Commercial Roof Insurance Claims: 7 Powerful Success Tips 2025

When Disaster Strikes: Understanding Commercial Roof Insurance Claims

Commercial roof insurance claimsare formal requests for compensation from your insurance company when your business property’s roof sustains damage from covered perils. If you’re facing roof damage and need to file a claim quickly, here’s what you need to know:

- Document everything– Take dated photos and videos of all damage

- File promptly– Most insurers require claims within 6-12 months of damage

- Understand your policy– Know if you have Actual Cash Value (ACV) or Replacement Cost Value (RCV)

- Mitigate further damage– Make temporary repairs and keep all receipts

- Consider professional help– A public adjuster can maximize your settlement

Roof damage is one of the most common reasons for commercial property insurance claims, with wind and hail accounting for nearly 40% of all property damage claims in the U.S. annually. For business owners, a damaged roof isn’t just a maintenance issue—it’s a potential financial crisis that threatens operations, inventory, and tenant safety.

When storm damage, leaks, or other disasters compromise your commercial roof, navigating the insurance claim process can be as stressful as the damage itself. The average commercial roof insurance claim for hail or wind damage ranges from $10,000 to $100,000 or more, depending on your roof size and type.

Most denied commercial roof claims (about 80%) stem from alleged maintenance issues or pre-existing wear and tear rather than the actual damaging event. This makes understanding the claims process and your coverage critical before you ever file.

Remember: the roof protects everything beneath it—your assets, employees, and business operations. A successful insurance claim ensures you can restore that protection without devastating your bottom line.

Commercial roof insurance claimsterms to know:

–commercial insurance claims attorney

–commercial insurance claims process

What Are Commercial Roof Insurance Claims and What Do They Cover?

When your business’s roof takes a beating from Mother Nature,commercial roof insurance claimsbecome your financial safety net. Unlike the simpler claims for homes, commercial claims deal with larger, more complex roofing systems that protect your livelihood.

Think of your commercial roof policy as a shield with specific powers and limitations. Most policies step up to protect you when nature gets rowdy or accidents happen.

Covered Perils

Your typical commercial policy has your back whenwind and hailcome calling – whether it’s a hurricane that tears through town or a sudden hailstorm that pounds your roof.Fire and smoke damagealso falls under standard coverage, even if the flames originated next door.

When trees topple or debris crashes onto your building during a storm, thesefalling objectstypically trigger coverage. Winter brings its own challenges, and damage from theweight of ice, snow, or sleetusually qualifies for a claim. Even human-caused problems likevandalism and malicious mischiefare covered when someone deliberately damages your roof.

“The roof is a critical component of commercial real estate that safeguards assets and ensures inhabitants’ safety,” notes an industry expert. “When properly covered by insurance, it protects not just the physical structure but the entire business operation.”

Common Exclusions

However, your policy isn’t all-powerful. Almost all policies draw the line atnormal wear and tear– that slow deterioration that happens to every roof over time.Maintenance issuesyou should have addressed aren’t covered either. Did someone cut corners during installation?Improper installationtypically falls outside coverage.

Many policies, especially for metal roofs, excludecosmetic damagethat doesn’t affect how your roof functions. And unless you’ve purchased separate policies,floodingandearthquakesremain beyond standard coverage.

Policy Types and Coverage Limits

The type of policy you have dramatically affects what you’ll receive after a claim:

| Feature | Actual Cash Value (ACV) | Replacement Cost Value (RCV) |

|---|---|---|

| Initial payout | Replacement cost minus depreciation | Full replacement cost (often in stages) |

| Depreciation | Applied and typically not recoverable | May be recoverable after repairs |

| Age impact | Older roofs lose significant value | Age has less impact on payout |

| Deductible | Applied before payment | Applied before payment |

| Best for | Newer roofs | All roof ages, especially older ones |

| Example | $100,000 roof, 10 years old (20-year life) = $50,000 payout minus deductible | $100,000 roof regardless of age = $100,000 payout minus deductible |

Here’s something shocking: “Unclaimed depreciation on insurance claims can total $1 billion or more in a given year, as many insureds are unaware they can recover these funds after repairs are completed,” reports an industry study.

Your roof’s age matters tremendously. Most insurers get nervous about roofs over 20 years old, often switching you from RCV to ACV coverage or hiking your deductible. Some may even refuse coverage entirely for roofs living on borrowed time.

More info about Property Damage Claims

When selecting contractors for roof repairs,states require roofing companiesto have specific licenses and insurance. Always verify credentials before signing any repair contract to ensure your claim proceeds smoothly.

Immediate Actions After Finding Roof Damage

The moment you find damage to your commercial roof can feel overwhelming. That knot in your stomach is normal – but how you respond in those first few hours can make all the difference both to your building’s safety and your insurance claim’s success. Let’s walk through what to do when disaster strikes.

Safety First

Before grabbing your camera or phone, make sure everyone is out of harm’s way:

- Clear people from areas with active leaks or structural concerns

- Turn off electricity to wet areas (water and electricity never mix!)

- Move valuable equipment and inventory to dry locations

- Block access to potentially dangerous sections of your building

No roof is worth risking someone’s safety – even a minute spent preventing injury is time well spent.

Document Everything

“You can never have enough documented proof of damage,” as one insurance expert puts it, and they’re absolutely right. Your smartphone is your best friend here.

Take clear, dated photographs and videos showing both the big picture and the details. Capture wide shots of the entire roof area, then move in for close-ups of specific damage points. Don’t forget to document any interior damage from leaks! Using a tape measure or ruler in your photos helps show scale – this seemingly small detail can make a huge difference when adjusters review your claim.

Implement Temporary Repairs

Don’t wait around for your insurance adjuster before protecting your property. Taking immediate action to prevent further damage isn’t just smart – it’s actually required by most policies.

Apply tarps to keep water out, remove standing water where you safely can, clear away debris that might cause additional problems, and secure any loose materials before they become projectiles in the next gust of wind.

“Making temporary repairs and retaining receipts before the adjuster’s visit is essential,” notes a claims specialist. “These costs are typically reimbursable under your policy’s mitigation clause.” So keep every receipt – even that $15 tarp might be covered!

The 24-Hour Rule

Most insurance policies contain what’s called a “duty to mitigate” clause. In plain English, this means you’re required to take reasonable steps to prevent further damage after the initial incident. Waiting too long could give your insurer grounds to deny portions of your claim, arguing that some damage occurred after the covered event due to your inaction.

Notify Your Insurer

Pick up the phone and call your insurance company within 24-48 hours. Have your policy number handy, be ready to describe the basic damage, and don’t be shy about asking questions: What emergency service providers do they recommend? What’s your coverage and deductible? Can they send written confirmation of your claim filing?

This initial call starts the official clock on yourcommercial roof insurance claimsprocess, so don’t delay.

Understand Time Limitations

The clock is ticking on your claim from the moment damage occurs. Most insurers require claims to be filed within 6-12 months of the damage event, but some states have specific laws that might shorten this window. Delayed reporting is one of the easiest grounds for claim denial, so don’t procrastinate.

More info about Roof Tarping Service Orlando

Types of Damage Covered Under Commercial Roof Insurance Claims

Commercial roofs face a variety of threats, and understanding exactly what type of damage you’re dealing with helps ensure proper documentation and repair.

Wind Damage

When wind attacks your roof, it leaves telltale signs that adjusters know to look for.Uplifted or missing shinglesare the most obvious, but also watch forloosened flashingsaround roof penetrations,damaged HVAC units,ballast displacementon built-up roofs, andcreased or rippled membranesections.

“High winds can cause loose or missing shingles, leading to wind damage claims,” explains a roofing expert. “Post-storm inspections specifically for commercial roofs are crucial to catch wind damage early.”

Hail Damage

Hail is sneaky – it leaves different evidence depending on your roofing material. On asphalt, look forgranule loss,bruising, orpunctures. Metal roofs showdenting,finish damage, ordimpling. EPDM/TPO membranes might havepunctures,tears, orbrittleness, while built-up roofing suffers fromgranule displacementandmembrane cracking.

A critical distinction: adjusters often differentiate between “functional damage” (affects roof performance) and “cosmetic damage” (looks bad but doesn’t impact function). Many policies exclude cosmetic damage, especially on metal roofs.

Water Intrusion and Leaks

Water damage might be the most destructive – and unfortunately, the most common. Look forbrown spots on interior ceilings or walls,mold or mildew growth,damaged insulation,deteriorated decking, andponding waterthat doesn’t drain within 48 hours.

“Brown spots on ceilings are common indicators of water intrusion and potential structural compromise,” notes a building expert. These spots are often your first warning sign of bigger problems above.

Impact Damage

When objects hit your roof, they leave distinct marks:punctures from tree limbs or debris,structural deformationfrom heavier items, damage from droppedmaintenance equipment, orpenetrations from storm-blown items. Document these carefully, as impact damage is usually well-covered by policies.

Hurricane and Severe Storm Damage

Hurricane damage is often a perfect storm of multiple types:wind uplift and tear-off,flying debris impact,water intrusion from driving rain, andstructural stress from pressure changes. These complex events require especially thorough documentation.

More info about Hurricane Damage Claims Orlando

How to File and Win Commercial Roof Insurance Claims

Successfully navigating thecommercial roof insurance claimsprocess isn’t just about paperwork—it’s about understanding how to advocate for your business when you need it most. Let’s walk through what this journey typically looks like and how to position yourself for success.

The Claim Timeline

From the moment you find damage until that final check arrives, your commercial roof claim follows a fairly predictable path:

The first 48 hours are critical—you’ll need to notify your insurer and get a claim number. Within a week, expect an adjuster assignment and inspection scheduling. The on-site evaluation usually takes just a day, but then comes the waiting game. Adjusters typically need 1-2 weeks to prepare their damage assessment and cost estimate.

“The most common mistake business owners make is assuming the process will be quick,” says an insurance expert. “In reality, from initial notification to final payment often takes 45-90 days for straightforward claims—and potentially months for complex ones.”

The settlement offer arrives within 7-30 days after inspection, followed by negotiation if needed. Once you’ve reached an agreement, expect initial payment within a month. Any supplemental claims or recoverable depreciation payments will come later, often after repairs are completed.

Notice of Loss

That first phone call to your insurance company sets the tone for your entire claim. But don’t stop there.

“Taking a ‘let’s wait and see what the adjuster says’ approach is like negotiating against yourself,” warns an insurance specialist. Instead, follow up with a detailed written notice that includes preliminary photos and documentation of the damage.

Be specific about requesting a timeline for when you can expect the adjuster to contact you, and always get written confirmation that your claim was received. This paper trail becomes invaluable if delays occur later.

The Adjuster Appointment

The adjuster’s visit is not just an inspection—it’s a negotiation. Treat it accordingly by being prepared.

Having your roofing contractor present during this inspection can be a game-changer. They can point out damage the adjuster might miss and provide technical context about repair requirements. Take detailed notes during the inspection, ask questions about their assessment process, and always request a copy of their findings before they leave.

“Having an experienced contractor on your side could save you thousands,” notes a claims specialist. “A qualified roofing and restoration contractor speaks the same language as adjusters and knows exactly what insurance companies look for during inspections.”

The Role of Contractors and Estimates

Your roofing contractor isn’t just there to fix your roof—they’re a crucial ally in the claims process. Experienced contractors provide detailed damage assessments that can identify issues adjusters sometimes overlook, like hidden structural damage or code compliance requirements.

Most reputable commercial roofing contractors use industry-standard software like Xactimate to prepare estimates—the same software many insurance companies use. This creates a common language for discussing costs and prevents disputes over pricing.

“A roofing contractor with claims experience can help steer insurer exceptions where adjusters act unreasonably or payouts are inadequate,” explains an industry expert. “They understand what constitutes a proper repair versus a band-aid solution.”

The Public Adjuster Advantage

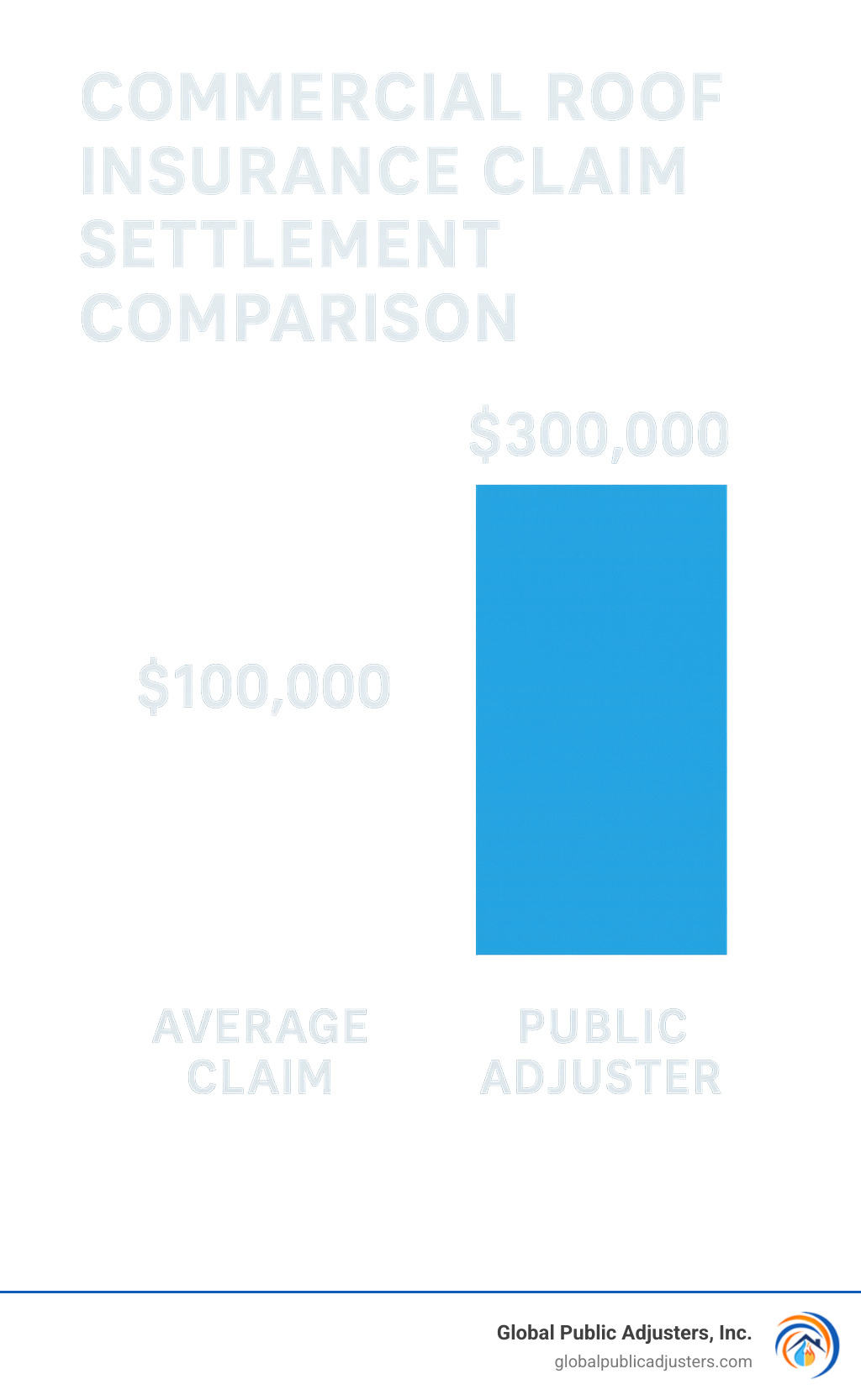

Sometimes, the complexity ofcommercial roof insurance claimswarrants professional representation. At Global Public Adjusters, Inc., we exclusively represent business owners—never insurance companies.

Our role includes conducting independent damage assessments, preparing comprehensive documentation that meets insurance company standards, and negotiating directly with adjusters. We identify coverage opportunities in your policy that might otherwise be overlooked and handle the mountains of paperwork and communications so you can focus on running your business.

With over 50 years of experience in Orlando, we’ve seen how proper representation can dramatically increase settlement amounts for commercial roof claims—often by 30% or more compared to unrepresented claims.

More info about Commercial Insurance Claims Orlando

Step-by-Step Claim Checklist

From notification to settlement, these are the essential steps for a successful claim:

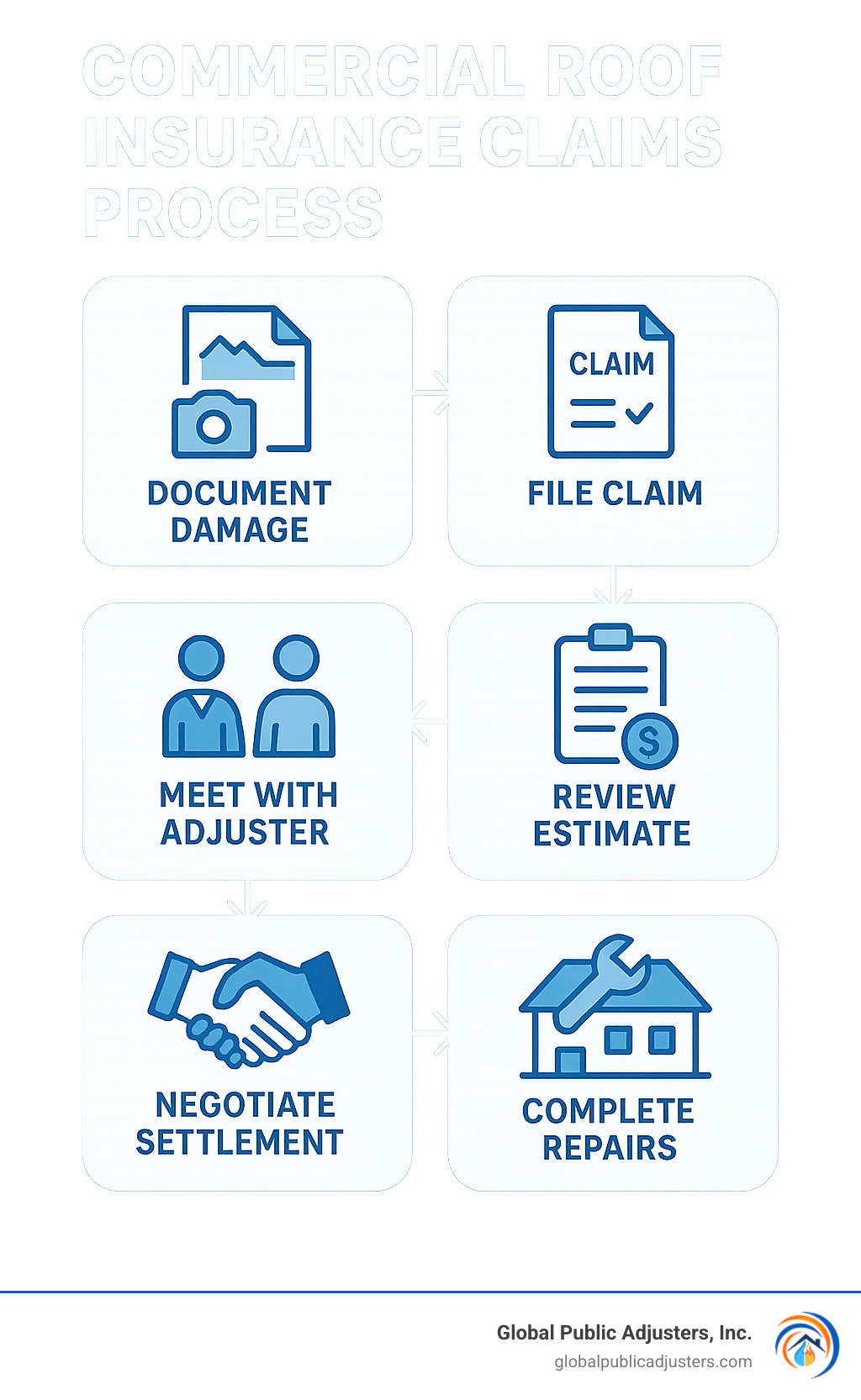

Notify your carrierimmediately after finding damage by calling their claims hotline. Follow up with written notification and keep records of your claim number and adjuster contact information.Gather maintenance recordsincluding inspection reports, repair invoices, and documentation of regular maintenance activities—these prove you’ve been a responsible property owner.Collect photo/video evidencewith time/date stamps showing all visible damage, interior water intrusion, and any temporary repairs you’ve made.

Make temporary repairsto prevent further damage, but save all receipts for reimbursement.File proof of lossforms with contractor estimates and supporting documentation within required timeframes. When youmeet with the adjuster, have your contractor present, provide copies of all documentation, and take detailed notes. Finally,negotiate settlementby reviewing the adjuster’s scope carefully, identifying any missing items, and submitting supplemental information as needed.

ACV vs RCV in Commercial Roof Insurance Claims

The difference between Actual Cash Value (ACV) and Replacement Cost Value (RCV) can mean tens of thousands of dollars in your settlement forcommercial roof insurance claims.

With an ACV policy, you receive only the depreciated value of your roof. For example, a 15-year-old roof with a 30-year expected lifespan might be depreciated by 50%. “That $100,000 replacement suddenly becomes a $50,000 check—minus your deductible,” explains an insurance specialist. This can leave you with a significant financial gap to fill.

RCV policies offer fuller protection, potentially covering the entire replacement cost. However, most insurers still hold back depreciation initially, paying it only after you’ve completed repairs. “Insurance companies are very literal about replacement cost and won’t pay until you prove actual incurred costs,” notes a claims expert. “This can create cash flow challenges for businesses without substantial reserves.”

Many commercial property owners don’t realize that depreciation can often be recovered. “Unclaimed depreciation can total $1 billion or more annually,” reports an industry study. “Many business owners simply never follow up to collect what they’re owed.”

To recover depreciation, complete all repairs according to the approved scope, submit proof of completion and payment, and formally request release of the recoverable depreciation. Don’t be surprised if you need to follow up—this is often the most delayed payment in the claims process.

Understanding your policy’s payment structure before damage occurs allows for better financial planning and fewer surprises when you’re already dealing with the stress of roof damage.

Today’s Homeowner roofing tips

Valuation, Documentation & Avoiding Claim Denials

When it comes tocommercial roof insurance claims, your best weapon is thorough documentation and a solid understanding of how your roof’s value is determined. If you want your claim to sail smoothly past the adjuster’s desk (and avoid hearing that dreaded “Denied!”), here’s what you need to know.

Documentation Best Practices

Think of documentation as your roof’s personal scrapbook—except this one could save you thousands of dollars. Always useclear, dated photosof every area impacted. Including a tape measure, ruler, or even a shoe (hey, whatever’s handy and shows scale!) in your pictures helps show the true size of the problem.

Go formultiple angles—adjusters aren’t mind-readers, and seeing the same damage from different perspectives can make all the difference. If you have old photos of the roof before the damage, dig them up for abefore-and-after comparison. This helps show that the problem wasn’t there last week, last month, or even last year.

Don’t stop at the surface. Make sure youdocument the entire roof—not just the obvious trouble spots. Pay attention tointerior evidencetoo, like water stains or sagging ceilings. And remember, keepingmaintenance logs—inspection reports, service receipts, and notes on regular upkeep—can be the key to proving your roof was in good shape before disaster struck.

Common Denial Reasons and How to Counter Them

It’s no secret: mostcommercial roof insurance claimsget denied because of a handful of common issues. The big culprits arepre-existing damage, lack of maintenance, cosmetic vs. functional damage, age-related wear, and tricky policy exclusions.

To avoid the dreaded denial letter, show you’ve done your homework. Dated maintenance records and regular inspection reports can quickly settle arguments about pre-existing damage. If your insurer points to a lack of maintenance, counter with your detailed logs and inspection receipts—proof that you’ve been a responsible roof owner.

Sometimes, insurers say damage is “cosmetic” and not covered. Here’s where you want an expert on your side, who can explain how those “just cosmetic” dents or marks actually impact your roof’s performance or lifespan. For age-related denials, evidence like core samples can help prove sudden storm impact versus slow, natural aging.

Policy exclusions can be sneaky—always read the fine print. Better yet, bring in a public adjuster who can translate the insurance-ese and pinpoint exactly where your coverage stands.

Remember:the burden of proof is on you, not the insurance company. If you can show clear, organized evidence, you’re much more likely to get your claim paid.

Understanding Cosmetic Damage Exclusions

Cosmetic damage exclusions are showing up in more policies every year (much to everyone’s frustration). These exclusions typically mean your insurer won’t pay for things likedents in metal roofingif they don’t affect how the roof sheds water, orsurface marksthat don’t actually let water inside. Evengranule lossthat doesn’t expose bare material orappearance issuesthat leave the roof functional might not be covered.

But don’t give up! If you can demonstrate that so-called “cosmetic” damage shortens your roof’s lifespan, violates the manufacturer’s warranty, or has started to impact performance, your claim stands a much better chance. Sometimes, bringing in an expert (like a contractor or public adjuster) to explain the real impact can tip the scales in your favor.

More info about Roof Leak Services Orlando

Disputing a Denied Claim

If yourcommercial roof insurance claimis denied or underpaid, don’t panic—there are still several ways to fight for what you’re owed.

First, you canrequest a reinspection. Ask for a different adjuster—sometimes a fresh set of eyes (plus your new documentation) will make all the difference. Make sure your contractor or public adjuster is present and highlight any new evidence since the first inspection.

If you find more damage during repairs or find that the initial payment isn’t enough, you canfile a supplement. This is common and covers new findings, code upgrades, or price hikes your original estimate missed.

Another option is toinvoke the appraisal clausein your policy. You and the insurer each pick an appraiser, and together they choose a neutral umpire. This “panel” decides how much the loss is worth, and their decision is usually binding.

Mediationis a less confrontational step. Here, a neutral third party helps both sides talk things through and find a middle ground. It’s typically faster than court, and the agreements usually stick.

Finally, if all else fails, you might considerlegal action. If you go down this path, work with an attorney who specializes in insurance claims, and keep a close eye on state deadlines for lawsuits. It can be a lengthy process, but sometimes it’s the only way forward.

One last tip: Choose a properly licensed and insured roofing contractor. It brings peace of mind—and makes your case much stronger if you end up in a dispute.

For more help withcommercial roof insurance claimsor if you’re staring down a denial letter, Global Public Adjusters, Inc. is here to help you every step of the way.

public adjuster overview

Maintenance, Mitigation & Future Preparedness

Taking care of your commercial roof isn’t just about extending its lifespan—it’s about protecting your investment and positioning yourself for successfulcommercial roof insurance claimsdown the road. Think of your roof as a shield that guards everything beneath it—when you maintain it properly, you’re not just preventing leaks; you’re building a documented history that can make all the difference when filing a claim.

Preventative Maintenance Strategies

The best defense against roof damage is a good offense. “Conduct biannual professional roof inspections and routine debris removal,” recommends a roofing specialist. “Trim overhanging branches to prevent storm damage.”

Those twice-yearly inspections (ideally in spring and fall) create a paper trail that insurance companies respect. Each time your roofing professional visits, make sure they document their findings with detailed photos and reports. This documentation becomes gold when you need to prove your roof was in good condition before a storm hit.

Regular maintenance doesn’t have to be complicated. Simple actions like clearing debris from your roof and drainage systems prevent water buildup that can damage even the best roofing systems. When gutters flow freely and drains remain clear, water doesn’t have the chance to pool and find its way inside your building.

Don’t forget to create a visual record of your roof’s condition. Take dated photographs regularly, especially after you’ve completed repairs or maintenance. These images establish a baseline that clearly shows the difference between normal wear and sudden storm damage.

Pre-Storm Preparation

When the weather forecast turns ominous, a little preparation can save you thousands. “When you know a major storm is coming, document the condition of your roof before and after the storm,” advises an insurance expert. This creates a clear before-and-after comparison that strengthens your claim.

Before the storm hits, grab your smartphone and take a quick video walking around your roof. Focus on areas around HVAC units, drains, and previous repairs. Store these files in cloud storage where they’ll be safe even if your building sustains damage.

Take a few minutes to secure any loose items that could become projectiles in high winds. Check that roof-mounted equipment is properly fastened and drainage paths are completely clear. Having your insurance agent’s direct contact information and policy details readily accessible will save precious time if you need to file a claim quickly.

Upgrade Considerations

Smart upgrades can reduce future damage and potentially lower your insurance costs. “Timely roof repairs are a prudent investment move that upholds property value,” notes a property management expert.

Consider upgrading toimpact-resistant materialslike Class 4 roofing products that can withstand severe hail. Many insurance companies offer premium discounts for these upgrades because they reduce claim frequency and severity.

Improved attachment methods make a significant difference in high-wind events. Additional fasteners in perimeter and corner zones (where wind uplift is strongest) can prevent costly blow-offs. Similarly, improved drainage systems with additional drains or tapered insulation prevent the ponding water that leads to leaks and structural damage.

These improvements might seem expensive initially, but they typically pay for themselves through reduced damage and lower insurance premiums over time.

More info about How Can Hail Storms Damage My Home?

Roof Age & Maintenance Records: Keys to Future Commercial Roof Insurance Claims

As your commercial roof ages, thorough documentation becomes increasingly important for insurance purposes. Insurance companies scrutinize older roofs more carefully, looking for any reason to classify damage as “wear and tear” rather than storm damage.

Yourinspection reportsserve as the backbone of your documentation strategy. Each report should include detailed findings with photographs, specific recommendations for repairs, and the professional qualifications of the inspector. Keep follow-up documentation showing that you addressed any issues promptly.

Maintain service logs that track every maintenance activity, repair, contractor information, and materials used. These records demonstrate your commitment to proper roof care and help distinguish between normal aging and sudden storm damage.

Don’t discard your original roof installation specifications and warranty information. These documents establish your roof’s expected service life—critical information when an adjuster tries to claim your roof was “too old” to be covered.

“Insurance adjusters often omit core sampling, which can lead to incomplete claim offers,” warns a roofing expert. Consider having periodic core samples taken of your commercial roof. These samples provide evidence of your roof’s internal condition and help distinguish new damage from pre-existing issues.

Work exclusively with properly licensed and insured contractors who have experience with your specific roofing system. “Research multiple contractors and get references and check reviews,” advises a property management specialist. “Make sure your contractor is insured.” A qualified contractor’s assessment carries more weight with insurance companies than one from an unlicensed handyman.

States require roofing companiesto maintain specific licenses and insurance coverage. Verifying these credentials before hiring ensures your roof work meets code requirements—another factor insurance companies consider when processing claims.

With proper maintenance and documentation, your commercial roof becomes not just a protective covering for your business, but a well-documented asset that insurance companies will find difficult to devalue when storm damage occurs.

Conclusion & Quick FAQ

Handlingcommercial roof insurance claimscan feel overwhelming—especially when your business, your tenants, or your livelihood are at risk. The good news? You don’t have to face it alone. At Global Public Adjusters, Inc., we’ve walked this road with Orlando business owners for over 50 years, helping them recover faster and claim every dollar they’re owed.

The secret to a smooth claim?Document everything—before disaster ever strikes and right after. Take lots of photos, keep inspection reports, and hold on to repair receipts. Make sure you really understand your policy: know your coverage, your limits, and those sneaky little deadlines hiding in the fine print. When damage does happen, jump into action. Secure the scene, prevent more damage, and notify your insurer without delay.

If the process gets confusing, complicated, or just downright frustrating, remember: you don’t have to go toe-to-toe with the insurance company by yourself. Our team specializes in maximizing settlements. We’ve seen it all—from wind-torn flat roofs to hail-pocked metal panels—and we’re here to advocate for you, every step of the way.

And don’t forget—regular roof maintenance is your best friend. Keeping up with inspections and documentation not only protects your property—it can make all the difference if you ever have to file another claim.

If you’re ever feeling uncertain or need a second opinion,reach out to us. We’re always happy to help.

What is the typical deadline for filing a commercial roof claim?

Most insurance companies requirecommercial roof insurance claimsto be filed within 6 to 12 months of the date you find the damage. In Florida, you generally have up to 2 years—but your policy could have stricter rules. When in doubt, don’t wait. Filing right away (ideally within a few days) is your safest bet and helps avoid any disputes about late reporting.

How do deductibles and depreciation affect my payout?

Here’s how it works:Your deductiblecomes off the top of any payment you receive. With an Actual Cash Value (ACV) policy, the insurer also subtractsdepreciationbased on your roof’s age—so the older the roof, the less you get. For example, a roof halfway through its lifespan might see your payout cut in half. If you have Replacement Cost Value (RCV) coverage, the insurer may hold back depreciation at first, but you can get it back after you finish repairs—just be sure to submit those invoices! Many owners forget, leaving millions of dollars in recoverable depreciation unclaimed each year.

Can I reopen a claim if hidden damage is found later?

Yes, you usually can—if you find more damage during repairs that’s clearly linked to the original event. This is called asupplemental claim. Take photos right away, have your contractor document everything, and contact your insurer promptly. There are time limits for submitting supplements, so don’t delay if new problems pop up behind the walls (or under the roof membrane).

At Global Public Adjusters, Inc., we know that every roof, every claim, and every business is unique. If your roof springs a leak—or worse—don’t let the insurance process add to your headaches. We’re here to help you protect what matters most.