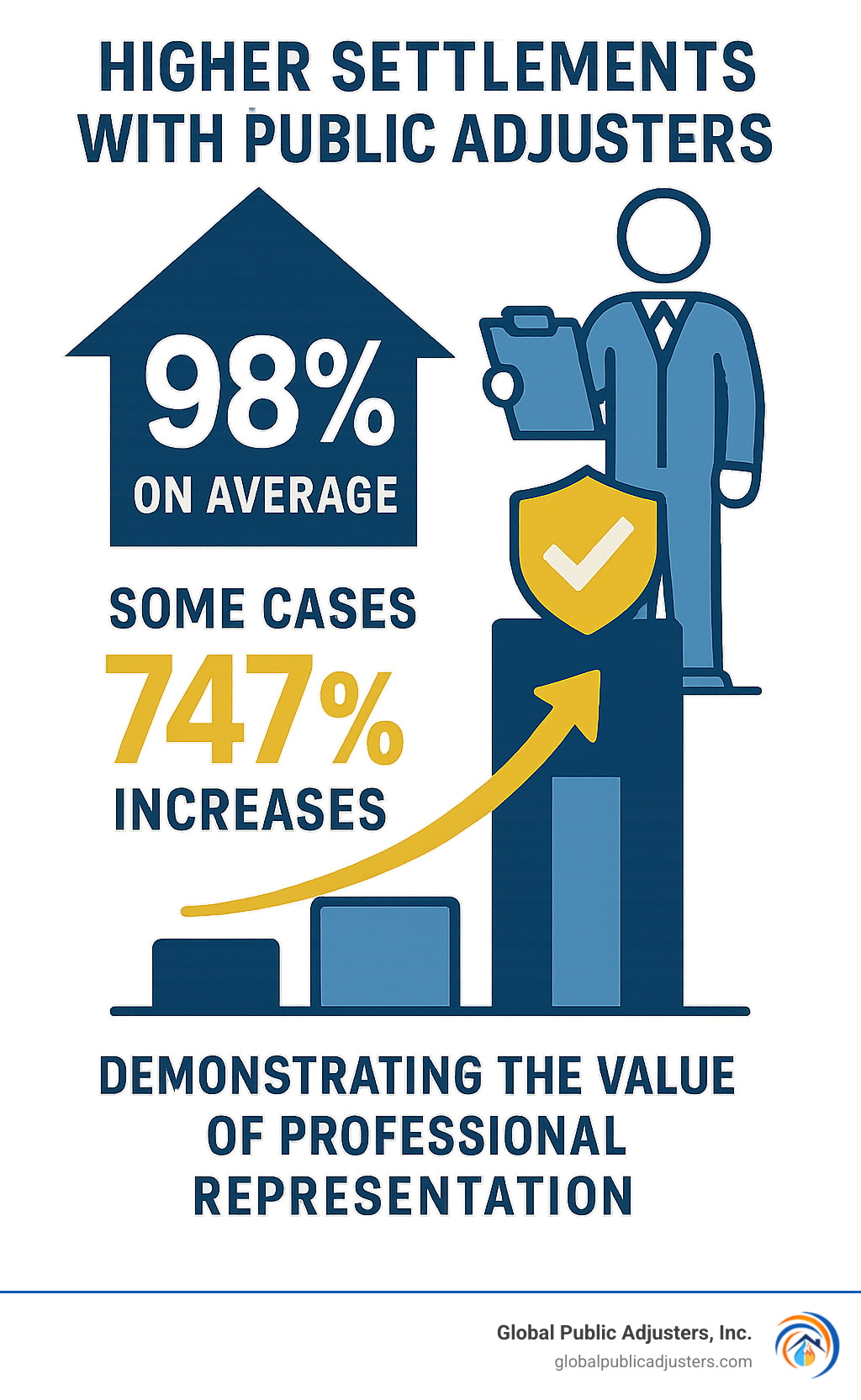

Research shows that policyholders who hire their own adjuster receive more for their claim than those who go it alone. Many Orlando public adjusters report they routinely double or triple initial insurance offers.

Common situations when you need an Orlando public adjuster:

- Hurricane or storm damage to your home or business

- Water damage from burst pipes, roof leaks, or plumbing failures

- Fire and smoke damage requiring extensive restoration

- Denied or underpaid insurance claims

- Large commercial property losses with complex coverage layers

- Mold damage following water intrusion

The good news? Claims can be reopened up to 5 years after they were initially filed in Florida. Even if you’ve cashed a small check from your insurer, this doesn’t automatically close your claim unless you’ve signed a notarized release form.

Related content aboutorlando public adjusters:

–insurance adjusters near me

–public adjuster jobs orlando

What Does a Public Adjuster Do & Why It Matters

When disaster strikes your Orlando property, you’re suddenly thrust into a world of insurance jargon, complex policies, and claim adjusters who seem to speak a different language. That’s where apublic adjustercomes in – think of us as your personal advocate in what can feel like an uphill battle against big insurance companies.

Orlando public adjustersare state-licensed professionals who work exclusively for you, the policyholder. We’re not employees of insurance companies, and we don’t answer to them. Our only job is to make sure you get every dollar you deserve from your insurance claim.

Here’s what we do for you: We thoroughly inspect your property to find all the damage (including hidden issues you might miss), review your insurance policy with a fine-tooth comb to identify every available coverage, prepare detailed repair estimates using the same software insurers use, and then negotiate directly with your insurance company for the maximum settlement possible.

| Public Adjusters | Independent Adjusters |

|---|---|

| Work for policyholders | Work for insurance companies |

| Paid by policyholder (contingency) | Paid by insurance company |

| Goal: Maximize settlement | Goal: Minimize claim costs |

| Licensed to represent insureds | Cannot legally represent insureds |

| Full negotiation authority | Limited authority, document only |

We handle everything from coordinating with contractors and engineers to managing all the paperwork and deadlines. Most importantly, we work on contingency – you don’t pay us unless we recover money for you.

Public vs. Insurance Company Adjusters

Let’s be honest about something: when you file a claim, your insurance company assigns an adjuster to handle it. But that adjuster doesn’t work for you – they work for the insurance company. Their job is to settle your claim for as little as possible while staying within legal bounds.

This creates amassive conflict of interest. Insurance companies are businesses focused on profitability. While they have legal obligations to handle claims fairly, their financial incentive is always to minimize what they pay out.

That’s exactly whyOrlando public adjustersexist. We level the playing field by bringing the same expertise to your side of the table. We understand policy language, know how to properly document losses, and have years of experience negotiating with these same insurance companies.

Independent Adjuster Myth Busting

Independent adjusters arehired by insurance companiesto handle claims on their behalf. They might not be direct employees of your insurer, but make no mistake – they’re paid by and work for the insurance company, not you.

The biggest difference is simple:only public adjusters are licensed to legally represent policyholdersin insurance claims. We have the training, experience, and legal authority to advocate for your interests throughout the entire process.

When to Call Orlando Public Adjusters

Timing can make or break your insurance claim. The absolute best time to bring inOrlando public adjustersis right after damage occurs – before you even call your insurance company. But here’s the good news: we can also rescue claims that have gone sideways, been denied, or left you feeling shortchanged.

Hurricane season hits Orlando hard every year.Whether it’s wind damage tearing off roof shingles, flooding from storm surge, or trees crashing through your home, storm damage creates some of the most complex insurance claims. The same goes for those sudden disasters that seem to happen at the worst possible times – burst pipes flooding your kitchen at 2 AM, or finding your roof has been leaking into your walls for months.

The5-year rule in Floridais a game-changer that many people don’t know about. You can reopen a claim up to five years after it was initially filed. This means if you settled too quickly after the last hurricane, or if new damage has appeared that’s related to your original claim, there’s still time to get the compensation you deserve.

For comprehensive assistance with all types of property damage, ourProperty Damage Claims Orlandoteam has the expertise to handle whatever Mother Nature or Murphy’s Law throws your way.

New Claims: Getting It Right From Day One

The first 48 hours after property damage can determine whether you get a fair settlement or get stuck with thousands in out-of-pocket costs.Most people are overwhelmed and just want to start cleaning up, but there are critical steps that must be taken to protect your claim.

Your insurance policy requiresprompt noticeof any loss. That means calling your insurance company right away. But here’s what they won’t tell you – you also have a duty to mitigate further damage. This means covering broken windows, tarping damaged roofs, or stopping water leaks. Keep every receipt for these emergency repairs because they’re usually covered under your policy.

Photography is absolutely crucial.Take pictures and videos of everything before you move or clean anything. We’ve seen claims denied because there wasn’t enough documentation of the original damage.

Reopened & Denied Claims: Orlando Public Adjusters to the Rescue

Getting a denial letter or a lowball settlement offer isn’t the end of your story.In fact, it’s often just the beginning of getting what you’re actually owed. Insurance companies count on people giving up when they hear “no” or accepting the first offer that comes their way.

Here’s a secret the insurance industry doesn’t want you to know:cashing their check doesn’t mean your claim is closed.Unless you’ve signed and had notarized a formal release document, your claim can still be reopened.

Orlando public adjustersspecialize in turning around problem claims. We know how to challenge bogus denial reasons like “wear and tear” when the damage was clearly caused by a recent storm. Thedelays in Orlando insurance claim payoutshave become so problematic that local news stations are investigating.

Commercial Properties & Large Losses

Commercial property claims are like residential claims on steroids– everything is more complex, more expensive, and involves more moving parts. When your business property is damaged, you’re not just dealing with repair costs. You’re also facing lost income, extra expenses to keep operating, and the pressure to get back up and running as quickly as possible.

Orlando public adjusterswho handle commercial claims work with entire teams of experts. We coordinate with structural engineers to assess building damage, forensic accountants to calculate business losses, and specialized contractors who understand commercial construction.

Claim Types Handled Across Central Florida

When property damage strikes in Orlando, you needOrlando public adjusterswho understand the unique challenges our region faces. At Global Public Adjusters, Inc., we’ve spent over 50 years helping Central Florida homeowners and businesses steer every type of property damage claim imaginable.

Living in Florida means dealing with a perfect storm of challenges – literally and figuratively. Our humid subtropical climate, hurricane seasons, aging infrastructure, and unique geological features create a recipe for property damage that keeps us busy year-round.

Water damagefrom burst pipes, roof leaks, and appliance failures represents our most common calls.Fire and smoke damagerequiring extensive restoration work follows closely behind. Then there’s the seasonal reality ofhurricane and wind damagethat affects roofs, siding, and interiors across the region.

For homeowners dealing with specific types of damage, we’ve developed specialized expertise inFire Damage Claims OrlandoandFlood Damage Claims Orlando.

After the Storm: Hurricane & Wind

Hurricane season isn’t just a weather forecast in Orlando – it’s a way of life thatOrlando public adjustersprepare for months in advance. When those storms hit, the damage they leave behind creates some of the most complex insurance claims we handle.

What makes hurricane claims so tricky is that they rarely involve just one type of damage. You might haveroof damage from high windsthat leads towater intrusionthrough damaged shingles or windows.Fallen treescan cause structural damage while simultaneously creating expensivedebris removalneeds.

Here’s where many Orlando homeowners miss out on money they’re entitled to:code upgrades. When hurricane damage requires repairs to your home, current building codes often mandate upgrades that weren’t required when your home was originally built. These upgrades can add thousands to your repair costs, but many insurance policies include coverage for them.

For comprehensive assistance with storm-related damage, ourHurricane Damage Claims Orlandoservices provide the specialized expertise you need to recover fully from these devastating events.

Hidden Hazards: Water, Mold & Plumbing Failures

Water damage keeps us busier than any other type of claim in Orlando, and there’s a good reason why. Water has this sneaky ability to cause massive destruction while staying completely hidden from view. By the time you notice that telltale stain on your ceiling or smell something musty in your bathroom, the damage has often been spreading for weeks or even months.

Orlando’s aging infrastructure creates perfect conditions for plumbing disasters. Thosecast iron pipesin older homes eventually corrode and fail, sometimes catastrophically.Roof leaksthat start small can go undetected until they’ve soaked through insulation and damaged multiple rooms.

Moldpresents its own unique challenges in Orlando’s humid climate. When mold results from a covered water event, most policies will pay for remediation, but the coverage often comes with specific limits and requirements.

For specialized guidance on mold-related issues, ourMold Damage Claims Orlandopage provides detailed information about coverage options and the claims process for these particularly complex situations.

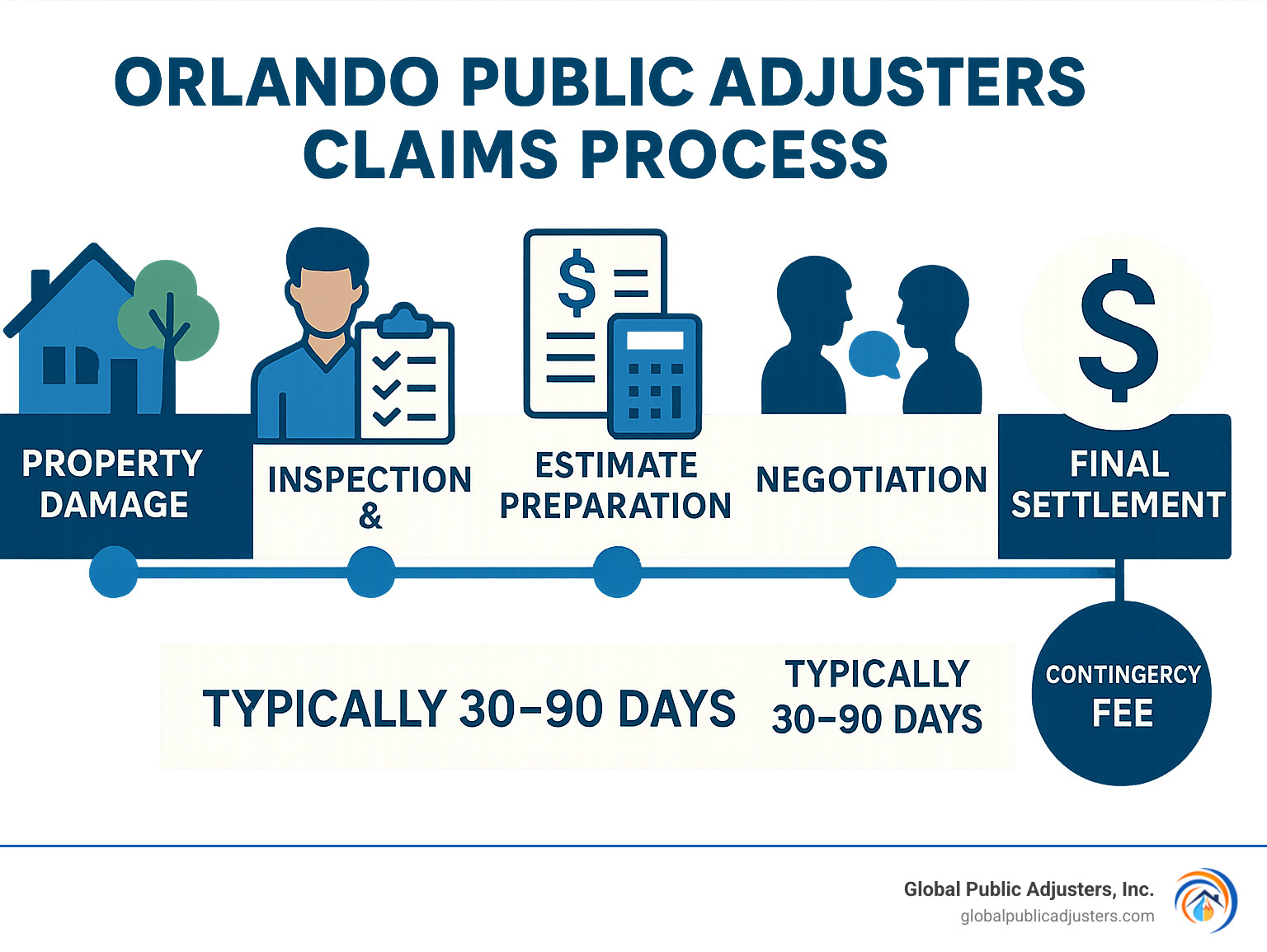

The Claims Journey with Orlando Public Adjusters

Working withOrlando public adjustersdoesn’t have to be complicated or stressful. We’ve designed our process to be straightforward and transparent, so you know exactly what to expect every step of the way.

Here’s what makes our approach different: we work on acontingency fee basis, which means you pay nothing upfront and nothing out of pocket. Our fees typically run around 20% of your final settlement, but here’s the key –no recovery means no fee. If we don’t get you money, we don’t get paid.

If you’re wondering whether hiring a public adjuster is worth it, check out our detailed explanation atWhy Should I Hire a Public Adjuster?

Step 1 – Free Consultation & Property Inspection

Everything starts with understanding exactly what happened to your property. We don’t just take a quick look around and call it good – we conduct athorough, professional inspectionusing the same advanced tools and techniques that insurance companies use.

During our inspection, we usemoisture metersto find water damage hiding behind walls where you can’t see it. We usethermal imaging camerasto spot temperature differences that reveal problems like missing insulation or air leaks. For roof damage, we usedrone photographyto safely document problems that would be dangerous to assess on foot.

We also spend timereviewing your insurance policyduring this first meeting. Many people don’t realize what their policy actually covers, and we often find coverage opportunities that policyholders didn’t know they had.

Step 2 – Building the Demand Package

Once we know what’s damaged and what your policy covers, we get to work building what we call thedemand package. Think of this as your case file – everything we need to prove your claim to the insurance company.

We prepare detailed repair estimates usingXactimate software, which is the same estimating system most insurance companies use. This levels the playing field because we’re speaking their language and using their tools.

For complex damage, we coordinate withengineering firmsto provide structural assessments. We work with restoration specialists to document the full scope of water or fire damage. We prepare completecontent inventorieswith replacement values for everything that was damaged or destroyed.

Step 3 – Negotiation & Settlement

This is where our experience really pays off. Insurance companies have teams of adjusters and lawyers working to minimize what they pay out. You need someone on your side who knows how to negotiate effectively.

We start by presenting our demand package to thedesk adjusterhandling your claim. They’ll review our documentation and typically come back with a counteroffer. This is where the real work begins – going back and forth until we reach a fair settlement.

One critical warning:never sign a release formwithout having it reviewed by a professional. These forms permanently close your claim, and we’ve seen too many people sign away their rights without understanding what they were agreeing to.

Choosing a Reputable Adjuster in Orlando

Finding the rightOrlando public adjustersto handle your claim is one of the most important decisions you’ll make during the insurance process. With potentially thousands of dollars on the line, you want someone who’s experienced, trustworthy, and has a proven track record of success.

The most important qualification is proper licensing.Every public adjuster in Florida must be licensed by the state Department of Financial Services. You can easily verify this online – and you absolutely should.

But licensing is just the starting point. You also want someone withlocal experiencewho understands Orlando’s unique challenges. Hurricane damage, aging infrastructure, and Florida’s complex insurance laws require specialized knowledge that only comes from years of working in the area.

Strong references tell the real story.Any reputable adjuster should be happy to provide references from recent clients. Don’t just ask for names – actually call these references and ask about their experience.

David Dwyer from Global Public Adjusters has been featured onWESH TV Newsdiscussing homeowner preparedness, demonstrating the kind of community involvement and media recognition that indicates a reputable professional.

Red Flags & Common Pitfalls

Unfortunately, disaster areas attract some unsavory characters looking to take advantage of vulnerable property owners. After major storms, you’ll likely seedoor-to-door solicitorsclaiming to be public adjusters or working with them. Be very cautious here.

Never pay upfront fees.This is perhaps the biggest red flag of all. Reputable public adjusters work on contingency – they get paid only when you get paid. Anyone asking for money upfront is likely running a scam.

Be wary of unrealistic promises.While public adjusters often double or triple initial insurance offers, anyone guaranteeing specific dollar amounts before even seeing your policy or damage is probably not being honest.

Your Ongoing Responsibilities as Policyholder

Even with excellentOrlando public adjustersrepresenting you, you’re still the policyholder with certain responsibilities under your insurance contract.

Prompt notificationis required by virtually every insurance policy. You need to notify your insurer of any loss as soon as reasonably possible.

Mitigating further damageis another key requirement. You must take reasonable steps to protect your property from additional damage. This might mean tarping a damaged roof or shutting off water to prevent flooding. Keep all receipts – these costs are usually covered.

Cooperation with the investigationis essential. This means providing requested documents, allowing property inspections, and answering questions honestly. Your public adjuster will guide you through this process and often handle much of the communication directly.

Frequently Asked Questions about Orlando Public Adjusters

Let’s address the most common questions we hear from property owners considering hiringOrlando public adjusters. These answers will help you make an informed decision about whether professional representation is right for your situation.

What are typical fees and are there out-of-pocket costs?

Here’s the good news:Orlando public adjusterswork on acontingency fee basis, which means you pay nothing upfront and only pay if we successfully recover money for you. Our typical fee is around20% of the total settlement amount.

Let’s put this in perspective with a real example. If your insurance company initially offers you $50,000 but we negotiate a $150,000 settlement, our 20% fee would be $30,000. You’d net $120,000 – that’s $70,000 more than you would have received on your own, even after paying our fee.

The“no recovery, no fee”guarantee means exactly what it says. If we don’t increase your settlement, you owe us nothing. There are absolutelyno upfront costs or out-of-pocket expenseswhen working with reputable public adjusters.

Can an adjuster really double or triple my offer?

This is probably the question we get asked most often, and the answer is a resoundingyes. We routinely see settlement increases of 200-300%, and sometimes much more.

Why is this possible? Insurance companies often makelowball initial offers, hoping homeowners will accept them without question. They’re counting on you not knowing your policy’s full coverage or not understanding how to properly document and present your claim.

Orlando public adjustersknow exactly what to look for. We identify damage that insurance adjusters might miss or downplay. We understand policy language and know which coverages apply to your specific situation.

For example, we recently helped a homeowner whose initial hurricane damage offer was $15,000. After our thorough inspection and negotiation, the final settlement was $127,000. That’s not unusual – it’s what happens when you have professional representation.

How far back can I reopen a claim in Florida?

Florida law gives youup to 5 yearsto reopen a claim after it was initially filed. This is incredibly important for Orlando homeowners who may have accepted inadequate settlements or found additional damage later.

Here’s a crucial point many people don’t understand:cashing an insurance check doesn’t automatically close your claim. Claims are only closed when you sign a notarized release form. If you haven’t signed one of these documents, your claim may still be open regardless of whether you’ve received payment.

We’ve successfully reopened claims that were initially settled years ago, often recovering substantial additional amounts for our clients. This is particularly common after major storms when homeowners were overwhelmed and accepted the first offer they received.

Don’t assume it’s too late just because time has passed. If you feel you were underpaid or if you’ve found additional damage related to a previous claim, it’s worth havingOrlando public adjustersreview your situation.

Conclusion

When disaster strikes your Orlando property, you don’t have to face the insurance companies alone.Orlando public adjustersat Global Public Adjusters, Inc. provide the expert advocacy and support you need during one of the most stressful times in your life.

We’ve spent over 50 years helping homeowners and business owners across Central Florida get the settlements they deserve. We know Orlando’s unique challenges – fromhurricane seasonthat brings devastating winds and flooding, toaging infrastructurethat can fail without warning, to thehumiditythat turns small water leaks into major mold problems.

What sets us apart is simple:we work exclusively for you, not the insurance companies. While their adjusters are focused on minimizing payouts, we’re focused on maximizing your recovery. Ourcontingency fee structuremeans we only get paid when you get paid – your success is literally our success.

Whether you’re dealing with afresh claim from storm damage, adenied claimthat doesn’t seem fair, or anold settlementthat left you feeling shortchanged, we’re here to help. Florida law gives you up to5 years to reopen claims, and cashing that small check doesn’t mean you’ve accepted final settlement unless you signed a release form.

The insurance claim process doesn’t have to be a nightmare.With the right advocate on your side, you can focus on getting your life back to normal while we handle the paperwork, negotiations, and red tape.

Your insurance policy is a contract, and you’ve paid your premiums faithfully. When disaster strikes, you deserve every dollar of coverage you’re entitled to under that contract. Don’t let insurance companies take advantage of your stress and unfamiliarity with the claims process.

Ready to get the settlement you deserve? Visit ourContact Uspage or give us a call today. We serve Orlando and throughout Central Florida, and we’re standing by to put our decades of experience to work for you.

You have rights as a policyholder– let Global Public Adjusters, Inc. help you exercise them. After all, we’re here to help you claim the sunshine after the storm.