How to negotiate an insurance settlement: 5 Maximize Payout

Why Knowing How to Negotiate an Insurance Settlement Is Your Most Powerful Tool

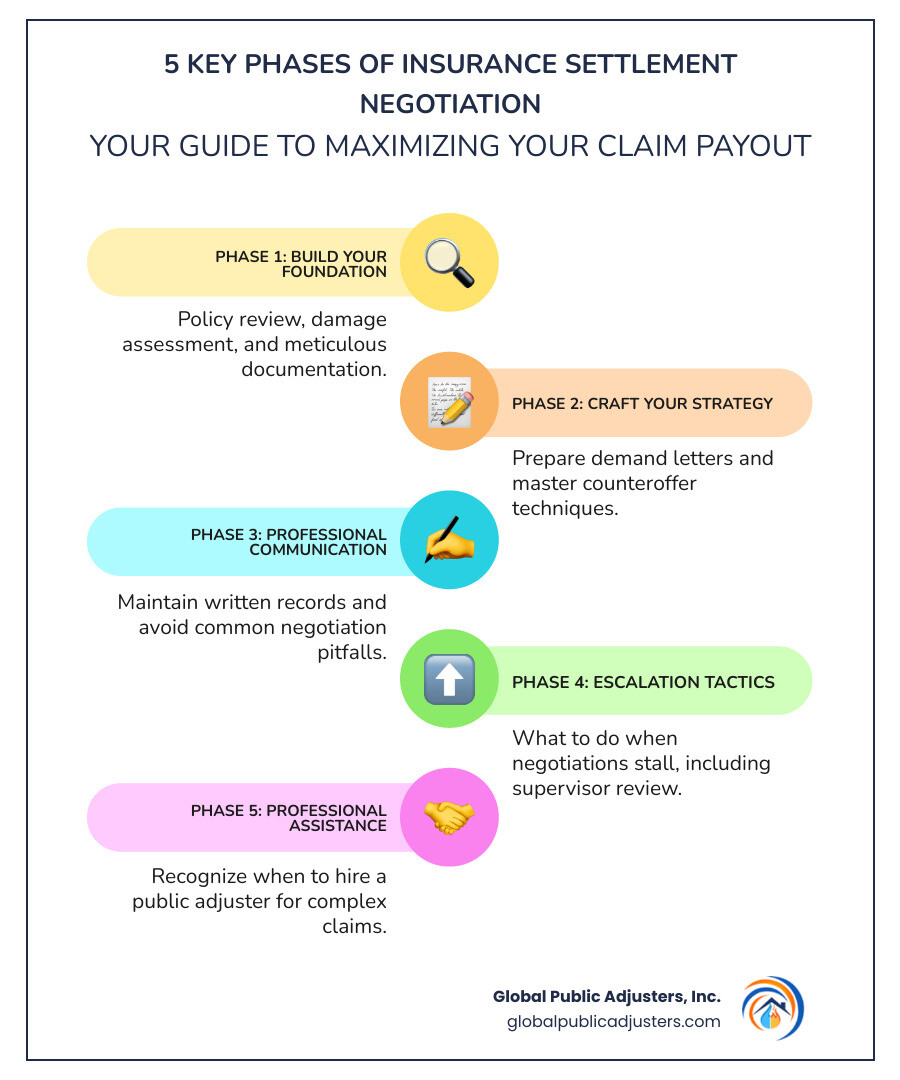

Learninghow to negotiate an insurance settlementis crucial because insurance companies are for-profit businesses focused on minimizing payouts. When your settlement offer arrives and it’s insultingly low, you need a plan. The negotiation process involves these key steps:

- Review your policyand document all damages with photos, videos, and receipts.

- Calculate your claim’s true value, including all repair, replacement, and additional living costs.

- Never accept the first offer, as it’s almost always a lowball tactic.

- Send a detailed demand letterwith evidence to justify your requested amount.

- Negotiate professionallyby communicating in writing and staying calm.

- Escalate when necessaryby requesting a supervisor review or hiring a public adjuster.

Insurers often rely on a quick inspection, hoping you won’t point out all the damage. But you don’t have to accept their low offer. Understanding the process gives you leverage. In Florida, insurers must resolve claims within 90 days of receiving proof of loss, and you have five years to file a breach of contract lawsuit if talks fail. Rushing to settle works against you.

This guide will walk you through each phase of the negotiation, from documenting your claim to knowing when professional help can maximize your payout.

Phase 1: Building Your Foundation for a Strong Negotiation

Think of negotiating with your insurer like preparing for a court case: you need evidence. Before you begin, you must understand your policy, thoroughly document all damage, and accurately calculate your claim’s worth. Without this groundwork, you’re negotiating blind, and the insurance company will take advantage of it.

Understand the Insurance Company’s Playbook

Your insurance company is a for-profit business, and its goal is to pay out as little as possible. This isn’t personal; it’s their business model. The adjuster they send works for them, not you, and is trained to minimize your claim. Their primary tactic is the lowball offer—an initial number far below your claim’s actual value. They’re testing to see if you’ve done your homework and are willing to push back.

You may also receive a “reservation of rights” letter. This is a standard legal formality stating they are investigating the claim but reserve the right not to pay if the loss isn’t covered. It doesn’t mean your claim is denied. Before filing, review yourstandard homeowner’s insurance policyto know what’s covered (like fire and wind) and what’s not (like floods, which require a separate policy). Understanding your policy is your first line of defense.

How to Determine the True Value of Your Claim

You can’t negotiate effectively without knowing what your claim is worth. For property damage, you’ll be dealing witheconomic damages: the quantifiable financial losses you’ve suffered. This includesrepair estimatesfrom licensed contractors,replacement costsfor destroyed items, andadditional living expensesif you’re displaced.

Get at least three repair estimates to establish a credible range. For replacement items, document the cost of new, similar products. Save every receipt for temporary housing, meals, and other costs if your home is uninhabitable. Your policy will use one of two valuation methods:

Actual Cash Value (ACV)is the replacement cost minus depreciation. This method accounts for the age and wear of your property, resulting in a lower payout.

Replacement Cost Value (RCV)is the cost to replace your property with new, similar items without deducting for depreciation. Insurers often pay the ACV first and reimburse the depreciation amount after you complete repairs and submit receipts.

| Valuation Method | Definition | Impact on Settlement Offer |

|---|---|---|

| Actual Cash Value (ACV) | The estimated market value of your damaged property at the time of loss, taking depreciation into account. The formula is typically: ACV = Replacement Cost – Depreciation. For example, an older roof or a used appliance will have a lower ACV than a brand-new one due to wear and tear. | Policies that pay out on an ACV basis will result in a lower initial settlement because they factor in the age and condition of your items. You receive less money upfront, often making it harder to fully replace or repair without out-of-pocket expenses. |

| Replacement Cost Value (RCV) | The estimated cost to replace a damaged item with a new or similar one without accounting for depreciation. The goal is to provide full compensation to replace what you lost. Many policies offer RCV, or you can often add it as an endorsement. | RCV policies generally offer a higher settlement, as they allow you to replace damaged items with new ones. However, insurers often pay ACV first, and then the depreciation amount once repairs are completed and receipts are submitted. This means you might still need to cover the difference initially. |

Knowing which method your policy uses is critical to your negotiation strategy.

Gather Undeniable Evidence to Support Your Valuation

Evidence is everything. The more thorough your documentation, the harder it is for an insurer to lowball you. Start withphotographs and videos, capturing damage from multiple angles, both close-up and wide. Also, photograph undamaged areas for contrast. Keep allreceipts and invoices, especially original purchase receipts and detailed, itemized quotes from licensed contractors.

Obtain copies ofofficial reportsfrom police or fire departments, as they provide objective, third-party documentation.Witness statementsfrom neighbors can also corroborate your account. For complex issues, consider anexpert opinionfrom an engineer or roofer.

Create a dedicated folder for all claim documents: your policy, damage inventory, contractor estimates, photos, videos, official reports, receipts for living expenses, and all correspondence with the insurer. This organized file is your ammunition for negotiation.

Phase 2: How to Negotiate an Insurance Settlement Like a Pro

You’ve documented your damages and calculated your claim’s value. Now it’s time tonegotiate an insurance settlement. While the adjuster has more experience, your preparation can level the playing field. This phase is about strategic communication, patience, and standing firm on a fair valuation.

The Crucial First Moves: The Demand Letter and Initial Offer

Your first move is sending a demand letter. This formal document outlines what happened, what was damaged, your evidence, and the settlement amount you’re seeking. A professional, evidence-backed demand letter shows the insurer you’re prepared and sets a serious tone for the negotiation.

Soon after, the insurance company will respond with their initial offer. A critical rule:never accept the first offer. It’s a negotiation tactic, almost always far below what you’re owed. They are testing you, hoping you’re stressed and will accept a low amount to end the process.

Don’t panic. Instead, ask the adjuster to justify their low offer in writing. This creates a paper trail and can expose weaknesses in their assessment. Once you understand their reasoning, submit a counteroffer. It should address their points while reaffirming your position with evidence. This back-and-forth is a normal part of bridging the gap between their low offer and your fair valuation.

Master the Art of Communication with the Adjuster

How you communicate is critical. Even if you’re frustrated,staying calm and professionalis essential. Anger won’t help and may cause the adjuster to become less cooperative.

The golden rule is toalways communicate in writing. Emails and letters create a paper trail of every conversation and offer, which is invaluable if you need to escalate the claim. If you speak on the phone, follow up with an email summarizing the discussion to ensure accountability.

When communicating,stick to the facts. Present your evidence and clearly explain why your valuation is accurate. Avoid emotional appeals or speculation. Critically,never admit faultfor the damage, as even a casual comment can be used to reduce or deny your claim. Your job is to prove the value of your covered loss, not explain how it could have been prevented.

Common Mistakes Policyholders Make When Negotiating Settlements

Avoiding common mistakes can save you thousands. Here are the biggest pitfalls:

- Accepting the first offer:As stated, this is a starting point, not a fair valuation.

- Failing to document everything:If you don’t point out and prove damage, it won’t be included in your settlement. Be thorough.

- Not understanding your policy:You can’t argue for what you’re owed if you don’t know your coverage limits, deductible, or valuation method (ACV vs. RCV).

- Rushing the process:Settling too quickly almost always means settling for less. Use the time you have to negotiate a fair deal.

- Giving recorded statements unprepared:Be careful with recorded conversations. Stick to facts and don’t speculate. It’s okay to say you need to check your records before answering.

- Throwing away damaged items:These items are your evidence. Don’t discard them until the adjuster has inspected them and you’ve agreed on their value.

- Minimizing your damages or suggesting fault:Statements like “it’s not that bad” can be used against you. Let your documentation speak for itself.

Phase 3: When Negotiations Stall: Escalation and Advanced Tactics

Sometimes, discussions with your insurance company reach an impasse. The adjuster becomes unresponsive, and the settlement offer remains stubbornly low. This isn’t the end. It’s time to escalate, deploy advanced tactics, and consider professional help.

What to Do When the Adjuster Won’t Budge

If an adjuster won’t move from a low offer, don’t give up. Change your tactics. First,ask for justification in writing. Demand a written explanation for their position, citing specific policy language or evidence. This forces transparency and may reveal flaws in their argument.

If that fails,escalate to a supervisor. Politely request to speak with a claims manager. A fresh pair of eyes may be more objective. Document this request and the outcome. You can alsorequest a review by a higher-level adjusteror an internal review department, providing them with your complete, organized documentation package.

If negotiations have stalled despite these efforts, it’s a strong sign you shouldconsider seeking professional assistance from a public adjuster. We specialize in breaking through these deadlocks. Often, an adjuster’s attitude changes once they know a professional is handling the claim.

Recognizing and Responding to Insurance Bad Faith

Sometimes, stalled negotiations are a sign of bad faith—an intentional failure by the insurer to uphold their obligations. This is a violation of Florida law.

Signs of bad faith include:

- Unreasonable delays:Per Florida Statutes Section 627.70131, insurers must resolve claims within 90 days of receiving proof of loss. Significant delays without a good reason are a red flag.

- Denying a claim without proper reason:A legitimate denial must cite specific policy language. Vague explanations are suspicious.

- Not conducting a proper investigation:This includes ignoring your evidence or performing only a superficial inspection of the damage.

- Misrepresenting policy languageor offering settlements that are dramatically below your proven damages.

If you suspect bad faith, document everything: dates, times, conversations, and broken promises. This evidence is crucial if you file a complaint with the Florida Department of Financial Services or pursue legal action.

When to Call in Professionals for Your Insurance Settlement Negotiation

Knowing when to hire an expert is a strategic decision that can dramatically increase your settlement. While you can negotiate on your own, certain situations strongly warrant professional help.

Consider hiring a public adjuster for:

- Complex or extensive claims:For major events like a hurricane or fire, valuing the claim and finding hidden damage is difficult. The higher the claim’s value, the harder the insurer will fight to reduce it.

- Suspected bad faith:An advocate who understands Florida insurance law is essential to challenge an insurer’s illegal tactics.

- Stalled negotiations:If you’ve hit a brick wall, a professional can often break the deadlock. We speak the insurer’s language and know how to build a case that’s hard to dismiss.

Apublic adjusterworks exclusively for you, the policyholder, to maximize your settlement. We handle the entire process, from documentation to negotiation. An attorney may become necessary if the case must go to court, and we often work with legal counsel in those situations. The key is not to wait until you’re desperate. The earlier you involve a professional, the better your outcome will likely be.

Frequently Asked Questions about Insurance Settlement Negotiation

Over our 50+ years in business, we’ve heard the same questions from Florida policyholders. Here are answers to the most common ones abouthow to negotiate an insurance settlement.

How long does an insurance company have to settle a claim in Florida?

Florida law prevents insurers from dragging their feet. According toFlorida Statutes, Section 627.70131, an insurance company mustacknowledge your claim within 14 daysof receiving it. From there, they have90 days to resolve your claim—meaning they must pay it, deny it, or provide a written explanation for the delay.

These deadlines are legal requirements. If your insurer misses them without a valid reason, it could be a sign of bad faith. Document all delays carefully.

What is the difference between an insurance adjuster and a public adjuster?

This is a critical distinction. Aninsurance adjuster(or company adjuster) works for the insurance company. Their loyalty is to their employer, whose goal is to minimize payouts.

Apublic adjusterworks foryou, the policyholder. We are licensed professionals hired by you to be your advocate. Our sole purpose is to maximize your settlement by thoroughly documenting damages, interpreting your policy, and negotiating on your behalf. We level the playing field by bringing expert knowledge to your side of the table.

For a deeper dive, visit our page onPublic Adjusters: What They Do.

Can I reopen a claim after a settlement is paid?

This is difficult. When you accept a settlement, you typically sign arelease of liability form, which finalizes the claim and prevents you from seeking more money for that incident. This is why it’s crucial to get the settlement right the first time.

There are rare exceptions. If you findnew, related damagethat was genuinely hidden and couldn’t have been found during the original inspection (like mold inside a wall found later), you may be able to file a supplemental claim. You must prove the damage is from the original event and was not findable earlier.

Another exception isbad faith handlingby the insurer. If you can prove they intentionally misled you or conducted a grossly inadequate investigation, you might be able to challenge the settlement, though this usually requires legal action.

It’s far better to ensure your claim is complete before settling. Don’t rush, and consider professional help to make sure nothing is missed.

Conclusion

You now have a playbook forhow to negotiate an insurance settlement. The path isn’t always easy, but with the right knowledge, you are no longer at the mercy of lowball offers and delay tactics. The key takeaway is thatpreparation is everything. Thorough documentation, an accurate claim valuation, and professional communication shift the balance of power in your favor.

Insurance companies count on policyholders giving up when negotiations get tough.But you don’t have to play by their rules.You paid your premiums, and you have the right to a fair settlement. Florida law gives you protections, including a 90-day resolution window for insurers and a five-year window to file a lawsuit if negotiations fail.

Sometimes, the fight is too complex to handle alone. When facing extensive damages, a stalled negotiation, or suspected bad faith, bringing in an experienced advocate is a smart strategic move.

At Global Public Adjusters, Inc., we have spent over 50 years fighting for Florida homeowners and business owners. We know the insurance companies’ tactics and how to counter them. While their adjuster works to minimize your claim, we work exclusively for you to maximize it. We handle the entire process so you can focus on recovery.

Don’t settle for less than you deserve.Get expert help from a public adjusterand let us fight for the settlement you’ve earned.