Average water backup claim 2025: Shocking Costs

The Hidden Flood in Your Home

When homeowners think of water damage, they picture dramatic floods or burst pipes. But theaverage water backup claimis a quieter, more common threat: sewage creeping up through drains or a sump pump failing during a storm. This can cause thousands in damage that standard insurance often won’t cover.

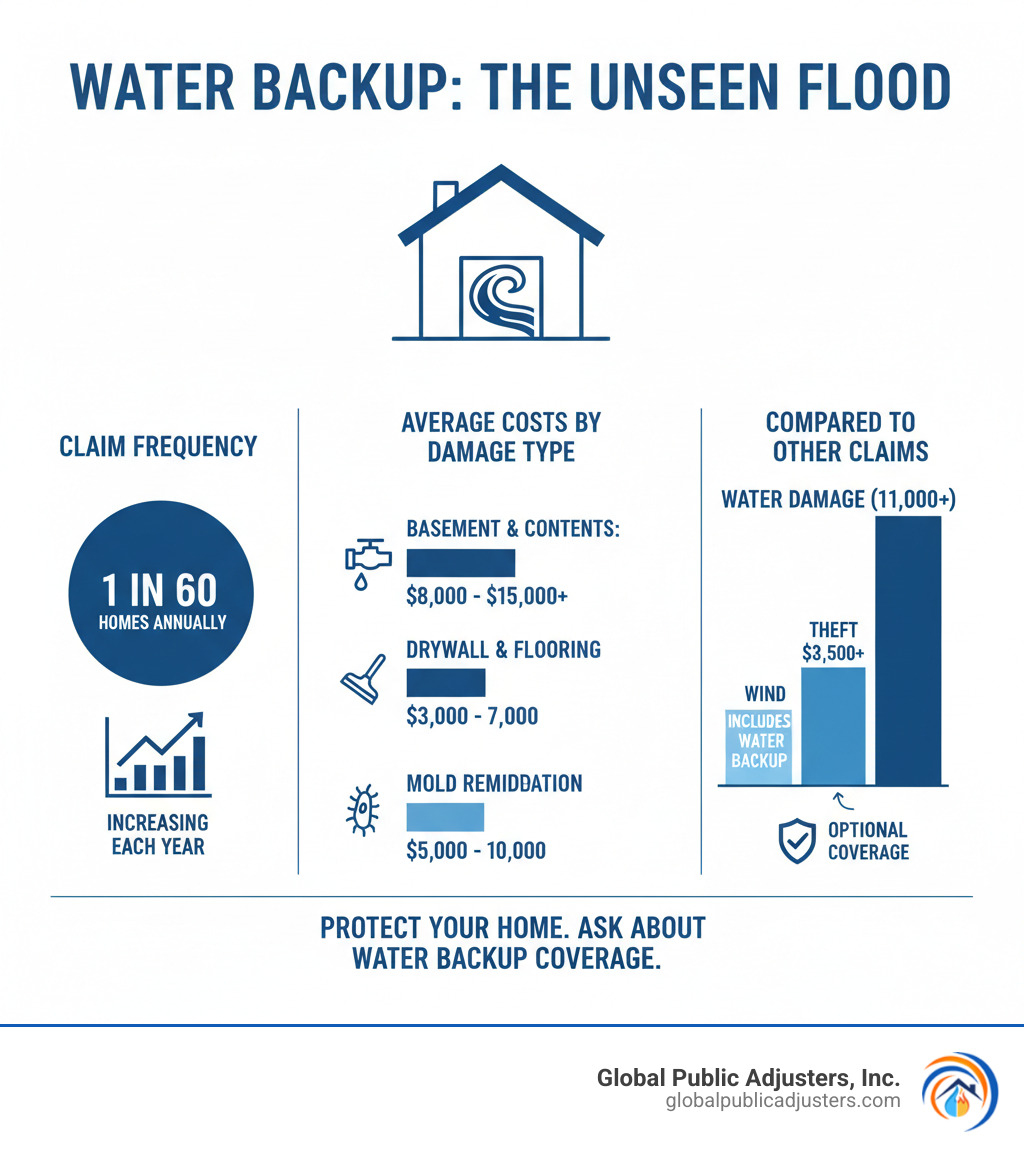

Quick Facts About Water Backup Claims:

- Average payout range:$3,000 – $15,000 per claim

- Annual coverage cost:$50 – $250

- Most common causes:Sewer backups and sump pump failures

- Coverage availability:Optional endorsement only (not included in standard policies)

- High-risk properties:Homes with basements, older properties, low-lying areas

Water damage is thethird most costly insurance claim, and water backup incidents are a significant part of these losses. Yet, most homeowners don’t realize their standard policy excludes this type of damage entirely.

The reality is stark:one in every 60 insured homesfiles a water damage claim each year. Without a specific water backup endorsement, homeowners face the full financial burden themselves.

A 900-square-foot finished basement can require over $62,000 in coverage to fully protect against water backup. That’s a sobering number when the alternative is paying out of pocket for contaminated belongings, ruined flooring, and potential mold remediation.

What is Water Backup and Why Isn’t It Covered?

Finding water bubbling up from a basement drain is a homeowner’s nightmare. Unfortunately, your standard homeowners insurance likely won’t cover it.

Water backup damageis different from the water damage most policies cover. A standard policy typically protects you when a pipe bursts inside your home or rain enters through a damaged roof. It draws the line when water comes from outside your plumbing system.

This distinction is critical. When water enters fromabove(roof leaks) orfrom withinyour plumbing (burst pipes), you’re usually covered. But when water flowsupwardthrough drains, sewers, or overwhelmed sump pumps, it’s considered a separate peril.

Insurers view water backup as a different risk tied to municipal sewer systems, ground saturation, or mechanical failures. To protect against this common threat, you need a specialendorsement, often called “Water Backup and Sump Pump Overflow” coverage. Without it, even anaverage water backup claimcomes entirely out of your pocket.

For more details, our guide onSome Different Types of Water Damageandscientific research on U.S. water-damage claimsshow how financially devastating these events can be.

What Water Backup Coverage Includes (and Excludes)

This valuable endorsement covers several key areas:

- Property Damage:Pays for structural repairs to things like drywall, flooring, and insulation damaged by the backup.

- Personal Belongings:Protects your possessions, such as electronics, furniture, and stored items, up to your policy limits.

- Mold Remediation:Often includes costs for mold testing and professional removal when it’s a direct result of a covered backup.

- Additional Living Expenses (ALE):Helps pay for temporary housing, meals, and other costs if the damage makes your home unlivable during repairs.

Understanding exclusions is just as important:

- Flood Damage:This is not flood insurance. Water entering from outside sources like overflowing rivers requires a separate policy, typically through theNational Flood Insurance Program.

- Maintenance Issues:Claims may be denied if the backup results from a known but ignored problem, like a slow drain you never fixed.

- The Source of the Problem:The policy covers thedamage causedby the backup, not the cost of repairing or replacing the failed sump pump or clogged pipe itself.

Common Causes and Who Is Most at Risk

Certain factors significantly increase the risk of water backup:

- Clogged Sewer Lines:Grease, “flushable” wipes, hair, and other debris can create blockages that force wastewater back into your home.

- Tree Root Intrusion:Roots seeking moisture can infiltrate and block sewer pipes, a common issue for properties with mature trees.

- Aging Public Sewer Systems:Many municipal systems are old and prone to failures, leading tosanitary sewer overflowsthat affect connected homes.

- Heavy Rainfall:Storms can overwhelm drainage and sewer systems, causing widespread backups.

- Sump Pump Failure:Power outages or mechanical issues can cause a sump pump to fail when it’s needed most.

Who is most at risk?

- Homes with basements, especially finished ones, are highly vulnerable as water flows to the lowest point.

- Older homesoften have aging plumbing (like cast iron pipes) that is susceptible to deterioration and root intrusion.

- Low-lying propertiesnaturally collect water, putting extra pressure on foundations and drainage systems.

Understanding the Average Water Backup Claim and What It Costs

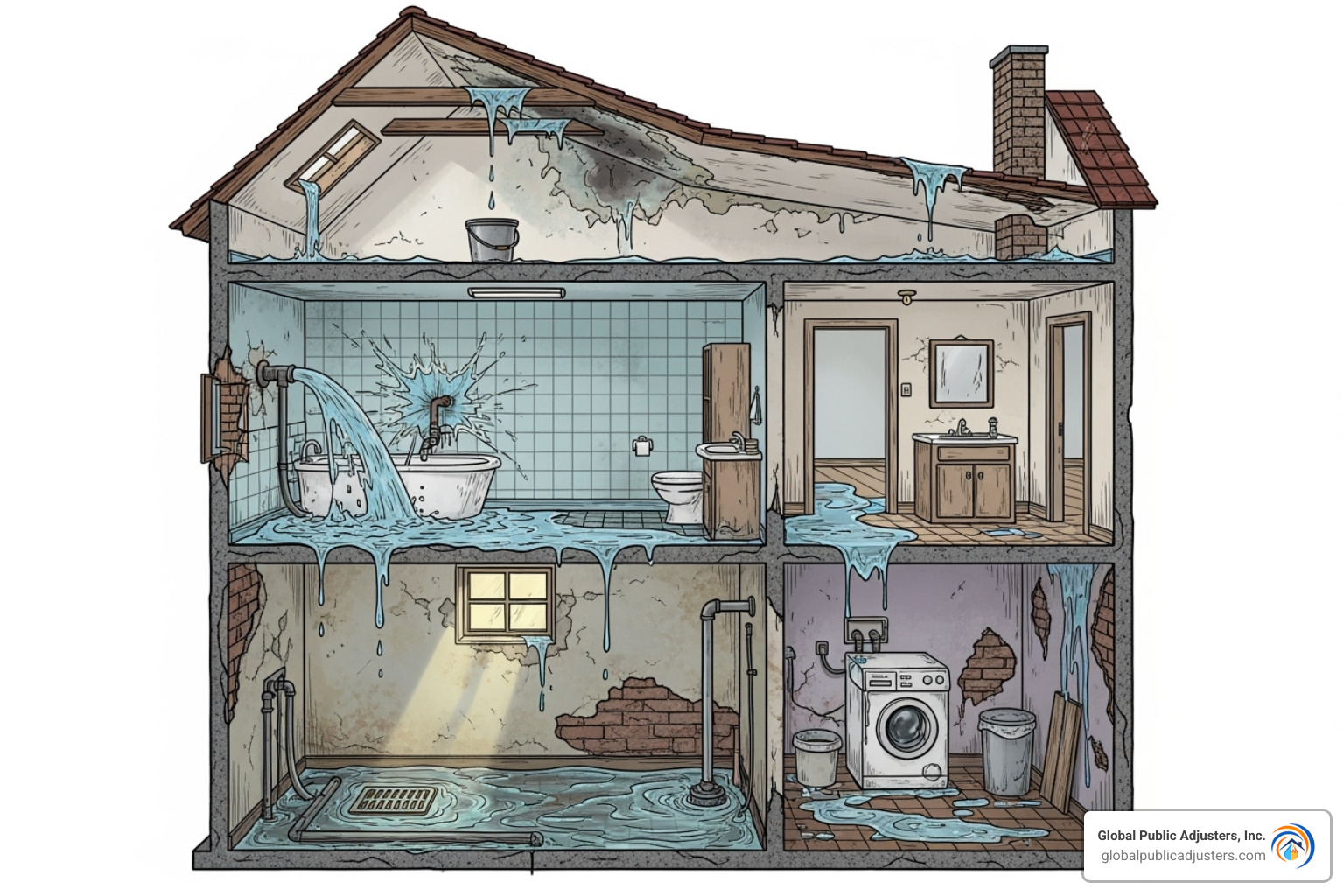

When water backs up into your home, the financial devastation can be immense. It’s not just a simple cleanup; it’s a complex and costly restoration process involving water extraction, drying, and replacing everything from drywall to personal belongings. Theaverage water backup claimreveals just how expensive these hidden floods can be.

Beneath the obvious damage to furniture and electronics lies an iceberg of costs. Professional water extraction, industrial drying equipment, removing contaminated materials, and potential mold remediation can add thousands to the bill. Your policy limits and deductible become critical in determining your out-of-pocket expenses.

What is the average cost of a water backup claim?

Theaverage water backup claimtypically ranges from$3,000 to $15,000, but severe cases can easily exceed $50,000. While general water damage claims average around $12,514, the cost of a backup incident depends heavily on the type of water involved.

A sewage backup in a finished basement can easily cost $30,000 or more. We’ve seen initial insurance offers of $30,000 settled for over $115,000 once the full extent of damage was properly assessed.

The type of water is a major cost factor:

- Clean Water:From sources like burst supply lines, this is the least expensive to remediate.

- Gray Water:From appliances like dishwashers, it contains contaminants and requires more specialized cleanup.

- Black Water:This is the most dangerous and expensive.Black water damageinvolves sewage and pathogens. Any porous material it touches—carpet, drywall, furniture—must be removed and disposed of as contaminated waste.

If you need expert guidance in the Orlando area, visit ourWater Damage Claims Orlandopage.

Key factors that influence the average water backup claim payout

Several factors determine the final payout for a water backup claim:

- Extent of Damage:A few inches of water in an unfinished space is far less costly than several feet in a finished basement.

- Type of Water:As noted, remediation for black water can cost five times more per square foot than for clean water.

- Policy Limits:Your coverage limit is the maximum your insurer will pay. If you have $10,000 in coverage for $25,000 in damage, you’re responsible for the $15,000 difference.

- Your Deductible:This is the amount you pay first. Water backup coverage may have its own separatethe deductible.

- Finished vs. Unfinished Basements:The same incident can cause $5,000 in damage to an unfinished basement but $40,000 to a finished one.

- Quality Documentation:Detailed photos, videos, and itemized lists of damaged property are crucial evidence to support your claim.

- How Quickly You Act:Prompt reporting and immediate mitigation (like professional water extraction) can prevent further damage like mold and strengthen your claim.

How Much Does Water Backup Coverage Cost?

Given the high potential cost of a claim, water backup coverage is surprisingly affordable, typically costing between$50 and $250 per year.

The premium depends on your chosen coverage limits and your home’s risk factors. Increasing your coverage from $5,000 to $25,000 might only cost an additional $75 per year. Homes with basements or in areas with older sewer systems may have slightly higher premiums, but the cost is minimal compared to the protection it provides.

Considering water damage is thethird most common homeowners insurance claim, this affordable endorsement is one of the smartest investments you can make. Learn more about water damage risks in our guide onHow Can Water Damage My Home?.

Prevention: Your First Line of Defense Against Water Backup

While insurance is crucial, preventing water backup is the smartest and most cost-effective strategy. Proactive maintenance can save you from the headache and expense of a claim, which often runs into thousands of dollars. Many disasters, like those fromBroken Cast Iron Pipes Orlando, are entirely preventable.

Most preventive measures cost a fraction of theaverage water backup claimand require just a little attention.

Essential Maintenance Checklist

- Test your sump pump regularly.Pour a bucket of water into the sump pit to ensure the pump activates, drains the water, and shuts off properly. Clear any debris from the pit.

- Get a battery backup for your sump pump.Storms that require a sump pump often cause power outages. A battery backup ensures it keeps running. A water-powered backup pump is an even more reliable option.

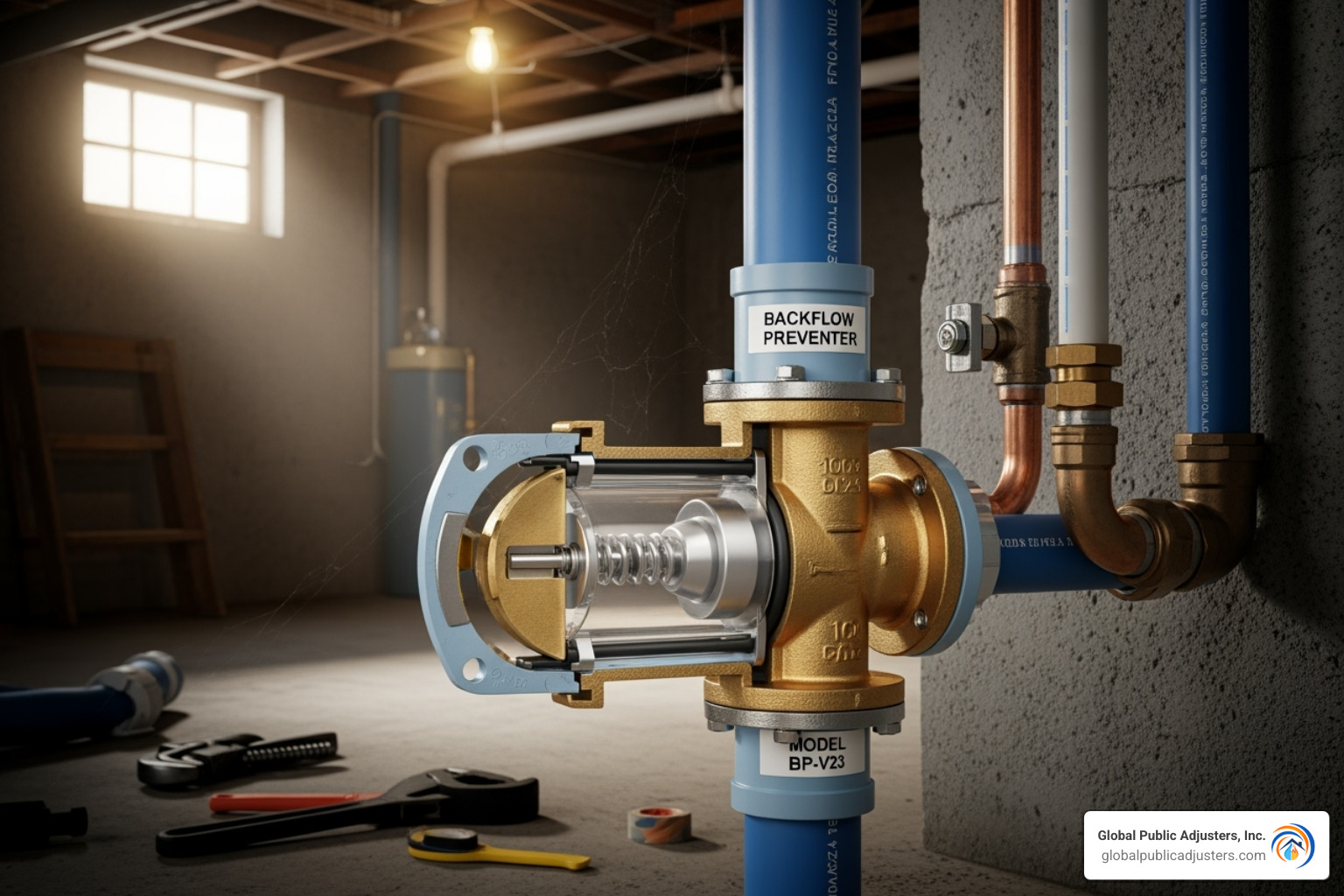

- Install a backwater valve.This device allows waste to flow out but automatically closes to prevent sewage from backing up into your home. It’s a wise investment for older homes.

- Watch what goes down your drains.Avoid pouring cooking grease down the drain, as it solidifies and causes clogs. Never flush so-called “flushable” wipes, which don’t break down and are a primary cause of blockages.

- Schedule regular plumbing inspections.A plumber can use a camera to inspect your sewer lines for tree root intrusion or other problems, especially if you have an older home or large trees.

- Keep gutters and downspouts clean.Ensure they direct water away from your foundation to prevent ground saturation that can overwhelm your drainage system.

Smart Upgrades to Protect Your Home

- Smart water sensors.Place these inexpensive devices near sump pumps, water heaters, and sinks. They send an alert to your phone at the first sign of moisture, allowing for early intervention.

- Replace old sewer lines.If your home has aging clay or cast iron pipes, replacing them with modern PVC can prevent root intrusion and future backups.

- Improve landscaping and grading.Ensure the ground around your home slopes away from the foundation to direct rainwater away from your basement.

- Water-powered backup sump pump.This is a highly reliable upgrade that uses your home’s water pressure to operate, making it effective even during long power outages.

How to File and Maximize Your Water Backup Claim

Even with perfect prevention, disasters happen. When water backup strikes, how you handle your claim determines whether you get a fair settlement or a disappointing payout. Navigating theHomeowners Claim Process Orlando FLcorrectly is key to maximizing youraverage water backup claim.

Step-by-Step Guide to Filing Your Claim

Your actions in the first few hours are critical. Follow these steps to protect your claim:

- Stop the water sourceif it’s safe. For a sewer backup, call a plumber immediately. Do not risk contact with contaminated water.

- Document everything before touching anything.Use your phone to take extensive photos and videos of the water source, water levels, and all damaged areas and items. This is your most important evidence.

- Contact your insurance company immediately.Prompt notification is required by most policies. Stick to the facts and don’t speculate on the cause.

- Mitigate further damage.Remove standing water (if safe), set up fans, and move undamaged items. Do not make permanent repairs or throw anything away until an adjuster has inspected the damage.

- Keep all receipts.Document all related expenses, including emergency cleanup, temporary repairs, and hotel stays. These are often reimbursable.

Our guide onNavigating Property Damage Claims: Tips for a Smoother Processoffers more detailed advice.

Common Pitfalls and Why Claims Get Denied

Avoid these common mistakes that can lead to a denied or underpaid claim:

- Poor Documentation:Without clear photo and video evidence, the insurer can easily dispute the extent of your losses.

- Late Reporting:Delaying your claim raises red flags and may lead the insurer to argue your inaction caused more damage (e.g., mold).

- Pre-existing Maintenance Issues:If the backup was caused by a known, unaddressed issue, your claim could be denied for negligence.

- Not Having the Right Coverage:Many homeowners find too late they lack a specific water backup endorsement.

- Misunderstanding Exclusions:This coverage won’t pay to fix the broken pump or cover damage from an external flood.

- Throwing Away Damaged Items:Keep all damaged property as proof of loss until your adjuster gives you approval to dispose of it.

Learn more about these issues in our guide onReasons Why Your Property Insurance Claim Can Be Denied.

The Role of a Public Adjuster

Insurance companies have experts working to minimize payouts. A public adjuster levels the playing field by advocating for your interests.

- Expert Damage Assessment:We identify hidden damage that is often missed, such as trapped moisture that leads to mold.

- Policy Interpretation:We understand complex insurance language and ensure you receive every benefit your policy allows.

- Skilled Negotiation:We are trained negotiators who work to maximize your settlement, countering the tactics used by insurance company adjusters.

- Maximizing Your Settlement:Our primary goal is to ensure you get the full amount you’re entitled to. We’ve seen initial offers of $30,000 increase to over $115,000 after our intervention.

Having a professional on your side provides peace of mind and dramatically improves your financial outcome. Find out more aboutWhy Hire a Public Adjuster?.

Frequently Asked Questions about Water Backup Claims

Water backup coverage can be confusing. Here are straight answers to the most common questions we hear from homeowners.

How much water backup coverage should I buy?

The right amount of coverage depends on your specific risk. There’s no one-size-fits-all answer. To determine your need, follow these steps:

- Assess your risk.Do you have a finished basement? Is your home in a low-lying area or have old plumbing? Higher risk means you need more coverage.

- Inventory your basement or lower levels.Add up the replacement cost of flooring, drywall, furniture, electronics, and stored personal belongings. Homeowners are often shocked to find they have $25,000 or more worth of property at risk.

- Factor in remediation costs.A serious backup, especially with contaminated water, can require professional mold remediation, which can cost $10,000-$20,000 or more.

Our recommendation:Opt for higher limits. The premium difference between $10,000 and $25,000 in coverage is often small but can save you from significant out-of-pocket costs. A finished basement can easily require $50,000 or more in coverage to be fully protected against a worst-case scenario.

Does water backup coverage pay for the broken pipe or sump pump?

No, this is a common misconception. Water backup coverage is designed to pay for the resulting damage—the mess, not the machine.

Your policy will help pay to replace ruined flooring, drywall, and furniture. However, the cost of buying and installing a new sump pump or hiring a plumber to clear a clogged sewer line is typically considered a homeowner maintenance expense and is not covered.

An exception may beService Line Coverage, a separate endorsement some insurers offer. This can help cover repairs to the utility lines connecting your home to municipal services.

What’s the difference between water backup and flood insurance?

This is the most critical distinction in water damage coverage. The difference is where the water comes from.

Water Backup Coverageis for water that enters your home from theinside out. This means water coming up through drains, toilets, or sewers due to a clog or failed sump pump.

Flood Insuranceis for water that enters your home from theoutside in. This covers damage from natural sources like overflowing rivers, storm surges, or heavy surface runoff that enters your home from the exterior.

A simple way to think about it: if water comes up through a drain, it’s a water backup issue. If it comes in through a window well, it’s a flood issue.

Your standard homeowners policy and your water backup endorsement bothexcludeflood damage. You must purchase a separate flood insurance policy for that protection.

Don’t Steer Your Claim Alone

A water backup is a serious financial event, not just a messy inconvenience. Theaverage water backup claimcan cost thousands and cause months of stress. Resolving these claims is complex, and homeowners are often at a disadvantage against experienced insurance companies.

Insurance policies are complicated, and adjusters work for the insurer, not for you. This is why many water backup claims areunderpaid or denied. Homeowners may not know they’re entitled to additional living expenses or may accept a lowball offer before the full extent of the damage, like mold, is known.

AtGlobal Public Adjusters, Inc., we have over 50 years of experience leveling the playing field for Florida homeowners. We know how to document water damage, identify hidden costs, and negotiate effectively with insurance companies.

When you hire us, you get an expert advocate dedicated to your claim. We handle the paperwork, the inspections, and the negotiations, allowing you to focus on your recovery. Our single goal is tomaximize your settlementso you can restore your home without draining your savings.

The peace of mind that comes from having a professional fighting for you is priceless. You’ve already dealt with the stress of the damage; let us handle the stress of the claim.

Ready to get the settlement you deserve?Contact us for help with your Water Damage Claim in Orlandoand let’s get started on maximizing your water backup claim today.