AC Leak Damage Insurance Claim 2025: Maximize Payout!

When Your AC Turns from Cooling Hero to Water-Spewing Villain

Anac leak damage insurance claimcan be overwhelming, but understanding what’s typically covered helps you take the right steps. Most homeowners insurance policies cover water damage from an AC leak if it’s sudden and accidental, not caused by neglect. However, the policy usually only covers the resulting water damage to your home (walls, floors, ceilings), not the AC unit repair itself.

Quick Answer: Does Insurance Cover AC Leak Damage?

- Usually YESfor sudden, accidental water damage to your property

- Usually NOfor gradual leaks, poor maintenance, or normal wear and tear

- Usually NOfor repairing the AC unit itself (unless damaged by a covered peril like fire or vandalism)

- Typical coverage limits: $5,000 to $10,000 for water damage

- Average claim timeline: 30-60 days to settle

Water damage from AC leaks can sneak up on you, causing thousands in repairs. A seemingly minor leak can damage ceilings, walls, flooring, insulation, and electrical systems. The confusion often starts right away:Is this covered? Will my claim be denied because I didn’t change the filter last month?These questions are stressful, especially when you’re already dealing with water-stained ceilings and the musty smell of potential mold.

Understanding AC Leak Damage and Insurance Coverage

Water damage claims are common, yet confusing. Your homeowners insurance is designed to protect you fromsudden and accidentalevents—not from issues that happen slowly or could have been prevented with regular upkeep. This distinction is critical for yourac leak damage insurance claim.

If your AC suddenly develops a leak that floods your ceiling overnight, that’s typically covered. But if you’ve ignored a slow drip for months, the insurance company will likely argue that’s “negligence” or “lack of maintenance,” a common reason for denial.

Most policies includedwelling coverage(for the physical structure of your home) andpersonal property coverage(for your belongings). When an AC leak damages your drywall, dwelling coverage applies. If it ruins your furniture, personal property coverage would be used.

Water can travel far from the source, so a leak in the attic might show up as a stain on your living room ceiling. By the time you spot it, the damage can be widespread. This is especially true in Florida, where AC units work overtime. For more help spotting issues, see our guide onSome Signs of Water Damage in Your Home.

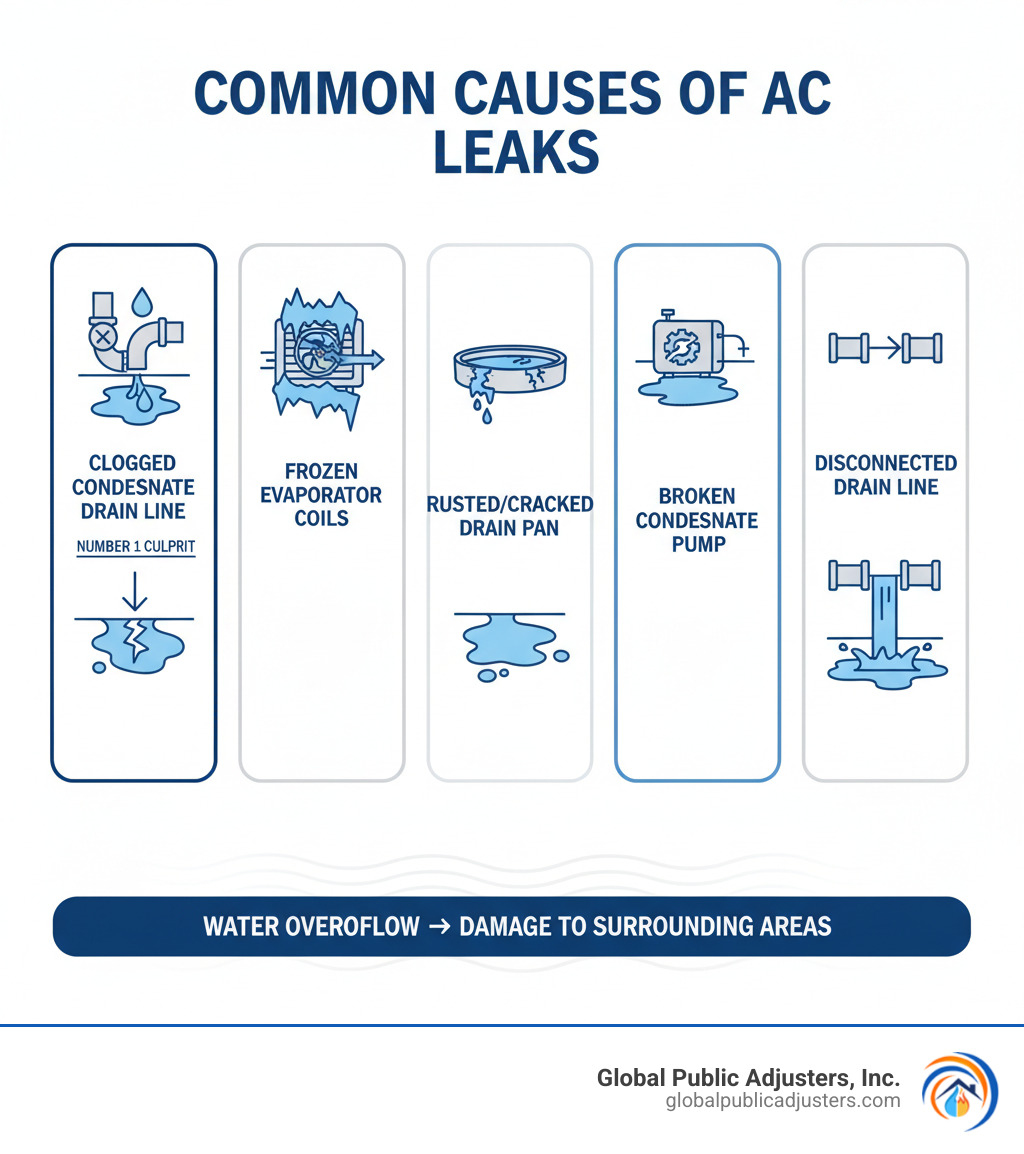

Common Causes of AC Leaks

Knowing why AC leaks happen can save you headaches. Most are preventable and stem from a few key issues:

- Clogged Condensate Drain Line: The number one culprit. Algae, mold, and dust build up, creating a blockage. Water backs up and overflows into your ceiling or walls.

- Frozen Evaporator Coils: Restricted airflow (usually from a dirty filter) causes coils to freeze. When they thaw, the excess water overwhelms the drain pan.

- Rusted or Cracked Drain Pans: In older units, these pans corrode or crack, allowing condensation to drip straight through.

- Broken Condensate Pump: If your unit is in a basement or attic, this pump actively removes water. If it fails, water accumulates and spills.

- Disconnected Drain Lines: Vibration or maintenance can loosen drain lines, causing water to go everywhere except where it should.

TheDepartment of Energyhas more information on common air conditioner problems.

Is it the AC Unit or the Water Damage That’s Covered?

This is a crucial distinction. Your insurance likely covers the damagecaused bythe leak, but not the AC unit itself.

For example, if a clogged drain line floods your ceiling, your policy will typically pay to repair the drywall, paint, and insulation. It will not, however, pay to unclog the drain line or fix the AC unit. Insurance views the AC unit as a mechanical system subject to wear and tear, and its maintenance is your responsibility.

There is an important exception: if your AC unit is damaged by acovered peril—like a fire, lightning strike, or vandalism—your policy may cover repairing or replacing the unit itself, along with any resulting water damage.

Most policies have water damage coverage limits, often from$5,000 to $10,000. This covers structural repairs and damaged belongings, not the HVAC repair. The key takeaway is that insurance helps with theconsequencesof the leak, not thecause. OurWater Damage Claims Orlandoguide can help you steer the process.

The Step-by-Step Guide to Your AC Leak Damage Insurance Claim

When you find water from your AC unit, how you respond in the first few hours can make or break yourac leak damage insurance claim. You don’t need to panic; you just need a clear plan.

What to Do Immediately After Finding the Leak

Your insurance company expects you to take reasonable steps to prevent further damage. Quick action protects your home and strengthens your claim.

- Turn Off Your AC Unit: Switch the thermostat to “off.” For safety, flip the AC circuit breaker as well. This stops the flow of condensate water.

- Stop or Contain the Water: If you can do so safely, place a bucket under a drip or use towels to soak up standing water. Do not attempt risky repairs.

- Protect Your Property: Move furniture, rugs, and electronics away from wet areas. Use tarps or plastic sheeting to protect undamaged areas.

- Save All Receipts: The cost of buckets, towels, or even an emergency water extraction company may be reimbursable. Keep all invoices.

- Call an HVAC Professional: Get an expert to diagnose the cause of the leak. Their report is crucial documentation for your claim. For significant damage, ourWater Restoration Services Orlandoteam can help with mitigation.

How to Document and File Your AC Leak Damage Insurance Claim

Proper documentation is where claims are won or lost. Without proof, even legitimate claims can be denied or underpaid.

- Take Photos and Videos: Before cleaning up, document everything. Get wide shots of the scope of the damage and close-ups of water stains, warped flooring, and the AC unit itself. Narrate a video walkthrough, noting the date and damage.

- Keep a Detailed Log: Write down the date and time you found the leak, what you observed, actions you took, and every conversation with your insurance company.

- Get Professional Estimates: Obtain at least two itemized estimates from qualified contractors for all repair work, including water damage restoration and mold remediation.

- Gather Maintenance Records: If you have records of regular servicing, they can help prove you weren’t negligent.

- File Your Claim: Contact your insurance company and report the facts. State what happened and what steps you’ve taken. Avoid speculating or admitting fault.

Our guide on theHomeowners Claim Process Orlando FLcan help you understand what comes next.

What to Expect During the Adjuster’s Inspection

After you file, the insurance company will send their adjuster to inspect your property.The company adjuster works for the insurance company, not for you.Their job is to assess the damage in a way that protects their employer’s bottom line.

The adjuster will take photos, make measurements, and create a “scope of loss.” This initial assessment often underestimates the true extent of damage, especially hidden issues like moisture inside walls. They will ask questions to determine if the event was sudden and accidental or the result of neglect.

Be present during the entire inspection.Walk with the adjuster, point out every area of damage, and provide your own photos and contractor estimates. Highlight issues they might miss, like a musty smell indicating hidden mold. The adjuster’s report is the insurance company’s opening position, and their first settlement offer is usually negotiable. This is where having professional help from a team like ours atProperty Damage Claims Orlandocan make a significant difference.

Navigating Potential Problems: Denials, Payouts, and Timelines

Even if you do everything right, yourac leak damage insurance claimcan hit roadblocks. Claims get denied, settlement offers are too low, and the process can feel endless. Understanding why this happens can help you protect yourself.

Common Reasons an AC Leak Damage Insurance Claim is Denied

Insurance companies often deny claims for a few common reasons:

- Lack of Maintenance or Negligence: The most frequent reason. If the adjuster finds the leak was from a clogged drain line or rusted pan that showed long-term deterioration, they’ll argue the damage was preventable.

- Age of Your AC Unit: If your unit is over 8-10 years old, the insurer may claim the failure was due to normal wear and tear, which isn’t covered.

- Gradual Damage: Policies cover “sudden and accidental” damage. A slow drip that went unnoticed for months may be denied.

- Policy Exclusions: Some policies have specific dollar limits for water damage or exclude mold coverage entirely.

- Improper Filing or Documentation: Unclear photos, an inconsistent timeline, or a lack of proof can be used to deny a claim.

Understanding Your Settlement: Payouts and Timelines

If your claim is approved, the payout and timeline are the next problems. Your payout depends on whether your policy usesReplacement Cost Value (RCV), which pays to replace items with new ones, orActual Cash Value (ACV), which deducts for depreciation. ACV payouts are lower and may not cover the full cost of repairs.

Remember yourdeductible—the amount you pay before insurance kicks in. Policies also havecoverage limitsfor water damage, typically $5,000 to $10,000. Depending on the severity, payouts can range from $2,000 to over $20,000.

As fortimelines, mostac leak damage insurance claimstake 30-60 days to settle. Complex cases involving structural issues or mold take longer. Delays can also occur if there are disagreements over the scope of damage or if the insurer is slow to respond. In Florida, state regulations provide some protection for homeowners, but disputes can still drag things out.

The Role of a Public Adjuster and How to Prevent Future Leaks

When you’re dealing with anac leak damage insurance claim, especially a denied or underpaid one, you might feel like you’re fighting a losing battle. This is where a public adjuster can change everything. The insurance company’s adjuster works for them; a public adjuster works exclusively for you, the policyholder.

Why You Should Consider a Public Adjuster

We level the playing field by bringing expertise to your side. Here’s how we help:

- Policy Expertise: We understand the complex language of insurance policies and use it to your advantage, identifying all applicable coverage.

- Detailed Damage Valuation: We conduct our own thorough inspection, uncovering hidden damage that company adjusters often miss, like moisture in wall cavities or early mold growth.

- Negotiation Power: Fighting underpaid claims is our specialty. We negotiate aggressively with the insurance company to maximize your payout. We’ve seen AC leak settlements range from $2,000 to over $20,000.

- Stress Reduction: We handle the paperwork, phone calls, and back-and-forth negotiations, taking the burden off your shoulders so you can focus on getting your life back to normal.

Our team at Global Public Adjusters, Inc. has over 50 years of combined experience helping homeowners in Orlando and Pensacola. We know how to steer the obstacles insurance companies create. Learn more aboutWhy Hire a Public Adjuster for Property Damageand reviewWhat Questions Should You Ask Your Public Adjusterto guide your decision.

Proactive AC Maintenance to Prevent Water Damage

The bestac leak damage insurance claimis the one you never file. Regular maintenance can save you from water damage, insurance hassles, and major expenses.

- Schedule Annual Professional Servicing: An HVAC technician can spot potential problems like corrosion or partial blockages before they cause a leak.

- Change Air Filters Regularly: A clogged filter restricts airflow, which can cause coils to freeze and overflow when they thaw. Change filters every 1-3 months.

- Clean Your Condensate Drain Line: Every few months, flush the line with a mixture of distilled vinegar and water to prevent algae and mold buildup.

- Install a Drain Pan Alarm: These inexpensive devices detect water in the overflow pan and can shut off your AC or sound an alarm, preventing a catastrophe.

- Inspect Your Indoor Unit: Regularly look for pooling water, rust, or musty odors. Catching a small leak early is key.

Frequently Asked Questions about AC Leak Claims

Homeowners across Florida have many questions aboutac leak damage insurance claims. Here are answers to the most common ones.

Can a leaking AC unit cause mold, and is it covered?

Yes, a leaking AC unit is a perfect recipe for mold, which needs only moisture, darkness, and an organic food source like drywall. According to theEPA, this can create real health risks.

Whether mold is covered is complicated. If the mold is a direct result of asudden and accidental AC leakthat your policy covers, then remediation is typically covered too. However, if the mold grew from aslow, gradual leakor is tied to poor maintenance, your claim will likely be denied. Many policies also have low dollar limits (sub-limits) for mold remediation, such as $5,000 or $10,000, which may not cover the full cost.

Will my insurance rates go up if I file a claim?

It’s possible, but not guaranteed. The impact depends on your claim history, the severity of the claim, and your specific insurer’s policies. If this is your first claim in years, the impact may be minimal. If you’ve filed multiple recent claims, a rate increase is more likely.

For minor damage that costs only slightly more than your deductible, you might consider paying out of pocket. But for significant damage costing thousands of dollars, filing a claim is almost always the right call. This is what you pay premiums for.

How long does it take to settle an AC leak claim?

Mostac leak damage insurance claimssettle in30 to 60 days. However, the timeline can be longer depending on several factors:

- Claim Complexity: Extensive damage involving structural repairs or mold remediation takes more time to assess.

- Insurer Responsiveness: Some companies are efficient, while others are slow to process paperwork and schedule inspections.

- Disputes: Disagreements over the cause of the leak, the scope of damage, or the settlement amount will cause delays.

Providing thorough documentation upfront can help speed up the process. As public adjusters, we work to keep the process moving for our clients in Orlando and Pensacola by ensuring all documentation is solid and advocating for prompt, fair settlements.

Get the Settlement You Deserve for Your AC Leak

Navigating anac leak damage insurance claimdoesn’t have to be a nightmare. The most important things to remember are that your policy typically covers the resulting water damage—not the AC unit itself—and that the leak must be sudden and accidental.

Quick action and thorough documentation are the foundation of a successful claim. Turn off the AC, protect your property, and photograph everything. Likewise, proactive prevention is your best defense. Regular maintenance, clean filters, and professional servicing can save you thousands in repairs and the stress of filing a claim.

However, insurance companies don’t always offer what you truly deserve. They may miss hidden damage, undervalue repairs, or wrongly cite policy exclusions. That’s where we come in.

At Global Public Adjusters, Inc., we have over 50 years of experience fighting for homeowners across Florida. We know the challenges you face, from hidden mold to structural damage, and we work for you, not the insurance company. While their adjuster looks to minimize the payout, we document every inch of damage and negotiate relentlessly to maximize your settlement. We’ve helped clients secure payouts from a few thousand dollars to over $20,000.

Don’t add the burden of fighting your insurer to an already stressful situation. Let us handle the claim while you focus on getting your life back to normal.

If you’re facing water damage from an AC leak, we’re ready to help you steer the claims process and get every dollar you’re entitled to.