Mold Damage Claims: 5 Proven Steps for Maximum Success 2025

Why Mold Damage Claims Fail (And How to Beat the Odds)

Mold damage claimsare among the trickiest insurance battles homeowners face. Most insurers will fight tooth and nail to deny or minimize these claims, leaving you stuck with bills that can easily reach $15,000 to $30,000 for remediation.

Quick Answer for Mold Damage Claims:

•When covered:Sudden water events (burst pipes, storm leaks, fire suppression water)

•When denied:Gradual leaks, humidity neglect, flooding without flood insurance

•Average cost:$15,000-$30,000 but policies often cap coverage at just $5,000-$10,000

•Success rate:Only about 30% of mold claims get approved due to policy exclusions

•Time limit:Must act within 24-48 hours to prevent growth and preserve coverage

Here’s the harsh reality:About 70% of homes have some form of mold, but insurance companies have gotten smart about limiting their exposure. After Texas saw mold claims spike over 1,000% in the early 2000s, insurers nationwide added strict exclusions and sub-limits to their policies.

The good news?You can still winif you know the system.

Imagine finding that musty smell creeping through your walls, only to find black mold spreading behind your drywall. Your first thought isn’t about insurance—it’s about your family’s health and the potential cost. But here’s what most homeowners don’t realize:how you handle the first 48 hours can make or break your entire claim.

The difference between a successful $25,000 settlement and a denied claim often comes down to five critical steps that most homeowners never learn. Insurance adjusters know these gaps in knowledge, and they use them against you.

Mold damage claimsterms made easy:

–can you file a homeowner claim for mold damage

–commercial mold damage claim florida

–construction delays claim from mold water damage

Step 1: Know When Mold Is Covered (and When It’s Not)

Here’s the truth insurance companies don’t want you to know: they’ve mademold damage claimsdeliberately confusing. After Texas saw mold claims skyrocket over 1,000% in the early 2000s, insurers across the country scrambled to limit their exposure. Now, understanding the difference between covered and excluded scenarios can save you thousands of dollars.

Your standard homeowners policy will only cover mold when it stems from what insurers call a“covered peril”—basically a sudden, accidental event. Think of it like this: if water shows up uninvited and causes chaos quickly, you’re probably covered. If it sneaks in slowly over months, you’re likely on your own.

Here’s where it gets frustrating: about40% of homeowners policiesnow include specific mold exclusions or sub-limits. Many policies cap mold coverage at just $5,000 to $10,000—barely enough to handle a serious remediation job that typically costs $15,000 to $30,000.

The magic phrase you need to look for in your policy is“sudden and accidental.”Insurance adjusters will scrutinize every detail to determine if your water damage happened quickly or gradually. They’re not being difficult just to be mean—they’re protecting their bottom line.

Smart homeowners often add extra protection through endorsements. Ahidden water damage ridercan cover mold from those sneaky slow leaks behind walls. If you live in a flood-prone area,flood insurancethrough the National Flood Insurance Program covers mold stemming from flood events.

Scientific research on mold and healthshows that certain molds like Stachybotrys (black mold) can produce mycotoxins linked to serious respiratory problems. This makes understanding your coverage even more critical—your family’s health depends on quick action.

Covered Scenarios to Leverage

These situations are your golden tickets for successfulmold damage claims. When these happen, document everything immediately.

Burst pipesare your best-case scenario for coverage. When a pipe suddenly fails and floods your property, any resulting mold growth typically gets covered. We’ve seen homeowners receive full settlements when they could prove the pipe failure was sudden and mold appeared within days. The key is showing the timeline—before and after photos are your best friend here.

Roof leaks from stormsusually get approved, but only if you can prove the damage happened during a specific weather event. Insurance adjusters will check weather reports to verify storm activity in your area. Don’t try to claim that slow roof deterioration happened overnight—they’ll catch you.

Fire suppression wateroften gets overlooked, but it’s explicitly covered in most policies. If firefighters flood your home to save it from fire, and that water leads to mold, you’re covered. This scenario might feel like adding insult to injury, but at least your insurance should handle the mold cleanup.

Appliance failureslike water heaters, washing machines, or dishwashers that suddenly malfunction and flood an area are typically covered. Document the appliance failure with photos and keep any repair receipts that show the malfunction was sudden, not from years of neglect.

Common Exclusions That Sink Claims

These scenarios will likely result in claim denials, no matter how convincing your argument seems.

Gradual leaksare the number one reasonmold damage claimsget denied. That slow drip behind your bathroom wall that you noticed but didn’t fix? Insurance won’t cover the resulting mold. Insurers argue this falls under maintenance issues that homeowners should have caught and addressed.

High humidity neglectis another common denial. Mold growth from consistently high humidity levels (above 60%) without proper ventilation gets excluded. The CDC estimates that indoor dampness and mold exposure increase respiratory health problems by 30% to 50%, but insurers still won’t pay for humidity-related mold.

Flood damage without flood insuranceleaves you completely exposed. Standard homeowners policies exclude flood damage and any resulting mold. You need separate flood insurance through FEMA’s National Flood Insurance Program for this coverage—and there’s typically a 30-day waiting period before it kicks in.

Maintenance-related issueslike failed caulking, deteriorated weatherstripping, or ignored gutter problems that lead to water intrusion get excluded. Insurance companies expect you to maintain your home properly. If you skip basic upkeep and mold results, you’ll be paying out of pocket.

Step 2: Act Fast—Safety, Mitigation & Initial Reporting

When you find mold, every hour counts. It’s not just about your health—though that’s obviously the most important thing—it’s also about protecting yourmold damage claimsfrom being denied later.

Here’s what many homeowners don’t realize: mold can start growing within 24 hours of water exposure. Within a week, those tiny spores can turn into a full-blown colony that’s expensive to remove and potentially dangerous to breathe.

But there’s another clock ticking that’s just as important. Your insurance policy includes something called a “duty to mitigate,” which means you’re required to take reasonable steps to prevent further damage once you find a problem. Fail to act quickly, and your insurer might use that against you to deny your claim entirely.

The first 48 hours are absolutely critical. We’ve seen insurance companies deny claims because homeowners waited just a few days to start drying out wet areas. They’ll argue that you made the problem worse by not acting fast enough.

Don’t panic, but do move quickly. Your priorities should besafety first, then stopping the damage, then documenting everything. Many people make the mistake of calling their insurance company before they’ve even turned off the water or started drying things out. That’s backwards—you need to show you acted responsibly before asking for coverage.

Professional moisture meters can help you track your progress, and taking photos of the drying process shows your insurer that you took mitigation seriously.More info about How to Tell if You Have Mold Damage in Your Homecan help you spot early warning signs before they become major headaches.

Immediate Health & Safety Moves

Your family’s safety trumps everything else, including your insurance claim. Don’t try to be a hero here—mold exposure can cause serious respiratory problems, especially for kids, elderly family members, and anyone with asthma or allergies.

Isolate the area immediately.Close doors to moldy rooms and seal any gaps with plastic sheeting and duct tape. This might seem extreme, but mold spores are microscopic and can travel through your home’s air system faster than you’d think.

Shut down your HVAC system right away.Your heating and air conditioning can spread spores throughout your entire house in just hours. Don’t turn it back on until a professional gives you the all-clear.

Get vulnerable family members out of the house.Children, seniors, and anyone with breathing problems should stay somewhere else until the problem is fixed. Even molds that aren’t technically “toxic” can trigger allergic reactions and make breathing difficult.

Protect yourself if you must enter the area.Wear at least an N95 mask, gloves, and eye protection. Professional remediation crews wear full protective suits for good reason—mold spores can irritate your skin, eyes, and lungs even during brief exposure.

Take photos and videos before you start any cleanup work. This documentation could make the difference between a successful claim and a denial later on.

Notify Your Insurer the Right Way

How and when you report your claim can significantly impact the outcome. Insurance companies are sticklers for proper procedures, and getting this wrong can hurt you later.

Call your claims hotline as soon as you’ve made the area safe.Most insurers have 24/7 reporting lines, and calling quickly shows you’re taking the situation seriously. Get a claim number and ask for your adjuster’s direct contact information.

Always follow up in writing.Send an email, fax, and letter confirming what you reported over the phone. Include the date you finded the problem, what you think caused it, and what steps you’ve already taken. Keep copies of everything with timestamps.

Save receipts for your emergency expenses.Tarps, fans, dehumidifiers, and temporary repairs are often reimbursable under your policy. More importantly, these receipts prove you acted quickly to minimize damage—exactly what your duty to mitigate requires.

Stick to the facts when talking to your insurer.Don’t guess about what caused the problem or whether it’s covered. Just describe what you found and when you found it. Speculation can come back to haunt you if you’re wrong, and admitting fault can void your coverage entirely.

Your insurance company isn’t your friend during this process—they’re a business trying to minimize their costs. Being helpful and cooperative is fine, but don’t volunteer information that wasn’t requested or make assumptions about coverage.

Step 3: Build an Airtight Evidence File for Your Mold Damage Claims

Think of your evidence file as the foundation of your entire case. Insurance adjusters are like detectives looking for any excuse to deny your claim, and they’re trained to spot weaknesses in documentation. The homeowners who get paid are the ones who can prove their case with rock-solid evidence.

Here’s what most people don’t realize:visual evidence alone isn’t enough anymore. Insurance companies have gotten sophisticated about fightingmold damage claims, so you need scientific backing to support what you’re seeing with your own eyes.

Professional mold testing might seem like an extra expense when you’re already facing thousands in damage, but it’s often the difference between getting paid and getting denied. When a certified industrial hygienist hands you a report showing dangerous levels of Stachybotrys in your living room, suddenly the insurance company can’t dismiss your claim as “just a little surface mold.”

More info about Mold Testing Orlandocan connect you with the right professionals who understand exactly what insurance companies need to see. These aren’t just any contractors—they’re specialists who know how to document findings in ways that hold up under scrutiny.

TheScientific research on certified consultantsdirectory helps you find qualified industrial hygienists in your area. These professionals carry the credentials that insurance adjusters respect, and their reports carry serious weight in claim negotiations.

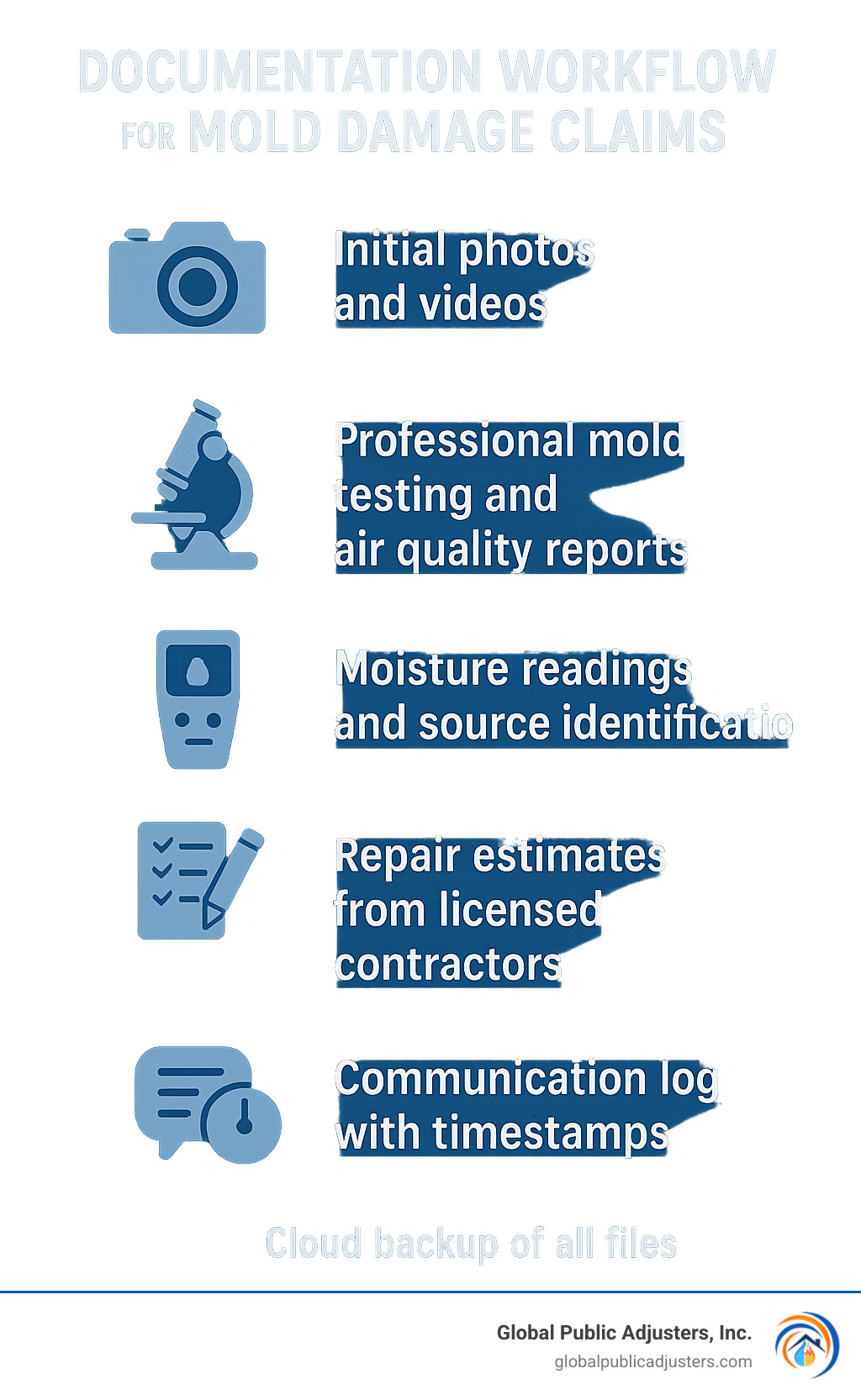

What Documentation Strengthens Mold Damage Claims?

High-quality photos and videosare your starting point, but they need to tell a complete story. Take shots from multiple angles showing not just the mold itself, but the water source, affected materials, and the scope of the problem. Close-ups reveal the type and extent of growth, while wide shots show how far the contamination has spread.

Don’t forget to photograph the areas that look normal too—this helps establish the boundaries of the damage. Videos can capture things that still photos miss, like the musty smell when you open a closet door or the sound of water dripping inside a wall.

Professional mold testing reportsprovide the scientific evidence that transforms your claim from “homeowner complaint” to “documented health hazard.” Air quality testing shows spore concentrations in your indoor environment, while surface sampling identifies the specific types of mold you’re dealing with.

When the lab report comes back showing liftd levels of toxic molds like Stachybotrys or Aspergillus, insurance companies can’t argue that it’s just cosmetic discoloration. These reports typically cost $300 to $800, but they often result in settlements thousands of dollars higher.

Moisture readingsusing professional-grade meters document the water content in your walls, floors, and other building materials. These numbers prove how saturated everything got and help establish the timeline of when the water intrusion occurred. Insurance adjusters love to claim that mold growth was “pre-existing,” but moisture readings taken immediately after findy make that argument much harder to support.

Multiple repair estimatesfrom licensed contractors prevent the insurance company from claiming your chosen contractor is overpricing the work. Get at least three estimates, and make sure each contractor is properly licensed and experienced with mold remediation. The estimates should break down both remediation costs (removing the mold) and restoration costs (rebuilding what was damaged).

Medical documentationbecomes crucial if anyone in your family develops health symptoms. When your doctor can connect respiratory problems, headaches, or allergic reactions to mold exposure in your home, it adds another layer of urgency to your claim. This documentation can also support claims for additional living expenses if your family needs to stay elsewhere during remediation.

| Weak Evidence | Strong Evidence |

|---|---|

| Blurry phone photos | Professional photography with timestamps |

| No professional testing | Certified industrial hygienist report |

| Single contractor estimate | Multiple licensed contractor estimates |

| Verbal communications only | Written confirmation of all conversations |

| No moisture readings | Documented moisture content levels |

| DIY assessment | Professional mold inspection report |

How to Organize Your Mold Damage Claims File

Cloud backupsaren’t just convenient—they’re essential protection against insurance company “oops” moments. We’ve seen adjusters claim they never received important documents, so having everything stored digitally with automatic backup gives you instant access to any document they need to “see again.”

Chronological organizationhelps tell your story in a way that makes sense. Start with the initial findy and work forward through each step you took. This timeline shows the insurance company that you acted quickly and responsibly, which strengthens your position in negotiations.

A detailed communication logoften becomes the most important document in your file. Every phone call, email, and meeting with insurance representatives should be recorded with names, dates, times, and summaries of what was discussed. When the adjuster later claims they told you something different, your log becomes your proof of what really happened.

Keep every receipt, no matter how small. Emergency tarps, fans, dehumidifiers, hotel stays, restaurant meals—many of these costs are reimbursable under your policy’s additional living expense coverage. We’ve seen homeowners recover thousands in expenses they didn’t even know were covered, simply because they kept good records.

The key is creating a file so complete and well-organized that the insurance adjuster has no choice but to take your claim seriously. When you can hand over a professional report, timestamped photos, moisture readings, and multiple contractor estimates, you’re speaking their language—and that’s when settlements start getting serious.

Step 4: Bring In the Pros—Remediators, Public Adjusters, Legal Muscle

Here’s the uncomfortable truth aboutmold damage claims: you’re going up against insurance companies that have entire teams of adjusters, engineers, and lawyers whose job is to pay you as little as possible. Trying to handle a complex mold claim on your own is like showing up to a gunfight with a water balloon.

The good news? You can build your own team of professionals who know exactly how to speak the insurance company’s language. When done right, professional remediation and representation often pays for itself through higher settlement amounts.

At Global Public Adjusters, Inc., we’ve watched too many homeowners accept lowball offers or get their claims denied entirely because they didn’t understand the game. With over 50 years of experience representing homeowners and business owners across Orlando and throughout Florida, we’ve learned that the right professional team can turn a $5,000 denial into a $25,000 settlement.

Professional mold remediation followingIICRC S520 standardsisn’t just about getting your home clean—it’s about creating a paper trail that insurance companies can’t ignore. When remediators follow industry standards and document everything properly, it becomes much harder for insurers to claim the work was unnecessary or overpriced.

More info about Why Hire a Public Adjuster for Mold Damage?explains how professional representation can dramatically increase your settlement amount, often by 3-5 times what homeowners achieve on their own.

For claims involving serious health impacts or extensive property damage, consulting with atoxic mold attorneymight be your best move to protect your legal rights and ensure maximum compensation.

Role of Professional Mold Remediation

Think of certified mold remediators as your insurance claim’s best friend. Everything they do creates documentation that strengthens your position with the insurance company.

Proper containment proceduresinvolve setting up negative air pressure systems and physical barriers to prevent mold spores from spreading during cleanup. This isn’t just good practice—it’s documented proof that the work was done to professional standards. Insurance adjusters respect contractors who follow established protocols.

Industrial HEPA air filtrationcaptures microscopic mold spores that regular vacuums miss entirely. Professional remediators document this equipment usage with photos and air monitoring reports that show insurance companies the work met industry standards.

Post-remediation clearance testingby independent third parties proves the mold has been successfully removed. Many insurance companies actually require this testing before they’ll consider a claim complete. Without it, you might find yourself stuck with an “incomplete” claim that never gets fully paid.

The detailed work documentation that certified remediators provide—including before and after photos, air quality measurements, and comprehensive work descriptions—becomes crucial evidence when negotiating with insurance adjusters. These professionals know what insurance companies need to see, and they document accordingly.

When to Hire a Public Adjuster or Attorney

Not every mold claim needs professional representation, but certain situations absolutely demand it. Here’s when you should seriously consider getting help:

Claim denialsare unfortunately common with mold cases, but they’re not the end of the story. We know how to appeal denials and often recover substantial settlements even after initial rejections. Insurance companies sometimes deny valid claims hoping homeowners will just give up—don’t let them win that easily.

Lowball settlement offersare another red flag. When insurers offer settlements far below actual remediation costs, experienced public adjusters can negotiate significantly higher amounts. Our deep experience withmold damage claimsin Orlando and throughout Florida gives us serious leverage in these negotiations.

Large loss complexityinvolving extensive structural damage, multiple types of mold, or documented health impacts requires sophisticated handling. The documentation and presentation requirements for these claims exceed what most homeowners can reasonably manage while also dealing with the stress of displaced family and damaged property.

Bad faith situationsoccur when your insurer delays unreasonably, misrepresents policy language, or fails to investigate properly. If you suspect your insurance company isn’t dealing with you honestly, you may need legal representation to protect your rights and recover the full settlement you deserve.

The bottom line? Professional help often pays for itself through higher settlements and faster claim resolution. You wouldn’t perform surgery on yourself—don’t try to handle a complex insurance claim alone either.

Step 5: Seal the Deal—Negotiate, Appeal & Prevent Future Problems

You’ve made it through the documentation maze and hired the right professionals. Now comes the moment of truth: getting your insurance company to pay what yourmold damage claimsare actually worth.

Here’s what most homeowners don’t expect—even with perfect paperwork, your first offer will likely be disappointingly low. Insurance companies count on you accepting less than you deserve, hoping you’ll just want the headache to end. But this is exactly when persistence pays off.

The negotiation phase is where professional representation really shines. We’ve seen insurers offer $8,000 settlements for damage that clearly cost $25,000 to fix properly. They’re testing your resolve and knowledge of the process.

About 22% of all property insurance claims involve water damage that leads to mold issues. This means adjusters see these claims constantly, and they know exactly which arguments work and which don’t. You need to be equally prepared.

Scientific research on mold preventionshows that proper prevention isn’t just smart homeownership—it’s essential for maintaining your ability to file future claims.

The most common reasons mold claims get denied:

– Waiting too long to report (beyond 24-48 hours)

– Can’t prove the water source was sudden

– Evidence suggests ongoing maintenance problems

– Missing documentation of mitigation efforts

– No professional mold testing results

– Incomplete contractor estimates

Negotiation strategies that actually work:

– Present multiple licensed contractor estimates showing consistent pricing

– Use scientific mold testing results to prove the scope of contamination

– Document any health impacts with medical records

– Reference similar successful claims in your area

– Highlight how quickly you acted to prevent further damage

– Let professional adjusters handle the back-and-forth

When insurers dig in their heels and deny valid claims, you have appeal rights. The key is understanding their denial reasoning and building a stronger case that addresses their specific objections.

Request a detailed written explanation of why they denied your claim. Often, their reasoning reveals gaps you can fill with additional evidence. Maybe they questioned whether the water source was sudden—that’s when you bring in a plumber’s report confirming the pipe failure was unexpected.

If appeals don’t work, most policies include mediation or arbitration clauses. These alternative dispute resolution methods can be faster and less expensive than court battles, while still giving you a fair hearing.

More info about How Can Mold Damage My Home?explains the long-term consequences of incomplete remediation and why fighting for full settlement value protects your home’s future.

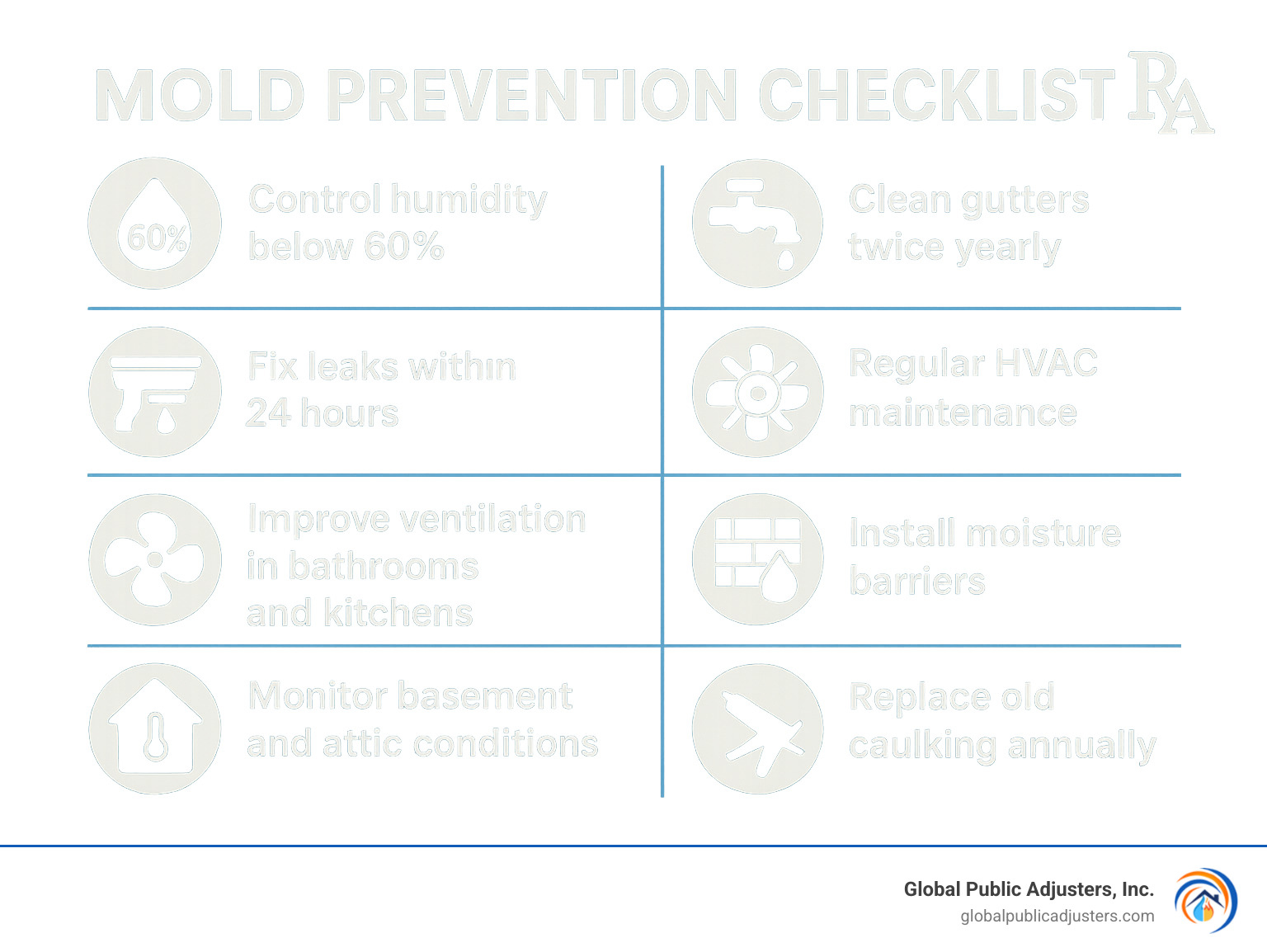

Prevention becomes crucial once your claim is settled. Insurance companies may require proof that you’ve fixed the root cause before they’ll consider coverage for any future mold issues. This isn’t just about avoiding problems—it’s about protecting your insurability.

Smart prevention starts with humidity control below 60%throughout your home. High humidity creates perfect conditions for mold growth, and insurers won’t cover mold that develops from poor ventilation or moisture control.

Fix any leaks within 24 hoursof findy. This isn’t just good advice—it’s often a policy requirement. Insurers can deny future claims if they determine you ignored maintenance issues that led to water damage.

Keep your gutters cleanand functioning properly. Clogged gutters cause water to back up and penetrate your home’s structure. Clean them at least twice yearly, and document this maintenance with photos and receipts.

Improve ventilation in bathrooms, kitchens, and laundry areaswhere moisture naturally accumulates. Install exhaust fans if needed, and make sure existing fans vent outside, not into attics or crawl spaces.

Quick Answers to Top Mold Damage Claim Questions

What’s the average settlement for mold damage claims?

Most significant mold remediation projects cost between $15,000 and $30,000, but many policies cap mold coverage at just $5,000 to $10,000. The key is proving additional damages like health impacts, temporary housing costs, and structural repairs that push settlements above policy limits.

We’ve helped clients recover settlements well beyond their policy caps by documenting how mold affected their entire living situation, not just the immediate cleanup costs.

How long do I have to file a mold damage claim?

You must notify your insurer immediately—within 24 to 48 hours of finding the problem. Most policies give you up to one year to file the formal claim paperwork, but waiting weakens your position significantly.

Your duty to prevent further damage starts the moment you find the problem, regardless of when you officially file the claim.

Can health impacts increase my settlement?

Absolutely. Medical documentation linking family health problems to mold exposure can support additional living expense claims and increase your overall settlement value. Keep records of doctor visits, medications, and any recommendations to temporarily relocate during remediation.

Children and elderly family members are particularly vulnerable to mold-related health issues, and insurers recognize this when calculating settlement values.

Ready to Maximize Your Settlement?

Fighting insurance companies overmold damage claimsisn’t something you should tackle alone. At Global Public Adjusters, Inc., we’ve spent over 50 years representing homeowners and business owners across Orlando, Pensacola, and throughout Florida.

We know exactly how insurance companies think about mold claims. They expect homeowners to get frustrated and accept lowball offers. They count on you not understanding the technical aspects of mold remediation or the legal requirements for proper documentation.

That’s where our expertise makes the difference. We speak the same language as insurance adjusters, but we’re fighting for your interests, not theirs. When insurers see our name on a claim, they know we won’t accept anything less than fair value.

Our team understands the science behind mold growth, the documentation requirements for maximum settlements, and the negotiation tactics that actually work. We’ve seen every excuse insurers use to minimize payouts, and we know exactly how to counter their arguments.

The difference between handling your own mold claim and having professional representation often means tens of thousands of dollars in additional settlement value. Insurance companies respect our experience and know we’ll take claims to appeal or arbitration if necessary.

More info about mold damage services in Orlandoshows how we can help you recover the full value of your mold damage claim.

Don’t let insurance companies minimize your claim.Mold damage doesn’t fix itself, and insurers won’t suddenly become more generous if you wait. Take action now to protect your family’s health and your financial future.

Contact Global Public Adjusters, Inc. today for a free consultation. Let us show you how professional representation can skyrocket yourmold damage claimssuccess and get you the settlement you deserve.