Does hail damage claim raise home insurance rates: 1

Why Understanding Hail Claims and Insurance Rates Matters

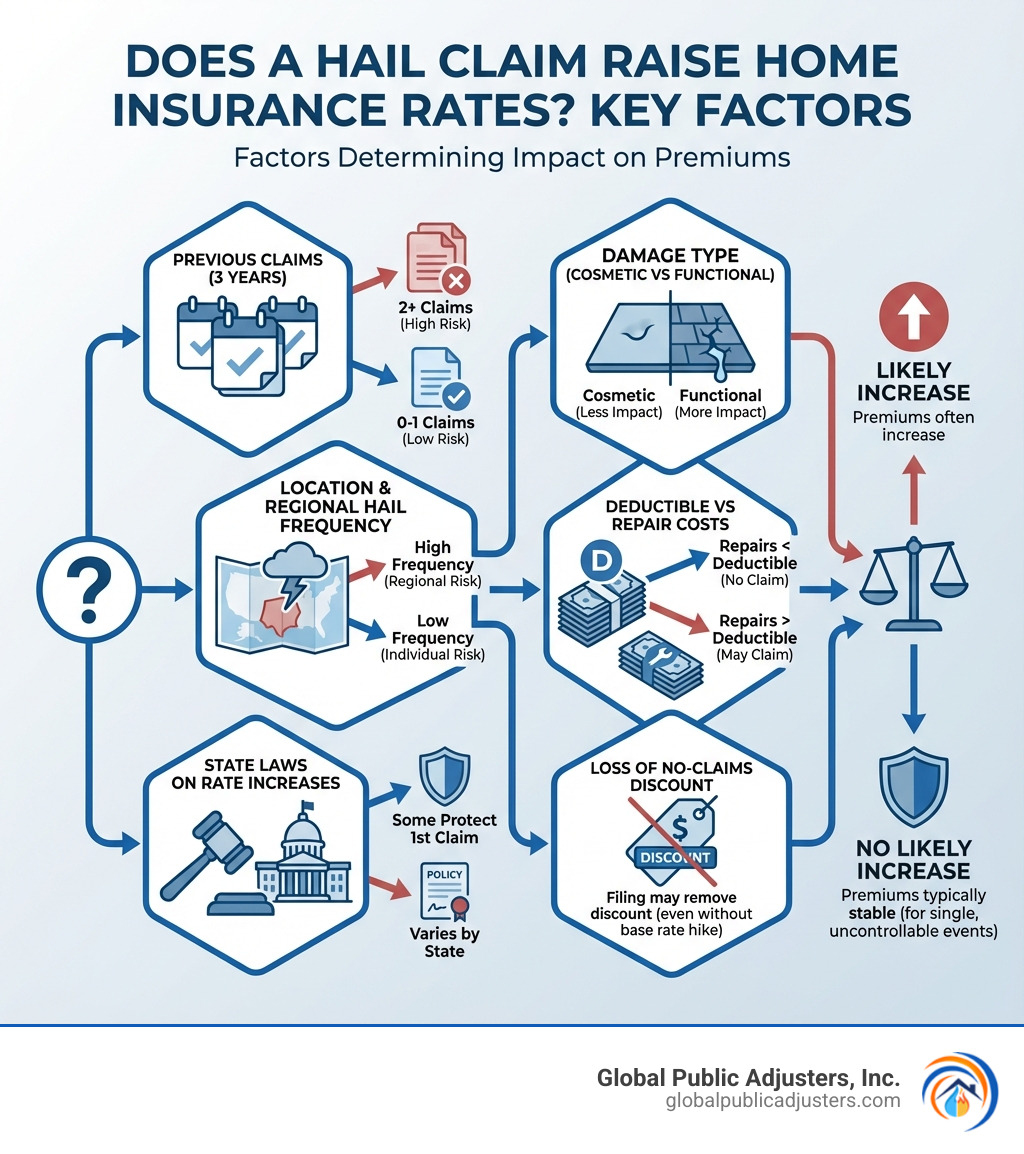

Does hail damage claim raise home insurance rates?The short answer is: it depends. In most cases, a single hail damage claim won’t cause your rates to increase because insurers classify weather events as “acts of God”—uncontrollable disasters. However, your premiumscango up if you file multiple claims within three years, or if your entire region experiences frequent hailstorms that prompt insurers to raise rates for everyone in that area.

Quick Facts About Hail Claims and Rate Increases:

- Single claim:Usually won’t raise your individual rate (weather damage is unpreventable)

- Multiple claims:Filing 2+ claims within 3 years will likely increase your premium

- Regional increases:If your area sees more hail events, insurers may raise rates for the entire region

- State protection:Some states prohibit rate hikes after a single weather-related claim

- No-claims discount:You may lose claim-free discounts even if your base rate doesn’t increase

Hailstorms cause over$10 billion in damagesannually across North America. In 2020 alone, the average homeowner hail damage claim reached nearly$12,000. For homeowners in disaster-prone regions like Florida, understanding how filing a claim affects your insurance premium is crucial to making smart financial decisions.

Many homeowners delay getting their property inspected after a storm because they fear their rates will skyrocket. This hesitation can lead to worse problems—small dents in your roof today can become major leaks tomorrow. The consequences of unrepaired damage often cost far more than any potential rate increase.

This guide will help you understand exactly how hail claims impact your insurance costs, when it makes sense to file, and how to steer the claims process effectively. We’ll break down the factors that determine rate increases and give you a clear roadmap for protecting both your property and your wallet.

Quickdoes hail damage claim raise home insurance ratesterms:

Understanding Your Home Insurance Policy and Hail Damage

When those frozen pellets start falling from the sky, a common question homeowners in Florida ask is: “Will my insurance cover this?” The good news is that for most of us, the answer is generally yes! Standard homeowners insurance policies, often referred to as HO-3 policies, typically cover damage caused by wind and hail storms. This is excellent news for residents in areas like Orlando and Pensacola, where severe weather is a frequent visitor.

Your dwelling coverage, which protects the structure of your home, will usually kick in for hail damage to your roof, siding, and other essential components. But it’s not just your main house that’s covered. If your detached garage, shed, or fence also took a beating, your “other structures coverage” should help with those repairs. Even your personal belongings damaged by hail inside your home can be covered under your personal property coverage.

While states like Texas, Nebraska, Minnesota, Kansas, and South Dakota are often highlighted for their high number of hail events, every state, including Florida, is susceptible to hail damage. In fact, hailstorms cause over $10 billion in damages annually across North America, demonstrating that this isn’t just a regional nuisance—it’s a national concern. To understand more about how hail can impact your home, check out our guide onHow Can Hail Storms Damage My Home?. TheInsurance Information Institute liststhese and other states as common areas for hail.

Is All Hail Damage Covered? Cosmetic vs. Functional Damage

Now, here’s where things can get a little tricky, especially in areas prone to frequent storms. While your policy likely covers hail damage, not all damage is treated equally. We’re talking about the difference between cosmetic and functional damage.

Cosmetic damage refers to imperfections that affect the appearance of your home but not its structural integrity or immediate function. Think of minor dents on your siding or roof shingles that don’t cause leaks. Functional damage, on the other hand, impairs the performance of a component, like a cracked shingle that could lead to a leak or siding damage that compromises your home’s insulation.

In high-risk areas, insurers are increasingly using “cosmetic damage exclusion” clauses. This means if hail leaves your siding looking like it lost a fight with a golf ball but isn’t letting water in, your insurer might deny the claim. Why? Because restricting coverage for cosmetic damage helps insurers reduce their exposure and, they argue, keeps premiums lower for everyone.

However, the line between cosmetic and functional damage can be murky. A home with dented siding might still function, but it certainly looks terrible and could significantly reduce your home’s value. We believe that if your home isn’t “made whole” after a storm, even if it’s just cosmetic, that’s not right. What looks like minor cosmetic damage today could also weaken materials and lead to functional problems down the road. This makes thorough inspections and clear policy language crucial. We always recommend clarifying with your insurer what they consider cosmetic versus functional damage.

What is a Hail Storm Deductible?

Before we dive into whetherdoes hail damage claim raise home insurance rates, let’s talk about something you’ll definitely pay: your deductible. A deductible is the amount you’re responsible for paying out of pocket before your insurance coverage kicks in. For hail damage, you might encounter two types: a standard dollar-amount deductible or a percentage-based hail storm deductible.

A standard deductible is a fixed dollar amount, such as $1,000 or $2,500. This is what you’d typically pay for most types of claims, like a small kitchen fire.

However, in areas like Florida, which are prone to severe weather, insurers often implement a separate, percentage-based deductible specifically for wind and hail events. This deductible is usually a percentage of your home’s total insured value, not a fixed dollar amount. These can range from 1% to 5% or even higher.

Let’s look at an example to see how this impacts your out-of-pocket costs:

| Deductible Type | Example Scenario | Your Cost (Deductible) | Insurance Payout (for $10,000 claim) |

|---|---|---|---|

| Standard Dollar Amount | Home insured for $300,000 with a $1,500 deductible. $10,000 hail damage. | $1,500 | $8,500 |

| Percentage-Based Hail | Home insured for $300,000 with a 3% hail deductible. $10,000 hail damage. | $9,000 ($300k * 3%) | $1,000 |

As you can see, a percentage-based hail deductible can significantly increase your financial responsibility, shifting a much larger portion of the repair costs onto you. This is why understanding your specific policy’s deductibles is so important, especially before a storm hits!

So, Does a Hail Damage Claim Raise Home Insurance Rates?

This is the million-dollar question, and it’s a valid concern for any homeowner. The simple answer, as we touched on earlier, is “yes, it can.” Insurance companies can and often do adjust rates after claims. However, the nuance lies inwhyandwhenthese increases occur.

Damage caused by hail is widely considered an “act of God” by insurance companies. This means the event was unforeseen and unpreventable by the homeowner. Logically, you might think, “If it’s not my fault, why should my rates go up?” And you’d have a point! But the insurance world operates on risk assessment.

While an individual claim for an act of God might not directly cause your personal premium to skyrocket, other factors can still lead to an increase. For instance, in states like Florida, where severe weather is a frequent occurrence, policyholders already face some of the highest home insurance costs in the country. If your region experiences a surge in hail events, insurers may raise rates for everyone in that area to offset their increased payouts. This is a regional adjustment, not necessarily a penalty foryourindividual claim.

Furthermore, insurers track a home’s claim history for up to seven years using Comprehensive Loss Underwriting Exchange (C.L.U.E.) reports. This means if you file a claim, it goes on your home’s record, which can influence future rates, even for subsequent owners. According to the Texas Department of Insurance, filing a claim can cause an insurer toincrease your premiums, and these higher premiums can persist for years.

Why a Single Weather Claim Might Not Affect Your Premium

Let’s start with the good news. If a hailstorm damages your home, your insurance company might not raise your individual rates simply because you filed a claim. Why? Because weather-related events are generally classified as “acts of God.” Since you couldn’t prevent the storm, your insurer typically won’t penalize you for damages that were entirely out of your control. This is the core principle behind why many single weather claims don’t lead to an immediate, individual rate hike.

Many homeowners also worry about losing their “no-claims discount” after filing. While it’s true that some insurers offer discounts for claim-free periods, the impact of losing this discount might be less than the cost of paying for significant repairs out of pocket. Moreover, some states have specific laws that prohibit insurers from raising rates after a single claim for natural causes, offering an additional layer of protection for homeowners.

When does a hail damage claim raise home insurance rates?

While a single, unpreventable weather event might not trigger an individual rate hike, several scenarios can lead to increased premiums after a hail damage claim:

Multiple Claims in a Short Period:This is perhaps the biggest red flag for insurers. If you file multiple claims—say, two or more within a three-year window—your insurer might view you as a higher risk. This isn’t just about hail; it applies to any type of claim. A history of frequent claims suggests a higher likelihood of future claims, which translates to higher premiums for you.

High-Risk Geographic Location:If you live in an area that experiences frequent severe weather, like many parts of Florida, your premiums might increase regardless of your personal claims history. If the frequency of hailstorms in your region increases, insurers will reassess the risk for the entire area. To offset their increased payouts across the community, they may raise rates for all policyholders in that geographic zone. This is a regional adjustment based on new data, not a direct punishment for your claim.

Previous Property Claims:Your home’s claims history isn’t just aboutyourclaims. Insurers look at the property’s history, even from previous occupants, via C.L.U.E. reports. If your home has a history of multiple claims, especially weather-related ones, it can influence your rates. For more on how claims impact your premiums, seeDoes Homeowners Insurance Go Up After a Claim?.

Loss of No-Claims Discount:While your base premium might not jump, you could lose any “claim-free” discounts you’ve accumulated. This effectively makes your premium higher than it would have been without the claim.

While the isolated act of God doesn’t always lead to a direct individual increase, the cumulative effect of claims (yours or your neighbors’), or a shift in regional risk, can certainly impact what you pay.

A Step-by-Step Guide to Navigating Your Hail Claim

Dealing with hail damage can be stressful, but having a clear plan can make the process much smoother. Here’s our step-by-step guide to navigating your hail damage claim effectively:

Step 1: Assess and Document the Damage

The first thing to do after a hailstorm has passed is to safely assess the damage. We can’t stress enough how important thorough documentation is. This is your evidence!

- Take Photos and Videos:Grab your smartphone and start snapping! Get wide shots of your home and close-ups of specific damage. Make sure to capture different angles.

- Note Date and Time:Record the exact date and time the storm occurred. This information is crucial for your claim.

- Use an Object for Scale:For hail damage, it’s incredibly helpful to place a common object (like a coin, ruler, or even your hand) next to the damage to show its size. Hailstones can range from pea-sized to golf-ball-sized, or even larger, like the eight-inch hailstone that weighed almost two pounds, recorded in South Dakota.

- Look for Damage Everywhere:Don’t just focus on the roof. Check your siding (look for dents, chipping, cracks, or peeling paint), windows (cracks or broken panes), gutters (dents or detached sections), and even air conditioning units or outdoor furniture. Dents on roof shingles are common, often less than a half inch in diameter. A strong windstorm combined with hail can cause more pronounced dents or cracks, and asphalt roof shingles may lose their granules, which can clog gutters—another sign of damage.

Step 2: Mitigate Further Damage and Get Estimates

Once you’ve documented everything, your next priority is to prevent further damage to your home.

- Temporary Repairs:If your roof is compromised, consider safely tarping it to prevent water intrusion. If windows are broken, board them up. These temporary measures are often covered by your policy and are vital to protect your home.

- Reputable Local Contractors:Before making permanent repairs, get estimates. We recommend getting multiple quotes from trusted local contractors. Be extremely wary of “storm chasers”—out-of-area contractors who show up after a major storm, often going door-to-door. While they might offer quick fixes, they can be dangerous due to potential scams, cutting corners, or doing poor-quality work that only becomes apparent years later. A local contractor, like those we recommend in Orlando and Pensacola, has a reputation to uphold and is invested in the community.

- Don’t Sign Contracts Yet:Do not sign any repair contracts or make significant payments before your insurance adjuster has inspected the damage and you have a clear understanding of your coverage and settlement.

Step 3: File the Claim and Work with the Adjuster

Now that you’ve documented the damage and have a sense of repair costs, it’s time to formally initiate your claim.

- Contact Your Insurer:Reach out to your insurance company as soon as possible. Have your policy number ready and clearly explain the damage. Many insurers allow you to file claims via their app or website, making the process quick and easy.

- Adjuster Meeting:Your insurer will send an adjuster to inspect the damage. It’s highly advisable to be present during this inspection. Even better, consider having one of your trusted contractors present as well. They can point out damage the adjuster might miss and discuss repair specifics.

- Presenting Documentation:Share all your photos, videos, notes (date/time of storm, hail size), and contractor estimates with the adjuster. This comprehensive package supports your claim and helps ensure a fair assessment.

- Negotiating the Settlement:The adjuster will provide an initial offer. If you don’t agree with their assessment or the proposed payout doesn’t cover your repair estimates, don’t just accept it. You have the right to negotiate. You can highlight discrepancies between your contractor’s estimate and the adjuster’s. If an agreement still can’t be reached, this is where a public adjuster like us can step in. We representyourinterests, not the insurance company’s, to help you maximize your settlement. Learn more about Why Hire a Public Adjuster for Property Damage.

- Mortgage Company Involvement:If you have a mortgage, your insurance check for repairs might be made out to both you and your mortgage company. You’ll then need to work with your lender to release the funds for repairs.

Frequently Asked Questions about Hail Damage Claims

We know you’ve got questions, and we’re here to answer them! Here are some of the most common inquiries we receive about hail damage claims.

How much is the average insurance payout for hail damage?

The average insurance payout for hail damage can vary depending on the extent of the damage, your location, and your policy specifics. However, statistics give us a good benchmark. In 2020 alone, the average homeowner claim for hail damage was nearly$12,000, according to State Farm data. Other reports show the average hail claim costs around$12,913or even$13,511. These figures highlight that hail damage is rarely minor and often requires significant repairs.

It’s crucial to understand how your policy determines payout, usually through one of two methods:

- Actual Cash Value (ACV):This pays for the depreciated value of your damaged property. For example, if your 10-year-old roof has a total replacement cost of $30,000 but has depreciated by half, an ACV policy might only cover $15,000 (minus your deductible), leaving you with a substantial gap.

- Replacement Cost Value (RCV):This covers the cost to repair or replace your damaged property with new materials of similar kind and quality, without deduction for depreciation. So, for that $30,000 roof, an RCV policy would cover the full $30,000 (minus your deductible).

Most insurance policies cover the total cost of damage minus your deductible. For more detailed statistics, you can refer to State Farm’s hail claims data.

Is it worth filing a claim for minor hail damage?

This is a common dilemma for homeowners, and the answer is usually “it depends” on a few factors.

First, consider your deductible. If the estimated cost of repairs is close to or less than your deductible, it might not be worth filing a claim. For instance, if you have a $1,000 deductible and the repairs are estimated at $900, you’d pay for everything out of pocket anyway. Plus, even if no money is paid out, merely filing a claim can still go on your home’s insurance record, which might impact future rates.

Second, weigh the potential impact on your premiums and any “no-claims discount” you might lose. While a single weather-related claim often doesn’t directly raise individual rates, losing a discount effectively makes your premium higher.

However, “minor” damage can sometimes be deceiving. What looks like a few small dents today could lead to bigger problems later, such as leaks or compromised structural integrity. If you’re unsure, we always recommend getting a free inspection from a reputable local contractor. They can accurately assess the damage and tell you if it’s significant enough to warrant a claim. As Kiplinger notes, it’s worth filing if the damage is significant, and if you’re unsure, ask a local contractor to look. Many will offer free inspections and advice on whetherHail Damage Insurance Claims: Is Filing Worth the Cost and Hassle?. The consequences of not fixing storm damage can be far more costly than any potential regional rate increase.

How can I protect my home from future hail damage?

While we can’t control the weather, there are proactive steps you can take to make your home more resilient to hail and potentially save on insurance costs.

- Invest in Impact-Resistant Roofing Materials:This is one of the most effective measures. Consider installing Class 4 impact-resistant shingles or other hail-resistant roofing materials. These are designed to withstand severe impacts and can significantly reduce the risk of damage. Many insurance companies offer premium discounts for homes with certified impact-resistant roofing, making it a smart long-term investment.

- Maintain Your Landscaping:Trim trees and remove dead branches around your home. Strong winds accompanying hailstorms can turn loose branches into projectiles, causing additional damage to your roof, windows, or vehicles.

- Consider Storm Shutters:While often associated with hurricanes, storm shutters can also provide an excellent layer of protection for your windows against large hailstones.

- Regular Inspections:Even without a major storm, periodically inspect your roof and exterior for any signs of wear or minor damage that could be exacerbated by future hail. Catching small issues early can prevent larger, more expensive problems down the line.

By taking these preventative measures, you not only fortify your home against the elements but may also qualify for insurance discounts, further reducing your financial burden.

Conclusion: Secure Your Property and Your Peace of Mind

Navigating hail damage claims and understanding howdoes hail damage claim raise home insurance ratescan feel like trying to solve a puzzle in a hurricane. But with the right information and a clear strategy, you can protect your property and your peace of mind.

The key is to make informed decisions. Don’t let the fear of a potential rate increase prevent you from addressing necessary repairs. Unrepaired damage almost always leads to more extensive and costly problems down the road, making a bad situation even worse. Balancing the cost of repairs, your deductible, and the nuances of your insurance policy is crucial.

If you’re feeling overwhelmed or believe your insurance company isn’t offering a fair settlement, you don’t have to face them alone. That’s where professional guidance comes in. As public adjusters, we at Global Public Adjusters, Inc. specialize in representing homeowners and business owners in insurance claims. With over 50 years of experience serving Florida, including Orlando and Pensacola, we focus on maximizing settlements for various damages, offering our expertise and advocacy against insurance companies. We’re here to ensure you get the full and fair compensation you deserve.

Don’t let hail damage linger, and don’t let fear prevent you from securing your home. Reach out to us for assistance.Get help with your Hail Damage Claims in Orlandotoday.