business interruption claims preparation: 7 Powerful Success Tips 2025

When Disaster Strikes: Be Prepared for Business Interruption Claims

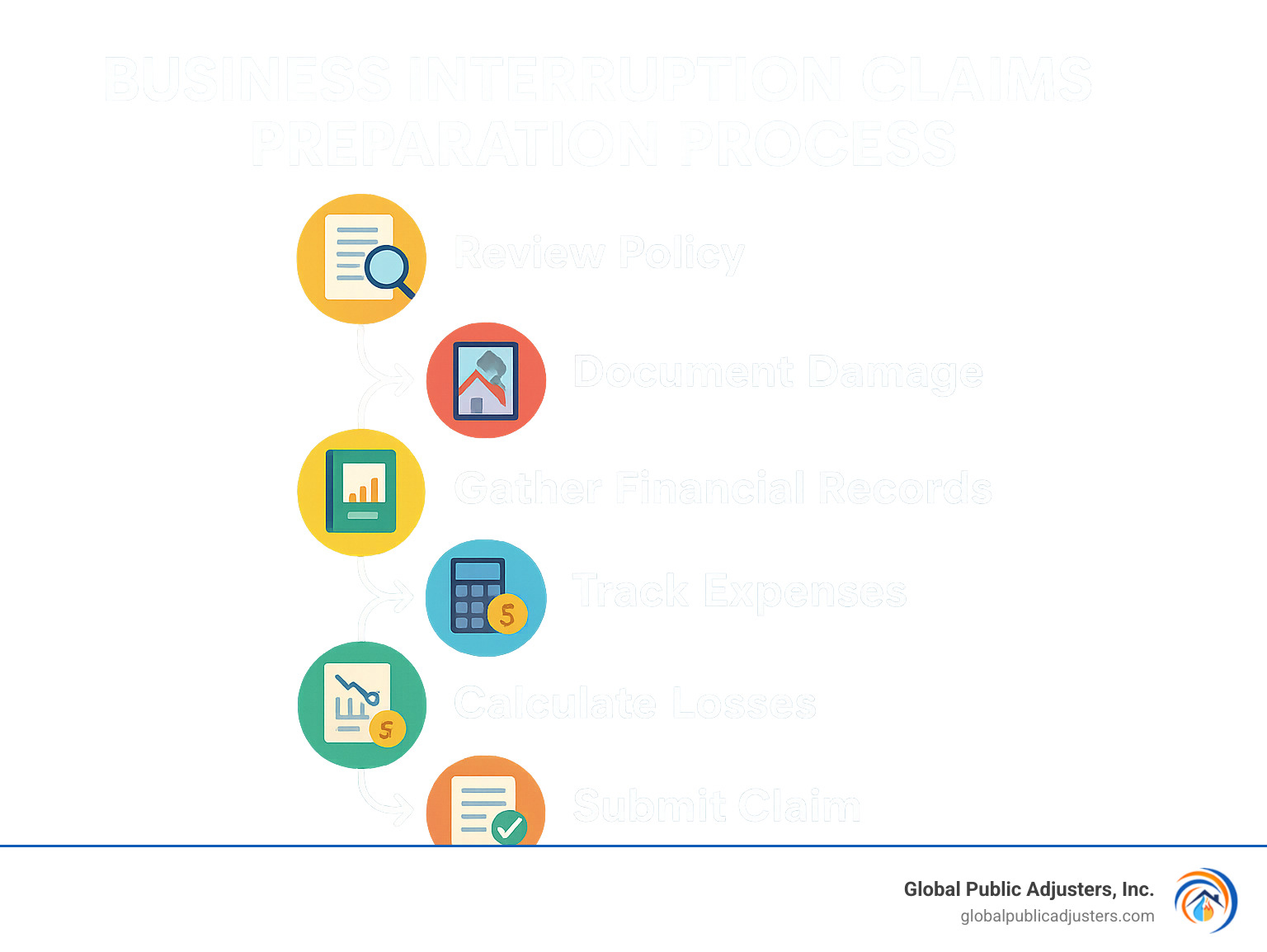

Business interruption claims preparationis the process of documenting, calculating, and substantiating financial losses when your business operations are disrupted by a covered event. For those seeking quick guidance, here are the essential steps:

- Review your insurance policyto understand coverage, limits, and exclusions

- Document physical damagewith photos and videos before repairs begin

- Gather financial recordsincluding tax returns, P&L statements, and sales forecasts

- Track all extra expensesrelated to the interruption in a separate ledger

- Appoint a single point of contactto manage communications with your insurer

According to the Insurance Information Institute, up to 40% of small businesses never reopen after a disaster, highlighting why proper business interruption claims preparation is critical for survival. When a fire, flood, hurricane or other disaster forces your business to close temporarily, the financial impact extends far beyond physical damage—lost income and ongoing expenses can quickly drain your reserves.

“Resolving a claim is more than a financial exercise—it’s making sure your story is understood,” notes one claims preparation expert. This underscores why detailed documentation and proper valuation are essential from day one.

While many business owners focus on property damage after a disaster, the more complex challenge often lies in accurately calculating and proving business income losses. Studies show that businesses with comprehensive documentation are 2-3 times more likely to receive full claim settlements compared to those with incomplete records.

Whether you’re facing a week-long power outage or months of rebuilding, how you prepare your business interruption claim will significantly impact your recovery and financial stability.

Simple guide tobusiness interruption claims preparationterms:

–business disruption insurance

–business interruption claims examples

Why Preparation Matters

The sobering statistic that 40% of small businesses never reopen after a disaster isn’t just a number—it represents thousands of entrepreneurs who watched their dreams and livelihoods vanish in the aftermath of a catastrophe. At Global Public Adjusters, we’ve witnessed how proper preparation can make the difference between a business that recovers and one that becomes another statistic.

A study by USI Insurance Services found that businesses with comprehensive documentation and claims preparation are 2-3 times more likely to receive full claim settlements compared to those with incomplete records. This dramatic difference underscores why having a continuity plan that includes detailedbusiness interruption claims preparationprotocols is essential.

“After Hurricane Sandy, nearly 25% of business interruption claims were delayed or underpaid due to insufficient documentation or misunderstanding of policy terms,” explains our senior claims specialist. “Many of these businesses could have received proper compensation if they had been better prepared.”

Understanding Business Interruption Insurance Basics

Before diving into the claims process, it’s crucial to understand what your business interruption insurance actually covers. Business interruption insurance (sometimes called business income insurance) is designed to replace income your business would have earned had no loss occurred, while covering continuing expenses during the period of restoration.

Typical Coverage & Triggers

Think of business interruption coverage as your financial safety net when disaster strikes.Business Income Coveragesteps in to replace that lost revenue and keep the lights on by covering normal operating expenses, including making sure your employees still get paid during shutdown.

When you’re scrambling to keep operations going,Extra Expense Coveragebecomes your best friend. It covers those reasonable costs beyond your normal operating expenses that allow you to continue serving customers while repairs are underway.

Your business doesn’t exist in isolation, and your insurance shouldn’t either. That’s whereContingent Business Interruptioncomes in, covering losses when damage hits your suppliers, key customers, or nearby businesses you depend on.

Sometimes the government steps in after a disaster and restricts access to entire areas.Civil Authority Coverageprovides protection when these actions prevent you from accessing your business premises due to covered damage to nearby properties.

I’ve seen countless businesses caught off guard by what actually triggers these coverages. Fire or smoke damage, hurricanes, tornadoes, severe storms, and equipment breakdowns are common culprits. Supplier shutdowns and utility outages caused by covered perils can also set the wheels in motion for a claim.

A Florida restaurant owner shared with me: “We assumed our policy would cover losses from the power outage alone after Hurricane Irma, but our claim was initially denied because we couldn’t prove physical damage to our property. Having a public adjuster review our policy and document the subtle electrical damage made all the difference.”

Standard policies typically require physical damage to trigger coverage. This is where properbusiness interruption claims preparationbecomes essential – knowing what your specific policy covers before disaster strikes.

For the latest guidance on filing claims after a disaster, check out theInsurance Information Institute’s overview.

Period of Restoration & Indemnity Limits

The “period of restoration” is where the rubber meets the road inbusiness interruption claims preparation. This critical timeframe determines how long your policy will pay for lost income and expenses.

The clock typically starts ticking on the date of physical loss or damage. It stops when your damaged property should reasonably be repaired or replaced with similar quality, or when you’ve set up shop at a new permanent location. Simple enough, right? Not always.

Most policies include a waiting period—usually 24-72 hours—before coverage kicks in. It’s like a time-based deductible that can catch business owners by surprise. I’ve seen many clients shocked to find those first crucial days weren’t covered.

Standard policies often cap the indemnity period at 12 months. For some businesses, that’s plenty of time to recover. For others, particularly in industries with complex equipment or specialized facilities, it’s barely enough to get back on their feet.

The smartest business owners I work with opt for “Extended Business Income” coverage. This provides additional protection after repairs are complete but before income returns to normal levels. Think of a restaurant that’s finally reopened but still waiting for customers to return to pre-disaster levels—this coverage bridges that gap.

Your policy limits for business interruption typically come in two flavors: a maximum dollar amount or a specific time period. Understanding these limits isn’t just helpful—it’s essential for properbusiness interruption claims preparation.

The difference between a denied claim and full compensation often comes down to understanding these fundamentals before disaster strikes. At Global Public Adjusters, we’ve seen how this knowledge can be the difference between a business that recovers and one that becomes another statistic.

First 48 Hours: Immediate Steps After a Loss

The clock starts ticking the moment disaster strikes your business. What you do in those first two days can make or break your claim’s success. Let’s walk through the critical first steps together:

When the unexpected happens, grab your phone first.Contact your insurance carrier immediately– ideally within 24 hours. I’ve seen too many business owners delay this crucial step while trying to assess damages, only to face complications or even claim denials later.

Next, you’ll need tosecure your propertyagainst further damage. This might mean boarding broken windows, covering roof damage with tarps, or moving valuable inventory to a safe location. Your insurer expects these reasonable protective measures.

Your policy requires you tobegin mitigation effortsright away. Document every step you take to prevent additional losses – from water extraction to temporary repairs. These efforts show good faith and protect your recovery.

Before the cleanup crews arrive,pause to document everything. Walk through with your smartphone capturing photos and videos of all damage. Create a detailed inventory of affected items, equipment, and structural damage. This visual evidence becomes invaluable when memories fade and repairs begin.

Take time toreview your policy detailscarefully. Understanding what’s covered, excluded, and any specific claim requirements will help you steer the process more effectively. Don’t hesitate to ask questions about confusing language or provisions.

Build Your Response Team

Having the right experts in your corner dramatically improves claim outcomes. Think of this as assembling your recovery dream team:

Apublic adjuster(like us at Global Public Adjusters) serves as your advocate, handling documentation, preparation, and negotiation to maximize your recovery. We’ve seen businesses receive settlements 40-50% higher with professional representation.

Youraccountant, especially one with forensic experience, becomes essential for calculating business income losses accurately. Industry data shows that engaging a forensic accountant early can reduce claim disputes by up to 50% and significantly improve accuracy.

Don’t overlook the value oflegal counselfamiliar with insurance claims. They can review settlement offers and advise on complex coverage issues before you sign anything binding.

Yourinsurance brokerhelps interpret confusing policy language and often serves as a helpful intermediary with the insurance company’s representatives.

Finally, reputablerestoration contractorsprovide professional damage assessments and repair estimates that carry weight with insurance adjusters.

Create a Real-Time Timeline

From the moment disaster strikes, keep a detailed chronology that tracks everything. This becomes your claim’s backbone and protects you from disputes later.

“The most successful claims we’ve handled had meticulous timelines,” explains our senior claims specialist. “When disagreements arise six months later about when certain damages occurred or specific decisions were made, this documentation becomes your best defense.”

Your timeline should capture thedate and time of the loss event, allcommunications with your insurance company(including names and content),adjuster visits,mitigation stepstaken,business decisionsmade in response,expenses incurred, and theimpact on your operations.

Consider creating a dedicated digital folder or physical binder for your claim where you store all receipts, correspondence, and notes. This organized approach tobusiness interruption claims preparationpays dividends when settlement time arrives.

For more information about navigating these critical first steps, check out theInsurance Information Institute’s guide to filing business insurance claims.

Documenting Damage and Financial Losses

Thorough documentation is the foundation of successfulbusiness interruption claims preparation. Your goal is to create a comprehensive record that clearly connects the physical damage to your financial losses.

Capturing Physical Damage

When disaster strikes, your first instinct might be to clean up and get back to business. But wait! Before touching anything, grab your camera. Those photos and videos will become gold during your claims process.

Start by capturing wide-angle shots that show the full extent of damage, then zoom in for detailed close-ups of every affected area. Don’t forget about equipment, inventory, and fixtures – everything matters when building your case.

For larger businesses or extensive damage, consider bringing in the professionals. A commercial photographer or drone operator can capture hard-to-reach areas that might otherwise go undocumented. One of our clients with a warehouse fire gained an additional $75,000 in their settlement simply because drone footage revealed roof damage that wasn’t visible from ground level.

“The hidden damage is what often gets overlooked,” says our senior adjuster at Global Public Adjusters. “We recently helped a boutique hotel owner who initially thought damage was limited to three flooded rooms. Our thorough inspection revealed mold beginning to form behind seemingly undamaged walls in adjacent rooms. That documentation prevented a potential health hazard and added $120,000 to their claim.”

Remember to create a detailed inventory as you go. For each damaged item, note its description, approximate age, replacement cost, and attach corresponding photos. And here’s a tip many people miss: save physical samples of damaged materials when possible. That water-stained drywall or smoke-damaged fabric can become compelling evidence if your insurer questions the severity of your loss.

Assembling Financial Support

While physical evidence tells half the story, financial documentation completes the picture of your business interruption. Think of this as building your business’s financial biography.

“The more detailed your financial records, the stronger your claim will be,” explains our business interruption specialist. “We once worked with a seasonal business whose claim was initially undervalued because the insurer didn’t account for their peak season timing. With proper documentation of seasonal patterns, we increased their settlement by over 40%.”

Start by gathering your business’s financial history: tax returns and financial statements spanning three years, monthly profit and loss statements for at least 24 months before the loss, and detailed sales journals. These establish your normal business patterns.

Next, collect documents that demonstrate your ongoing expenses: payroll records, utility bills, rent statements, and vendor contracts. These show what you’re still paying despite being unable to operate normally.

Don’t forget about your business’s future trajectory! Include business forecasts, budgets, and industry trend data that support projections of what your earnings would have been without the interruption. For seasonal businesses, highlighting sales patterns throughout the year is particularly important.

One Florida restaurant owner shared her experience: “After a kitchen fire, we thought the damage was limited to the cooking area. But our public adjuster insisted on a thorough inspection that revealed smoke damage throughout our ventilation system and subtle odor issues in our dining area. This documentation doubled our recovery amount.”

| Physical Documentation | Financial Documentation |

|---|---|

| Photos and videos of damage | Tax returns (3 years) |

| Inventory of damaged items | Monthly P&L statements |

| Professional inspection reports | Sales records and forecasts |

| Repair estimates | Payroll and expense records |

| Samples of damaged materials | Utility and rent statements |

| Timeline of events | Vendor contracts and invoices |

| Mitigation receipts | Industry trend data |

At Global Public Adjusters, we’ve seen countless claims where the difference between a denied claim and a full settlement came down to documentation quality. When in doubt, document more rather than less – you can’t capture too much evidence, but missing documentation might cost you thousands in unreimbursed losses.

For more specialized assistance with documenting your losses, you might want to check out ourProperty Loss Public Adjusterservices, where we provide expert guidance through every step of this process.

Business Interruption Claims Preparation Checklist

When disaster strikes, having a clear roadmap forbusiness interruption claims preparationcan make all the difference between a swift recovery and prolonged financial strain. Think of this checklist as your North Star during what’s likely to be a challenging time for your business.

Start by designating one trusted team member as your claim quarterback—your single point of contact with insurers, adjusters, and contractors. This prevents the all-too-common “he said, she said” scenarios that can derail your claim. As one of our clients put it: “Having my operations manager handle all insurance communications kept our story consistent and saved me countless headaches.”

Next, work with your accounting team to establish a separate cost code for tracking all interruption-related expenses. This simple step creates a clean paper trail that will prove invaluable when calculating your claim. It’s much easier to track these expenses from day one than to untangle them months later.

Before diving too deep into recovery mode, take time to document your business’s pre-loss condition. Gather those financial records, dust off any recent photos of your operations, and create a clear picture of “normal” that you can present to your adjuster.

Communication is king during the claims process. Create a simple protocol for logging every insurance-related conversation—noting dates, participants, and what was discussed. This documentation can be a lifesaver if disputes arise later.

Don’t be shy about requesting advance payments from your insurer if cash flow is tight. Many policies allow for this, and it can provide the breathing room needed to keep your doors open during recovery. As our claims specialist often reminds clients: “Insurance is meant to help you recover, not after you’ve gone bankrupt waiting for a settlement.”

Your mitigation plan—showing how you’re working to reduce losses—signals to insurers that you’re a responsible partner. Document your temporary relocations, alternative suppliers, or modified operations that demonstrate your commitment to minimizing the claim.

Remember to track customer impacts too. Those canceled orders, customer communications, and lost opportunities directly connect to your financial losses and strengthen your claim narrative.

For more guidance on preparing a comprehensive claim, check out theseBest Practices articlefor additional insights.

Financial Records for Business Interruption Claims Preparation

The financial side ofbusiness interruption claims preparationrequires both attention to detail and telling your business’s unique story.

Start with establishing historical trends by compiling at least three years of financial data. This creates the baseline for what your business would have earned without the interruption. One restaurant owner we worked with finded their three-year records revealed a consistent 15% year-over-year growth pattern that significantly increased their final settlement.

Don’t forget to highlight seasonality in your business. A beachfront shop that experiences 70% of annual revenue during summer months will need different projections than a business with steady year-round income. Your seasonal patterns matter tremendously in calculating accurate projections.

Were you experiencing growth before the disaster? Document those growth factors with evidence like new contracts, expanded facilities, marketing initiatives, or industry recognition that would have contributed to higher future income. These growth indicators aren’t just nice-to-haves—they’re essential pieces of your financial story.

Take time to separate your fixed expenses (rent, insurance, salaried employees) from variable costs that fluctuate with business volume. This distinction helps accurately calculate continuing expenses that persist during closure—costs your policy is designed to cover.

“The most successful claims I’ve seen,” shares our senior adjuster, “come from businesses that can tell their financial story with clarity and evidence. It’s not just about numbers on spreadsheets—it’s about connecting those numbers to your business reality.”

Avoiding Pitfalls in Business Interruption Claims Preparation

Even the most prepared business owners can stumble during the claims process. Being aware of common pitfalls can save you significant headaches—and money.

Late notice tops the list of claim killers. Report your loss immediately, even if you don’t yet know the full extent of damages. That phone call starts the official clock on your claim and demonstrates your compliance with policy requirements.

Inadequate documentation remains the number one reason claims get undervalued. From day one, document everything carefully—physical damages, financial impacts, and recovery efforts. As we tell our clients: “If it isn’t documented, it didn’t happen” in the eyes of many adjusters.

The temptation to accept a quick settlement can be strong, especially when cash flow is tight. But rushing to settle before understanding your full losses is like selling your car without checking its market value—you’ll likely leave money on the table. Take the time to complete a thorough analysis before accepting any offers.

Many business owners misunderstand how deductibles apply to interruption claims, leading to calculation errors that can cost thousands. Similarly, overlooking coverage extensions like civil authority provisions or extended business income can significantly reduce your recovery.

Remember your obligation to mitigate losses—taking reasonable steps to prevent further damage and reduce the claim amount. Failure to do so can result in denied coverage for damages deemed preventable.

Lastly, keep your claim expenses clearly separated from normal business costs. This clean accounting makes it easier to identify and substantiate claim-related expenses, streamlining the adjustment process.

By following these guidelines and working with experienced professionals like our team at Global Public Adjusters, you’ll be well-positioned to steer the complex world ofbusiness interruption claims preparationand secure the settlement your business deserves.

Crunching the Numbers: Calculating Your Loss

When it comes tobusiness interruption claims preparation, accurately calculating your financial loss often proves to be the most challenging hurdle. Think of it as telling your business’s financial story during a crisis – you need the right approach to make sure every chapter is accounted for.

Selecting the Right Method

There are two primary ways to calculate your business interruption loss, and choosing the right one can make a significant difference in your recovery.

TheTop-Down Approachstarts with what might have been – your projected sales had the disaster never occurred – and then subtracts expenses you didn’t incur while your doors were closed. The formula is straightforward: Lost Sales – Expenses Saved = Business Interruption Loss. This method works beautifully for businesses with clear-cut operations and easily identifiable variable costs.

On the flip side, theBottom-Up Approachbuilds your claim from the ground up. You start with your projected net income, add in those stubborn expenses that continued despite your closure, and include any extra costs you shouldered to minimize losses. The formula here is: Projected Net Income + Continuing Expenses + Extra Expenses = Business Interruption Loss. This method tends to shine for businesses with more complex operations.

“I remember working with a family-owned bakery in Orlando that initially used the top-down approach,” shares our senior adjuster at Global Public Adjusters. “When we switched to the bottom-up method, we finded nearly $27,000 in continuing expenses they hadn’t properly accounted for. That simple change increased their settlement by almost 25%.”

| Top-Down Approach | Bottom-Up Approach |

|---|---|

| Start with projected gross sales | Start with projected net income |

| Subtract expenses saved | Add continuing expenses |

| Add extra expenses | Add extra expenses |

| Simpler calculation | More detailed analysis |

| Good for straightforward operations | Better for complex businesses |

| Focuses on revenue impact | Focuses on profit impact |

The difference between these methods isn’t just academic – it can translate into thousands of dollars in your recovery. Your choice should reflect your business’s complexity and which approach better captures your unique situation.

Accounting for Extra & Expediting Expenses

When disaster strikes, you often need to spend money to save money. These additional costs fall into two important categories that yourbusiness interruption claims preparationshould carefully document.

Extra expensesare those unexpected costs you incur to keep operations going during recovery. Think of the restaurant owner who rented food trucks to maintain some revenue while their dining room was being repaired, or the accountant who paid premium rates for temporary office space during tax season.

These might include temporary relocation costs, equipment rentals, overtime pay, rush shipping charges, or even additional advertising to let customers know you’re still in business. These expenses are generally covered because they help minimize your overall loss.

Expediting expenses, meanwhile, are specifically aimed at speeding up your recovery timeline. These are the costs of getting back to normal faster – like paying contractors overtime to work weekends, or paying extra for rush delivery of essential equipment.

“One of our retail clients in South Florida faced a six-month rebuild after hurricane damage,” our claims specialist recalls with a smile. “By spending about $35,000 on expedited construction and overnight shipping for custom fixtures, they reopened in just eight weeks – right before their busiest season. Their insurer covered these expenses because they saved over $120,000 in potential lost income.”

The key to maximizing your claim is documenting how these expenses directly reduced your period of interruption or maintained some level of business activity. At Global Public Adjusters, we help clients identify, document, and justify these expenses to ensure they’re properly reimbursed during thebusiness interruption claims preparationprocess. After all, smart spending during recovery can dramatically improve your business’s chances of long-term survival.

Communicating and Negotiating with Insurers

When it comes to getting your claim approved, how you talk with your insurance company can make or break your case. Think of this as telling the story of your business’s journey through disaster and recovery.

Best Practices for Productive Dialogue

Your insurance adjuster isn’t living through your business crisis – you need to help them understand it. Start by creating what we call a “claim narrative” – essentially the story of what happened, how it affected your operations, and the financial impact, all backed up with those documents you’ve been carefully gathering.

Don’t wait for your insurer to ask for information. In my years at Global Public Adjusters, I’ve seen how businesses that proactively submit detailed breakdowns of their losses tend to receive faster, more favorable settlements.

“I always tell my clients to think of their adjuster as someone who needs to be educated about their unique business,” explains our senior public adjuster. “The more clearly you can explain how the physical damage translated to lost income, the better your results will be.”

Make it a habit to touch base with your adjuster regularly – weekly or even daily during critical phases. After each conversation, send a quick email summarizing what was discussed. This creates a paper trail that can be invaluable if memories differ later on.

Whenever your adjuster requests additional documents, ask them to put the request in writing. This simple step prevents miscommunication and gives you a clear checklist to work from.

For complexbusiness interruption claims preparation, consider breaking your claim into manageable chunks that can be settled separately. This approach often results in partial payments that can help with cash flow while more complicated aspects are still being negotiated.

If your business is struggling financially during the claim process, don’t hesitate to request advance payments on the undisputed portions of your claim. Most insurers understand that maintaining operations is in everyone’s best interest.

What If the Carrier Undervalues Your Claim?

It happens more often than you might think – the insurance company comes back with an offer that seems nowhere near what your business actually lost. Don’t panic, and definitely don’t rush to accept.

Start by politely requesting a detailed explanation of their calculation. Understanding their reasoning often reveals opportunities to provide additional information that might change their assessment.

“After Hurricane Irma, a local Orlando restaurant received an initial offer that barely covered half their actual losses,” shares our claims specialist. “When we reviewed their policy and submitted additional documentation showing their typical seasonal patterns, the insurer nearly doubled their offer.”

Most insurance policies include an appraisal clause – a formal process for resolving valuation disputes without going to court. This can be a powerful tool when you’re facing significant disagreement about the value of your loss.

Before considering litigation, explore mediation. It’s less adversarial, less expensive, and often leads to faster resolutions. Many courts require mediation before a lawsuit can proceed anyway.

If substantial disputes persist, have your attorney issue a litigation hold letter. This formal notice requires the insurance company to preserve all claim-related documentation, which can be crucial if legal action becomes necessary.

You don’t have to steer these negotiations alone. At Global Public Adjusters, we’ve helped countless Orlando businesses turn inadequate offers into fair settlements that truly reflect their losses. Our expertise inbusiness interruption claims preparationoften makes the difference between a settlement that barely keeps the lights on and one that fully funds your recovery.

Frequently Asked Questions about Business Interruption Claims Preparation

What financial records are mandatory?

Let’s face it – gathering financial records isn’t anyone’s idea of fun, especially after a disaster. But having the right documentation makes all the difference in your claim’s success.

Most insurers will ask for yourbusiness tax returnsfrom the past three years andmonthly profit and loss statementsgoing back 24-36 months. These establish your business’s financial patterns before the interruption. You’ll also needsales records and forecaststo show what you would have earned if disaster hadn’t struck.

“When my restaurant flooded last year, I was overwhelmed by all the paperwork requests,” shares Maria, an Orlando restaurant owner. “But my public adjuster explained that each document told part of my business’s story – and that story secured my full settlement.”

Other essential records includepayroll documentation(to prove continuing wage expenses),fixed expense recordslike rent and loan payments,inventory lists,production schedules, andbudget projections. The more thoroughly you can document your financial picture, the stronger your case will be.

It’s always better to over-document than under-document. As we often tell our clients at Global Public Adjusters: the insurer wasn’t there to see your thriving business before the disaster – your records have to tell that story.

How is the period of restoration determined?

The “period of restoration” might sound like a spa treatment, but it’s actually one of the most crucial concepts inbusiness interruption claims preparation. This timeframe determines how long your policy will pay for losses.

Typically, this period starts when the damage occurs and ends when your property should reasonably be repaired or replaced. I emphasize “should” because insurers often have different ideas about what’s “reasonable” than business owners do!

Several factors influence this timeline:

– The extent of your physical damage (a small kitchen fire vs. total building loss)

– Local availability of contractors and materials

– Permitting and inspection schedules in your area

– Whether specialized equipment needs replacement

– Your business decisions about repairing vs. replacing

“After Hurricane Michael, one of our clients’ insurers claimed their restaurant should reopen in three months,” recalls our senior adjuster. “But with the local construction backlog and specialized kitchen equipment on 16-week order, we successfully argued for a nine-month restoration period – tripling their recovery.”

Most policies cap this period at 12 months, though you can purchase extensions. If you’re concerned about lengthy rebuilds, talk to your broker about extended period endorsements before disaster strikes.

Who pays for professional fees during claim prep?

Good news! You might not have to shoulder the cost of hiring experts to prepare your claim. Many commercial property policies include what’s called “claims preparation coverage” or “professional fees coverage.”

This valuable but often overlooked provision can cover the costs offorensic accountants,public adjusters,appraisers,consultants, andinventory specialistswho help document and substantiate your claim.

The coverage typically ranges from $10,000 to $50,000 and—here’s the beautiful part—it doesn’t reduce your business interruption payment. It’s separate coverage specifically designed to help you present the strongest possible claim.

“One of our Orlando retail clients hesitated to bring in a forensic accountant because of the expense,” shares our claims specialist. “When we reviewed their policy, we finded they had $25,000 in professional fees coverage. That accountant’s detailed analysis increased their final settlement by $175,000—a remarkable return on investment!”

Before hiring claim preparation professionals, check your policy for this coverage and understand any limitations. If you’re unsure, we at Global Public Adjusters can review your policy to identify all available coverages that might help in your recovery.

Insurance companies have teams of adjusters and accountants working to minimize their payout. Having your own experts levels the playing field and often leads to significantly better outcomes.

Conclusion

When disaster strikes, the difference between a business that bounces back and one that becomes another sad statistic often comes down to one thing: properbusiness interruption claims preparation. After helping countless Florida businesses steer the choppy waters of insurance claims, we’ve seen how preparation can transform an overwhelming situation into a manageable one.

I’ll never forget what Maria, a small bakery owner in Orlando, told us after we helped her secure a settlement that was nearly triple the insurance company’s initial offer: “Having experts guide us through the process made all the difference. What seemed overwhelming became manageable, and we recovered far more than we initially thought possible.”

Her experience isn’t unusual. The data backs this up—businesses with thorough documentation and professional claims preparation are 2-3 times more likely to receive full claim settlements compared to those trying to steer the process alone. That’s not just a number—that’s the difference between reopening your doors or closing them permanently.

At Global Public Adjusters, our team brings over 50 years of combined experience to your corner. We’ve seen every tactic insurance companies use to minimize payouts, and we know exactly how to counter them with proper documentation, strategic negotiation, and unwavering advocacy.

We work exclusively for you—not the insurance company. While their adjusters are focused on controlling costs, our only goal is maximizing your recovery. We speak the language of insurance claims fluently, translating complex policy terms into real-world solutions that help your business recover.

The hours and days after a disaster are critical, and the decisions you make during this time can significantly impact your claim’s outcome. Having a trusted advisor by your side from the beginning can prevent costly mistakes and ensure you’re taking all the right steps to document your loss properly.

If your Florida business has suffered an interruption due to a covered event—whether it’s hurricane damage, fire, flood, or any other disaster—don’t face the claims process alone. Contact us today for a free consultation and find how our expertise inbusiness interruption claims preparationcan help secure the settlement you deserve.

With offices in Orlando, Pensacola, and throughout Florida, we’re ready to help you steer the claims process and get your business back on solid ground.