Claims adjuster Florida: Master 3 Steps to Success

Why Understanding Claims Adjuster Roles in Florida Matters

Claims adjuster Floridaprofessionals play a critical role in the insurance industry, determining how much money policyholders receive after property damage or loss. Whether you’re considering this career path or you’re a property owner dealing with a claim, understanding the different types of adjusters and what they do is essential.

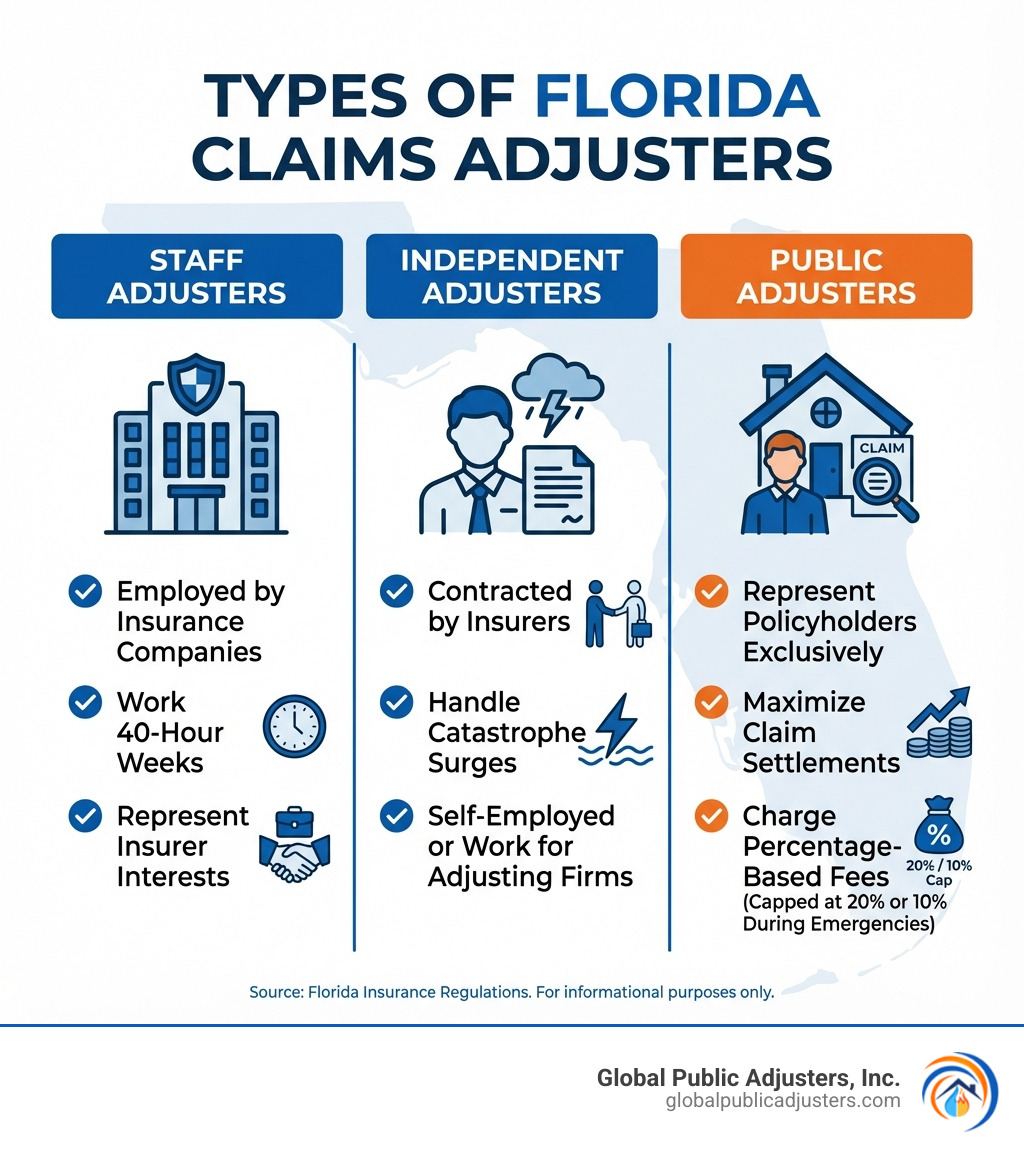

Quick Answer: Types of Claims Adjusters in Florida

- Staff Adjusters: Work directly for insurance companies, handling claims on behalf of their employer

- Independent Adjusters: Self-employed or work for adjusting firms, contracted by insurers to handle claims during busy periods or catastrophes

- Public Adjusters: Work exclusively for policyholders to maximize their insurance settlements, not the insurance company

Florida’s insurance landscape is unique. The state faces extreme weather events like hurricanes, has complex insurance regulations, and maintains an evolving legal environment around claims. This creates steady demand for qualified adjusters across all three categories.

The path to becoming a licensed adjuster in Florida requires specific steps: completing a 40-hour pre-licensing course, passing an exam, and obtaining the appropriate license type (6-20, 7-20, or 70-20). Once licensed, Florida adjusters can leverage reciprocity agreements to work in over 25 other states without additional testing.

For property owners, knowing the difference between these adjuster types is crucial. While staff and independent adjusters represent insurance companies,public adjusters advocate solely for policyholders—working to document losses thoroughly and negotiate fair settlements. In Florida, public adjusters can charge up to 20% of the claim settlement (reduced to 10% in the first year after a governor-declared emergency).

This guide walks through everything you need to know about becoming a claims adjuster in Florida, from licensing requirements to career paths, and helps property owners understand when they might need professional claim representation.

Glossary forClaims adjuster Florida:

Understanding the Different Types of Claims Adjusters in Florida

When we talk aboutClaims adjuster Florida, it’s crucial to recognize that not all adjusters are created equal. Each type serves a distinct purpose within the insurance ecosystem, primarily defined by who they represent. The main categories are staff adjusters, independent adjusters, and public adjusters. Understanding these distinctions is key, whether you’re looking to enter the profession or seeking assistance with a claim.

Who Does Each Adjuster Work For?

Staff Adjusters: These are employees of an insurance company. Their role is to investigate, evaluate, and settle claims on behalf of their employer. They work directly for the insurer, ensuring that the company’s interests are protected while adhering to policy terms and regulations. A staff adjuster typically works a standard 40-hour week, offering the stability of a set schedule and guaranteed hours. For instance, Citizens Property Insurance Corporation employs staff adjusters to handle claims for their policyholders in Florida.

Independent Adjusters: Unlike staff adjusters, independent adjusters are typically self-employed or work for independent adjusting firms. Insurance companies contract them on an as-needed basis, especially during periods of high claim volume, such as after a hurricane or other major catastrophe. They also represent the insurance company’s interests, acting as a third-party contractor to ascertain and determine the amount of any claim, loss, or damage payable under an insurance contract. While they are not direct employees, their allegiance remains with the insurer that hired them.

Public Adjusters: This is where we come in! Public adjusters are unique because we work exclusively for the policyholder, not the insurance company. Our sole responsibility is to represent the insured’s best interests in claims against an insurance company. We are licensed and bonded professionals who assist policyholders with the complicated insurance claim process when they suffer an insured loss. Our goal is to ensure policyholders receive the maximum entitlements under their policy.

The Unique Role of a Public Adjuster

The role of a public adjuster is fundamentally different from that of staff or independent adjusters. While the latter two represent the insurance company, we, as public adjusters, are the only adjusters specifically licensed by the State of Florida to represent you, the insured. Our main responsibility is to protect your interests in claims against a loss with the insurance company.

When a policyholder experiences a significant loss—be it from a pipe burst, a fire, or a hurricane—they often face complex insurance policies written in technical terms. It’s up to the policyholder to prove the extent of their loss. This is where we step in. We help ensure policy conditions are met, carefully document the loss, and vigorously negotiate with the insurance company to get the claim paid fairly. We have the experience, knowledge, and expertise to obtain maximum entitlements under the policy.

One of the most common questions we receive is about our fees. Public adjusters charge a percentage of the settlement. Importantly, we are not paid until you are paid, meaning there are no upfront fees. In Florida, the maximum percentage a public adjuster can charge for a claim is 20% of the claim paid after you sign the contract with us. In the event of a declared emergency by the Governor’s office, that fee is reduced to 10% for any claim made in the first year after the date of loss. After the first year of a declared emergency, the maximum charge reverts to 20%. This fee structure aligns our success directly with yours.

The Path to Becoming a Licensed Claims Adjuster in Florida

Starting on a career as aClaims adjuster Floridaprofessional involves a clear, regulated path set by the Florida Department of Financial Services (FLDFS). The FLDFS is the regulatory body overseeing adjuster licensing in Florida, ensuring that all professionals meet specific standards.

To become a licensed adjuster in Florida, you must first meet several basic requirements:

- You must be a natural person at least 18 years of age.

- You must be a resident of the State of Florida.

- You must be a United States citizen or a legal alien with work authorization.

The application process typically involves submitting your application through the FLDFS MyProfile system. You can find more information andapply for a licensedirectly through the FLDFS website. A critical step in this process is fingerprinting, which is required for a background check. Applicants with a criminal history will have their cases reviewed by the FLDFS, which we will discuss in more detail later.

Step 1: Complete Pre-Licensing Education

Before you can even think about taking an exam (or bypassing it!), you need to complete the required pre-licensing education. Florida mandates a 40-hour all-lines adjuster education course. This is not just a formality; it’s designed to equip you with the foundational knowledge needed to handle diverse claims.

Several state-approved providers offer these courses, both online and in traditional classroom settings. For instance, the Claims Adjuster Certified Professional (CACP) online certification program allows individuals to complete the 40-hour Florida All-Lines Adjuster education requirements. This course covers essential topics, preparing you for the complexities of the job. You canfind approved pre-licensing courses on the FLDFS Education Databaseby selecting the “Prelicensing” radio button.

Step 2: Pass the Florida Adjuster Exam

Once you’ve completed your pre-licensing education, the next step is typically to pass the Florida adjuster exam. However, here’s a fantastic insight for aspiringClaims adjuster Floridaprofessionals: if you complete an approved 40-hour pre-licensing course, such as the CACP program, you can often be exempt from taking the state licensing exam! This means the exam included within your pre-licensing course serves as your qualification. Upon successful completion of the course and its internal exam, you can submit your application to the state without further testing. This is a significant advantage, streamlining your path to licensure.

Step 3: Understanding Key Florida Adjuster License Types

Florida offers specific license types for adjusters, each with its own scope and residency requirements. It’s vital to choose the correct license for your career aspirations.

6-20 Resident Adjuster License (All-Lines): This is the standard license for Florida residents who want to handle all types of claims (property, casualty, auto, etc.). It signifies you are a resident of Florida and have met all state requirements for an all-lines license.

7-20 Non-Resident Adjuster License (All-Lines): This license is for individuals who are residents of another state but wish to be licensed in Florida. It typically requires you to hold an equivalent all-lines license in your home state.

70-20 Designated Home State (DHS) Adjuster License (All-Lines): This license is particularly important for individuals who reside in a state that does not license adjusters (e.g., Colorado, Illinois, Maryland, Pennsylvania, etc.) or for company adjusters whose home state only licenses specific lines of authority. By obtaining a Florida 70-20 DHS license, you designate Florida as your “home state” for licensing purposes, allowing you to leverage Florida’s strong reciprocity agreements with other states.

Here’s a quick comparison of these key licenses:

| License Type | Residency | Purpose | Reciprocity Implications |

|---|---|---|---|

| 6-20 | Florida | Resident All-Lines Adjuster | Strong, as a resident license |

| 7-20 | Non-Florida | Non-Resident All-Lines Adjuster | Based on home state license |

| 70-20 | Any (especially non-licensing states) | Designated Home State (DHS) All-Lines Adjuster | Strong, allows for multi-state reciprocity |

Navigating Your Career: Staff vs. Independent Adjuster Roles

Once you’ve secured yourClaims adjuster Floridalicense, you’ll face a fork in the road: do you pursue a career as a staff adjuster or an independent adjuster? Both paths offer unique opportunities and challenges.

Staff Adjusters: As we mentioned, staff adjusters work directly for insurance carriers. This path typically offers a steady salary, benefits, and a predictable work schedule. Companies like Citizens Property Insurance Corporation hire staff adjusters for various roles, from auto claims to field adjusters. This can be a great entry point for new adjusters, providing structured training and a clear career progression within a single organization.

Independent Adjusters: Independent adjusters, on the other hand, are often called upon during peak times, particularly after major weather events. This is where the term “Catastrophe (CAT) adjusting” comes into play. CAT adjusters deploy to disaster zones, working long hours but earning significantly higher pay per claim. While this offers immense flexibility and income potential, it also comes with less job security and often requires extensive travel away from home for extended periods. Many independent adjusters partner with independent adjusting firms that contract with various insurance carriers.

Benefits and Drawbacks of Each Path

Let’s weigh the pros and cons to help you decide which path might be the best fit for you:

Staff Adjuster

- Benefits: Stable income, comprehensive benefits (health, retirement), paid training, company car (sometimes), less travel, clear career ladder, mentorship opportunities.

- Drawbacks: Lower earning potential compared to busy independent adjusters, less flexibility, tied to one company’s procedures and policies, workload can still be high during surges.

Independent Adjuster

- Benefits: High earning potential (especially during CAT events), flexible schedule (when not deployed), ability to work for multiple carriers, autonomy, diverse work experiences.

- Drawbacks: Income can be inconsistent, no benefits, responsible for all business expenses (equipment, travel, insurance), significant travel and time away from home, high-stress situations, constant need to market oneself.

How to Find Employment

Finding employment as aClaims adjuster Floridarequires a proactive approach.

- Staff Adjuster Roles: Start by checking the careers pages of major insurance carriers operating in Florida. Many companies post entry-level and experienced adjuster positions. Look for opportunities in Orlando, Pensacola, and other key Florida cities.

- Independent Adjuster Roles: Connect with independent adjusting firms. Many firms maintain rosters of adjusters they can deploy. Networking at industry events and joining professional organizations can also open doors. Websites like LinkedIn also list numerous adjuster positions, including auto claims adjuster jobs in Florida.

Maintaining Your License and Professional Growth

Obtaining yourClaims adjuster Floridalicense is just the first step. To remain a licensed professional, you must adhere to continuing education (CE) requirements and actively pursue professional development.

In Florida, adjusters are generally required to complete 24 hours of continuing education every two years. This must include a 5-hour update course on Florida insurance laws and ethics. These requirements ensure that adjusters stay current with the latest regulations, industry best practices, and ethical considerations. Numerous CE providers offer approved courses, both online and in person.

Beyond mandatory CE, consider advanced certifications (e.g., AIC, CPCU) and specialized training in areas like Xactimate (a widely used estimating software) or construction basics. These can significantly improve your skills and marketability. Resources for professional development and continuing education are often available through industry associations and specialized training providers.

Getting Licensed in Multiple States

One of the significant advantages of holding a Florida adjuster license, particularly the 6-20 Resident Adjuster License or the 70-20 Designated Home State (DHS) Adjuster License, is its broad reciprocity. Florida is reciprocal with over 25 states and territories, meaning you can often obtain licenses in those states without taking additional exams or completing further pre-license education.

However, it’s important to note that Florida does not have reciprocal agreements with all states. Specifically, Arizona, California, Hawaii, New Mexico, and New York do not have reciprocal agreements with Florida. If you plan to work in these states, you will likely need to meet their specific licensing requirements independently.

For non-residents, selecting Florida as your Designated Home State (DHS) can be a strategic move. If you reside in a state that doesn’t license adjusters, the Florida 70-20 DHS license allows you to establish Florida as your home state for licensing purposes. This then grants you access to Florida’s extensive reciprocity network, enabling you to get licensed in many other states. The National Association of Insurance Commissioners (NAIC) and the National Insurance Producer Registry (NIPR) are excellent resources for checking specific state reciprocity rules. You can also find more details regarding reciprocity for Florida adjusters on theFLDFS Adjuster Reciprocity page.

Frequently Asked Questions about Becoming a Claims Adjuster Florida

How does Florida handle applicants with a criminal history?

The Florida Department of Financial Services (FLDFS) reviews all applications, including those from individuals with a criminal history. While a criminal record doesn’t automatically disqualify an applicant, certain offenses, especially those related to moral turpitude or financial crimes, can lead to denial. The FLDFS evaluates each case individually, considering the nature and severity of the crime, the time elapsed since the conviction, and evidence of rehabilitation. Applicants are encouraged to be transparent about their history and provide all requested documentation. You can find more information on this topic on theFLCFO Criminal History page.

What are the typical fees for a claims adjuster Florida license?

The costs associated with obtaining and maintaining aClaims adjuster Floridalicense include:

- Initial Licensing and Application Fee: $57.45

- Fingerprint Fee: $50.75 (for the required background check)

- Pre-licensing Course Costs: These vary by provider but can range from approximately $299 for a basic pre-licensing course with an exam exemption to around $699 for comprehensive packages that include additional training like Xactimate.

- Independent Adjuster Appointment Fee: If you’re an independent adjuster, Florida requires you to self-appoint your license, which incurs a fee of $60 (plus a credit card convenience fee).

There is typically no renewal fee for the license itself, but you will have costs associated with continuing education courses every two years.

What is the difference between a 6-20, 7-20, and 70-20 license?

We’ve touched on this, but let’s clarify the key distinctions:

- 6-20 All-Lines Resident Adjuster License: This is for individuals who reside in Florida and want to handle all types of insurance claims within the state. It’s your primary license if Florida is your permanent home.

- 7-20 All-Lines Non-Resident Adjuster License: This license is for individuals who reside in another state but wish to be licensed in Florida. You typically must hold an equivalent all-lines license in your home state to qualify.

- 70-20 All-Lines Designated Home State (DHS) Adjuster License: This is a crucial option for those whose home state does not require an adjuster license (e.g., New Jersey, Illinois, etc.) or only licenses specific types of adjusters. By obtaining a Florida 70-20, you designate Florida as your “home state” for licensing. This allows you to leverage Florida’s extensive reciprocity agreements to get licensed in many other states without needing to pass separate state exams. Choosing the right license depends entirely on your residency and career goals.

Conclusion: Starting Your Adjuster Career and Helping Policyholders

The journey from an aspiring individual to a professionalClaims adjuster Floridais a rewarding one, offering diverse career paths and the opportunity to help people when they need it most. Whether you choose the stability of a staff adjuster role, the dynamic world of independent adjusting, or the advocacy-focused path of a public adjuster, Florida’s unique insurance landscape provides ample opportunities.

For policyholders in Orlando, Pensacola, and across Florida, understanding the different types of adjusters is paramount. While staff and independent adjusters serve the insurance company, we, at Global Public Adjusters, Inc., stand firmly on your side. With over 50 years of experience, our team specializes in navigating complex property damage claims, ensuring you receive the maximum settlement you’re entitled to. Our expertise and unwavering advocacy make a significant difference, especially when battling against insurance companies that may initially underpay or deny claims.

If you’re a policyholder facing a claim, you don’t have to steer the complexities alone. For policyholders needing expert claim representation, the experienced team at Global Public Adjusters, Inc. specializes in navigating complexproperty damage claims in Orlando. We’re here to help you understand your policy, document your losses, and fight for a fair resolution.