Bathroom Damage Claims: Maximize Your 2025 Payout

When Disaster Strikes: Understanding Bathroom Damage Claims

Bathroom damage claimsare one of the most common—and stressful—insurance claims homeowners face. Whether you’re dealing with a burst pipe, an overflowing toilet, or water seeping through your ceiling from an upstairs leak, knowing how to steer the claims process can mean the difference between a fair settlement and financial frustration.

Quick Answer: What You Need to Know About Bathroom Damage Claims

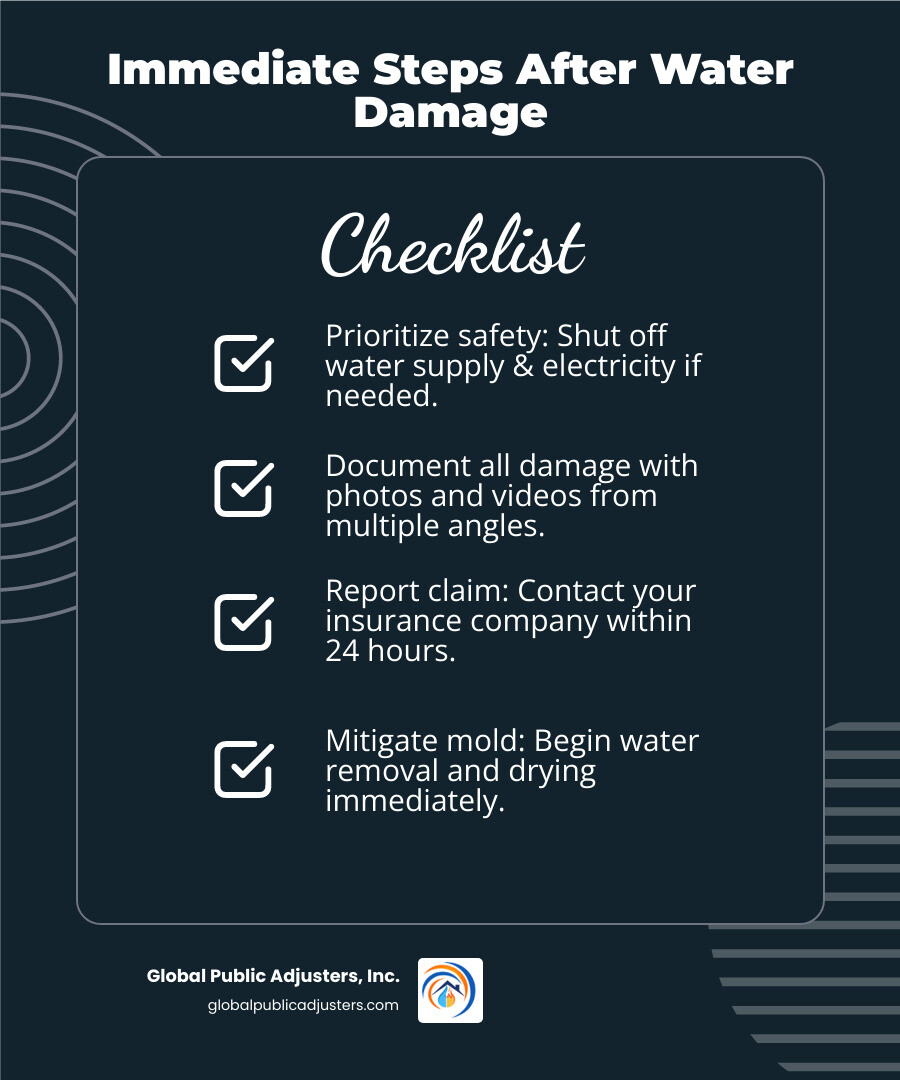

- Act Fast– Stop the water source and document damage within 24-48 hours before mold develops

- Check Your Policy– Standard homeowners insurance typically covers “sudden and accidental” water damage, but not gradual leaks or flood damage

- Document Everything– Take photos, videos, and keep detailed records of all damage and communications

- File Promptly– Report your claim to your insurance company immediately to avoid denial

- Understand Your Settlement– Know the difference between Actual Cash Value (ACV) and Replacement Cost Value (RCV)

- Consider Professional Help– For claims over $5,000 or denied claims, a public adjuster can maximize your settlement

The Reality of Water Damage

Nearly one in four home insurance claims results from water damage. From 2014-2016, water damage claims in the U.S. actuallyoutpacedlosses from fires and hurricanes combined.

The bathroom is particularly vulnerable. Laundry and utility areas account for 19% of water damage claims, with washing machine hose failures releasing over 500 gallons per hour. But bathrooms themselves face constant risks from aging pipes, toilet seal failures, and shower pan leaks.

Why This Guide Matters

When water invades your bathroom, you’re racing against time. Mold can begin developing within 24-48 hours of water exposure. Insurance companies have complex policies with specific exclusions, and the average water damage claim costs between $7,200 and well over $10,000.

This guide walks you through every step of thebathroom damage claimsprocess—from the moment you find water damage to negotiating your final settlement. You’ll learn what your policy actually covers, how to document damage properly, and when to call in professional help.

First Steps After Finding Bathroom Water Damage

Finding water damage in your bathroom can be startling, but acting quickly and methodically is crucial. Our immediate goal is to prevent further damage and ensure everyone’s safety.

First and foremost, prioritize safety. If the water damage is extensive or near electrical outlets, turn off the electricity to the affected area at your main breaker panel. Water and electricity are a dangerous combination.

Next, you need to stop the water flow. This might involve shutting off an individual water supply valve (often called a “stop”) located under your toilet or sink, or if the source isn’t immediately clear, turning off your home’s main water valve. Knowing how to shut off your water supply valves is a homeowner superpower. Your main water shut-off valve might require a wrench, so ensure you know its location and how to operate itbeforedisaster strikes.

Once the water flow is stopped, begin initial damage mitigation. If it’s safe, mop up excess water, use towels, and if you have one, a wet/dry vacuum. Move any unaffected personal property to a dry area. However, be cautious not to remove or lift flooring incorrectly, as this could cause additional damage.

As soon as the immediate crisis is under control, document everything. Take photos and videos of the damaged areas, the source of the leak (if identifiable), and any affected belongings. This evidence will be invaluable for yourbathroom damage claims.

When should you call a plumber? If you can’t locate the leak, or don’t know how to stop the water flow, a plumber is your first call. They can identify the source and make necessary repairs. When should you call a restoration company? If the water damage is significant, if the water contains sewage or toxic substances (Category 3 water, which we’ll discuss later), or if you’re concerned about hidden moisture, a professional water damage restoration company is essential. They have specialized equipment to dry out your home thoroughly and prevent mold. You can find more information onSome Signs of Bathroom Water Damagethat indicate professional help is needed.

Understanding the Urgency: Mold Growth and Timelines

Time is truly of the essence when dealing with water damage. The clock starts ticking for mold development almost immediately. Mold and mildew can begin to develop within 24 to 48 hours after water exposure. This isn’t just about aesthetics; mold can pose significant health risks, especially for individuals with respiratory issues or allergies.

The urgency of this timeline directly impacts yourbathroom damage claims. Most insurance policies require policyholders to report damage promptly. Delays in reporting can lead to claim denials, as insurers may argue that your inaction exacerbated the damage, particularly concerning mold growth. Prompt action helps contain the damage and ensures you get the support you need from your insurer.

What to Document Immediately

Thorough documentation is the backbone of any successful insurance claim. Forbathroom damage claims, this means capturing a comprehensive record of the damage as soon as it occurs and before significant cleanup or repairs begin.

Here’s what to document:

- Photo Evidence:Take numerous photos from different angles. Capture wide shots of the entire room, as well as close-ups of specific damage to walls, floors, ceilings, fixtures, and personal items. Ensure photos are clear and well-lit.

- Video Walkthroughs:A video walkthrough provides a dynamic record of the damage. Narrate what you’re seeing, pointing out specific affected areas and the estimated location of the leak source.

- Written Notes:Keep a detailed log. Include the date and time you finded the damage, what you observed, the steps you took to stop the water, and any initial mitigation efforts. Note down the brand, model, and approximate age of any failed appliances or components.

- Damaged Personal Property List:Create an inventory of all personal belongings affected by the water. For each item, list its description, brand, model, approximate age, and estimated replacement cost. If you have receipts or photos of items before the damage, include those.

- Keeping Receipts for Initial Expenses:Hold onto all receipts for any expenses incurred during the immediate aftermath, such as emergency repairs, water extraction, fans, dehumidifiers, or temporary housing. These costs may be reimbursable under your policy.

The more detailed your documentation, the stronger your claim will be. Remember to date all your photos, videos, and notes.

Understanding Your Homeowners Insurance Policy

Navigatingbathroom damage claimseffectively starts with understanding the nuances of your homeowners insurance policy. This document is your rulebook, outlining what’s covered, what’s excluded, and your responsibilities as a policyholder.

Take the time to review your policy thoroughly. Pay close attention to sections on water damage, covered perils, and exclusions. These sections will define the scope of your coverage. Policy limits specify the maximum amount your insurer will pay for different types of damage (e.g., dwelling, personal property). Your deductible is the amount you’re responsible for paying out-of-pocket before your insurance coverage kicks in. Knowing these details upfront will help manage your expectations and guide your actions.

Covered vs. Excluded: The “Sudden and Accidental” Clause

One of the most critical distinctions in water damage claims revolves around the “sudden and accidental” clause. Most standard homeowners insurance policies in Florida are designed to cover water damage that occurs suddenly and accidentally. This typically includes events like:

- Burst Pipes:A pipe that unexpectedly ruptures due to freezing, corrosion, or pressure.

- Appliance Malfunctions:Water damage from a washing machine hose failure (which can release over 500 gallons per hour!), a dishwasher leak, or a hot water heater rupture. 75% of water heater failures occur before their expected lifespan.

- Overflowing Fixtures:An overflowing toilet or bathtub, provided the overflow was sudden and accidental, not due to a known, unaddressed blockage.

However, many policies explicitly exclude damage that occurs gradually over time. This includes issues like:

- Slow Leaks:A persistent drip from a pipe or fixture that causes damage over weeks or months. Insurance policies usuallydon’t cover damage that occurs gradually.

- Maintenance-Related Issues:Damage resulting from a lack of proper home maintenance, such as deteriorating plumbing, old caulk, or ignored leaks. Insurers view these as preventable issues. For instance, supply line bursts for washing machines typically occur around 6-8 years of age, highlighting the importance of regular checks.

- Seepage:Water seeping through your home’s foundation or through improperly sealed areas over an extended period.

The distinction between “sudden and accidental” and “gradual” can be a point of contention with insurers. If the source of the leak isn’t immediately obvious, the insurance adjuster may try to deny your claim, arguing it was a gradual issue. This is where thorough documentation and, potentially, expert advocacy become crucial. UnderstandingHow Can Water Damage My Home?can help you identify potential coverage issues.

Water Damage vs. Flood Damage: A Critical Distinction

It’s a common misconception that all water damage is covered by a standard homeowners insurance policy. In reality, there’s a critical distinction between “water damage” and “flood damage” that can significantly impact yourbathroom damage claims.

Standard homeowners insurance policies typically cover water damage that originateswithinyour home, such as a burst pipe, appliance leak, or overflowing fixture. However, they almost universally exclude damage caused by a “flood.”

So, what constitutes a flood? According to the National Flood Insurance Program (NFIP), a flood is defined as a general and temporary condition of partial or complete inundation of two or more acres of normally dry land or of two or more properties (at least one of which is your property) from:

- Overflow of inland or tidal waters.

- Unusual and rapid accumulation or runoff of surface waters from any source.

- Mudflow.

This means that water damage from heavy rains, hurricanes, tropical storms, groundwater seepage, or storm surge entering your home from the outside is considered flood damage. In Florida, where we experience frequent tropical weather, this distinction is particularly vital. To protect your property from flood damage, a separate flood insurance policy, often available through theNational Flood Insurance Program, is required. Standard homeowners policies do not cover flood damage. For more specialized information onFlood Damage Claims Orlando, we can provide assistance.

Deciphering Your Settlement: ACV, RCV, and ALE

When your insurance claim is settled, you’ll encounter terms like Actual Cash Value (ACV), Replacement Cost Value (RCV), and Additional Living Expenses (ALE). Understanding these can significantly impact your payout forbathroom damage claims.

Here’s a quick breakdown:

| Feature | Actual Cash Value (ACV) | Replacement Cost Value (RCV) |

|---|---|---|

| Definition | The cost to replace damaged property minus depreciation. | The cost to replace damaged property with new items of similar kind and quality, without depreciation. |

| Depreciation | Deducted from the replacement cost. | Not deducted initially; recoverable once repairs/replacements are completed. |

| Payout | Lower initial payout. | Higher potential payout, often in two stages (ACV upfront, then depreciation once replaced). |

| “What it’s worth” | What your property is actually worth today. | What it would cost to replace the damaged item with a new one. |

Essentially, ACV represents what your property is worth today, accounting for wear and tear, while RCV covers the cost to replace it new. Most policies pay ACV first, then release the “recoverable depreciation” once you’ve actually replaced or repaired the items. Make sure you understand the difference betweenACV versus replacement costto avoid surprises.

Additional Living Expenses (ALE), also known as Loss of Use, is another crucial component. If your home becomes uninhabitable due to covered water damage, ALE coverage helps pay for increased living costs while your home is being repaired. This can include hotel stays, temporary rent, meals above your normal expenses, and even pet boarding. ALE applies when the damage is severe enough to force you out of your home, ensuring you can maintain your usual standard of living as much as possible.

How to File Successful Bathroom Damage Claims

Filingbathroom damage claimscan feel overwhelming, but a structured approach can significantly improve your chances of a successful outcome. The process generally involves reporting the claim, working with your insurance company’s adjuster, and eventually negotiating a fair settlement.

Step-by-Step: The Claims Filing Process

Here’s a step-by-step guide to filing your claim:

- Contact Your Insurer Promptly:As soon as you’ve mitigated the immediate damage and ensured safety, contact your insurance company. Most carriers maintain 24/7 hotlines. Prompt reporting is key, as delays can lead to claim denials.

- Provide Notice:When you call, be ready to provide details about the incident: when it happened, what was damaged, and the steps you’ve taken to mitigate further loss.

- Obtain a Claim Number:Once you’ve reported the incident, your insurer will assign a claim number. Keep this number handy for all future correspondence.

- Initial Assessment:The insurer will conduct an initial assessment, often over the phone. They’ll ask questions to determine if the damage falls under your policy’s coverage.

- Schedule the Adjuster Visit:An insurance adjuster will be assigned to your claim and will schedule a visit to your property to assess the damage in person. Be prepared to walk them through the affected areas and present your documentation (photos, videos, inventory).

For a more general overview, Kin provides a helpful guide onHow to file a home insurance claim for water damage. For specific insights into the process in our area, you can also review information on theHomeowners Claim Process Orlando, FL.

Essential Documentation for Your Bathroom Damage Claims

We can’t stress this enough: documentation is your best friend when filingbathroom damage claims. The more thoroughly you document, the stronger your position will be.

- Detailed Inventory of Damaged Items:Beyond just listing items, include descriptions, brands, models, serial numbers, approximate age, and original purchase price if possible. Attach receipts or credit card statements if available.

- Contractor Repair Estimates:Obtain multiple written estimates from reputable, licensed contractors for the repairs needed. These estimates should be detailed, breaking down costs for labor, materials, and any necessary demolition or remediation. This provides a strong basis for your negotiation.

- Photos and Videos of Damage:This includes before-and-after photos (if you have them), photos of the leak source, wide shots of affected rooms, and close-ups of specific damage to property and belongings. Date-stamped evidence is ideal.

- Communication Log with Insurer:Maintain a meticulous log of all interactions with your insurance company. Record dates, times, names of individuals you spoke with, what was discussed, and any agreements or disagreements. Keep copies of all emails and letters.

- Proof of Loss Form:Your insurer may require you to complete a “Proof of Loss” form. This is a sworn statement detailing your loss, and it’s crucial to complete it accurately and within the specified timeframe.

This comprehensive documentation will be invaluable for yourProperty Damage Claims Orlando.

Understanding Water Categories and Their Impact

Not all water damage is created equal, and insurance companies categorize water based on its level of contamination. These categories significantly impact the restoration process, health risks, and ultimately, yourbathroom damage claims.

Category 1: Clean Water

According to Northern Arizona University,Category 1 water damage is defined as“Water originating from a source that does not pose substantial harm to humans. Category 1 water is also referred to as ‘clean water.’” This means it’s sanitary and typically comes from sources like a broken water supply line, a bathtub overflow with no contaminants, or melting ice. While less hazardous, it still requires prompt attention to prevent it from degrading into Category 2 or 3.Category 2: Grey Water

Experts at Northern Arizona University state thatCategory 2 water damage is defined as“Water containing a significant degree of chemical, biological and/or physical contamination and having the potential to cause discomfort or sickness if consumed by or exposed to humans.” This “grey water” might come from a washing machine overflow, a dishwasher discharge, or a toilet overflow containing urine but no feces. It carries a higher risk of illness if ingested or exposed to, and restoration requires more caution.Category 3: Black Water

Northern Arizona University researchers indicate thatCategory 3 water damage is defined as“Grossly unsanitary water containing pathogenic agents, arising from sewage or other contaminated water sources and having the likelihood of causing discomfort or sickness if consumed or exposed to humans.” This “black water” is the most hazardous, originating from sewage backups, toilet overflows with feces, or rising floodwaters. It’s highly contaminated and poses severe health risks.

The category of water directly influences the restoration methods, the need for specialized equipment, and the scope of work. Black water, for instance, often requires extensive demolition and sanitization of affected materials, which dramatically increases the cost and complexity of the claim. This, in turn, impacts the value of your settlement. Insurers will assess the water category to determine appropriate remediation and coverage.

Navigating Challenges and Maximizing Your Settlement

Even with meticulous documentation,bathroom damage claimscan present challenges. It’s not uncommon for policyholders to face lowball offers, unreasonable delays, or even outright claim denials. These situations can add immense stress to an already difficult time, and can even lead to increased premiums or policy non-renewal, especially if you’ve filed multiple claims within a short period.

The Role of a Public Adjuster in Bathroom Damage Claims

This is where a public adjuster becomes your invaluable advocate. Unlike the insurance company’s adjuster, who works for the insurer, a public adjuster worksexclusively for you, the policyholder. Our role at Global Public Adjusters, Inc. is to level the playing field.

- Policyholder Advocate:We represent your best interests, ensuring your rights are protected throughout the claims process.

- Independent Damage Assessment:We conduct our own thorough inspection and independent assessment of the damage, often uncovering hidden issues that the insurance company’s adjuster might overlook. This includes identifying the correct water category and the full extent of structural and personal property damage.

- Policy Interpretation:Insurance policies are complex legal documents. We have the expertise to interpret your policy’s language, ensuring all applicable coverages are identified and applied to your claim. We challenge any misinterpretations or unfair exclusions.

- Negotiating with the Insurance Company:We handle all communications and negotiations with your insurance company, presenting a well-documented and professionally prepared claim. Our goal is to counter lowball offers and advocate for a fair settlement that fully covers your losses.

- Maximizing Your Settlement:With over 50 years of combined experience, our focus is on maximizing your settlement. We ensure that every detail of your loss is accounted for, from immediate repairs to potential long-term issues like mold remediation, ensuring you receive the compensation you deserve.

When you’re dealing with the stress of water damage and complex insurance policies, having an expert on your side can make all the difference. Learn more aboutWhy Hire a Public Adjuster?

Choosing a Reputable Restoration Company or Contractor

After water damage, you’ll likely need to hire professionals for cleanup and repairs. Choosing the right restoration company or contractor is crucial to ensure proper remediation and prevent future issues.

Here’s what to consider:

- IICRC Certification:Look for companies certified by the Institute of Inspection, Cleaning and Restoration Certification (IICRC). This signifies they meet industry standards for water damage restoration.

- Licensing and Insurance:Always verify that the company is properly licensed and insured in Florida. This protects you from liability if workers are injured or if additional damage occurs during the restoration process.

- Local References:Ask for references from previous clients, especially those with similar types of water damage. Check online reviews and their standing with the Better Business Bureau.

- Detailed Estimates:Obtain written, itemized estimates that clearly outline all costs, including labor, materials, equipment rental, and timeline. Be wary of vague or unusually low bids.

- Avoiding Scams:Be cautious of companies that pressure you into signing contracts immediately, demand large upfront payments, or solicit door-to-door after a disaster.

A reputable company will work with your public adjuster to ensure all necessary work is performed and properly documented for your claim. For assistance with cleanup and restoration, we can connect you with trusted professionals offeringWater Restoration Services Orlando.

Proactive Prevention: How to Avoid Future Water Damage

While we’re here to help when disaster strikes, prevention is always the best strategy forbathroom damage claims. Many water damage incidents are preventable with regular maintenance and smart home solutions.

Here are proactive steps you can take:

- Regular Inspections:Periodically inspect your bathroom for signs of leaks. Look under sinks, around toilets, and in shower areas for discoloration, musty smells, or visible moisture.Contact a professionalif you notice signs of leaks.

- Grout and Caulk Maintenance:The caulk around your tub, shower, and sink, along with the grout in your tiles, is your first line of defense against water intrusion. Inspect it regularly for cracks or deterioration and re-caulk or re-grout as needed.

- Checking Supply Lines:Inspect the supply lines to your toilets, sinks, and washing machine. Replace rubber hoses with more durable metal mesh connection hoses, especially for washing machines (supply line bursts typically occur around 6-8 years of age).

- Appliance Upkeep:Maintain your water heater according to manufacturer recommendations. Flushing it every six months can help prevent sediment buildup and extend its life. 75% of water heater failures occur before their expected lifespan.

- Water Leak Detectors:Consider installing smart water leak detectors in high-risk areas like under sinks, near toilets, and behind washing machines. These devices can alert you to leaks early, allowing you to address them before they become major problems. Some even come with automatic shut-off valves.

By following these tips, you can significantly reduce the risk of future water damage. For more detailed guidance, exploreHow to Help Detect and Prevent Bathroom Leaksand understandWhere Can Bathroom Leaks Occur?in your home.

Conclusion

Navigatingbathroom damage claimscan be a complex and stressful journey, but with the right knowledge and support, you can achieve a fair settlement. We’ve walked through the crucial steps: from immediate action and meticulous documentation to understanding your policy’s nuances and the different categories of water damage. Acting quickly to stop the water and document the damage is paramount, especially given how rapidly mold can develop. Understanding the distinction between “sudden and accidental” water damage and excluded “gradual” damage or “flood” damage is key to interpreting your policy.

While the process can be challenging, you’re not alone. The value of professional help, particularly from a public adjuster, cannot be overstated when facing complexbathroom damage claims, lowball offers, or outright denials. We work for you, assessing the true extent of your damage, interpreting your policy, and negotiating with your insurance company to maximize your settlement.

If you’re facing a difficult claim, learn more about how we handleBathroom Damage Claims in Orlando.Our team at Global Public Adjusters, Inc. is here to advocate for your best interests, ensuring you receive the full compensation you deserve to restore your home and peace of mind.