commercial insurance claims attorney: Top 3 Proven Winning Tips 2025

When Your Business Needs Legal Muscle for Insurance Claims

When disaster strikes your business, the last thing you need is a battle with your insurance company. Yet sadly, that’s exactly what many business owners face after filing a claim.

Acommercial insurance claims attorneyspecializes in leveling the playing field when insurance companies try to minimize or avoid paying legitimate business claims. These legal professionals become your advocate when insurers don’t play fair—and knowing when to bring them aboard can make all the difference.

Quick Answer: When to Hire a Commercial Insurance Claims Attorney

* When your claim has been denied or significantly underpaid

* When facing bad faith insurance practices (delays, misrepresentations, harassment)

* When dealing with complex claims exceeding $100,000

* When your business survival depends on proper claim settlement

* Before signing any settlement agreement with your insurer

The statistics tell a sobering story: nearly half of small businesses will submit some type of insurance claim within their first decade of operation. Fire damage to commercial properties costs businesses nearly $35,000 on average, while wind and hail damage typically results in a $26,000 financial hit. These aren’t small numbers for most businesses.

You’ve faithfully paid your premiums, expecting protection when you need it most—whether from hurricane destruction, fire damage, or flooding from burst pipes. But insurance companies have their own bottom line to consider. As one attorney puts it bluntly: “The deck is stacked against you… You have no chance against a big insurance company without the help of an experienced insurance claims attorney.”

When disputes arise, acommercial insurance claims attorneybrings specialized knowledge of policy language, claim procedures, and insurance law to your side. They understand the tactics insurers use to minimize payouts and know how to counter them effectively. Most importantly, these attorneys typically work on contingency fees—meaning you pay nothing unless they win your case.

For Texas business owners, timing is critical. You generally have just two years from the date an insurance company acted in bad faith to file a lawsuit. This makes prompt action essential when you suspect your claim isn’t being handled properly.

At Global Public Adjusters, Inc., we often work alongside skilled attorneys to ensure our clients receive the full compensation they deserve. While we handle the detailed damage assessment and claim preparation, attorneys provide the legal muscle when negotiations stall or bad faith practices emerge. This partnership approach often delivers the best outcomes for business owners facing significant losses.

If you’re wondering whether your situation warrants legal assistance, consider consulting both a public adjuster and acommercial insurance claims attorneybefore accepting any settlement offer. The right professional guidance can mean the difference between business recovery and financial devastation after a major loss.More info about Reasons to Hire a Public Adjuster for Property Damage

Commercial Insurance Claims Attorney 101: Role, Timing & Value

When insurance companies start playing hardball with your business claim, acommercial insurance claims attorneybecomes your most valuable ally. These specialized legal professionals serve as your business’s champion when insurers seem more interested in protecting their profits than honoring your policy. They steer the maze of complex policy language, recognize common denial tactics, and leverage legal protections that many business owners don’t even know exist.

As one legal expert puts it: “A business entity’s insurance coverage can mean the difference between a surviving or thriving company.” When that coverage is threatened by an insurer’s refusal to pay, having skilled legal representation isn’t just helpful—it’s essential.

The good news? Mostcommercial insurance claims attorneyswork on contingency. This means they only get paid if you recover compensation—typically between 25-40% of your settlement or court award. The exact percentage depends on case complexity and whether litigation becomes necessary. This fee structure aligns their interests perfectly with yours: maximizing your recovery.

These attorneys provide comprehensive support—from detailed policy review and proper claim documentation to aggressive negotiation and, when needed, courtroom advocacy. They also ensure your business meets critical deadlines that could otherwise jeopardize your entire claim.

More info about Reasons to Hire a Public Adjuster for Property Damage

What a Commercial Insurance Claims Attorney Does

Acommercial insurance claims attorneydoes far more than push papers. They become your business’s insurance interpreter, advocate, and defender throughout the entire claims process.

First, they perform a thorough policy analysis to identify all potential coverage areas. As one attorney notes, “Insurance policies can span over 100 pages with complex language that most laypeople misunderstand.” They uncover hidden benefits you might not even realize you’re entitled to receive.

They also help gather and organize compelling evidence to support your claim. This includes coordinating property damage assessments, calculating accurate business interruption losses, and assembling expert reports that strengthen your position.

When it comes to dealing with adjusters, your attorney serves as a protective buffer. Those friendly insurance adjusters seen in commercials as a “big fluffy blanket” often employ tactics designed to minimize payouts. Your attorney handles these interactions, preventing you from making innocent statements that could later damage your claim.

Perhaps most importantly, they recognize when insurers cross the line into bad faith territory. When this happens, they take appropriate legal action—whether filing complaints with state insurance departments or pursuing bad faith lawsuits that can result in additional damages.

If negotiations stall, your attorney seamlessly transitions to courtroom advocacy, presenting evidence, examining witnesses, and making compelling arguments before judges and juries.

As one satisfied client shared: “Shannon did an exceptional job representing our company. She is dedicated, determined and will not settle for less than you deserve.”

When Should a Business Hire a Commercial Insurance Claims Attorney

Timing matters tremendously when engaging acommercial insurance claims attorney. Here’s when legal representation becomes particularly valuable:

Before filing complex or high-value claims, having an attorney involved from day one ensures your claim is properly documented and strategically presented. This proactive approach often prevents problems before they occur.

Immediately after receiving a denial letter, an attorney can quickly analyze the stated reasons for denial and develop an effective appeal strategy. Many legitimate claims are initially denied but later approved with proper legal assistance.

When facing an underpaid claim, attorneys have the expertise to quantify your full losses—including hidden damages and business impacts that adjusters often overlook or undervalue.

Following catastrophic events like hurricanes, fires or floods, insurers face claim surges and often become more aggressive in their denial and underpayment tactics. Having legal representation during these periods provides essential leverage.

If you notice suspicious delays, misrepresentations, or harassment, these may signal bad faith practices. An attorney can identify these violations and pursue additional compensation beyond your policy limits.

In Texas, you typically have just two years from the date of bad faith actions to file a lawsuit. This relatively short window makes prompt legal consultation essential when disputes arise.

How a Commercial Insurance Claims Attorney Steers Negotiations

Acommercial insurance claims attorneytransforms the negotiation dynamic with insurance companies in ways that significantly impact your outcome.

They prepare comprehensive demand packages that present your losses with professional precision. These detailed submissions—backed by evidence, policy provisions, and legal precedents—are much harder for insurers to dismiss than informal requests from policyholders.

When negotiations reach an impasse, skilled attorneys excel in mediation settings. They effectively present your case to neutral third parties while strategically countering insurance company arguments.

In Texas, attorneys leverage a powerful legal principle called the Stowers Doctrine during negotiations. As one attorney explains: “A Stowers demand is a reasonable settlement offer within policy limits; if the insurer rejects it and a judgment exceeds policy limits, the insurer must pay the full judgment.” This creates significant pressure on insurers to settle fairly.

Your attorney also brings invaluable settlement strategy expertise. They know when to push for more and when to accept reasonable offers based on your specific policy language, relevant precedents, and unique circumstances.

Perhaps most importantly, insurers take attorneys seriously because they represent the very real threat of litigation. Insurance companies understand that fighting a prepared attorney in court is expensive and unpredictable—often motivating them to make better settlement offers to avoid that risk.

As one relieved client shared: “We had damage to our roof and were not satisfied with our insurance… [The attorney] really did all he could to help us get enough to repair our roof.”

Common Commercial Insurance Claims, Denials & Texas Legal Protections

When the unexpected happens, your business’s survival often depends on your insurance coming through. But what exactly are you up against? Let’s look at the real-world challenges businesses face and how Texas law protects you when insurers don’t play fair.

Most businesses will eventually need to file an insurance claim – it’s not a matter of if, but when. Whether it’s a devastating fire that destroys inventory, a burst pipe flooding your office, or a customer injury on your premises, these situations can threaten everything you’ve built.

Common Commercial Insurance Claims

Property damage claims top the list for most businesses. When a roof collapses after a heavy storm or fire tears through your warehouse, the costs add up quickly. Beyond the physical damage,business interruptionlosses often hurt even more – those days, weeks, or months when you can’t operate normally but still have bills to pay.

Liability claims represent another major category, where someone alleges your business caused them harm. Whether it’s a slip-and-fall or damage to someone else’s property, these claims can become complicated quickly.

Equipment breakdown claims are particularly painful for manufacturing or service businesses that rely on specific machinery. When critical equipment fails unexpectedly, both repair costs and downtime create a double financial hit.

Common Reasons for Claim Denials

Insurance companies have mastered the art of finding reasons not to pay. You’ll often hear them citepolicy exclusions– those paragraphs of fine print that carve out exceptions to your coverage. They might point tocoverage limitationsthat cap payouts below your actual losses, or they’ll scrutinize your payment history looking for late premiums that might have created a coverage gap.

Some of the most frustrating denials come from allegations ofinsufficient documentationor suspected fraud – where the insurer essentially accuses you of exaggerating or fabricating your claim. These tactics feel personal because they question your integrity as a business owner.

Texas Legal Protections for Businesses

Fortunately, Texas law provides substantial protections against insurer misconduct. TheTexas Insurance Codecontains powerful provisions that level the playing field between businesses and insurance companies.

Chapter 541 prohibits unfair practices and deceptive acts, while Chapter 542 establishes strict timelines for insurers to respond to and pay claims. TheStowers Doctrine– a unique Texas legal principle – creates additional leverage by holding insurers responsible when they unreasonably refuse reasonable settlement offers.

These protections didn’t happen by accident. They evolved because Texas recognized that businesses need protection from insurance companies that prioritize profits over honoring their commitments.

Scientific research on Unfair Practices

Bad Faith Tactics a Commercial Insurance Claims Attorney Can Uncover

Insurance companies have developed sophisticated strategies to minimize payouts. Acommercial insurance claims attorneyknows exactly what to look for when reviewing your case.

The most common bad faith tactic is the delay game. Your claim sits on someone’s desk for weeks while they “review” it. Then they request more documentation. Then they need to consult with supervisors. Meanwhile, your business is bleeding money.

Lowball offersarrive with pressure to accept them quickly. The adjuster might misrepresent what your policy actually covers, hoping you won’t verify their claims. Some insurers request mountains of unnecessary documentation, creating a paper chase that exhausts most business owners.

“We’ve seen cases where insurers requested the same information three different times, each time claiming they never received it,” shares one experienced attorney. “They’re counting on you giving up out of frustration.”

Your Rights Under Chapters 541 & 542 and the Stowers Doctrine

Texas law gives you specific, enforceable rights when dealing with insurance companies:

Under Chapter 541, insurers cannot mislead you about your coverage or engage in unfair settlement practices. If they do, you can recover your actual damages plus attorney fees. In cases of knowing violations, you might recover up to three times your actual damages.

Chapter 542, known as thePrompt Payment of Claims Act, puts insurers on a strict timeline. They must acknowledge your claim within 15 days and accept or reject it within 15-30 days of receiving all necessary information. Violations trigger an 18% annual interest penalty on your claim amount, plus they’ll have to pay your attorney fees.

Scientific research on Prompt Payment

TheStowers Doctrinecreates powerful negotiation leverage. When you make a reasonable settlement offer within policy limits, the insurer must accept it or risk being liable for the entire judgment amount if they lose in court – even if that amount exceeds your policy limits.

In Texas you typically have just two years from the date of the bad faith act to file a lawsuit. This relatively short timeline makes it crucial to consult with acommercial insurance claims attorneypromptly when you suspect your insurer isn’t treating your claim fairly.

When your business’s future hangs in the balance, understanding these protections isn’t just helpful—it’s essential. The right legal guidance can transform your claim from a frustrating denial into the fair settlement you deserve.

Disputing a Denied or Underpaid Claim: Step-by-Step Guide

When your insurance company sends that disappointing letter denying your claim or offering pennies on the dollar, it can feel like the end of the road. But take a deep breath—this is actually just the beginning of your journey toward fair compensation.

The path from denial to fair settlement isn’t always easy, but with the right approach, many businesses successfully overturn these initial decisions. Let’s walk through how to challenge the insurance company’s decision and fight for what your business deserves.

First, carefully review why they denied or underpaid your claim. Look for specific policy provisions they’re citing and any facts they’ve misunderstood about your situation. This information is your roadmap for building a strong counterargument.

Next, gather additional evidence that directly addresses their reasons for denial. This might include more detailed damage assessments, expert opinions that contradict their findings, additional photographs showing the full extent of damage, or business records that demonstrate the true financial impact of your loss.

Most insurance companies have a formal appeals process—use it. Submit a written appeal that clearly references your policy number, explains why their decision was incorrect, includes all your supporting documentation, specifies the amount you believe you’re entitled to, and requests a response by a specific date. Be professional but firm.

If your dispute centers around the value of your loss rather than coverage issues, your policy likely includes an appraisal clause. This process involves both you and the insurance company selecting appraisers who then choose a neutral umpire together. While potentially costly, this approach often resolves valuation disputes without court involvement.

When internal processes don’t yield results, consider filing a complaint with the Texas Department of Insurance. While they can’t force a settlement, they can investigate potential violations and sometimes nudge insurers toward more reasonable positions.

Mediation offers another pathway to resolution. A neutral third party can often help bridge the gap between your position and the insurer’s, facilitating productive settlement discussions in a less adversarial environment than court.

If these approaches don’t produce results, it’s time to consult with acommercial insurance claims attorney. They can evaluate your case’s strength, advise you on legal options, draft formal demand letters that carry legal weight, and prepare for litigation if necessary.

As a last resort, your attorney may recommend filing a lawsuit. This typically involves filing a formal complaint, engaging in findy (exchanging information with the insurance company), participating in depositions and hearings, and potentially going to trial. While most cases settle before reaching a courtroom, having an attorney prepared to go the distance often motivates insurers to offer fair settlements.

Documentation & Evidence Checklist

The strength of your insurance dispute often comes down to one thing: documentation. Think of evidence as the fuel that powers your claim—without enough of it, you’ll stall out before reaching your destination.

Having helped hundreds of businesses through this process, we’ve developed a comprehensive checklist of what you need to build an ironclad case:

Policy Documentation:Keep your complete insurance policy with all endorsements and amendments, proof of premium payments, and any correspondence about policy changes or renewals. Your policy is the contract that the insurer must honor—know it inside and out.

Claim Documentation:Maintain copies of your original claim submission, claim number and adjuster contact information, the denial letter or underpayment explanation, all correspondence with the insurance company, and detailed notes from phone conversations (including dates, times, and names).

Damage Evidence:This is where many claims succeed or fail. Capture photographs and videos of all damage from multiple angles, before-and-after images if available, surveillance footage, and consider drone footage for roof or large property damage. You can never have too many photos.

Financial Documentation:Prepare inventory lists of damaged items, original purchase receipts, replacement cost estimates from vendors, repair estimates from contractors (get at least three), business income records for interruption claims, payroll records, and tax returns or financial statements that establish your business value.

Expert Reports:Independent assessments carry significant weight. Gather independent adjuster assessments, engineering reports, environmental testing results, and contractor inspection reports that support your position.

Witness Information:Collect statements from employees who witnessed the damage, statements from customers or others present during the incident, and contact information for all witnesses who can corroborate your version of events.

Timeline Documentation:Create a chronological record including the date and time of loss, weather reports for weather-related claims, police or fire department reports, maintenance records proving proper upkeep, and a log of all claim-related activities and communications.

At Global Public Adjusters, Inc., we recommend organizing these documents in a dedicated claim file, both physically and digitally, with secure backups. This level of organization not only strengthens your position but also signals to insurers that you’re serious about pursuing fair compensation.

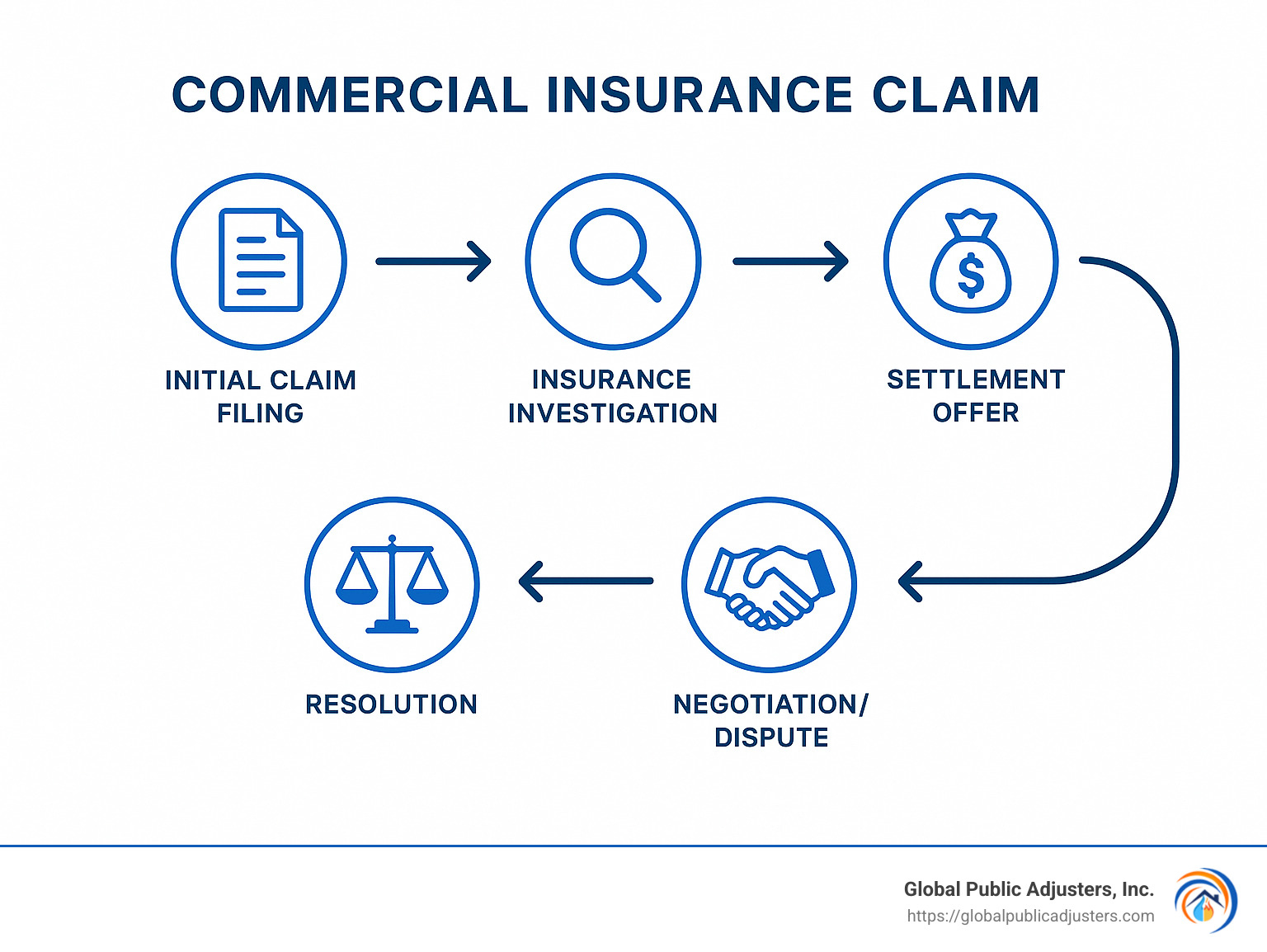

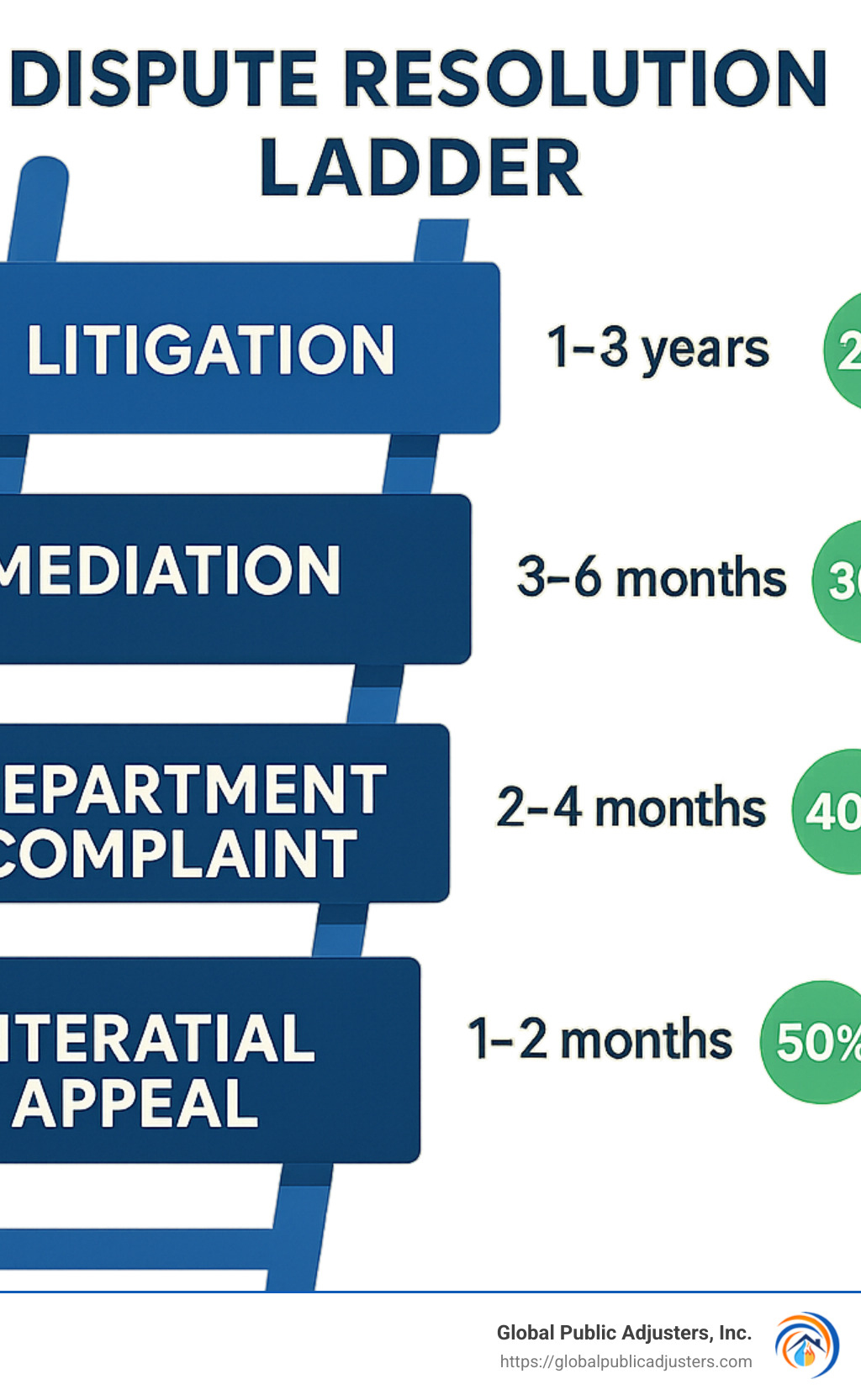

The Process from Internal Appeal to Courtroom

Understanding the typical progression of an insurance dispute helps set realistic expectations and prepare for each phase of the process.

Carrier Review (1-2 months):After submitting your internal appeal, the insurance company will conduct a review of their initial decision. A different adjuster typically examines your claim, supervisory personnel get involved, they may re-inspect the damaged property, and they’ll assess any new evidence you’ve provided. This stage results in approximately 30% of denials being reversed or offers improved—not great odds, but worth the effort.

Appraisal Process (2-4 months):If your policy includes an appraisal clause and you invoke it, both parties select and pay for their own appraisers, who then jointly select an umpire (or a court appoints one if they cannot agree). The appraisers inspect the property, prepare damage estimates, and the umpire resolves any disagreements. The final appraisal award binds both parties on the amount of loss, though not on coverage issues. This process resolves about 40% of remaining disputes and works particularly well for straightforward valuation disagreements.

Mediation (1-2 days):When appraisal isn’t available or doesn’t resolve all issues, mediation often helps. A neutral mediator facilitates negotiation between parties in a non-binding but often effective process. Both sides present their positions informally, and the mediator helps identify common ground and potential compromises. Mediation successfully resolves approximately 60% of cases that reach this stage, making it one of the most efficient resolution methods.

Stowers Demand and Pre-Litigation Negotiation (30-60 days):Before filing a lawsuit, yourcommercial insurance claims attorneymay issue a formal Stowers demand (in Texas), prepare a detailed settlement package, engage in direct negotiation with the insurer’s legal department, and provide a specific deadline for response. This final pre-litigation effort resolves approximately 15-20% of remaining cases, often because insurers want to avoid the costs and risks of litigation.

Litigation (1-2 years):If all else fails, your attorney files a formal lawsuit outlining your claims. Both sides exchange information through document requests, written questions, sworn testimony, and expert witness reports during the findy phase. Either side may ask the court to rule on certain issues without a trial through summary judgment motions. After final preparation, the case proceeds to trial with presentation of evidence and arguments before a judge or jury, followed by a verdict and possible appeals.

While litigation sounds daunting, approximately 90-95% of cases settle before trial—though often not until significant litigation costs have been incurred. The prospect of courtroom scrutiny often motivates previously stubborn insurers to negotiate more reasonably.

How a Commercial Insurance Claims Attorney Negotiates with Insurers

When you’re dealing with insurance companies that handle thousands of claims daily, what makes them take your claim seriously? Often, it’s having acommercial insurance claims attorneyin your corner who knows exactly how to apply pressure where it counts.

Legal Knowledge as Leverage:Insurance companies employ teams of lawyers who know every loophole and technicality. Acommercial insurance claims attorneylevels the playing field by bringing deep knowledge of insurance law, regulations, and court decisions to negotiations. When your attorney cites specific cases where insurers paid hefty penalties for similar behavior, adjusters suddenly become more attentive.

The Power of Contingency:When an attorney takes your case on contingency, it sends a powerful message to the insurance company. They know the attorney has thoroughly evaluated your claim and believes it has merit—otherwise, they wouldn’t have invested their time and resources. As one client put it: “When my attorney said they’d only get paid if I got paid, the insurance company finally started taking my claim seriously.”

Pressure from Multiple Angles:Experienced attorneys don’t rely on a single approach. They might simultaneously send formal demand letters with statutory deadlines, file complaints with regulatory authorities, hint at media attention for egregious cases, issue Stowers demands in Texas, and threaten bad faith litigation with punitive damages. This multi-layered pressure often breaks through insurer resistance.

Compelling Damage Models:Unlike individual policyholders, attorneys work with networks of experts to develop comprehensive damage assessments that are difficult to dismiss. These might include detailed property valuations from certified appraisers, business interruption calculations from forensic accountants, future impact projections, and comparative case settlements that establish precedent.

Exploiting Insurer Weaknesses:Every claim has its vulnerabilities—on both sides. Skilled attorneys identify and exploit weaknesses in an insurer’s position, such as policy ambiguities (which courts interpret in favor of the policyholder), procedural errors in claim handling, inconsistencies in the insurer’s position, or problematic claim file notes obtained through findy.

Creating Settlement Momentum:Strategic attorneys know how to create momentum toward settlement by starting with areas of agreement, resolving smaller issues before tackling larger ones, using partial payments to establish precedent, and creating artificial deadlines tied to litigation events. This incremental approach often leads to complete resolution.

As one Texas attorney famously put it: “Insurance companies have departments dedicated to saying ‘no.’ We’re dedicated to turning that ‘no’ into a ‘yes.'” This determination, combined with strategic negotiation skills, often results in settlements far exceeding what policyholders could achieve on their own.

Maximizing Recovery: Attorney Strategies, Damages & Fees

When disaster strikes your business, the gap between barely getting by and truly bouncing back often hinges on one factor: how well your insurance claim is handled. This is where a skilledcommercial insurance claims attorneymakes all the difference.

I’ve seen countless business owners settle for far less than they deserve simply because they didn’t know what was possible. Let’s change that by exploring how these specialized attorneys can transform your recovery.

Strategic Approaches to Maximization

Think of your insurance claim like an iceberg – what’s visible above water is just a fraction of what you’re entitled to. A goodcommercial insurance claims attorneydives deep to uncover every dollar you deserve.

These legal experts go far beyond the obvious damages. While you might focus on repairing that collapsed roof, they’re already calculating code upgrade requirements, business interruption losses, and extra expense coverage. They’re investigating whether civil authority coverage applies and determining if you need an extended period of indemnity.

“Most business owners focus solely on property damage, missing thousands in legitimate business interruption compensation,” explains one veteran attorney. “We’re trained to see the whole picture.”

What truly sets top attorneys apart is their multi-pronged legal approach. Rather than pursuing a simple breach of contract claim, they simultaneously build cases for statutory bad faith violations, common law bad faith, and sometimes even fraud in extreme cases. This creates multiple paths to recovery, dramatically increasing your leverage.

Expert witnesses become powerful allies in this process. Your attorney will strategically deploy building consultants, forensic accountants, and industry-specific valuation experts to strengthen your claim. One attorney notes, “The right expert can transform a claim from questionable to undeniable.”

Timing is everything in these negotiations. Knowing exactly when to push for settlement and when to escalate to litigation is an art form developed through years of experience. Some issues are ripe for early resolution, while others become powerful bargaining chips during litigation.

Types of Recoverable Damages

Most business owners drastically underestimate what they can recover after an insurance company acts in bad faith. Your potential compensation extends far beyond basic policy benefits.

Of course, you’re entitled to your contractual damages – the full policy benefits covering property replacement, business income loss, and extra expenses. But that’s just the beginning.

Texas law provides powerful statutory protections that can significantly increase your recovery. Under the Prompt Payment Act, you may be entitled to 18% interest penalties on delayed payments. The insurance company might also be forced to pay your attorney’s fees and costs. In cases of knowing violations, your damages can be multiplied up to three times.

Bad faith behavior opens another avenue for compensation. Business owners can recover for reputation harm and consequential damages that exceed policy limits. In particularly egregious cases, punitive damages may be awarded to punish the insurance company and deter similar behavior in the future.

Don’t overlook consequential damages either. Did your business lose valuable opportunities while fighting for proper payment? Did your credit rating suffer? Were you forced to take on additional financing costs? A skilledcommercial insurance claims attorneyensures these losses don’t go uncompensated.

“You may recover full claim value, attorney’s fees, court costs, and possibly mental anguish or punitive damages,” explains one attorney who specializes in these cases. “The insurance company is betting you don’t know this.”

Fee Structures and Cost Considerations

One of the most beautiful aspects of working with acommercial insurance claims attorneyis the alignment of interests. Most operate on contingency fees, meaning they only get paid when you do.

This arrangement eliminates the financial barrier to quality legal representation. You don’t need to write a big check upfront when your business is already struggling after a loss. Instead, your attorney invests their time and resources in your case, confident in their ability to win.

Typically, contingency fees range from 25-30% for pre-litigation settlements, increasing to 33-40% if a lawsuit is filed, and 40-45% if your case goes to trial or appeal. While these percentages might seem substantial, attorneys working this way are highly motivated to maximize your recovery – their success is literally tied to yours.

Many firms will also advance case expenses, covering the costs of expert witnesses, court filings, and investigation until your case resolves. This removes another potential barrier to pursuing your full rights.

At Global Public Adjusters, Inc., we often collaborate with attorneys, combining our insurance claim expertise with their legal knowledge. This partnership approach can be particularly effective, giving you the best of both worlds.

| Comparison | Public Adjuster | Attorney |

|---|---|---|

| Focus | Claim valuation and documentation | Legal rights and litigation |

| Typical Fee | 5-15% of recovery | 25-40% of recovery |

| Can File Lawsuit | No | Yes |

| Bad Faith Claims | Limited | Comprehensive |

| Best For | Initial claim filing, valuation disputes | Denied claims, bad faith situations |

| Timeline | Generally faster | May involve lengthy litigation |

| Expertise | Insurance policy and damage assessment | Insurance law and litigation strategy |

How to Choose the Right Commercial Insurance Claims Attorney

Finding the rightcommercial insurance claims attorneyisn’t just about picking someone with a law degree – it’s about finding a specialist who understands the unique challenges your business faces.

Start by looking for specialized experience with commercial policies. This isn’t the time for a general practitioner or personal injury lawyer. You need someone who speaks the language of commercial insurance fluently. Ask potential attorneys how many commercial claims they’ve handled and whether they understand your specific industry’s challenges.

Trial experience matters tremendously, even if your case never sees a courtroom. Insurance companies track which attorneys actually try cases and which ones always settle. Those with proven trial success often secure better settlements because insurers know they’re not bluffing about going to court. Don’t be shy about asking for their success rate against your specific insurance company.

Consider the firm’s resources too. Commercial insurance disputes can be resource-intensive battles. Does the attorney have access to qualified experts? Can they advance case costs? Is there a team supporting your case, or is it just one overwhelmed lawyer? These factors can significantly impact your outcome.

Communication style should never be overlooked. Your attorney should explain complex concepts in terms you understand and be readily accessible when you have questions. During your initial consultation, pay attention to how clearly they explain things and whether they seem genuinely interested in your situation.

Local knowledge often provides an edge in these cases. Attorneys familiar with local courts understand the tendencies of specific judges and have relationships with local experts who can strengthen your claim. This “home field advantage” shouldn’t be underestimated.

Finally, check their track record through client testimonials and references. Past performance often predicts future results. One satisfied business owner shared: “If you need an attorney regarding property damage, residential property, commercial property, or insurance claims, [a good attorney] is the attorney to contact FIRST!”

Frequently Asked Questions about Commercial Insurance Claims Attorneys

Q: How long do I have to file a bad faith insurance claim in Texas?

A: In Texas, you typically have two years from the date the insurance company acted in bad faith to file a lawsuit. This is your statute of limitations. However, pinpointing exactly when the “bad faith act” occurred can get tricky – was it when they first delayed your claim, when they denied it, or somewhere in between?

To complicate matters further, your insurance policy might contain contractual deadlines even shorter than this two-year period. This is why consulting with an attorney as soon as you suspect problems is so crucial. The clock is always ticking, and missing deadlines can permanently forfeit your rights.

Q: What percentage do commercial insurance claims attorneys typically charge on contingency?

A: Mostcommercial insurance claims attorneyswork on a sliding scale that reflects the amount of work and risk involved. Typically, you’ll see fees around 25-30% for cases resolved before filing a lawsuit. This increases to 33-40% if litigation becomes necessary, and may reach 40-45% if your case goes all the way to trial or appeal.

While these percentages might initially seem high, remember two important points. First, you pay nothing unless your attorney succeeds. Second, experienced attorneys typically recover significantly more than what insurance companies initially offer – often enough to cover their fee many times over. I’ve seen attorneys turn $50,000 offers into $500,000 settlements, creating wins for everyone involved (except the insurance company!).

Q: What’s the difference between first-party and third-party bad faith claims in Texas?

A: This distinction is crucial but often misunderstood. First-party bad faith occurs when your own insurance company treats you unfairly. Texas law provides robust protections here, allowing you to recover not just your policy benefits but potentially additional damages as well.

Third-party bad faith is different – it happens when someone else’s insurance company treats you unfairly. Texas doesn’t allow you to directly sue another person’s insurer for bad faith. However, we do have the Stowers Doctrine, which provides a pathway to recovery when an insurer negligently refuses a reasonable settlement offer within policy limits.

Understanding this distinction helps your attorney develop the right strategy for your specific situation. The legal theories, potential damages, and approach to negotiation all depend on whether you’re dealing with your own insurer or someone else’s.

Conclusion

When your business faces an insurance claim dispute, having the right legal support can truly be the difference between financial recovery and potential ruin.Commercial insurance claims attorneysbring a powerful combination of specialized knowledge, strategic negotiation skills, and litigation experience that helps level the playing field against well-resourced insurance companies.

At Global Public Adjusters, Inc., we’ve seen the challenges businesses face when dealing with insurance claims. While our public adjusting services specialize in advocating for fair settlements, we recognize that some situations demand legal intervention. That’s why we often collaborate with experienced attorneys to ensure our clients receive every dollar they deserve for their losses.

If you take away nothing else from this guide, remember these essential points:

Time is not on your side. Insurance claims come with strict deadlines, and in Texas, you typically have just two years to file a bad faith lawsuit. The moment you suspect your claim isn’t being handled properly, it’s time to consider professional help.

Documentation is your strongest ally. Take photos, save emails, record phone calls (where legal), and keep detailed notes of every interaction with your insurer. This evidence creates the foundation for a successful claim or lawsuit.

Bad faith tactics come in many forms. When you notice patterns of delays, unjustified denials, misrepresentations about your policy, or insulting lowball offers, these aren’t just frustrating business practices—they may be legally actionable bad faith behaviors that an attorney can challenge effectively.

Texas law stands with policyholders. The Prompt Payment Act, provisions against unfair practices, and the Stowers Doctrine all provide meaningful protections for businesses. Understanding these rights gives you leverage in negotiations and potential litigation.

Professional representation pays for itself. Whether through a public adjuster, an attorney, or both working in tandem, professional advocacy typically results in settlements significantly higher than what businesses can secure on their own—even after accounting for contingency fees.

Don’t let insurance companies deny you the protection you’ve faithfully paid for. If your business has suffered a loss and your insurer isn’t fulfilling their obligations, taking action today can save your tomorrow.

More info about Commercial Insurance Claims Orlando

With over 50 years of combined experience representing business owners through complex insurance claims, we at Global Public Adjusters, Inc. remain committed to maximizing settlements for our clients throughout Florida, including Orlando and Pensacola. When your business needs support with a commercial insurance claim, we’re here to help—whether through our direct services or by connecting you with trusted legal partners when the situation demands it.

Remember: insurance companies have teams of adjusters, experts, and attorneys working diligently to minimize their payouts. Shouldn’t you have experienced professionals fighting just as hard on your side?