Insurance claims for mold damage: 5 Powerful Truths for 2025

Why Mold Insurance Claims Are So Complicated

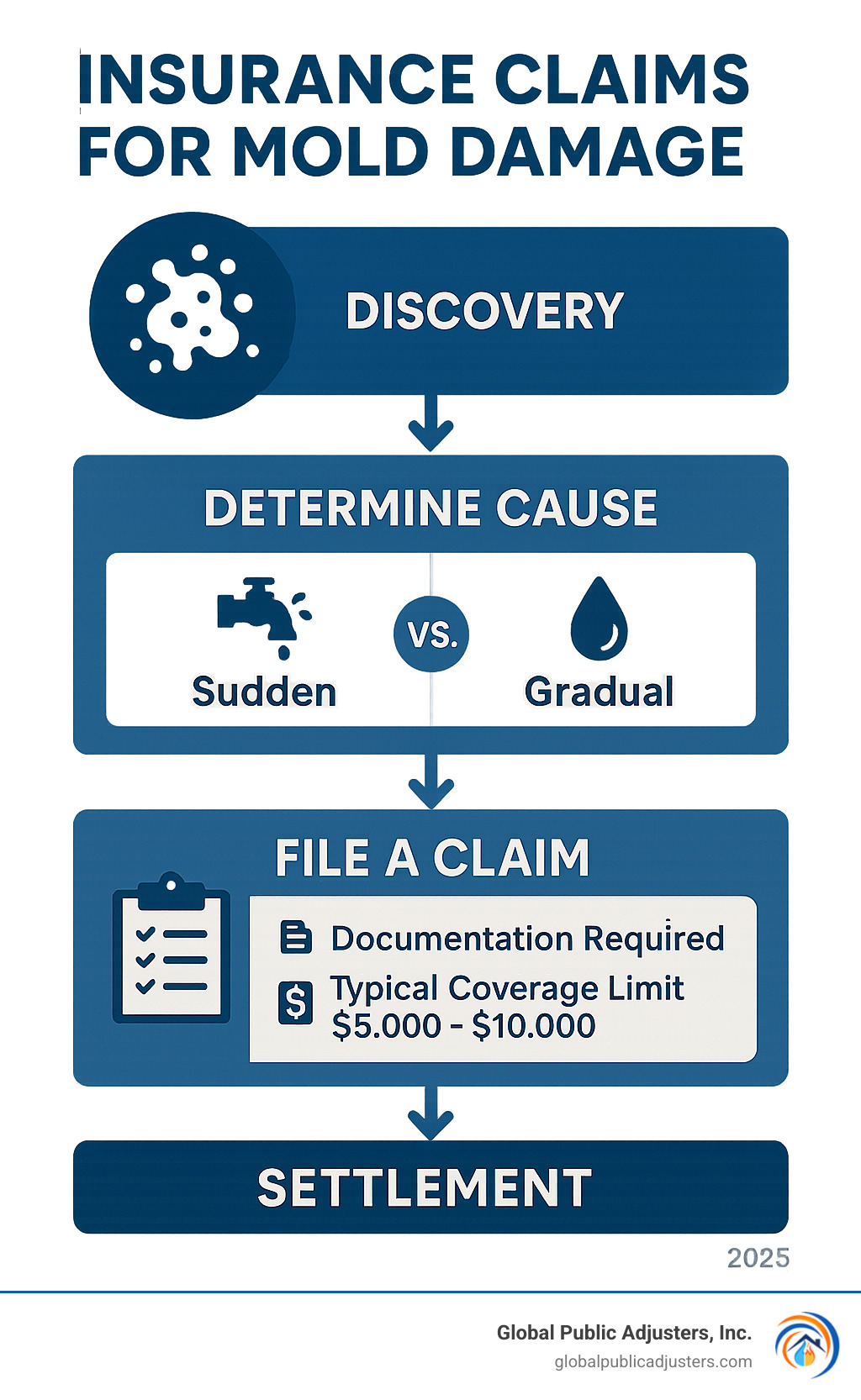

Insurance claims for mold damageare among the most challenging property insurance claims to steer. Unlike fire or wind damage, mold coverage depends heavily onwhat causedthe moisture problem in the first place.

Quick Answer: When Mold Claims Are Covered

- Sudden water events: Burst pipes, appliance overflows, toilet backups

- Storm-related leaks: Roof damage from wind or hail

- Fire suppression water: Mold from firefighting efforts

- Coverage limits: Usually capped at $5,000-$10,000

- Not covered: Gradual leaks, poor ventilation, humidity, neglect

The challenge isn’t just whether you have coverage—it’s proving your mold problem qualifies. Insurance companies often deny mold claims by arguing the damage resulted from “maintenance issues” rather than a covered event.

Why This Matters Now

Mold remediation costs typically range from $3,000 to $30,000 in North America. In severe cases, you might need to temporarily relocate while your home undergoes extensive remediation. Without proper insurance coverage, these costs come straight out of your pocket.

The key is understandingwhenyour policy covers mold damage andhowto document your claim properly. Many homeowners find too late that their “sudden” pipe leak was actually a slow drip that invalidates their coverage.

Handyinsurance claims for mold damageterms:

- construction delays claim from mold water damage

- florida attorneys mold and water damage claims

- commercial mold damage claim florida

Mold 101: What It Is, Why It Grows, and Health Risks

Think of mold as nature’s recycling crew—it breaks down organic matter everywhere, from fallen leaves in your yard to that forgotten sandwich in your fridge. While mold serves an important purpose outdoors, it becomes a serious problem when it sets up shop inside your home.

Mold is simply a fungus that spreads through tiny, invisible spores floating through the air.These microscopic hitchhikers land on surfaces throughout your home every day. Most of the time, they just sit there doing nothing. But when they find the perfect conditions, they spring into action faster than you might expect.

Here’s what mold needs to throw its own growing party:moisture(the VIP guest),something organic to munch onlike wood or drywall,comfortable temperaturesbetween 60-80°F, and just24 to 48 hoursto get started. Remove any one of these elements, and the party’s over.

The Three Types of Household Mold

Allergenic moldslike Cladosporium and Alternaria are the most common troublemakers, causing sneezing, watery eyes, and asthma flare-ups.Pathogenic molds, including Aspergillus, can actually cause infections, especially in people whose immune systems are already fighting other battles.Toxigenic moldsare the scary ones you hear about on the news. Stachybotrys—often called “black mold”—produces mycotoxins that can cause severe health problems.

Health symptoms from mold exposurerange from mild to serious. You might experience respiratory problems, allergic reactions like runny nose and red eyes, headaches, fatigue, or in severe cases, neurological symptoms.

When it comes toinsurance claims for mold damage, understanding what type of mold you’re dealing with can significantly impact your claim’s success. For more insights on how mold affects your property value and structural integrity, check outHow Can Mold Damage My Home?

Where Does Mold Hide in a Home?

Mold is like a detective—it always follows the moisture clues.Bathroomstop the list because of all that steam from hot showers.Kitchenscreate their own moisture problems through cooking steam and dishwashing.Basements and crawl spacesoften feel like mold’s favorite vacation spots—cool, damp, and often forgotten.

Laundry roomswith poor ventilation can develop mold around washing machines and dryers.HVAC systemscan harbor mold in ductwork, particularly when there’s been water intrusion or poor maintenance.Windowsillswhere condensation regularly occurs can develop mold growth.

Atticsoften surprise homeowners with mold growth, especially when roof leaks occur or when bathroom exhaust fans vent into the attic space instead of outside where they belong.

Health Risks & Vulnerable Groups

While mold can affect anyone, some people face much higher risks.Children and infantshave developing immune systems and smaller airways.Elderly individualsoften have compromised immune systems or existing respiratory conditions that mold can worsen.People with asthma or allergiesoften experience severe reactions to mold spores.Immunocompromised individualsface the most serious risks.

Understanding these health risks is crucial when filinginsurance claims for mold damagebecause the severity of health impacts can influence both the urgency of remediation and the scope of your claim. For comprehensive information about different mold types and their specific health impacts,scientific research on indoor mold typesprovides valuable insights.

Additional research from theEPA on mold and healthoffers detailed information about exposure symptoms and when to seek medical attention.

Does Home Insurance Cover Mold? Understanding Policy Language

Most standard homeowners insurance policies treat mold coverage like a puzzle with very specific pieces that have to fit together perfectly.

The golden rule is simple but strict: Your insurance will only coverinsurance claims for mold damagewhen the mold results from a “sudden and accidental” event that’s already covered by your policy. This concept is called the “ensuing loss doctrine”—basically, if a covered disaster causes water damage, and that water damage leads to mold, then you might have coverage for the cleanup.

Think of it this way: if a pipe bursts behind your wall on Tuesday and you find mold growing there two weeks later, that’s likely covered. But if that same pipe has been slowly dripping for six months and finally created a mold problem, your insurer will probably say “sorry, that’s maintenance, not an accident.”

Coverage caps are the next curveball. Even when mold damage is covered, most policies put a lid on how much they’ll pay—typically between $5,000 and $10,000. Given that professional mold remediation can easily cost $15,000 to $30,000 (or more in severe cases), these caps often leave homeowners scrambling to cover the difference.

Your policy’s exclusions matter more than you might think. Standard homeowners insurance typically won’t cover mold damage from flooding, sewer backups, long-term leaks, poor maintenance, or high humidity.

For expert guidance on navigating these complex claims,Why Hire a Public Adjuster for Mold Damage?explains how professional advocacy can help maximize your settlement.

TheScientific research on moisture controlprovides valuable insights into preventing moisture problems that could lead to claim denials.

When Mold IS Covered

Burst pipesare the classic covered scenario. When a pipe suddenly fails behind a wall and creates mold growth, this typically qualifies as a covered event.Appliance overflowsusually get approval too.Fire suppression water damageis another covered situation.Storm-related water intrusionworks when Mother Nature damages your roof.

When Mold Is NOT Covered

High humidityproblems won’t get you anywhere with your insurer.Poor ventilationfalls into the same category.Gradual leaksare coverage killers.Flood damagerequires separate flood insurance through the National Flood Insurance Program (NFIP).Sewer backupissues need a specific endorsement.Neglectis the ultimate claim killer.

Add-On Coverages Worth Considering

Water backup coveragecan be a lifesaver. This endorsement covers water damage from sewer or drain backups.Hidden water damage coverageaddresses water damage that occurs behind walls or under floors.Flood insurancebecomes essential if you’re in a flood-prone area.Mold endorsementsbump up your coverage limits from the standard $5,000-$10,000 to $25,000 or more.

The cost-benefit analysis often favors these add-ons, especially in humid climates like Florida. The annual cost of additional coverage is typically much less than the potential out-of-pocket expenses for a single mold remediation project.

Filing Insurance Claims for Mold Damage: Step-by-Step

When you find mold in your home, your first instinct might be panic. Take a deep breath—insurance claims for mold damageare definitely complex, but with the right approach, you can steer this process successfully.

Time is absolutely criticalwhen filing mold claims. The moment you spot mold growth, contact your insurance company within 24-48 hours. Follow up your phone call with written notice via email or certified mail.

Document everything before touching anything.Grab your phone and start taking photos and videos of all visible mold and water damage. Capture wide shots showing the affected area in context, then zoom in for detailed close-ups. Create a detailed inventory of damaged items and affected areas.

Your duty to mitigate further damage begins immediately.Turn off water sources if possible, use dehumidifiers to reduce humidity, and remove wet materials that can’t be dried within 48 hours. Avoid spending time in affected areas to prevent spore spread.

Professional assessment strengthens your position significantly.Hire a certified mold inspector to assess the contamination extent and identify the moisture source. Get written estimates from licensed mold remediation companies. Don’t rely on just one estimate—multiple professional opinions carry more weight with adjusters.

Review your policy carefullyto understand your mold coverage limits, exclusions, and requirements. Most policies cap mold coverage at $5,000-$10,000, which often falls short of actual remediation costs.

Consider professional advocacy early in the process.Given the complexity of mold claims, many homeowners benefit from hiring a public adjuster who specializes in these cases.

For specific guidance on Orlando-area mold claims, visitMold Damage Claims OrlandoandNavigating Mold Damage Claims: Expert Assistance in Orlando FL with Global Public Adjusters Inc.

| DIY Remediation | Professional Remediation |

|---|---|

| Areas under 10 sq ft | Areas over 10 sq ft |

| $200-$500 in materials | $3,000-$30,000+ |

| Risk of incomplete removal | Certified complete removal |

| No warranty | Warranty provided |

| Potential health exposure | Proper safety protocols |

Documentation Needed for Insurance Claims for Mold Damage

Strong photographic evidence forms the backbone of successful mold claims.Take photos from multiple angles showing the extent of mold growth. Include both close-ups that clearly show the mold and wide shots that put the affected area in context.

Professional reports carry significant weight with insurance adjusters.Lab reports from mold testing, professional assessments from certified inspectors, and written remediation plans all strengthen your position.

Maintenance records prove you’ve been a responsible homeowner.Keep records of regular home maintenance, HVAC servicing, and any previous water damage repairs.

Timeline documentation protects you from coverage disputes.Maintain a detailed log of when you found the mold, when you reported it, and all communications with your insurer.

Working with Adjusters on Insurance Claims for Mold Damage

Understanding the adjuster’s perspective helps you prepare for negotiations.Insurance adjusters are trained to minimize claim payouts, and they’ll look for reasons to deny or reduce your claim.

Scope of work disputes are common in mold claims.Adjusters frequently challenge the extent of remediation work. Professional remediation companies can provide detailed scopes of work that justify necessary procedures.

The initial reserve amount isn’t your final settlement.The adjuster will set a “reserve” amount for your claim based on their initial assessment. This is just their estimate of potential costs, not a ceiling on your settlement.

Don’t accept the first settlement offer.Most initial settlements are low, especially for mold claims. Use professional estimates and expert opinions to negotiate higher settlements.

Appealing a Denied Mold Claim

Common denial reasons follow predictable patterns.Insurers often claim the damage resulted from “maintenance issues,” argue the water damage was “gradual” rather than sudden, or invoke policy exclusions.

Building a strong appeal requires expert support.Obtain opinions from certified mold inspectors who can refute insurer arguments. Consider hiring a public adjuster to advocate for your position.

The formal appeal process has strict deadlines.Most insurers have internal appeal processes that require written submissions within specific timeframes. You may need to pursue appraisal, mediation, or legal action if internal appeals fail.

Prevention and Risk Reduction: Keep Mold—and Claim Denials—at Bay

The smartest approach toinsurance claims for mold damageis avoiding them altogether. Prevention isn’t just about protecting your health—it’s about maintaining your insurability and avoiding those dreaded claim denials.

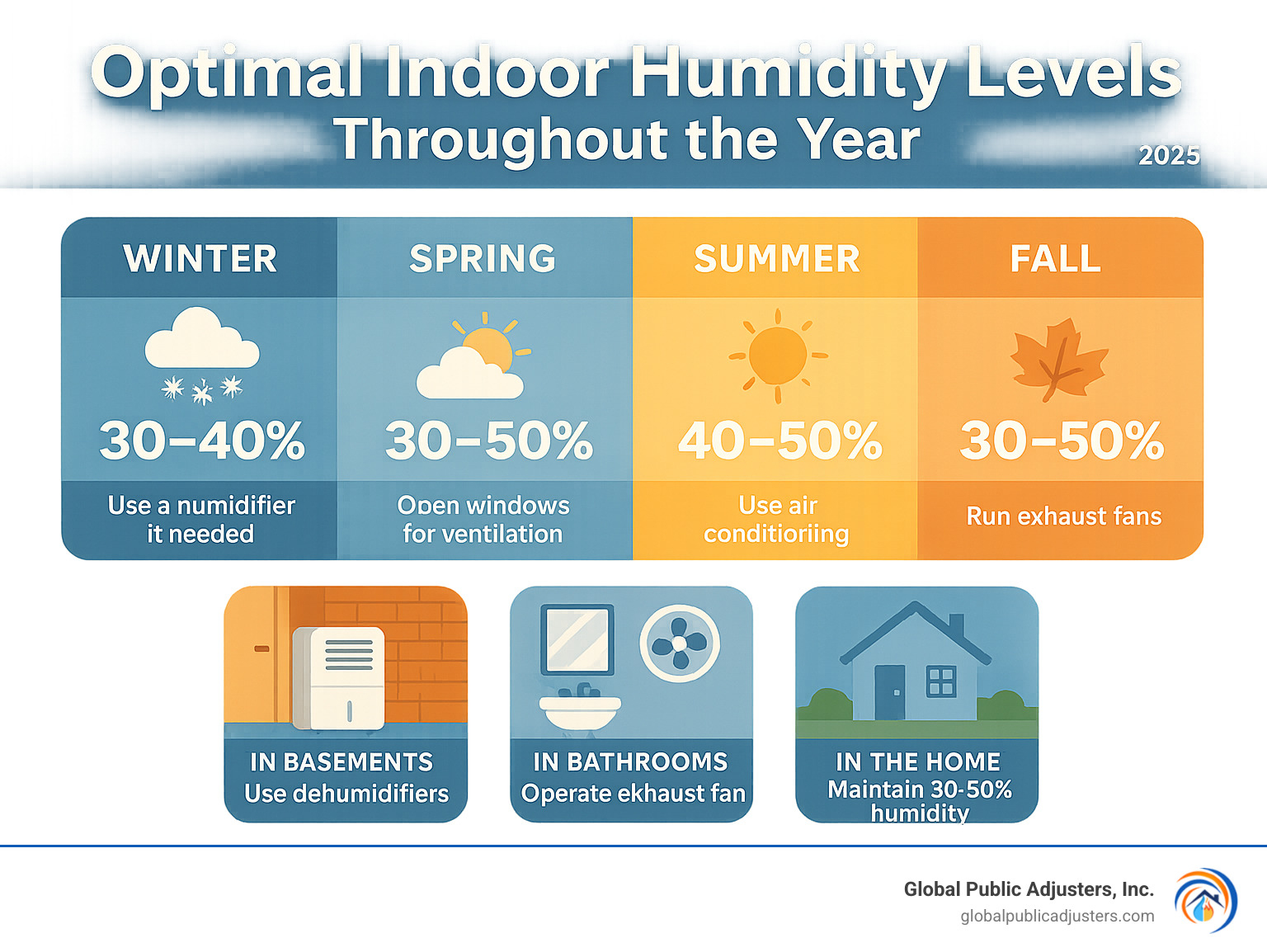

Humidity is your biggest enemy. Keep indoor humidity between 30-50% year-round. This sweet spot prevents mold growth while keeping your home comfortable. In humid climates like Florida, this often means running dehumidifiers in basements, crawl spaces, and other problem areas.

Ventilation makes all the difference. Your bathroom and kitchen exhaust fans aren’t just for odors—they’re your first line of defense against moisture buildup. Run them during showers and cooking, and keep them running for at least 30 minutes afterward. Make sure these fans vent outside, not into your attic.

Quick action saves thousands. When you spot a leak, fix it immediately. Insurance companies love to deny claims by arguing that water damage was “gradual” rather than sudden.

Smart water sensors are game-changers. These inexpensive devices can alert you to water problems before they become major issues. Place them near water heaters, washing machines, dishwashers, and in basements.

Annual inspections are worth their weight in gold. Walk through your home each year with a critical eye. Check around appliances, under sinks, in attics, and in basements. Look for water stains, musty odors, or any signs of moisture problems.

Don’t neglect your gutters. Clogged gutters can cause water to back up and seep into your home’s structure. Clean them at least twice yearly and ensure water drains away from your foundation.

Your HVAC system needs attention too. Change air filters regularly and have the system professionally serviced annually. If you notice musty odors when the system runs, have the ductwork inspected and cleaned.

Roof maintenance prevents major headaches. Check your roof annually for loose or damaged shingles, especially after storms. Small roof leaks can cause extensive mold problems before you even notice them.

The key to all these prevention strategies isdocumentation. Keep records of your maintenance efforts, professional inspections, and any repairs you make.

For detailed guidance on recognizing early warning signs, check outHow to Tell if You Have Mold Damage in Your Home.

Insurance companies expect you to be a responsible homeowner. By staying on top of these prevention measures, you’re not just protecting your home—you’re protecting your ability to collect on your insurance when you truly need it.

Frequently Asked Questions about insurance claims for mold damage

Will filing a mold claim raise my premiums?

Insurance claims for mold damagecan affect your premiums, but the impact isn’t always as dramatic as you might fear.

If your mold claim stems from a sudden, covered event like a burst pipe, most insurers won’t penalize you as severely as they would for a claim involving maintenance issues.Your claims history matters more than the individual claim. One mold claim probably won’t break the bank, but multiple claims within three to five years will definitely catch your insurer’s attention.

Don’t let fear of premium increases stop you from filing a legitimate claim. The cost of mold remediation often far exceeds any potential premium increase.

Does renters insurance cover mold damage?

Your renters insurance typically covers mold damage under the same rules as homeowners policies—only when it results from a sudden, covered event. So if your upstairs neighbor’s bathtub overflows and causes mold in your apartment, your renters insurance would likely cover your damaged belongings.

If mold develops because of building maintenance issues like poor ventilation or a leaky roof, that’s usually your landlord’s responsibility, not yours.What your renters insurance does coveris your personal property damaged by mold and temporary living expenses if the mold makes your rental uninhabitable.

Who pays for mold cleanup in condos?

The general rule follows your condo association’s bylaws and declarations. Most associations operate on a “walls in” principle—you’re responsible for everything inside your unit boundaries. The association handles common areas.

Your condo association’s master policytypically covers structural elements and common areas, but it rarely covers mold damage within individual units. That’s where your individual condo insurance policy comes in—but many standard condo policies have the same mold coverage limitations as regular homeowners insurance.

Consider endorsements that increase mold coverage limits, especially if you live in a humid climate or an older building.

Conclusion

Dealing withinsurance claims for mold damagedoesn’t have to feel like fighting an uphill battle. Once you understand how these claims work, you can protect both your family’s health and your financial security.

The most important thing to remember?Coverage hinges on what caused the moisture problem. That burst pipe flooding your basement? Likely covered. The slow leak behind your bathroom wall that went unnoticed for months? Probably not. Insurance companies draw a hard line between sudden accidents and gradual problems they consider maintenance issues.

Documentation becomes your best friendwhen filing these claims. Take photos before you start any cleanup. Keep detailed records of when you found the mold and what you did about it. Get professional assessments from certified inspectors.

Prevention actually protects your insurability. When you maintain proper humidity levels, fix leaks quickly, and keep your home well-ventilated, you’re not just preventing mold—you’re avoiding claim denials based on “neglect” or “maintenance issues.”

The health stakes make this especially important. Mold exposure can trigger asthma attacks, cause respiratory problems, and create serious health issues for vulnerable family members. The financial stakes are equally serious, with remediation costs often reaching $10,000 to $30,000 or more.

Professional help often makes the differencein complex mold cases. Insurance adjusters know exactly how to minimize payouts, especially with mold claims where coverage depends on technical details about sudden versus gradual damage.

At Global Public Adjusters, Inc., we’ve spent over 50 years helping Orlando homeowners steer these challenging claims. We understand the tactics insurers use to deny or minimize mold settlements, and we know how to build compelling cases that get results.

Take action on two fronts: Review your current policy to understand your mold coverage limits and exclusions. If you live in Florida’s humid climate, consider additional endorsements that increase your protection. And if you find mold in your home, act quickly—both for your health and to preserve your insurance rights.

For comprehensive assistance with mold damage claims, visitMore info about mold damage servicesto learn how we can help maximize your settlement.

Your home is likely your largest investment. Don’t let mold problems—or inadequate insurance settlements—put that investment at risk. With proper preparation, quick action, and the right professional guidance, you can successfully protect both your family’s health and your financial future.