home insurance adjusters near me: Top 5 Trusted 2025 Picks

Finding Professional Help After Property Damage

When facing property damage, findinghome insurance adjusters near meis often the first step toward a fair settlement. Here’s what you need to know to quickly find qualified help in your area:

How to Find Local Home Insurance Adjusters:

1. Check state insurance department websites for licensed adjusters

2. Search NAPIA (National Association of Public Insurance Adjusters) directory

3. Ask for referrals from neighbors who’ve filed successful claims

4. Read online reviews focusing on local expertise and results

5. Verify licensing status before initial consultation

Property damage can turn your life upside down in an instant. Whether it’s a burst pipe flooding your basement, a tree crashing through your roof during a storm, or fire damage that’s left parts of your home uninhabitable, dealing with the aftermath is overwhelming.

Filing an insurance claim should bring relief, but many homeowners find that the process is complex, time-consuming, and often results in settlements that don’t cover the full cost of repairs. This is where professional help becomes invaluable.

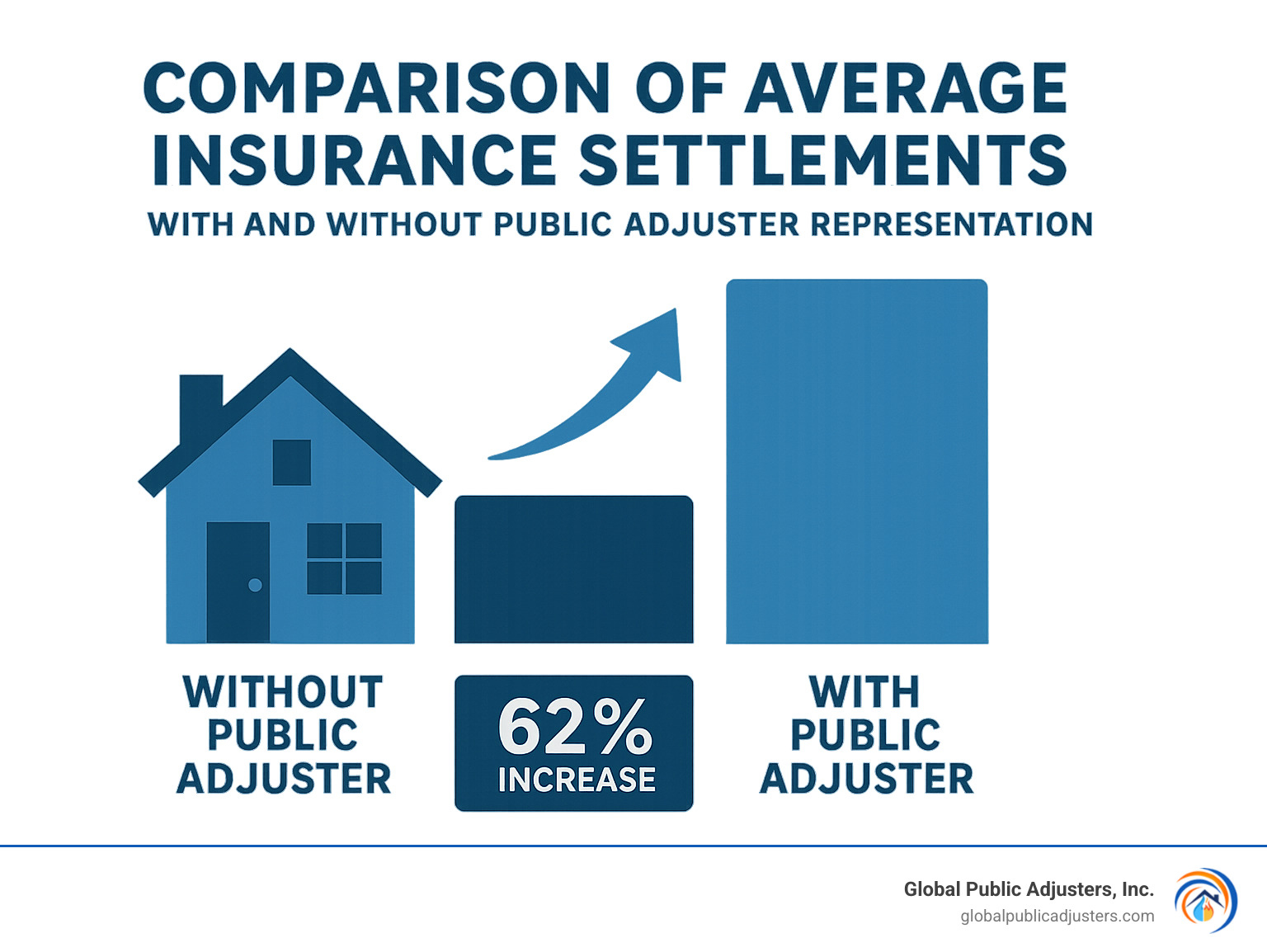

Studies show that claims handled by public adjusters receive settlements that are 62% higher on average than those negotiated directly with insurance companies. These professionals work exclusively for you—not the insurance company—ensuring your interests are protected throughout the claims process.

But not all adjusters are created equal. Understanding the different types of adjusters and finding the right local professional can make all the difference between a denied claim and a fair settlement that fully restores your property.

Local adjusters bring invaluable knowledge of regional building codes, weather patterns, and common property issues in your area. They’ve likely handled numerous similar claims in your neighborhood and understand exactly what documentation your specific insurance company requires.

The search for “home insurance adjusters near me” is more than just finding a convenient professional—it’s about finding an advocate who knows your local market and can level the playing field with insurance companies.

Commonhome insurance adjusters near mevocab:

–licensed insurance adjusters

–what do insurance adjusters do

Understanding Home Insurance Adjusters: Who’s Really on Your Side?

When your home suffers damage, you’ll quickly find yourself navigating a world of insurance terminology and meeting different types of adjusters. Knowing who’s truly looking out for your interests can make thousands of dollars of difference in your settlement.

What a Home Insurance Adjuster Does

A home insurance adjuster is the person who evaluates your property damage and determines how much money you’ll receive for repairs. But their job goes far beyond a simple walk-through of your property.

Good adjusters conduct detailed inspections, document every bit of damage with photos and notes, carefully review your policy’s fine print, create comprehensive repair estimates, and negotiate the final settlement amount.

“A good adjuster doesn’t just look at the obvious damage,” explains Michael Keeler, an experienced professional in the field. “They understand how one type of damage can lead to others—like how water intrusion might later cause mold or structural issues that aren’t immediately visible.”

This assessment directly impacts your family’s financial recovery. That’s why understanding who the adjuster represents is crucial to protecting your home and finances.

Public vs. Independent vs. Company Adjusters

Here’s where things get tricky—and why finding the righthome insurance adjusters near mematters so much. Not all adjusters have the same goals or loyalties:

| Adjuster Type | Who They Work For | Payment Structure | Primary Goal |

|---|---|---|---|

| Company (Staff) Adjuster | Insurance company | Salary from insurer | Minimize company payout |

| Independent Adjuster | Insurance company | Fee from insurer | Satisfy insurer who hired them |

| Public Adjuster | You (the policyholder) | Percentage of settlement | Maximize your settlement |

Company Adjusterswork directly for your insurance provider. While they may seem helpful and friendly (and many truly want to do right by you), they ultimately answer to their employer. Their performance reviews often depend on how well they control costs—meaning smaller payouts benefit their career.

Independent Adjustersaren’t employees but contractors hired by insurance companies. They’re especially common after major disasters when insurers need extra help. Though technically “independent,” they’re still paid by and represent the insurance company’s interests. Their next job depends on keeping insurers happy.

Public Adjustersstand apart as the only type working exclusively for you. These licensed professionals serve as your advocate throughout the entire claims process. Since they typically earn a percentage of your settlement, their success is directly tied to yours—the more you receive, the better for both of you.

“Insurance companies are tough, but so are we,” notes Global Public Adjusters, Inc. “When you hire a public adjuster, you never need to talk to the insurance company again. We handle everything.”

This fundamental difference in loyalty creates an obvious conflict of interest. Company and independent adjusters, no matter how ethical, must ultimately serve the insurance company’s bottom line. Onlypublic insurance adjustersare legally obligated to fight exclusively for your maximum recovery.

When searching forhome insurance adjusters near me, understanding these crucial differences helps you make an informed choice about who will truly advocate for your family’s recovery.

When and Why to Hire a Public Adjuster

Facing property damage is stressful enough without having to steer the complex world of insurance claims. While not every situation requires professional help, knowing when to bring in a public adjuster can make all the difference in your recovery journey.

Signs You Need Professional Help

When your home suffers significant damage, the insurance company’s initial offer often falls short of what you truly need.Large claims over $10,000especially warrant professional representation, with studies showing that claims exceeding $50,000 see the most dramatic benefits from having an advocate in your corner.

Has your insurance companydenied your claimoutright? This is a clear red flag. Insurance companies commonly cite “normal wear and tear” or obscure policy exclusions to avoid paying legitimate claims. A public adjuster can review these denials with expert eyes and identify solid grounds for appeal.

“I was devastated when my claim was denied after my kitchen flooded,” shares Maria from Orlando. “My local public adjuster found coverage in my policy the insurance company had overlooked, and we ended up with a full settlement.”

If you’ve received alowball offerthat doesn’t begin to cover your actual repair costs, don’t accept it! This is one of the most common situations where public adjusters prove their worth. They know how to document the true extent of your damages and fight for what you’re owed.

Time constraints are another crucial factor. The claims process demands hours of documentation, phone calls, and follow-ups. If you’re alreadyjuggling work, family, and recoveryfrom property damage, a public adjuster can lift this burden from your shoulders.

“I’ve already started the claim process, can you still help?” We hear this question almost daily at Global Public Adjusters. The answer is absolutely yes—though the sooner we get involved, the better your outcome will likely be.

Benefits of a Neighborhood Advocate

When searching forhome insurance adjusters near me, choosing someone with local expertise offers distinct advantages. A neighborhood adjuster understands regional construction costs, building codes, and common property issues specific to Florida areas like Orlando and Pensacola.

The financial impact is substantial. Over the past three years, public adjusters at Global Public Adjusters have secured settlements averaging62% higherthan what insurance companies initially offered. This dramatic difference often more than covers their fee.

Speed matters when you’re trying to rebuild your life. Professional documentation and skilled negotiation typically accelerate claims that might otherwise drag on for months or even years. Small claims may settle in days with professional help, while larger losses might resolve in 60-120 days instead of the years they could take otherwise.

Perhaps the most underrated benefit ispeace of mind. As one homeowner testified after working with us: “They made a stressful time a lot easier… they fought for every dollar while I focused on getting my family back to normal.”

Most reputable public adjusters, including Global Public Adjusters, work on contingency—meaning you pay nothing unless they increase your settlement. This no-risk arrangement aligns their interests perfectly with yours.

After Hurricane Ian devastated parts of Florida, a homeowner in Pensacola shared this experience: “The insurance company offered $22,000 for our roof damage—not even half of what was needed. Our local public adjuster documented additional damage the company’s adjuster completely missed and negotiated a final settlement of $58,500. The difference more than covered their fee and let us properly repair our home.”

When disaster strikes, having a professional advocate who understands both your local area and the insurance industry can transform your recovery experience. Learn more aboutWhy Should I Hire a Public Adjuster?to understand if your situation calls for professional help.

Finding & Vetting Home Insurance Adjusters Near Me

When your home has been damaged, finding the righthome insurance adjusters near mecan feel like searching for a needle in a haystack. But don’t worry—with a little guidance, you’ll find a professional who truly has your best interests at heart.

Search Tools for Home Insurance Adjusters Near Me

The good news is you have several reliable places to start your search. Your state insurance department website is a goldmine of information, with searchable databases of licensed professionals right at your fingertips. In Florida, the Department of Financial Services makes it easy to verify who’s legitimate and who’s not.

Professional associations can be your best friend in this process. TheNational Association of Public Insurance Adjusters (NAPIA)maintains a comprehensive directory organized by state, making it simple to find someone in your neighborhood. You might also check theCIA Directoryfor additional options.

Nothing beats a personal recommendation from someone who’s been in your shoes. That neighbor who successfully steerd a similar claim last year? Ask who helped them through it. Their experience is invaluable.

Online reviews can tell you a lot about an adjuster’s reputation. A quick search on Google, Yelp, or the Better Business Bureau will reveal patterns in how they treat clients. And don’t overlook attorneys who specialize in insurance claims—they often work closely with the most reputable adjusters and can point you in the right direction.

When you’re specifically looking forhome insurance adjusters near mein Orlando or Pensacola, focus on professionals with deep roots in your community. They’ll understand the unique challenges of Florida properties, from hurricane damage patterns to local building codes that might affect your repairs.

Verify Licensing of Home Insurance Adjusters Near Me

Trust but verify—that’s the golden rule when it comes to choosing an adjuster. In Florida, legitimate public adjusters must be licensed through the Department of Financial Services. Verification is as simple as making a phone call to (866) 445-5364 or checking their credentials online.

Bond status matters too. Florida requires public adjusters to maintain a surety bond, which is essentially your insurance policy against an adjuster who doesn’t fulfill their obligations. Think of it as a safety net for your safety net.

Professional memberships speak volumes about an adjuster’s commitment to their craft. Organizations like NAPIA hold members to high ethical standards and require ongoing education—exactly what you want in someone handling your claim.

Don’t be shy about asking for references from previous clients with similar claims. As one homeowner told us, “Talking to another family who had gone through the same nightmare with their roof gave me confidence that my adjuster knew exactly what they were doing.” A reputable professional will happily connect you with satisfied clients.

As a wise public adjuster with over 25 years of experience once said, “You wouldn’t hire the I.R.S. to prepare your tax returns, so why allow your insurer to prepare your claim damages?” It’s a perfect analogy for why finding an independent advocate is so crucial.

Red Flags When Hiring Home Insurance Adjusters Near Me

Not all adjusters are created equal, and some warning signs should send you running in the opposite direction.

Be immediately suspicious ofunsolicited contactafter a disaster. In Florida, it’s actually illegal for adjusters to knock on your door between 7 p.m. and 8 a.m.—a rule designed to protect vulnerable homeowners from predatory practices.

A legitimate adjuster will always provide awritten contractthat clearly spells out services and compensation. Florida law requires it, and you should demand nothing less. Similarly, be wary ofupfront fees—reputable public adjusters work on contingency, meaning they don’t get paid until you do.

Watch out forpressure tactics. Anyone rushing you to sign paperwork without thoroughly answering your questions doesn’t deserve your business. Your home is too important for hasty decisions.

Be cautious of adjusters withvague experienceor no specific knowledge of your type of claim. Water damage, fire, and hurricane claims all require different expertise. And prefer adjusters with alocal office—it indicates stability and a genuine investment in your community.

At Global Public Adjusters, we encourage you to ask potential adjusters about their local experience, the percentage of similar claims they handle, and their communication style. After all, you’ll be working closely with this person during a stressful time in your life.

In Florida, you have the right to cancel a public adjuster contract within 5 business days by sending written notice via certified mail. It’s a consumer protection that gives you breathing room if you have second thoughts.

Finding the right adjuster takes some effort, but as many of our clients will tell you, it’s time well spent. The difference between a mediocre and excellent public adjuster can literally be tens of thousands of dollars in your settlement—and the peace of mind knowing someone is truly fighting for your best interests is priceless.

For more guidance, check out our article onQuestions to Ask Your Public Adjusterbefore making your final decision.

Working With a Public Adjuster: Process, Fees & Claim Types

Partnering with a public adjuster can feel like having a knowledgeable friend by your side during a stressful time. Once you’ve chosen your advocate, understanding what happens next will help you steer the journey with confidence.

Start-to-Finish Claim Roadmap

The path from damage to settlement follows a clear route when you work with a professional:

Your journey begins with afree consultationwhere your adjuster examines the damage and reviews your policy. This no-pressure meeting helps both of you determine if working together makes sense. If you decide to move forward, you’ll sign a contract that clearly spells out services and fees.

Next comes the detective work. Your adjuster conducts athorough inspection, documenting every bit of damage with photos, videos, and detailed notes. “We often find damage that homeowners never noticed,” explains a veteran adjuster at Global Public Adjusters. “That tiny water stain on the ceiling? It might indicate serious problems above.”

While you focus on getting your life back to normal, your adjuster dives into your policy, identifying all possible coverage angles. They’ll create detailed repair estimates using the same industry-standard software that insurance companies use.

With all evidence gathered, your adjuster prepares and submits a comprehensive claim package. From this point forward, you can step back and breathe easy – they’ll handle all those frustrating phone calls and emails with the insurance company.

“We stand by our work, and we stand by our word,” is the philosophy at Global Public Adjusters. This commitment means you’re never left wondering what’s happening with your claim.

Once a fair settlement is reached, you receive your payment, your adjuster receives their fee, and all paperwork is properly filed to close the claim.

How Public Adjuster Fees Work

Understanding the financial side of working with a public adjuster is straightforward once you know the basics:

Most public adjusters work on acontingency basis, typically charging between 10% and 15% of your final settlement. This percentage may reach up to 25% for especially complex or high-risk claims. The beauty of this arrangement? If they don’t secure a settlement, you pay nothing.

These fees are negotiable, especially for larger claims, so don’t hesitate to discuss this during your initial consultation. Your insurance policy doesn’t cover these fees – they come from your settlement.

Florida law requires that all fee arrangements be clearly spelled out in your contract, so there should never be surprises about what you’ll pay.

“If attorneys trusted me as an expert witness, you can too,” notes one experienced adjuster. This professional credibility often leads to more effective negotiations with insurance companies, resulting in settlements that more than offset their fees.

Common Home Claim Types a Public Adjuster Handles

Home insurance adjusters near mecome with specialized expertise in handling various types of property damage:

Fire and smoke damageclaims extend far beyond visible burns. Your adjuster will identify hidden smoke damage, water damage from firefighting efforts, and structural concerns that might lurk beneath the surface.

When dealing withwater damagefrom burst pipes or roof leaks, quick action prevents secondary issues like mold. A good public adjuster ensures all consequential damages make it into your claim.

Florida homeowners know the threat ofhurricane and storm damageall too well. These claims involve complex coverage questions about wind, rain, and flood damage that public adjusters are skilled at navigating.

Roof damageclaims, whether from wind, hail, or falling trees, are notorious for being undervalued by insurance companies. Your public adjuster will assess not just the roof itself, but any interior damage caused by leaks.

If you’re dealing withmold damageresulting from a covered water event, your policy likely covers remediation. The key is documenting the connection between the initial event and the mold – something public adjusters excel at.

Many Florida homes suffer fromcast iron pipe damageas aging plumbing systems fail. These specialized claims require knowledge of both plumbing systems and policy coverage details.

Florida’s limestone geology makessinkhole damagea real concern for many homeowners. These complex claims almost always benefit from professional representation.

As one relieved client shared: “After my kitchen sink leak was initially denied, the public adjuster found coverage under a different policy provision and secured a $36,000 settlement for repairs I thought I’d have to pay out of pocket.”

When searching forhome insurance adjusters near mein Orlando or elsewhere in Florida, finding someone with experience in your specific type of damage can make all the difference in your claim’s outcome. The experts atGlobal Public Adjustershave seen it all – and know exactly how to help.

FAQs & Real-Life Success Stories

Are public adjuster fees negotiable?

Absolutely! While mosthome insurance adjusters near metypically charge between 10% and 15% of your settlement, there’s usually room for discussion. Several factors can influence your fee arrangement, including how complex your claim is, the total dollar amount (larger claims often qualify for lower percentages), and at what stage of the process you bring in professional help.

At Global Public Adjusters, we believe in complete transparency about fees during your first consultation. One recent client told us, “I initially worried about the cost, but after seeing how much more they recovered compared to what the insurance company first offered, it was a no-brainer. Even after their fee, I ended up with thousands more in my pocket.”

Florida law requires all fee arrangements to be clearly spelled out in your contract—this protects both you and the adjuster. Don’t be afraid to ask questions about the fee structure; a reputable adjuster will be happy to explain everything in detail.

How long does a claim take with a public adjuster?

“How soon can I get back to normal?” This is probably one of the most common questions we hear from homeowners facing property damage. The honest answer is that timelines vary based on your specific situation.

For small, straightforward claims, you might see resolution in just a few weeks. Most moderate fire, water, or wind claims typically take between 60-120 days from start to finish. More complex situations or very large losses might extend to 12-24 months, especially if there are complicated coverage issues to resolve.

One factor that significantly impacts timeline is whether your claim is part of a widespread catastrophe. After major hurricanes or flooding events, all claims naturally take longer due to the sheer volume of cases insurance companies are handling.

The good news? Public adjusters generally speed up the process. By providing thorough documentation upfront and maintaining persistent communication with insurance companies, we help prevent the endless back-and-forth requests for more information that often delay claims.

As one Orlando homeowner recently shared, “My claim had been sitting in insurance limbo for almost four months with zero progress. Within six weeks of hiring Global Public Adjusters, we reached a settlement that was more than double what I was originally offered—and I could finally start rebuilding.”

Can my contractor negotiate my insurance claim for me?

This is a definiteno—and it’s not just our opinion, it’s the law. In Florida and most other states, it’s actually illegal for contractors to negotiate insurance claims unless they also hold a public adjuster license. This practice has a name: Unauthorized Practice of Public Adjusting (UPPA), and both you and your contractor could face serious consequences if you go this route.

Why is this prohibited? There are several important reasons:

Conflict of intereststands at the top of the list. Your contractor’s primary goal is securing repair work, while a public adjuster’s sole focus is maximizing your overall settlement. These aren’t always aligned interests.

Contractors certainly understand construction and repairs, but they typically lack comprehensive knowledge of insurance policies, coverage limitations, and negotiation strategies. Most importantly, unlikehome insurance adjusters near me, contractors negotiating claims aren’t regulated or held to strict ethical standards.

A much better approach is having your public adjuster work alongside your chosen contractor, ensuring repair estimates accurately reflect all necessary work while staying within your policy’s coverage terms.

Real-Life Success Stories

Nothing illustrates the value of professional claim help better than seeing actual results from real Florida homeowners:

Maria’s story perfectly captures what we often see after major storms. Following Hurricane Ian, this Orlando homeowner received an initial offer of just $28,500 for significant roof damage and interior water intrusion. The insurance company claimed most problems were “pre-existing conditions” not covered by her policy.

After bringing in Global Public Adjusters, our team conducted a thorough inspection using specialized moisture detection equipment that revealed extensive water damage hidden inside walls—damage the insurance adjuster had completely missed. We also provided clear documentation proving the roof damage was indeed storm-related, not pre-existing.

The result? A revised settlement of $67,300—a 136% increase. Even after our fee, Maria received substantially more than the original offer and was able to properly restore her home rather than settling for partial repairs that would have left lingering problems.

James faced a different challenge after an electrical fire damaged his Pensacola home. The insurance company’s adjuster spent just 45 minutes on site before offering $130,000 for repairs. Concerned this wouldn’t cover the true extent of damage, James called us for a second opinion.

Our adjuster spent over four hours carefully documenting everything—smoke residue throughout the HVAC system, structural damage not visible during casual inspection, smoke odor embedded in soft surfaces, and water damage from firefighting efforts. This comprehensive approach resulted in a revised settlement of $550,000—more than four times the original offer.

As James later told us, “They fought for every dollar while I focused on getting my family’s life back to normal. I couldn’t have steerd this process alone.”

These stories represent what we see every day: homeowners who initially feel overwhelmed by the claims process but find both relief and significantly better outcomes with professional representation. You canview more testimonialsfrom clients who’ve experienced the difference professional advocacy makes.

Conclusion

Finding the righthome insurance adjusters near meisn’t just about convenience—it’s about making a smart choice that could put thousands of extra dollars in your pocket after disaster strikes. Throughout this guide, we’ve seen how professional representation can transform what’s often a frustrating, confusing process into a path to full recovery.

When you’re standing amid the wreckage of your home—whether from hurricane winds, burst pipes, or fire damage—having someone truly in your corner makes all the difference. Public adjusters bring something invaluable to the table: they work exclusively for you, not the insurance company.

The numbers tell a compelling story. Claims handled by public adjusters receive settlements that are62% higher on averagethan those negotiated directly with insurance companies. Even after paying the adjuster’s fee, most homeowners walk away with substantially more money for repairs. Beyond the financial benefit, there’s also the priceless relief of having an expert handle the paperwork, phone calls, and negotiations while you focus on getting your life back on track.

At Global Public Adjusters, Inc., we’ve spent over five decades helping Florida homeowners steer the claims maze. Our team understands the unique challenges facing property owners in Orlando, Pensacola, and throughout the state. We’ve seen it all—from catastrophic hurricane damage to slow-developing mold problems—and we know exactly how to document and present your claim for maximum recovery.

As you consider your next steps, remember these essentials:

First, always verify credentials before signing with any adjuster. Second, don’t wait until you’re frustrated with your insurance company to seek help—earlier involvement typically leads to better outcomes. Third, get fee agreements in writing and make sure you understand exactly what you’ll pay. Fourth, thorough documentation is crucial, so work with someone who takes this seriously. And finally, let professionals handle insurance company communications—their experience navigating these conversations is invaluable.

The road to recovery after property damage doesn’t have to be a lonely, stressful journey. With the right professional by your side, you can focus on rebuilding your home while experts handle the complex process of securing every dollar you deserve.

For more information about our comprehensive claim services, visitour services pageor reach out for a free, no-obligation consultation. At Global Public Adjusters, your recovery isn’t just our job—it’s our mission.